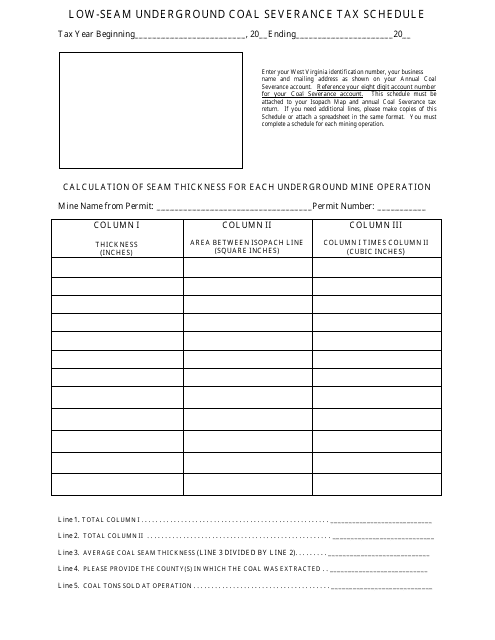

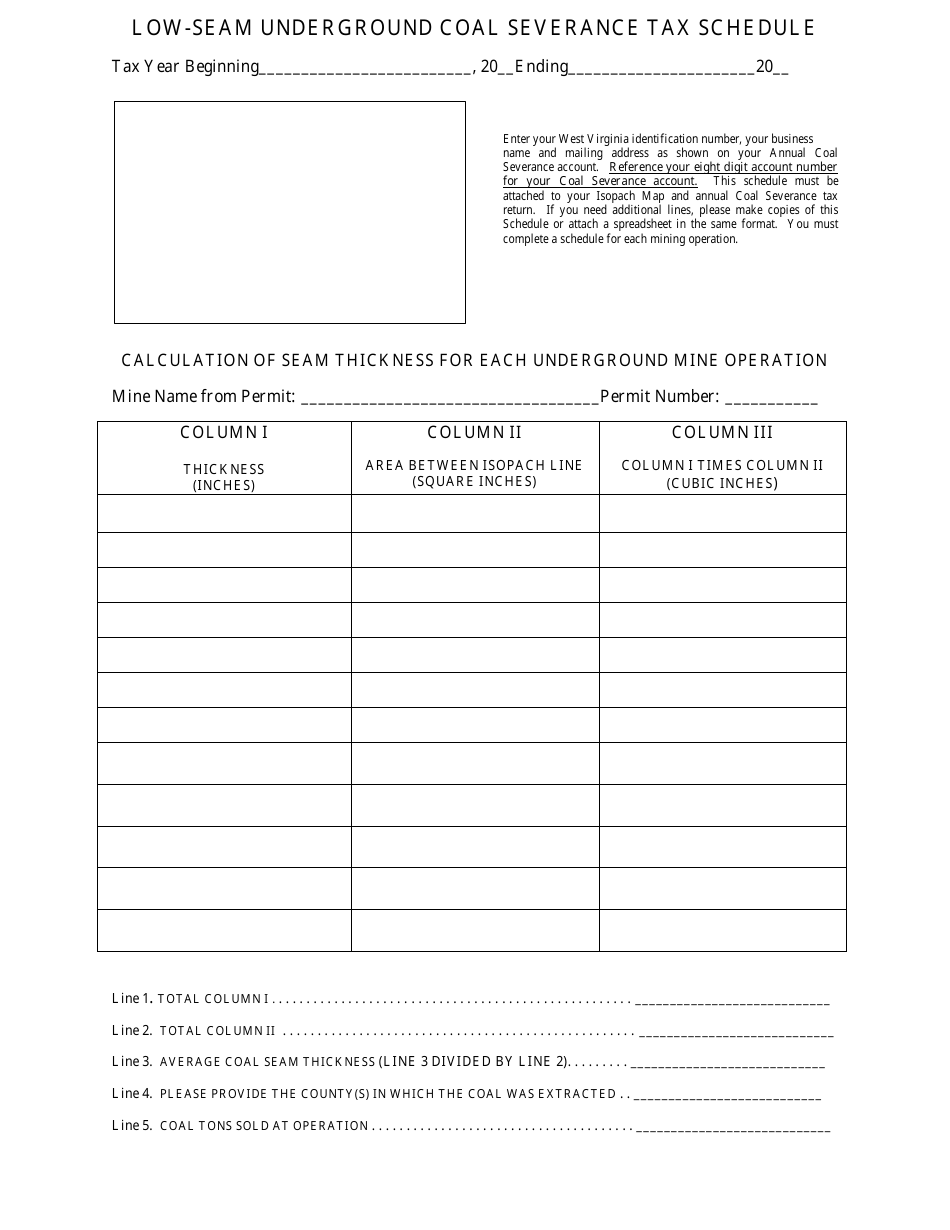

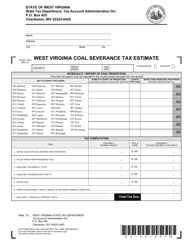

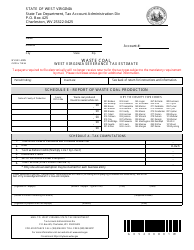

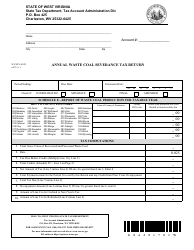

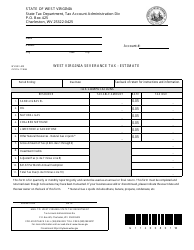

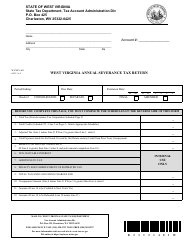

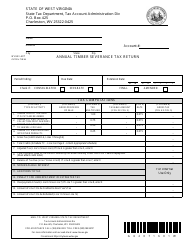

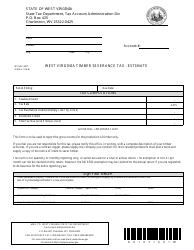

Low-Seam Underground Coal Severance Tax Schedule - West Virginia

Low-Seam Underground Coal Severance Tax Schedule is a legal document that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.

FAQ

Q: What is the Low-Seam Underground Coal Severance Tax Schedule?

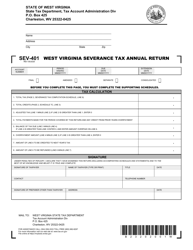

A: The Low-Seam Underground Coal Severance Tax Schedule is a tax schedule in West Virginia that applies to the extraction of coal from low-seam underground mines.

Q: What is a severance tax?

A: A severance tax is a tax imposed on the extraction of natural resources, such as coal, oil, or gas.

Q: What is considered low-seam underground coal?

A: Low-seam underground coal refers to coal deposits that are located close to the surface and can be extracted through underground mining methods.

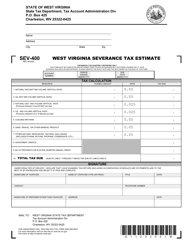

Q: How does the tax schedule work?

A: The tax schedule sets the tax rates based on the tonnage of low-seam underground coal extracted. The higher the tonnage, the higher the tax rate.

Q: What is the purpose of the tax?

A: The tax is imposed to generate revenue for the state and to offset the environmental and social costs associated with the extraction of coal.

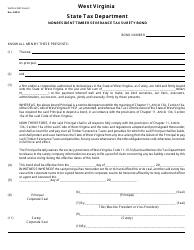

Q: Who pays the severance tax?

A: The tax is paid by the mining companies or operators who extract low-seam underground coal.

Q: Is the tax rate the same for all low-seam underground coal?

A: No, the tax rates vary depending on the tonnage of coal extracted. Higher tonnage leads to higher tax rates.

Q: Are there any exemptions from the tax?

A: Yes, certain exemptions and credits may apply based on specific criteria, such as the location of the mine or the amount of coal extracted.

Form Details:

- The latest edition currently provided by the West Virginia State Tax Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.