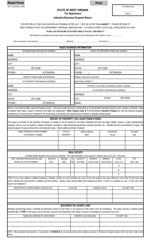

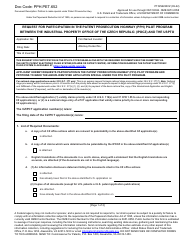

This version of the form is not currently in use and is provided for reference only. Download this version of

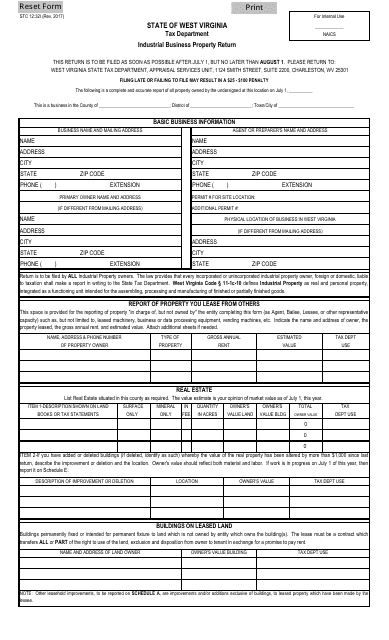

Form STC12:32I

for the current year.

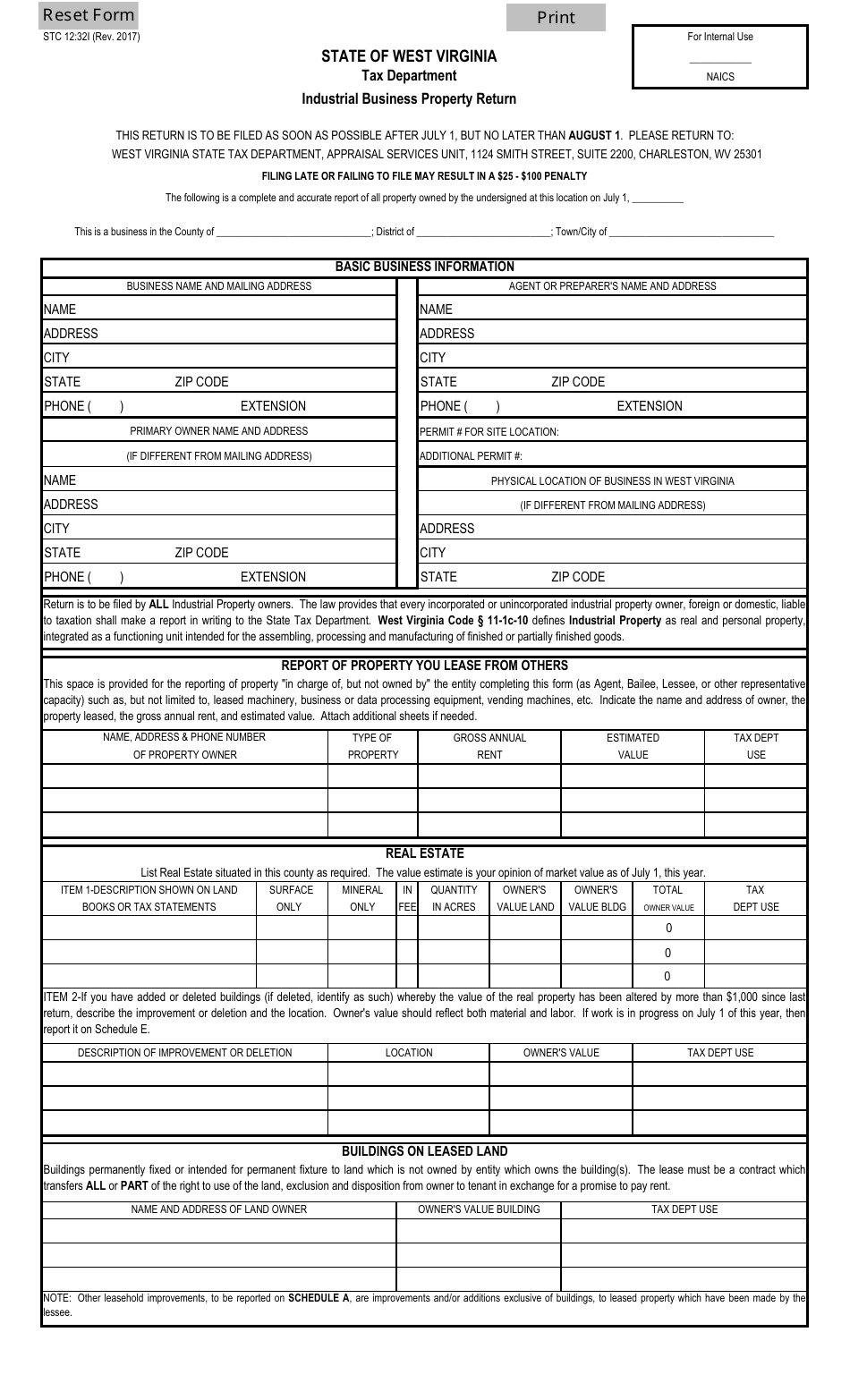

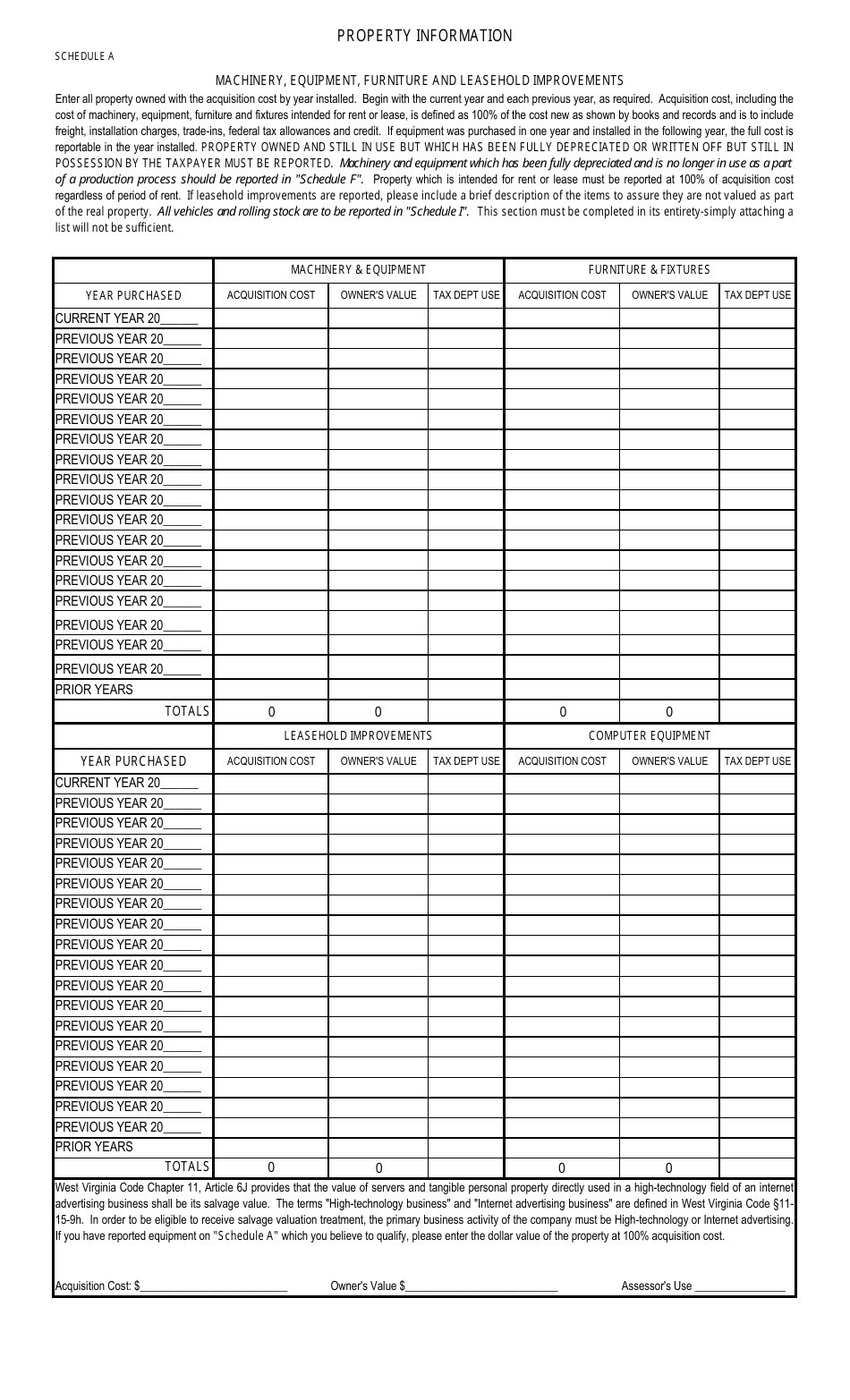

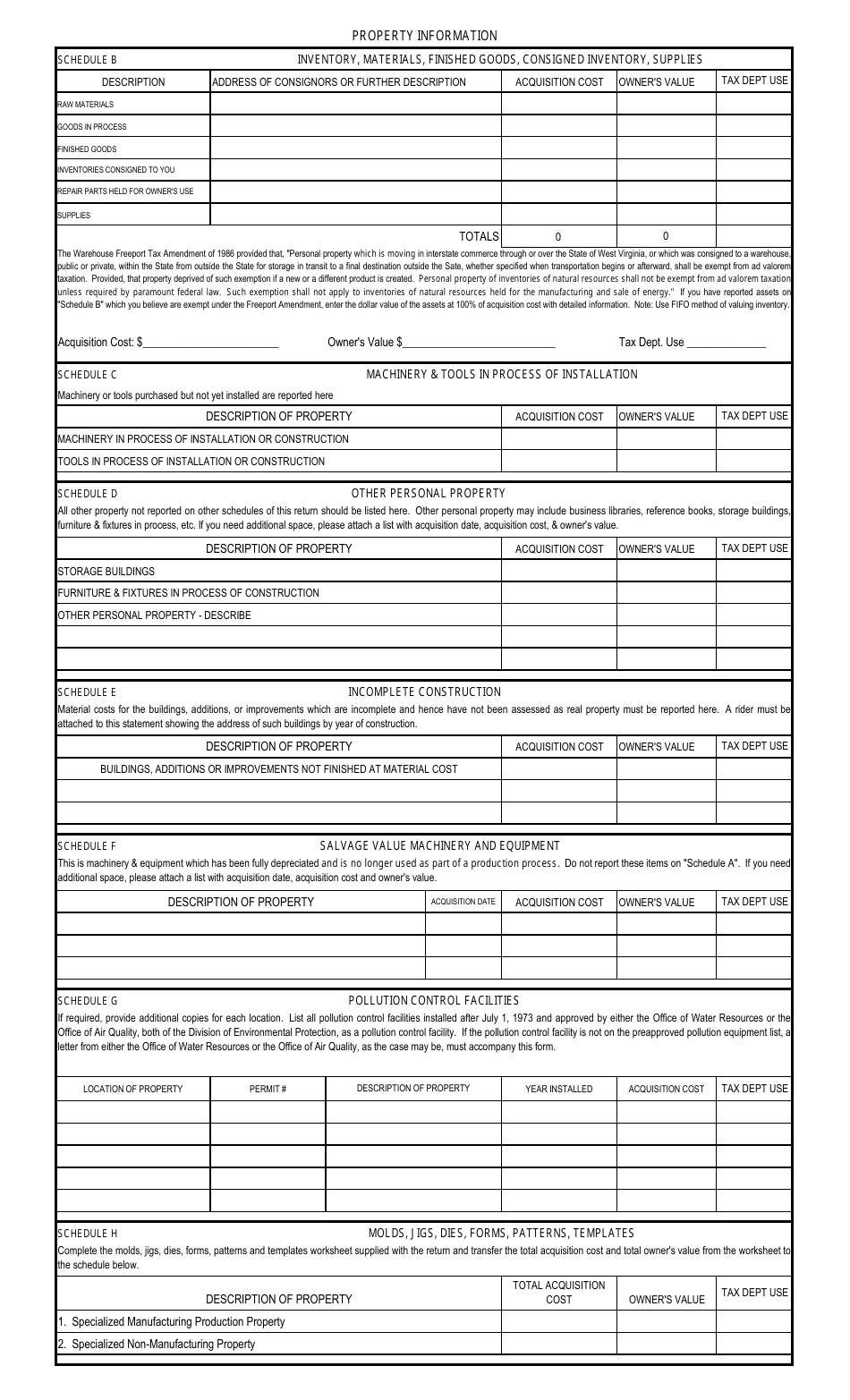

