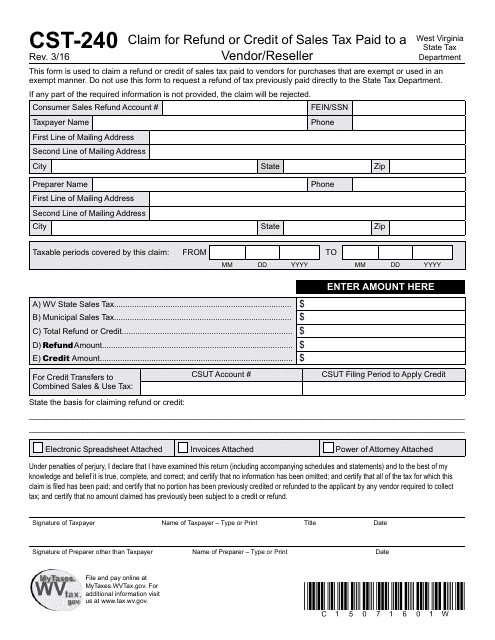

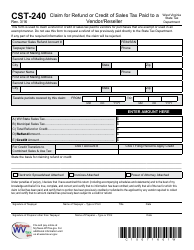

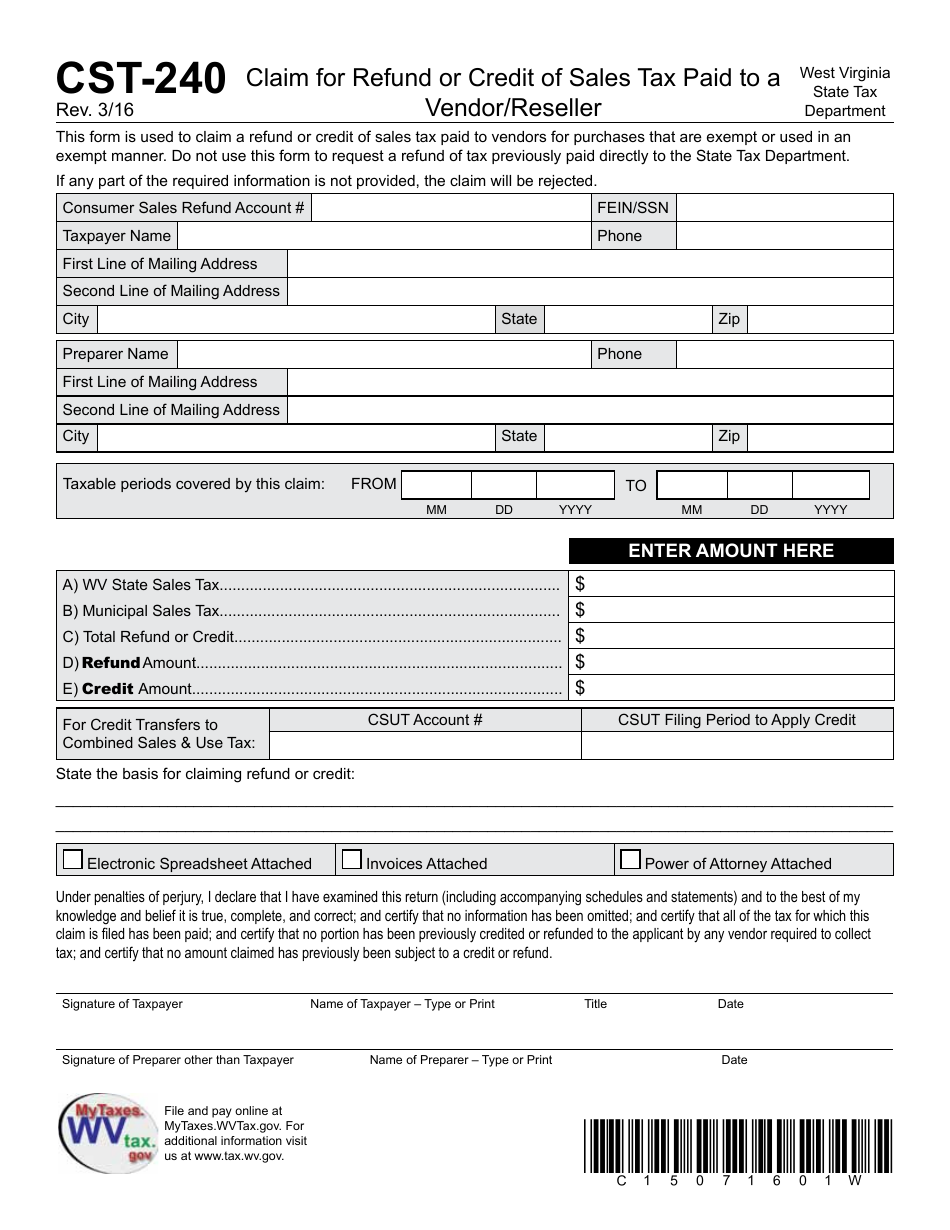

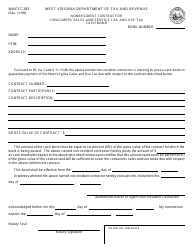

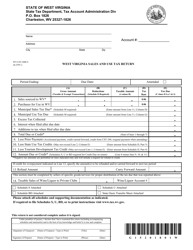

Form CST-240 Claim for Refund or Credit of Sales Tax Paid to a Vendor / Reseller - West Virginia

What Is Form CST-240?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

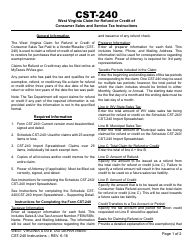

Q: What is the Form CST-240?

A: The Form CST-240 is a claim for refund or credit of sales tax paid to a vendor/reseller in West Virginia.

Q: What is the purpose of the Form CST-240?

A: The Form CST-240 is used to request a refund or credit of sales tax that was paid to a vendor or reseller in West Virginia.

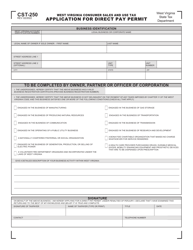

Q: Who can use the Form CST-240?

A: Any individual or business who paid sales tax to a vendor or reseller in West Virginia can use the Form CST-240 to request a refund or credit.

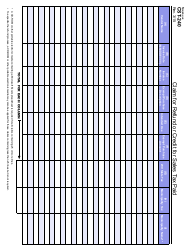

