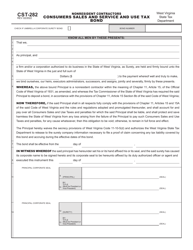

This version of the form is not currently in use and is provided for reference only. Download this version of

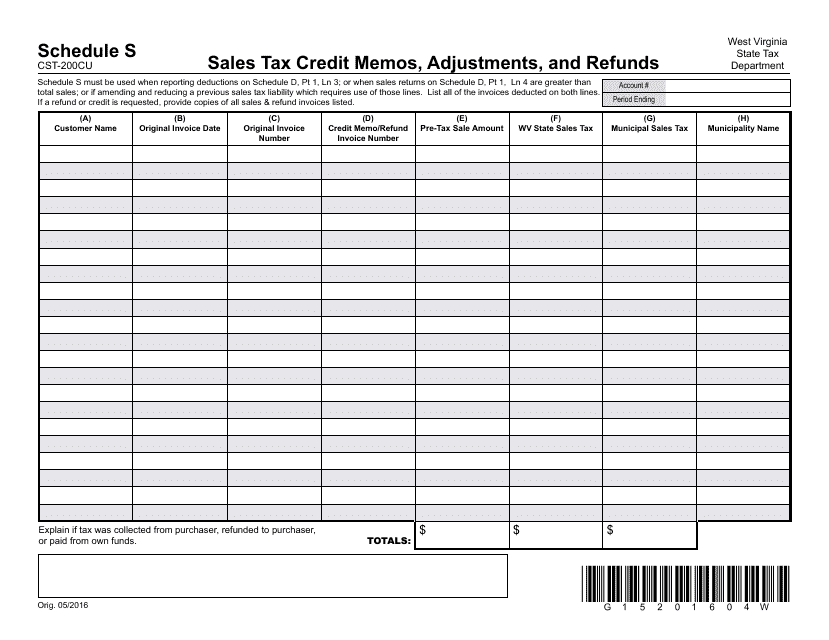

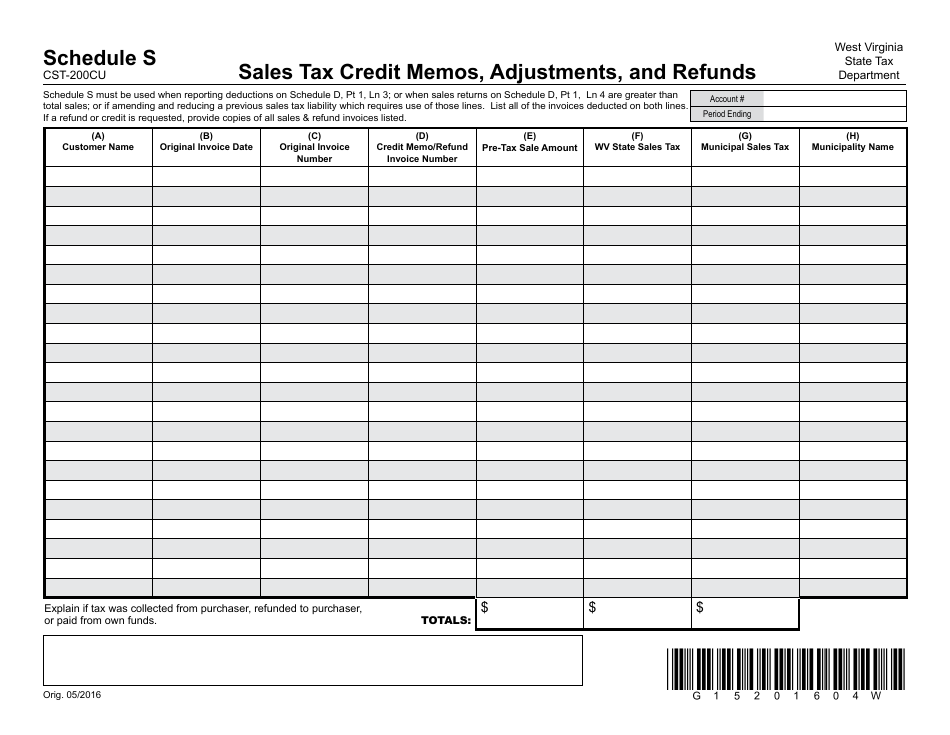

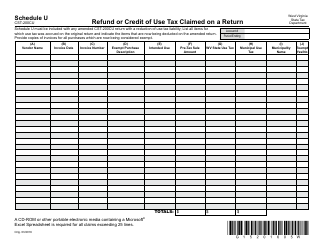

Form CST-200CU Schedule S

for the current year.

Form CST-200CU Schedule S Sales Tax Credit Memos, Adjustments, and Refunds - West Virginia

What Is Form CST-200CU Schedule S?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

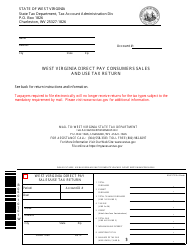

Q: What is the Form CST-200CU Schedule S?

A: The Form CST-200CU Schedule S is a tax form used in West Virginia to report sales taxcredit memos, adjustments, and refunds.

Q: Who needs to file the Form CST-200CU Schedule S?

A: Any business or individual that has sales tax credit memos, adjustments, or refunds in West Virginia needs to file the Form CST-200CU Schedule S.

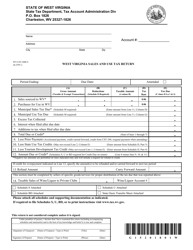

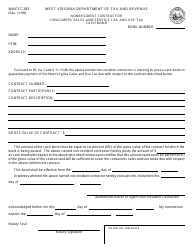

Q: What information is required on the Form CST-200CU Schedule S?

A: The form requires information about the credit memos, adjustments, or refunds, including the dates, amounts, and reasons for the transactions.

Q: When is the deadline to file the Form CST-200CU Schedule S?

A: The deadline to file the form is usually the same as the deadline to file the regular sales tax return in West Virginia.

Q: Do I need to include supporting documents with the Form CST-200CU Schedule S?

A: It is recommended to keep supporting documents for at least three years, but they do not need to be submitted with the form.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CST-200CU Schedule S by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.