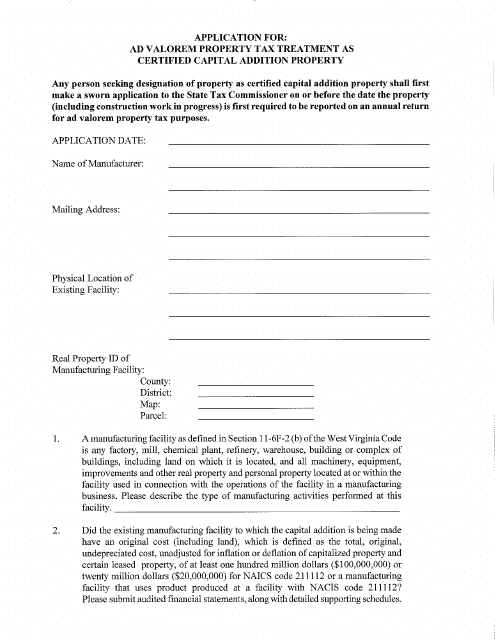

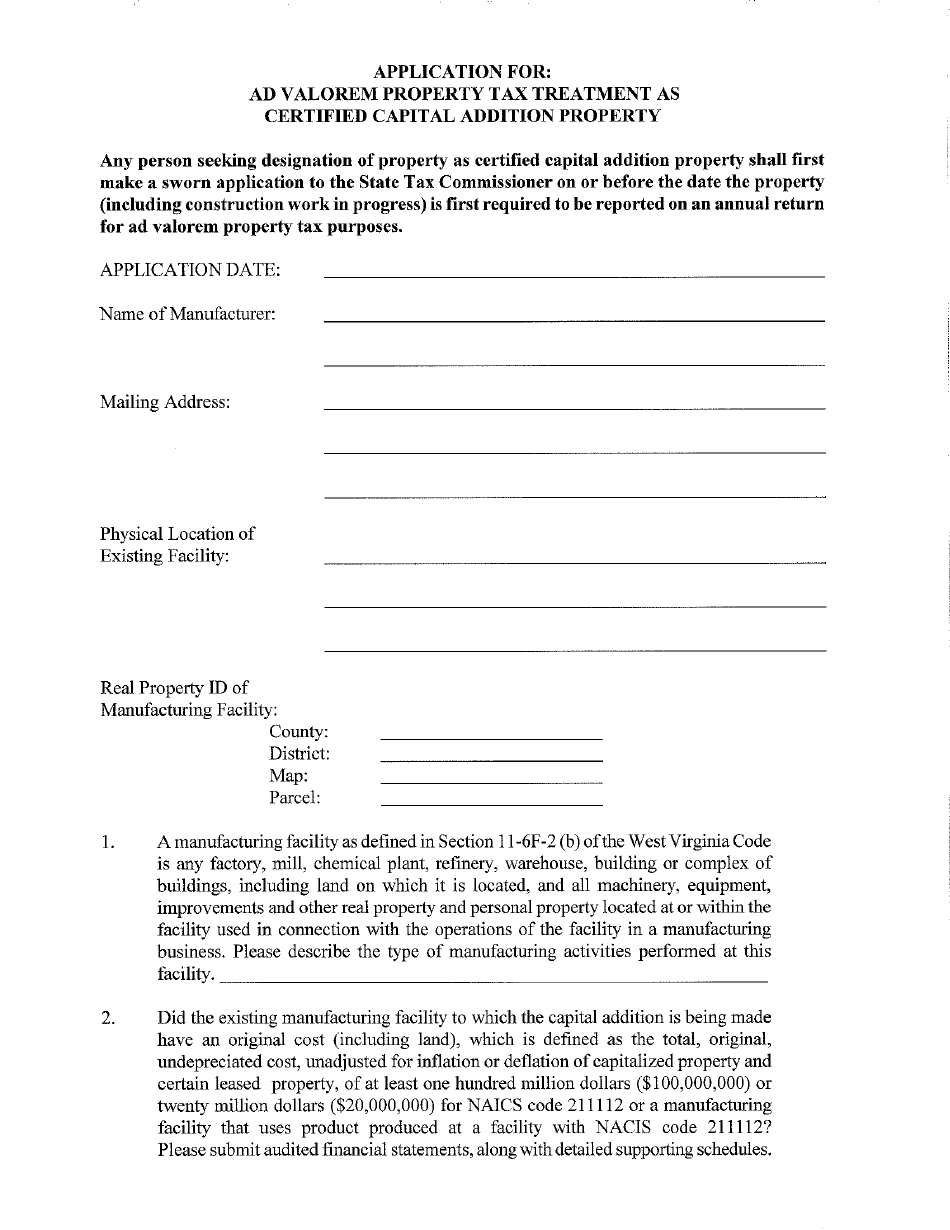

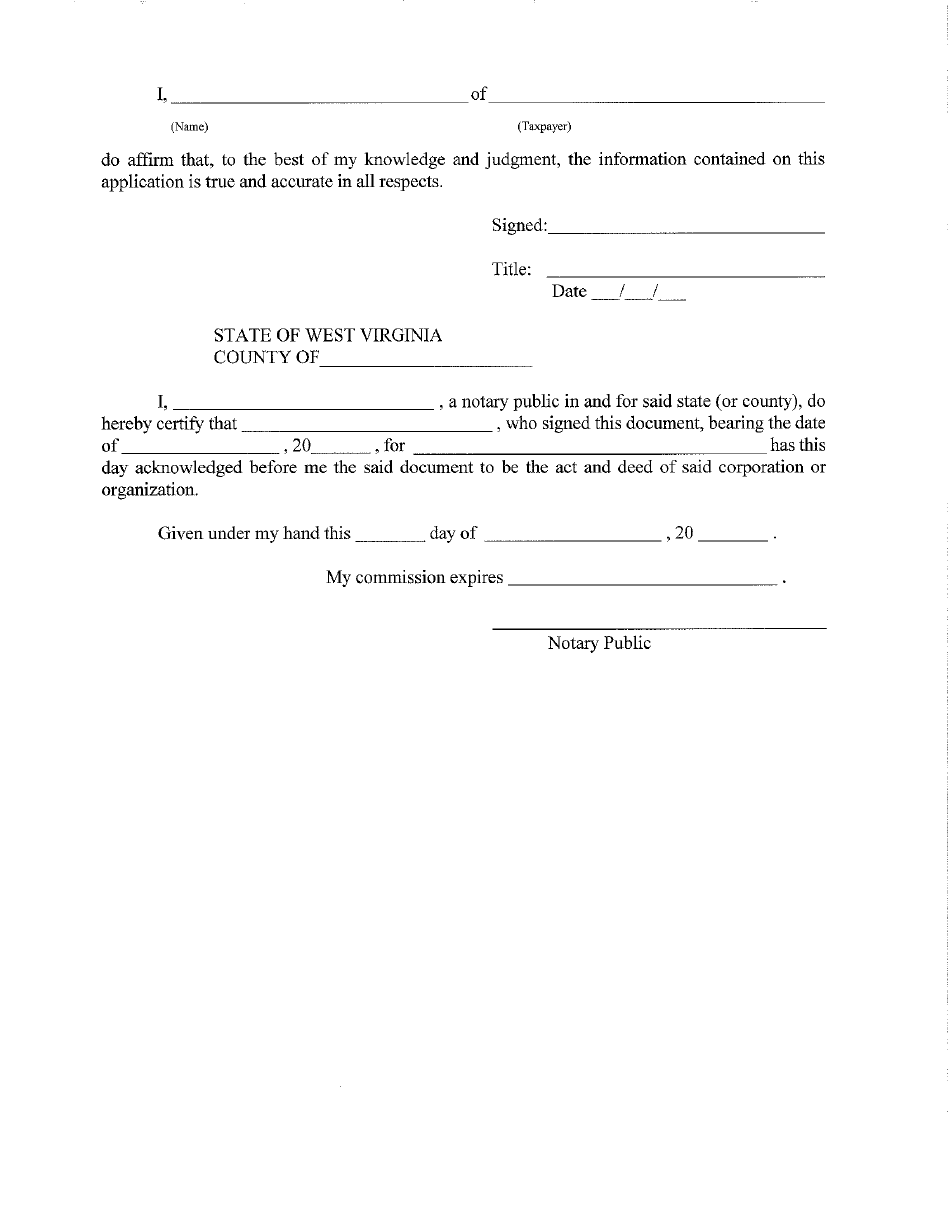

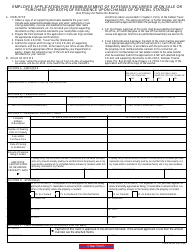

Application Form for Ad Valorem Property Tax Treatment as Certified Capital Addition Property - West Virginia

Application Form for Ad Valorem Property Tax Treatment as Certified Capital Addition Property is a legal document that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.

