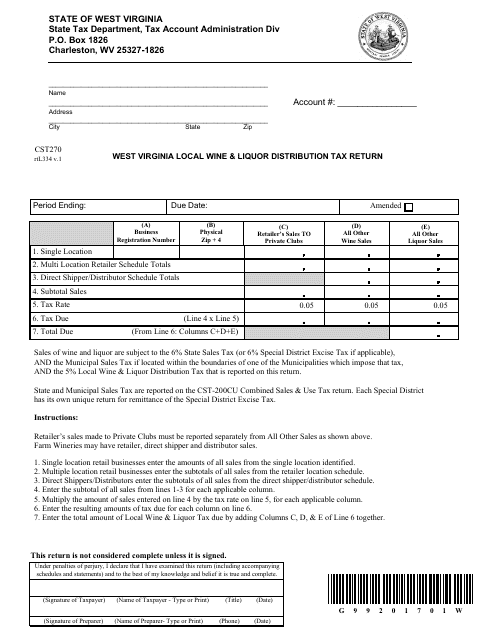

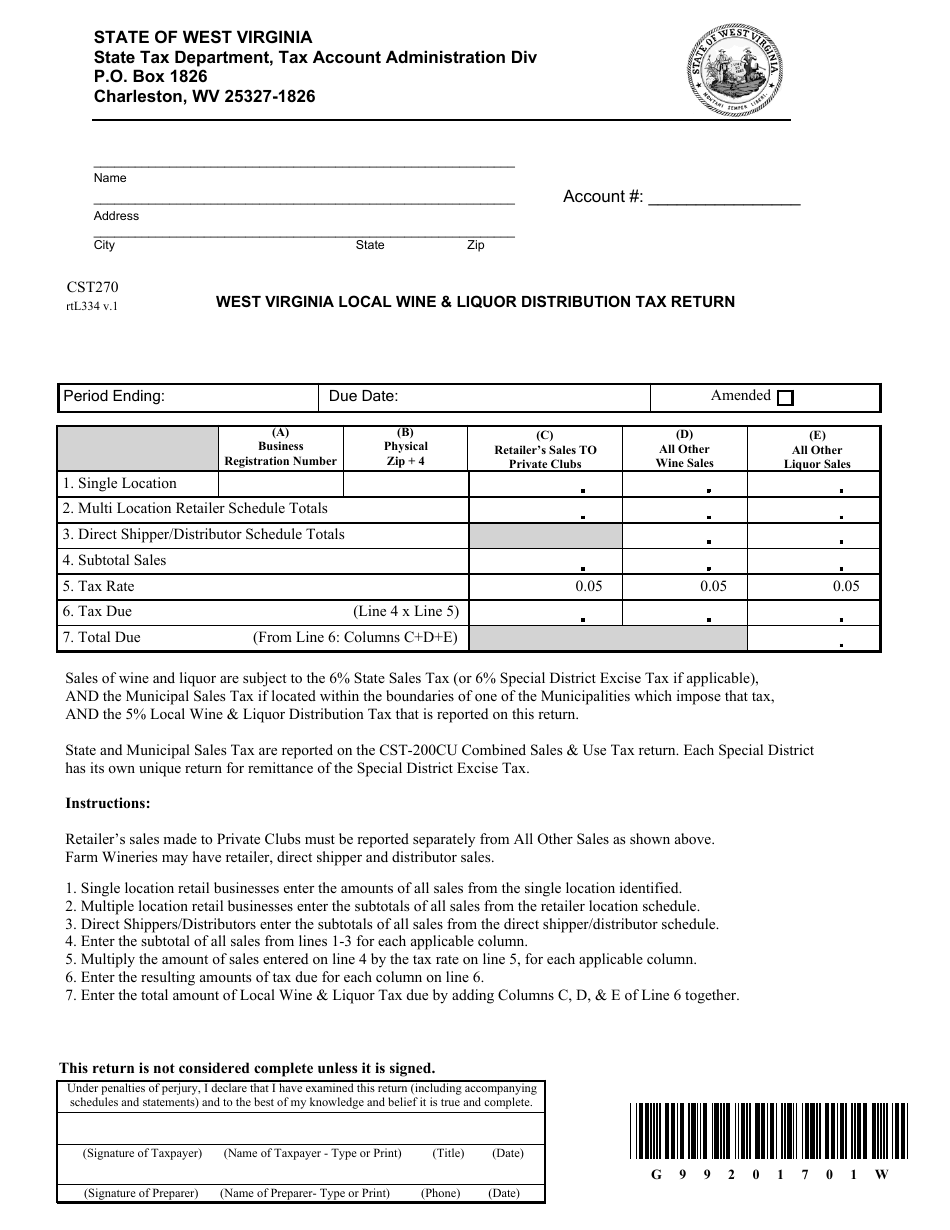

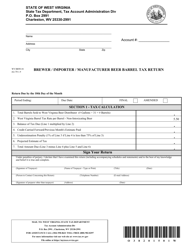

Form CST-270 Local Wine & Liquor Distribution Tax Return - West Virginia

What Is Form CST-270?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CST-270?

