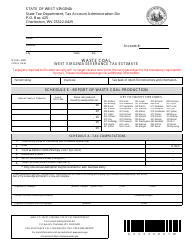

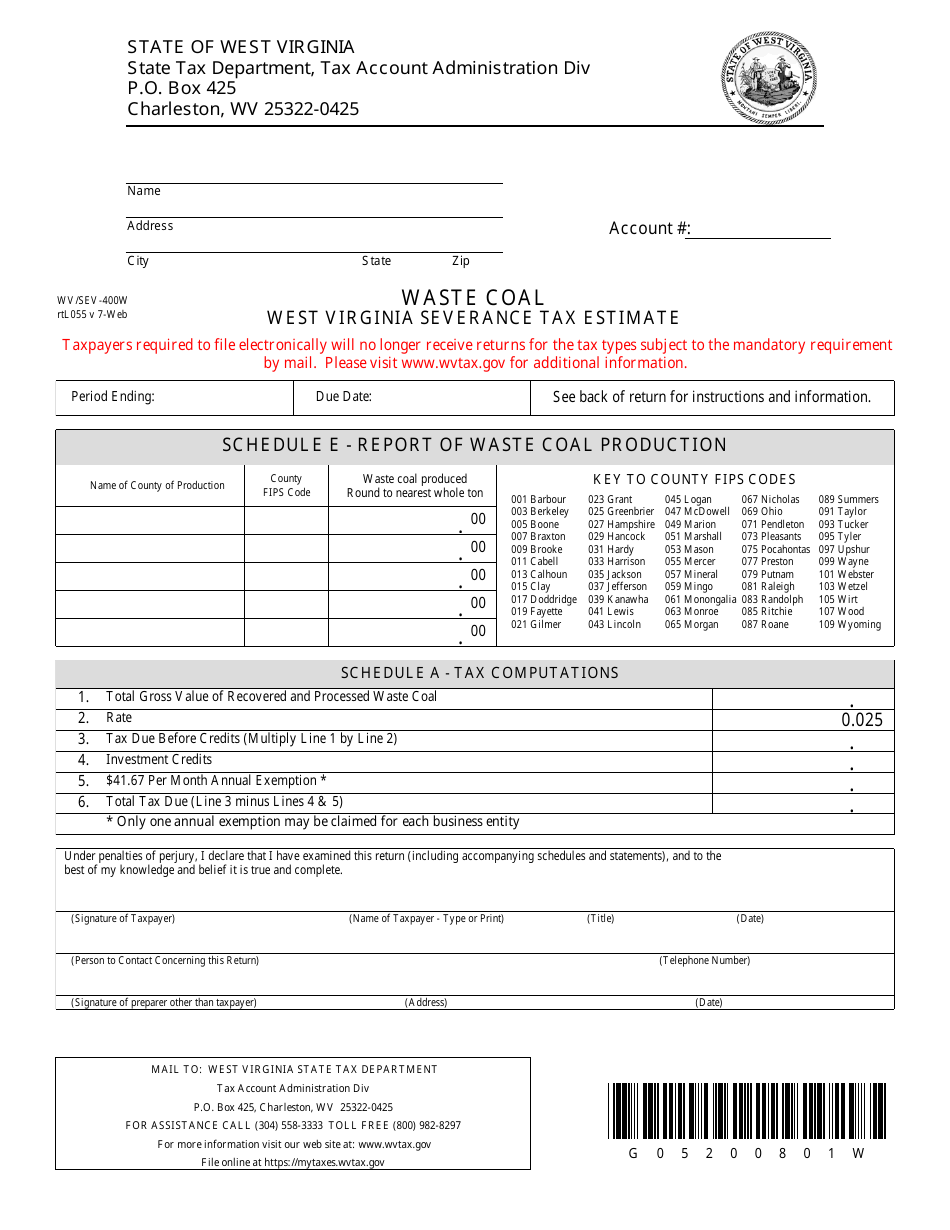

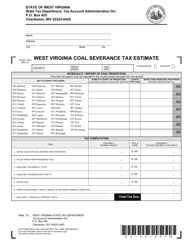

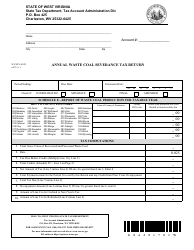

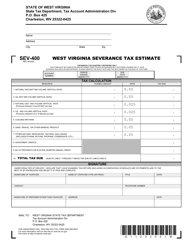

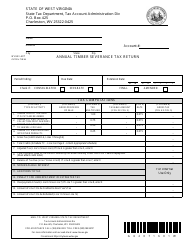

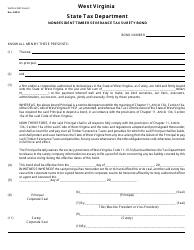

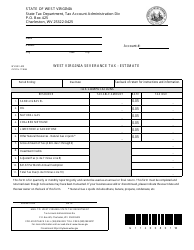

Form WV / SEV-400w Waste Coal West Virginia Severance Tax Estimate - West Virginia

What Is Form WV/SEV-400w?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/SEV-400w form?

A: The WV/SEV-400w form is the Waste Coal West Virginia Severance Tax Estimate form.