FAQ

Q: What is the Ad Valorem Property Tax Treatment?

A: Ad Valorem Property Tax Treatment is a classification for property tax assessment based on the value of the property.

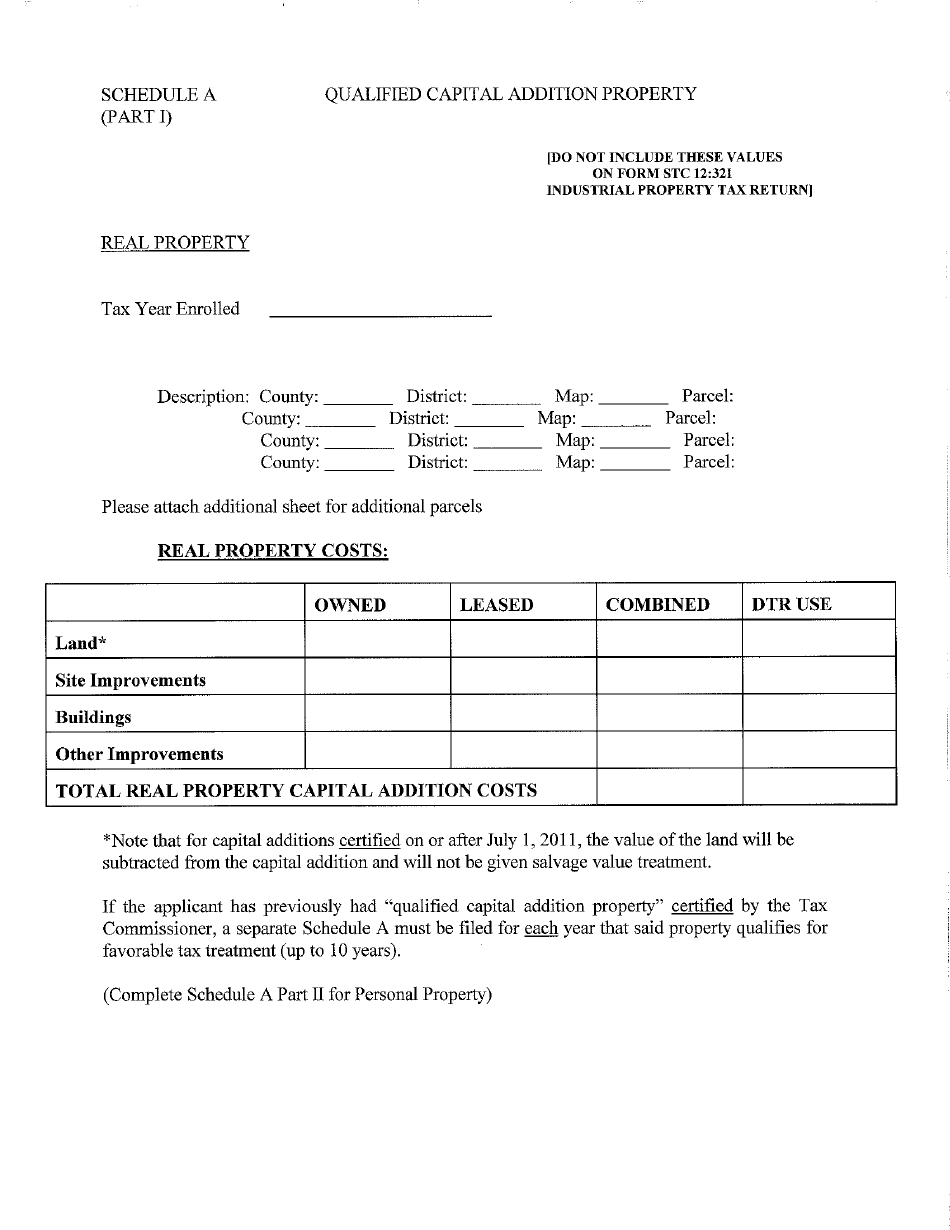

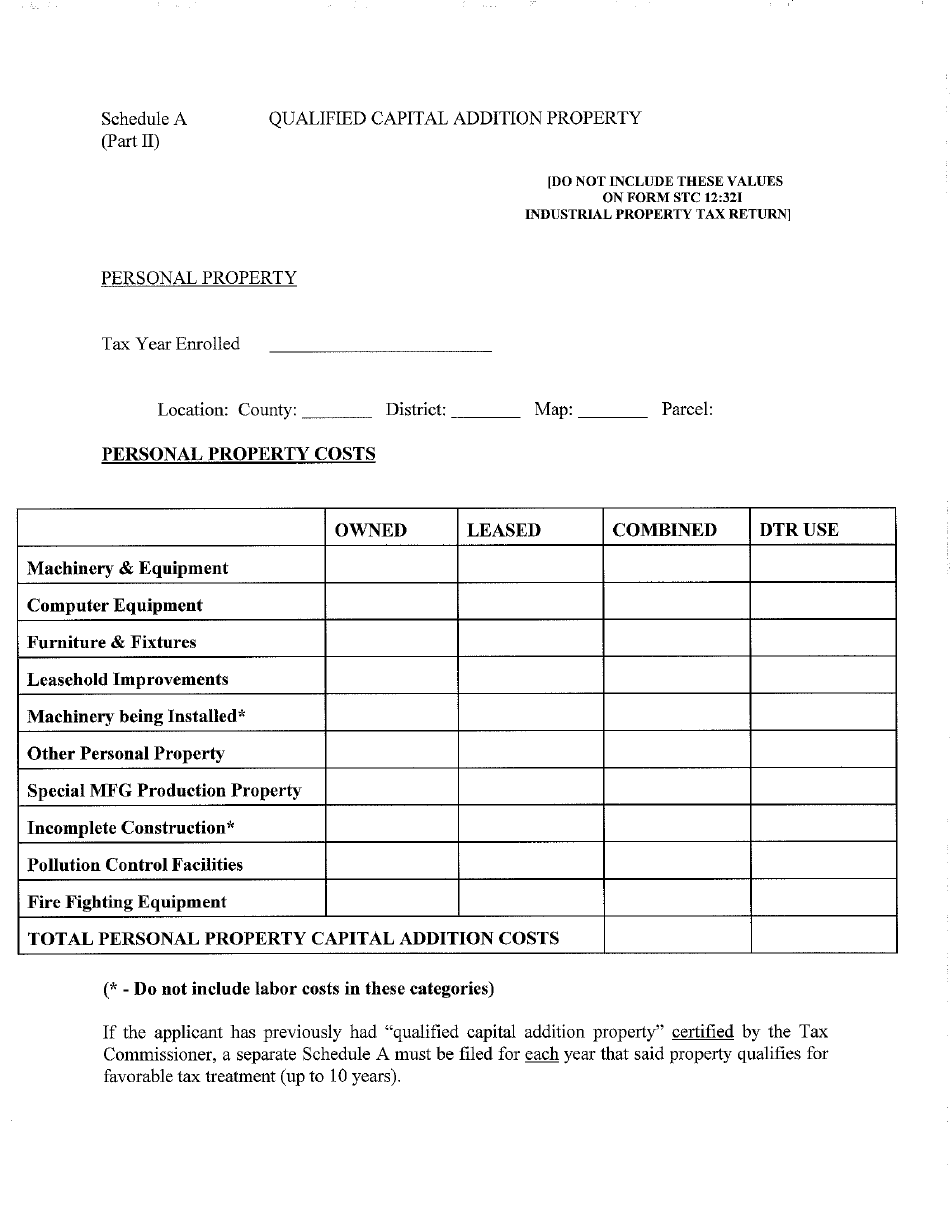

Q: What is Certified Capital Addition Property?

A: Certified Capital Addition Property refers to property that has undergone approved improvements or additions.

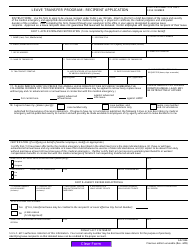

Q: How can I apply for Ad Valorem Property Tax Treatment as Certified Capital Addition Property?