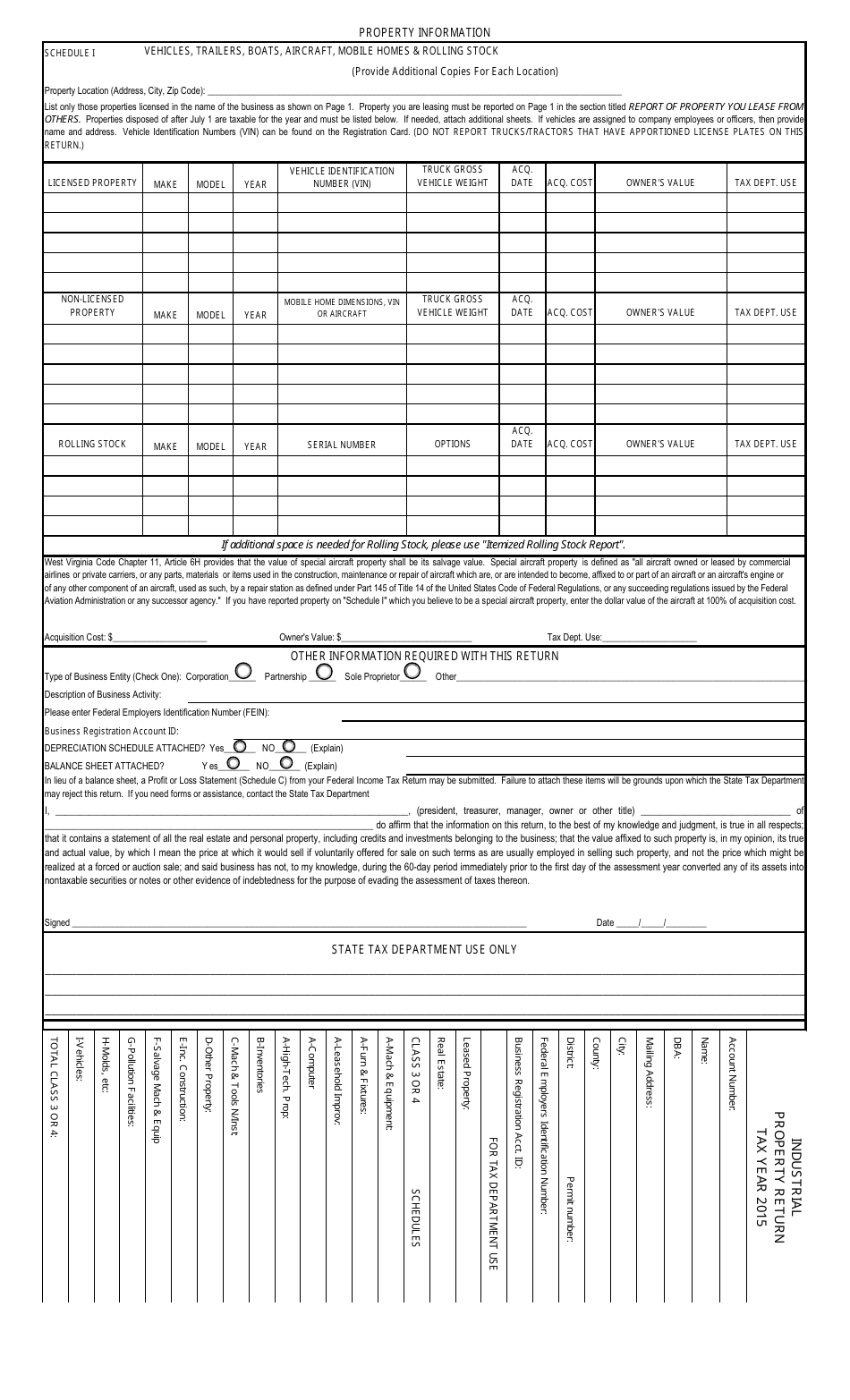

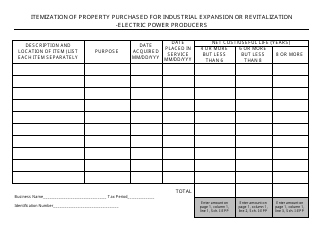

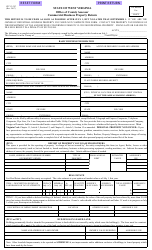

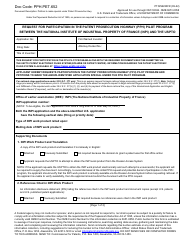

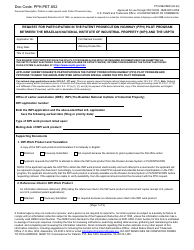

Form STC12:32I Industrial Business Property Return - West Virginia

What Is Form STC12:32I?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STC12:32I?

A: Form STC12:32I is the Industrial Business Property Return form used in West Virginia.

Q: Who needs to file Form STC12:32I?

A: Businesses that own industrial property in West Virginia are required to file Form STC12:32I.

Q: What is the purpose of Form STC12:32I?

A: The purpose of Form STC12:32I is to report and assess taxes on industrial business property in West Virginia.

Q: When is the deadline to file Form STC12:32I?

A: Form STC12:32I must be filed by September 1st of each year.

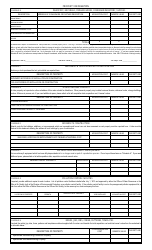

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form STC12:32I. The penalty is 10% of the tax due, with a minimum penalty of $25.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STC12:32I by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.