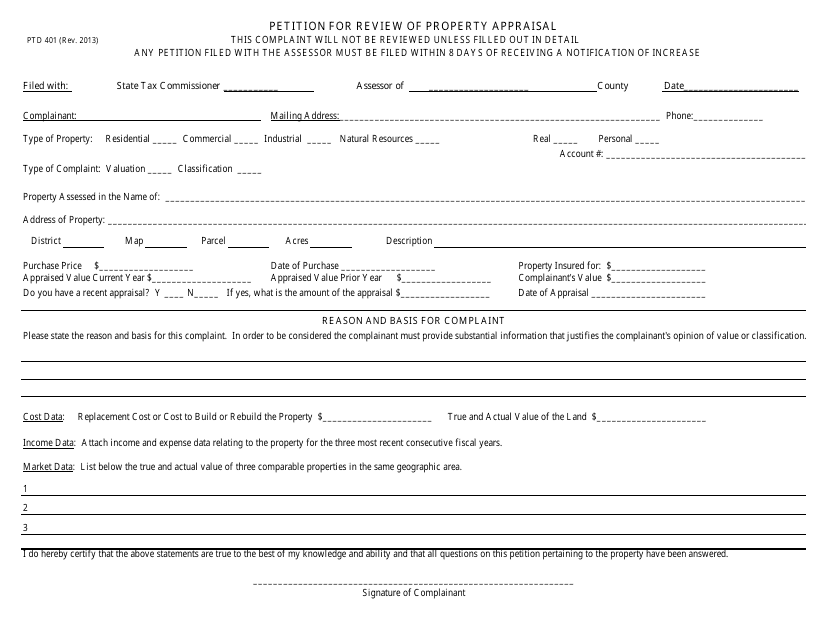

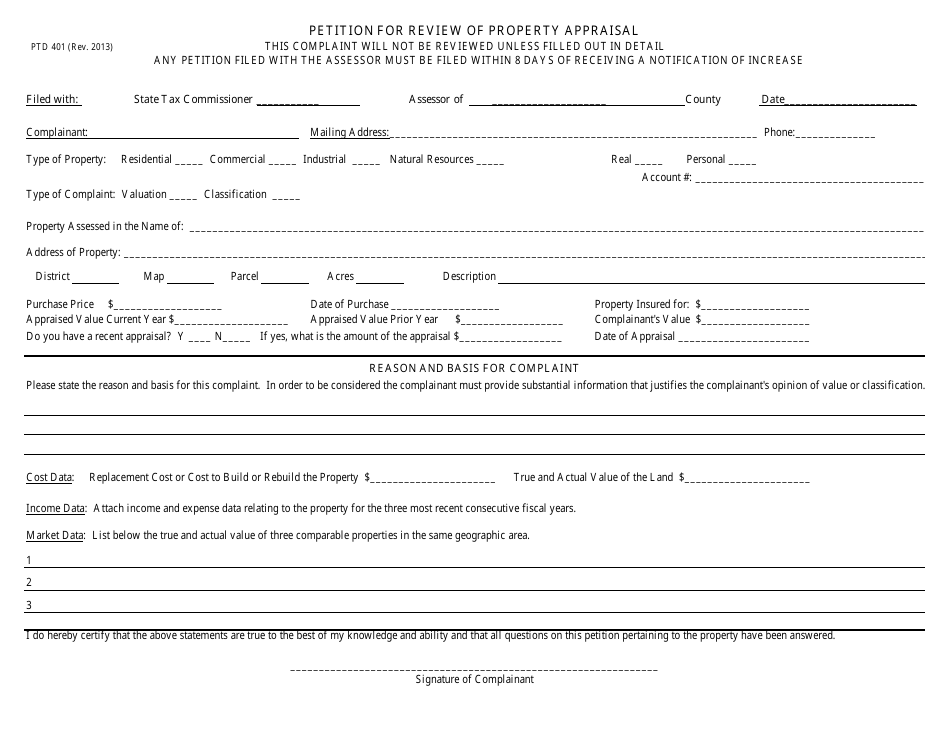

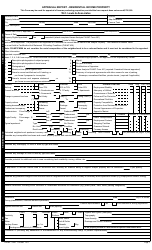

Form PTD401 Petition for Review of Property Appraisal - West Virginia

What Is Form PTD401?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form PTD401?

A: Form PTD401 is used to petition for a review of a property appraisal in West Virginia.

Q: When should I submit Form PTD401?

A: Form PTD401 should be submitted within 30 days of the date of the notice of assessment.

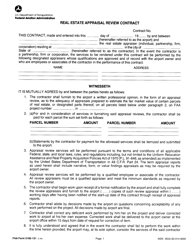

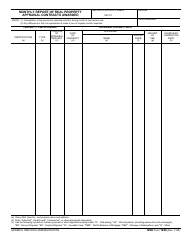

Q: What information should I provide on Form PTD401?

A: You should provide detailed information about the property and the grounds for your appeal.

Q: Are there any fees associated with filing Form PTD401?

A: Yes, there is a $10 filing fee for submitting Form PTD401.

Q: What happens after I submit Form PTD401?

A: After you submit Form PTD401, the local county commission will review your petition and schedule a hearing if necessary.

Q: Can I appeal the decision of the local county commission?

A: Yes, if you are not satisfied with the decision of the local county commission, you can further appeal to the West Virginia State Tax Department's Property Tax Division.

Q: Is there a deadline for filing an appeal?

A: Yes, the deadline for filing an appeal is June 30th of the assessment year.

Q: Can I represent myself in the appeal process?

A: Yes, you have the option to represent yourself or hire an attorney to represent you during the appeal process.

Q: What is the purpose of the appeal process?

A: The appeal process provides an opportunity for property owners to challenge the assessed value of their property and potentially lower their property tax liability.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTD401 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.