A: The Form CST-270 is the Local Wine & Liquor Distribution Tax Return in West Virginia.

Q: Who needs to file the Form CST-270?

A: Anyone engaged in the distribution of wine and liquor in West Virginia needs to file the Form CST-270.

Q: What is the purpose of the Form CST-270?

A: The purpose of the Form CST-270 is to report and pay the local wine & liquor distribution tax in West Virginia.

Q: How often do I need to file the Form CST-270?

A: The Form CST-270 should be filed on a monthly basis by the 20th day of the following month.

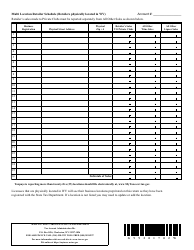

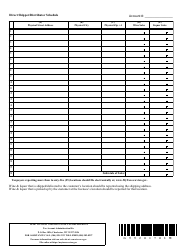

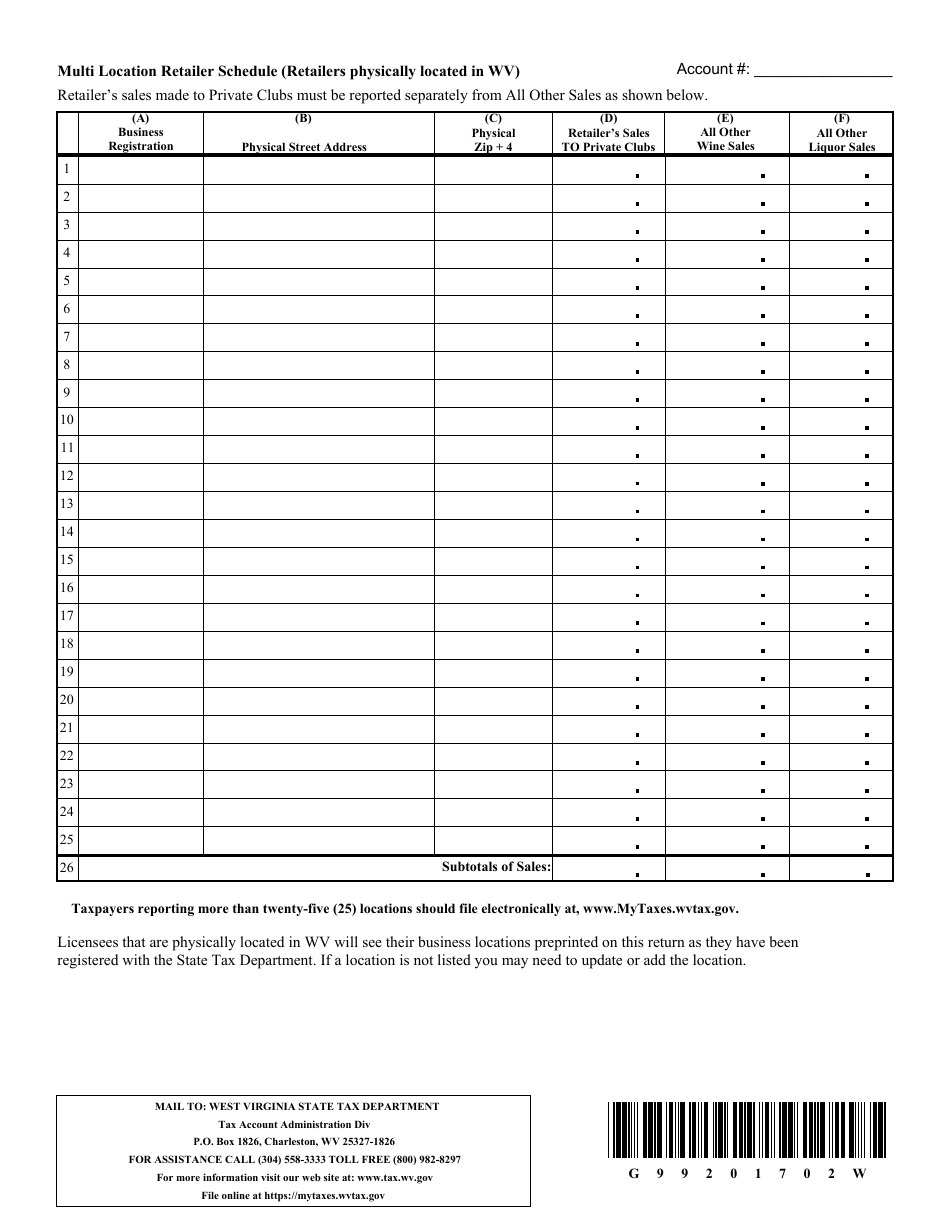

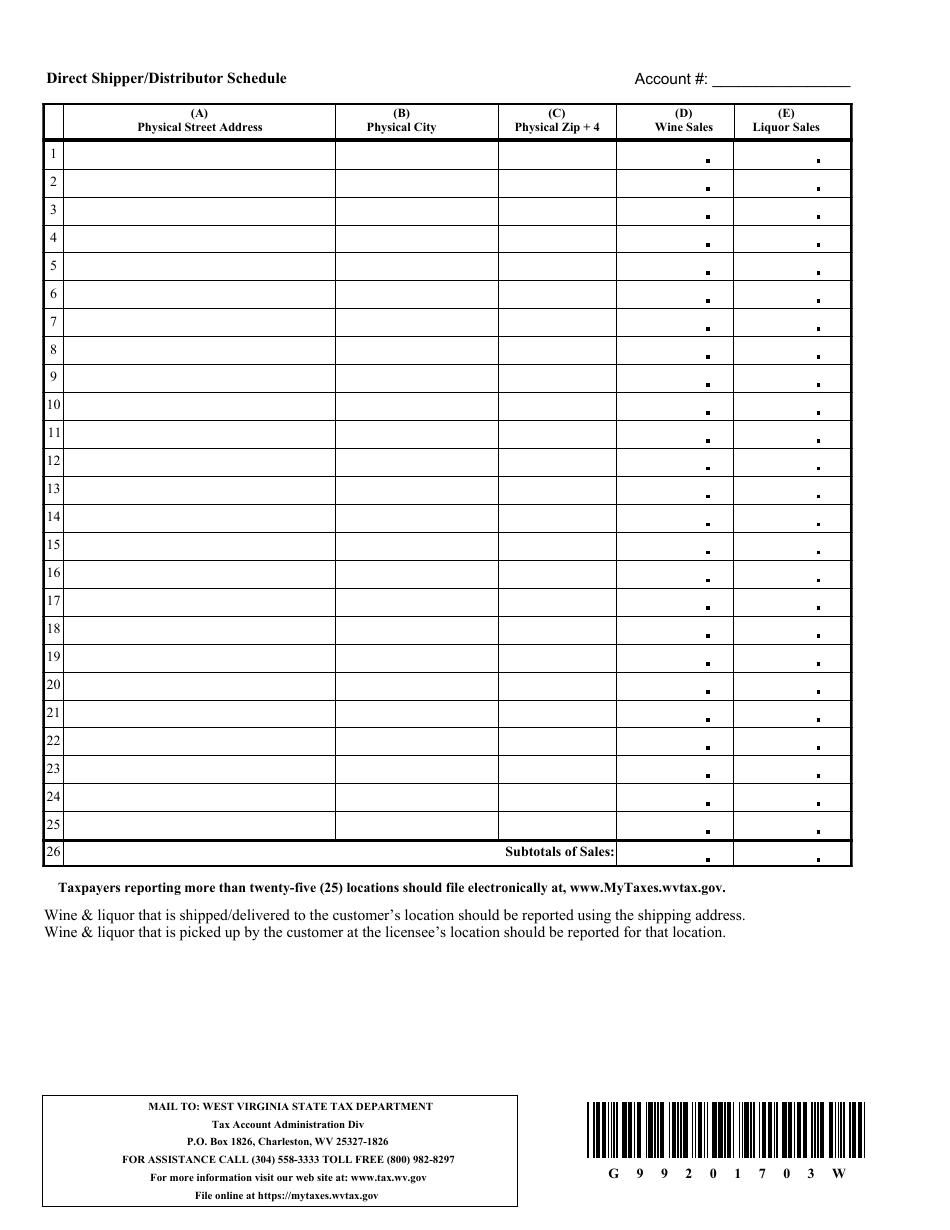

Q: What information do I need to provide on the Form CST-270?

A: You need to provide information about the total gallons of wine and liquor distributed, as well as the distribution tax due.

Q: What happens if I don't file the Form CST-270?

A: Failure to file the Form CST-270 or pay the tax due may result in penalties and interest.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CST-270 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.