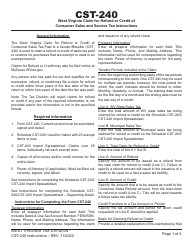

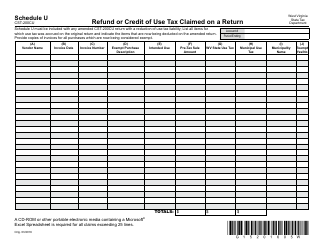

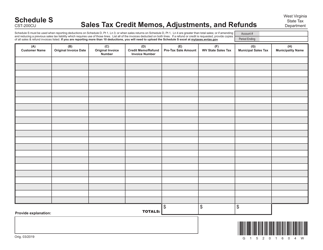

Q: What information is required on the Form CST-240?

A: The Form CST-240 requires information such as the taxpayer's name, address, tax account number, vendor/reseller information, and details of the sales tax paid.

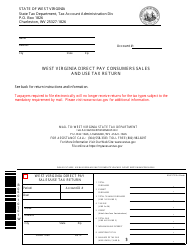

Q: How should the Form CST-240 be filed?

A: The Form CST-240 should be completed and mailed to the West Virginia State Tax Department.

Q: Is there a deadline to file the Form CST-240?

A: Yes, the Form CST-240 must be filed within three years from the date of payment of the sales tax.

Q: Can I claim a refund or credit for sales tax paid in other states on the Form CST-240?

A: No, the Form CST-240 is specifically for requesting a refund or credit of sales tax paid to a vendor or reseller in West Virginia.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CST-240 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.