A: You can apply by completing the application form specifically for this purpose.

Q: Is the application form specific to West Virginia?

A: Yes, this application form is specific to West Virginia property tax treatment.

Q: What are the benefits of Ad Valorem Property Tax Treatment as Certified Capital Addition Property?

A: The benefits include potential tax exemptions or reductions on the assessed value of the certified capital addition property.

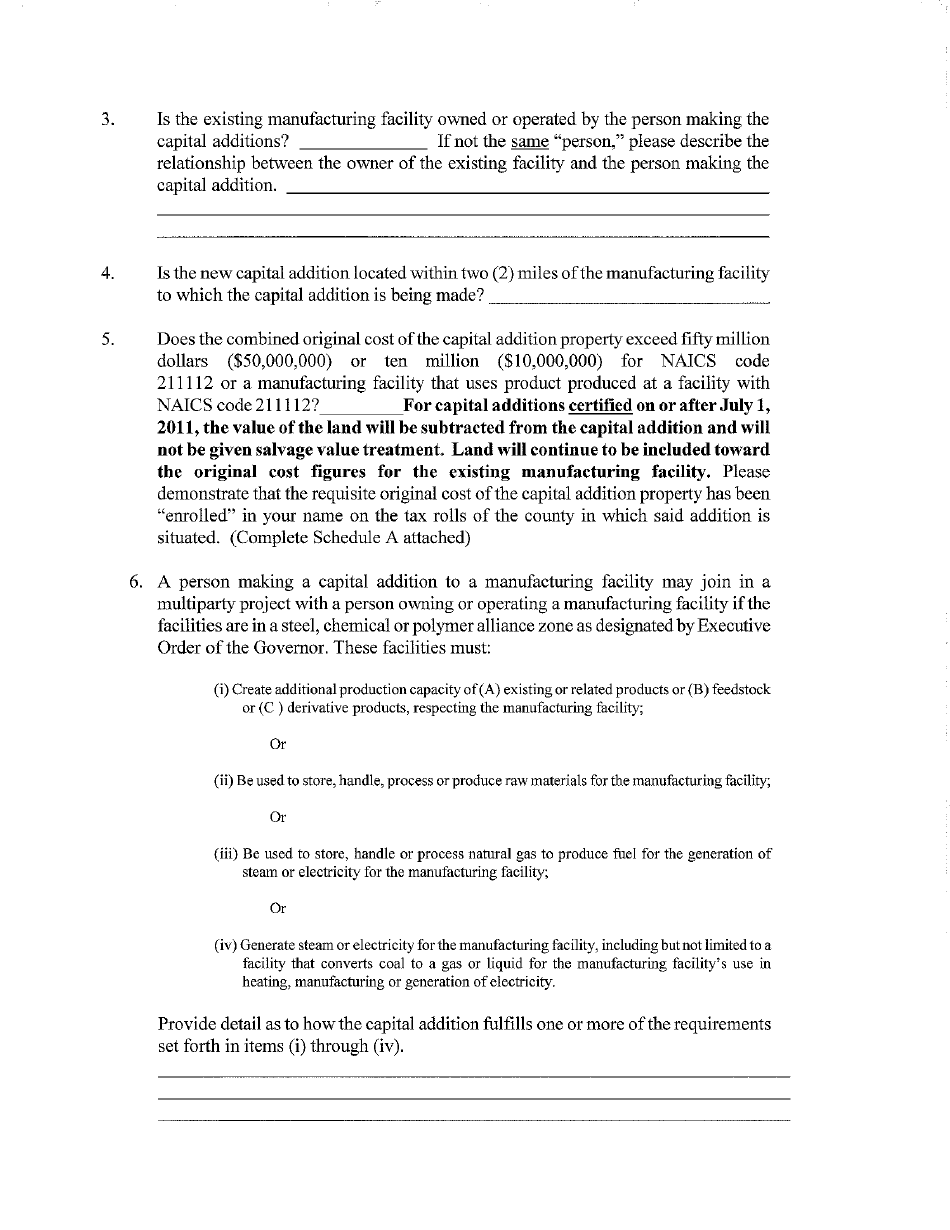

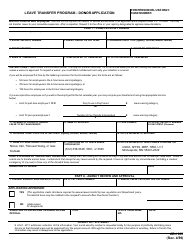

Q: Are there any eligibility requirements for this tax treatment?