Q: What is the purpose of the WV/SEV-400w form?

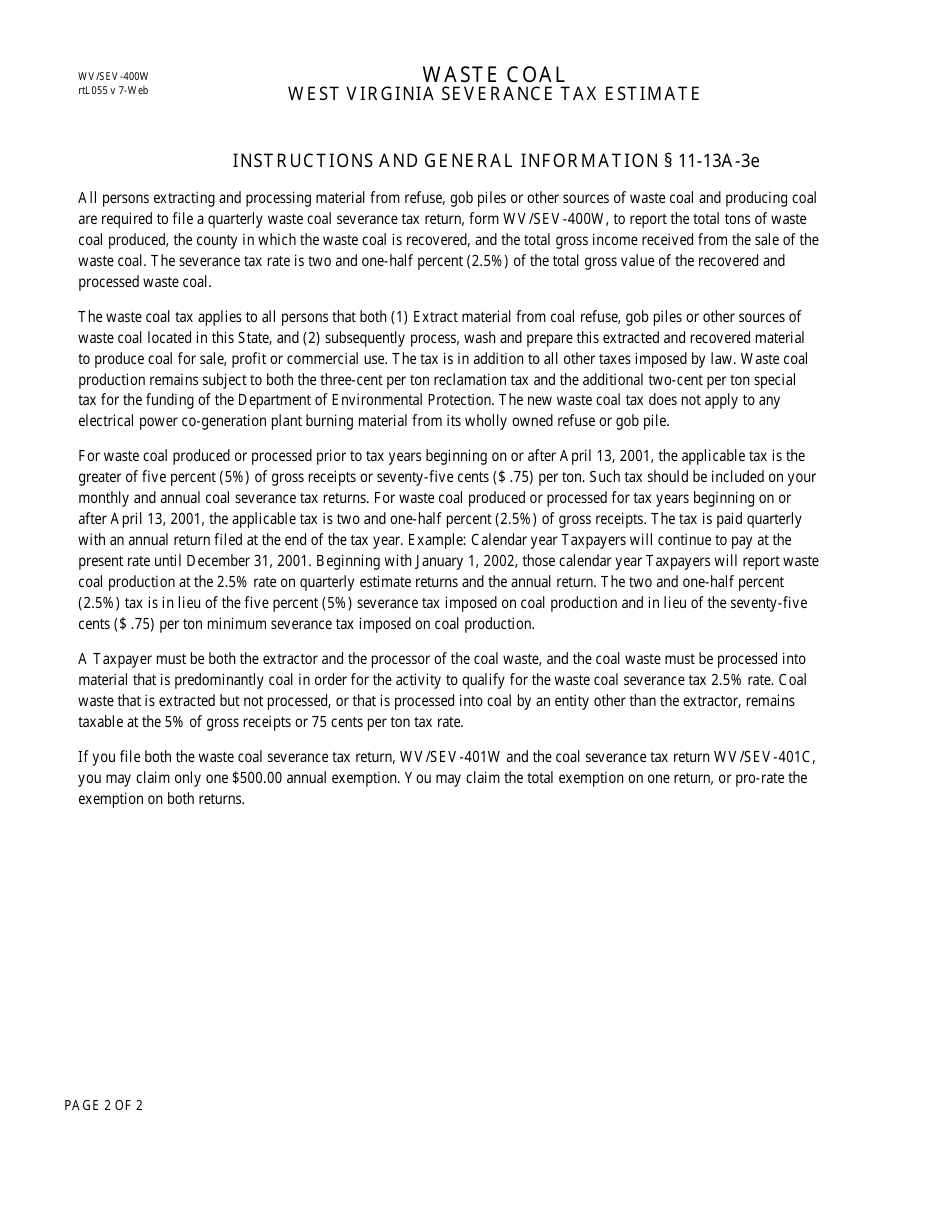

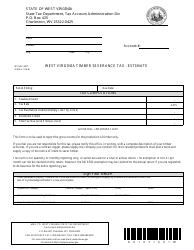

A: The purpose of the WV/SEV-400w form is to estimate the severance tax due on waste coal in West Virginia.

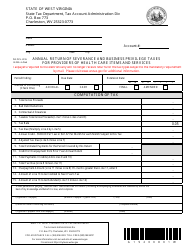

Q: Who needs to fill out the WV/SEV-400w form?

A: Anyone who is involved in the waste coal industry in West Virginia and is liable for severance tax needs to fill out the WV/SEV-400w form.

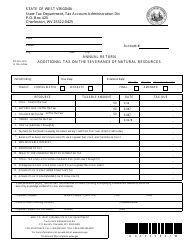

Q: What is the severance tax for waste coal in West Virginia?

A: The severance tax rate for waste coal in West Virginia is $0.28 per ton for underground mines and $0.12 per ton for surface mines.

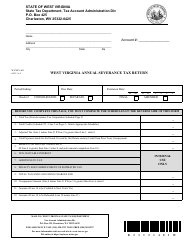

Q: How do I calculate the severance tax using the WV/SEV-400w form?

A: The WV/SEV-400w form provides instructions and a calculation worksheet to help you determine the severance tax amount based on the weight and other factors of the waste coal.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/SEV-400w by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.