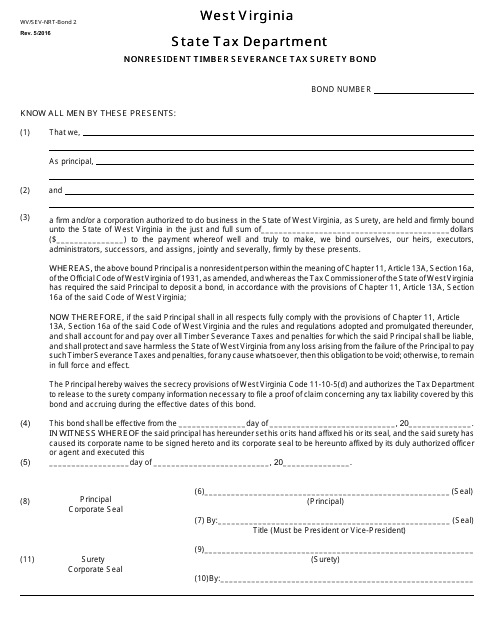

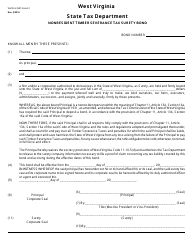

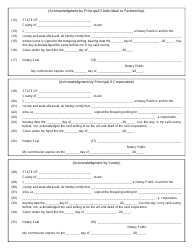

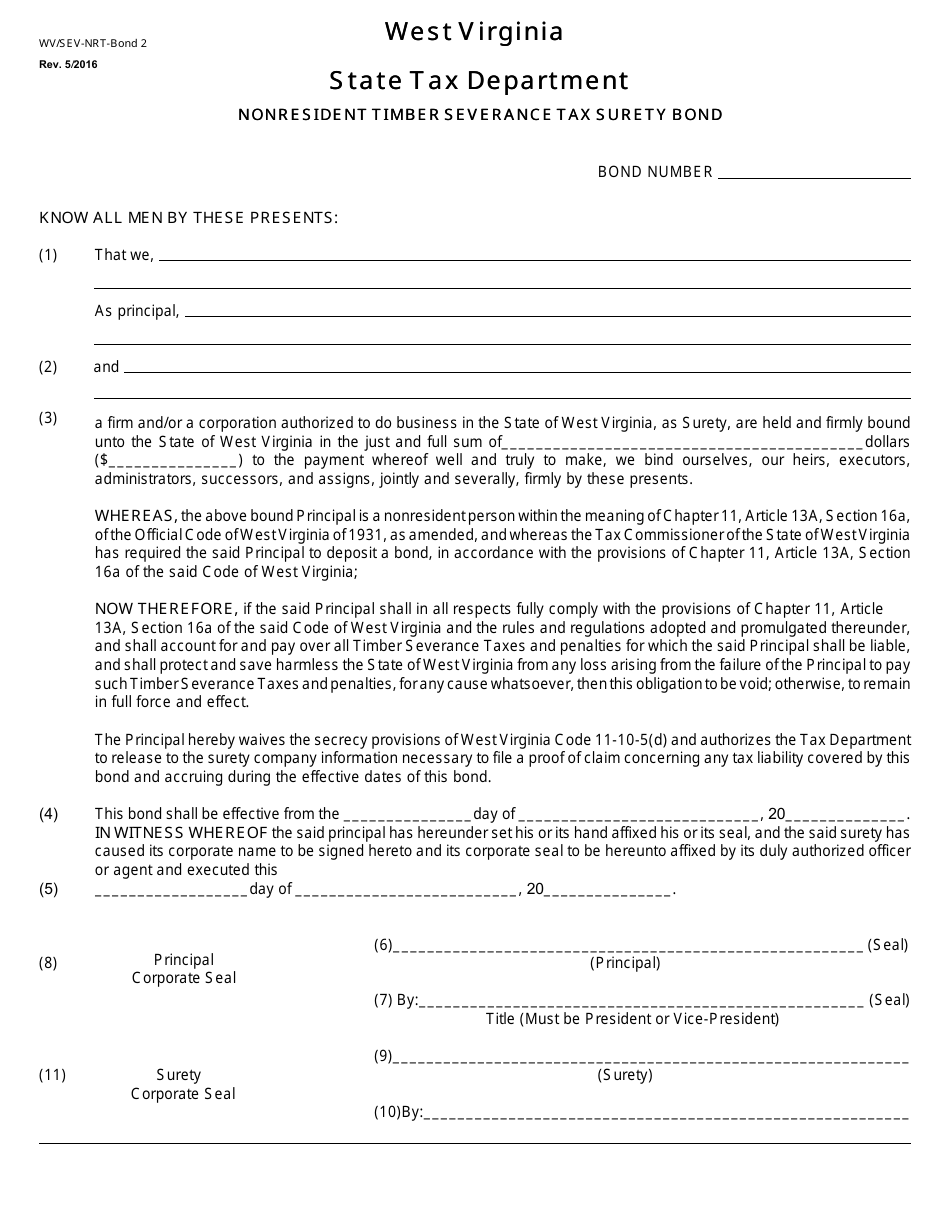

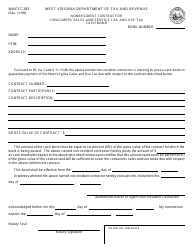

Form WV / SEV-nrt-Bond 2 Nonresident Timber Severance Tax Surety Bond - West Virginia

What Is Form WV/SEV-nrt-Bond 2?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/SEV-nrt-Bond 2?

A: The WV/SEV-nrt-Bond 2 is a nonresident timber severance taxsurety bond used in West Virginia.

Q: What is the purpose of the WV/SEV-nrt-Bond 2?

A: The purpose of the WV/SEV-nrt-Bond 2 is to provide a guarantee for the payment of timber severance taxes by nonresident taxpayers in West Virginia.

Q: Who needs to file the WV/SEV-nrt-Bond 2?

A: Nonresident taxpayers who engage in timber severance activities in West Virginia need to file the WV/SEV-nrt-Bond 2.

Q: What does the WV/SEV-nrt-Bond 2 cover?

A: The WV/SEV-nrt-Bond 2 covers the payment of timber severance taxes for nonresident taxpayers in West Virginia.

Q: Are there any fees or costs associated with the WV/SEV-nrt-Bond 2?

A: Yes, there may be fees or costs associated with obtaining the WV/SEV-nrt-Bond 2. You should contact the West Virginia State Tax Department for more information.

Q: Is the WV/SEV-nrt-Bond 2 specific to nonresident taxpayers?

A: Yes, the WV/SEV-nrt-Bond 2 is specifically for nonresident taxpayers who engage in timber severance activities in West Virginia.

Q: What happens if a nonresident taxpayer fails to pay timber severance taxes?

A: If a nonresident taxpayer fails to pay timber severance taxes, the WV/SEV-nrt-Bond 2 can be used to cover the unpaid taxes.

Q: Can the WV/SEV-nrt-Bond 2 be canceled or revoked?

A: Yes, the WV/SEV-nrt-Bond 2 can be canceled or revoked by the West Virginia State Tax Department if certain conditions are not met.

Q: Is the WV/SEV-nrt-Bond 2 required for all nonresident taxpayers?

A: Yes, the WV/SEV-nrt-Bond 2 is required for all nonresident taxpayers who engage in timber severance activities in West Virginia.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/SEV-nrt-Bond 2 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.