A: Yes, the property must meet certain criteria for the certified capital addition property classification.

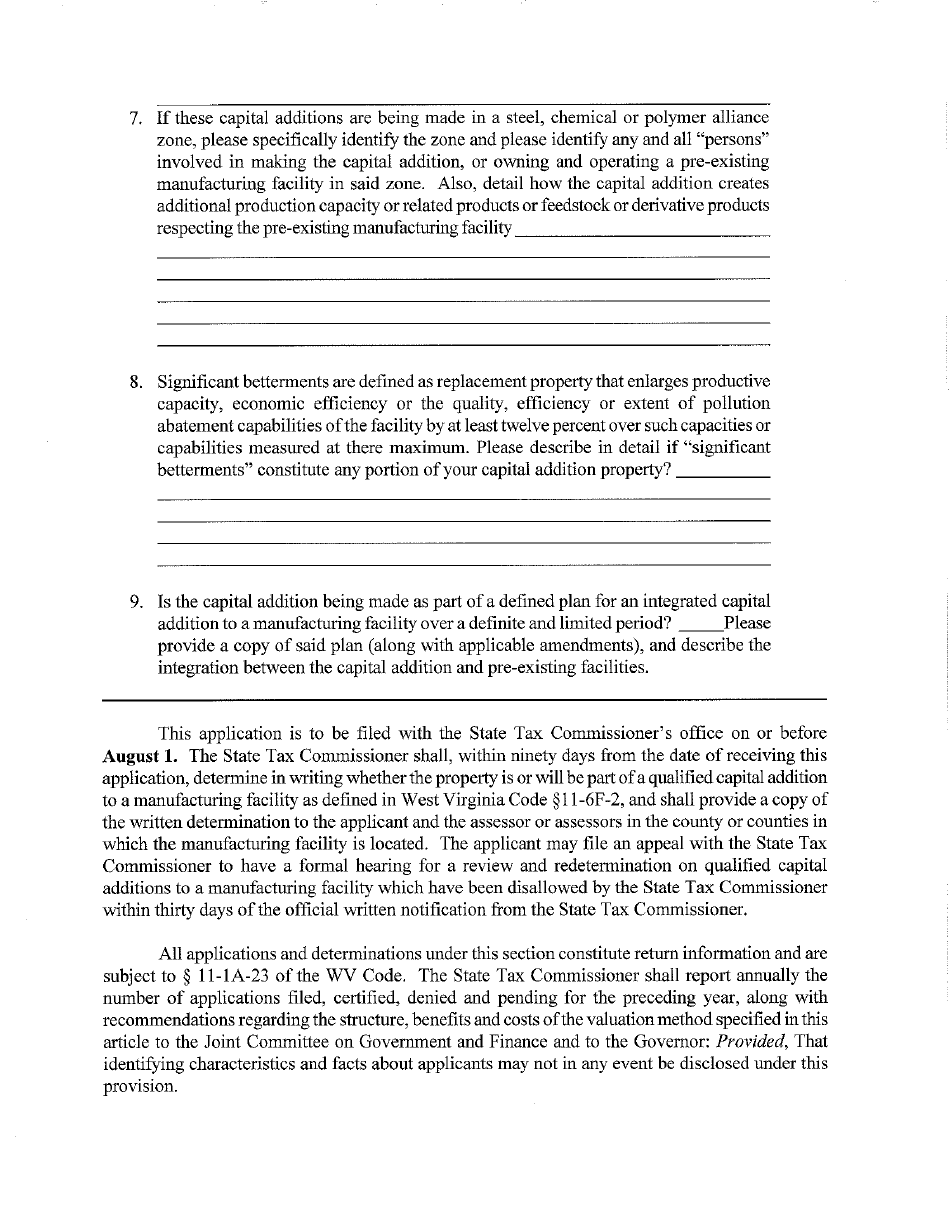

Q: Is there a deadline for submitting the application?

A: The application deadline may vary, so it's advisable to inquire with the local tax authority for specific deadlines.

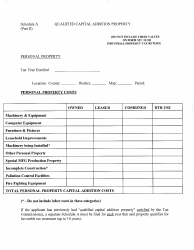

Form Details:

- The latest edition currently provided by the West Virginia State Tax Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.