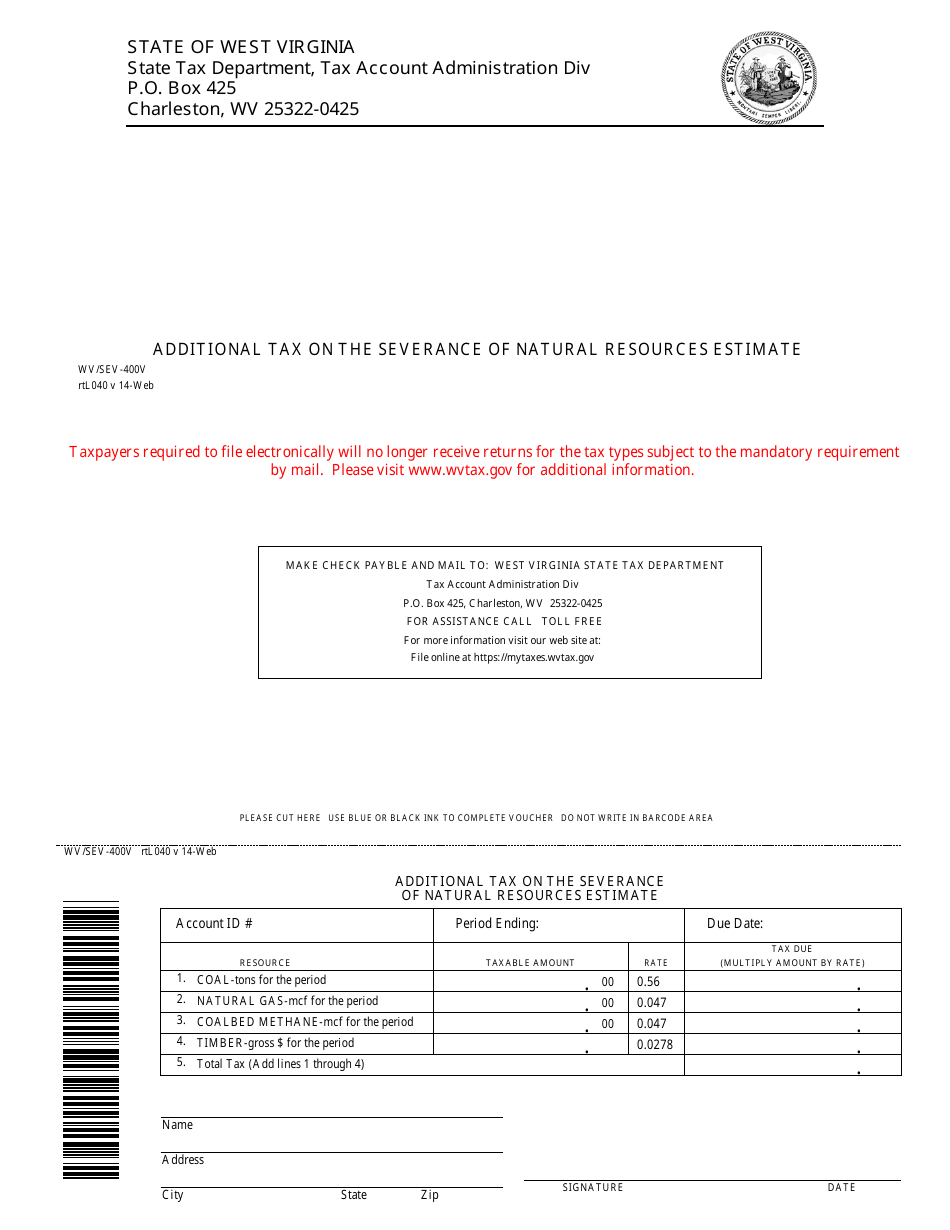

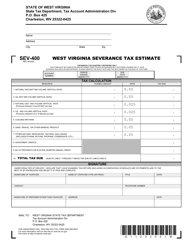

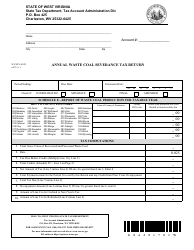

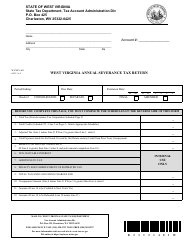

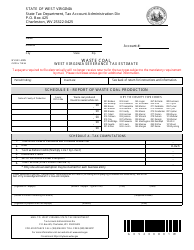

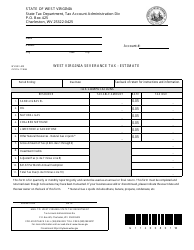

Form WV / SEV-400v Additional Tax on the Severance of Natural Resources Estimate - West Virginia

What Is Form WV/SEV-400v?

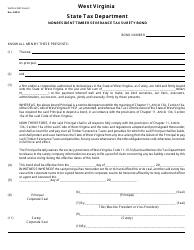

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/SEV-400v form?

A: The WV/SEV-400v form is a form used in West Virginia to estimate additional tax on the severance of natural resources.

Q: What is the purpose of the WV/SEV-400v form?

A: The purpose of the WV/SEV-400v form is to calculate and estimate the additional tax owed on the severance of natural resources in West Virginia.

Q: Who needs to fill out the WV/SEV-400v form?

A: Anyone who is involved in the severance of natural resources in West Virginia may need to fill out the WV/SEV-400v form.

Q: What are considered natural resources in West Virginia?

A: Natural resources in West Virginia include minerals, oil, gas, and other resources that are extracted from the ground.

Q: How is the additional tax on the severance of natural resources calculated?

A: The additional tax on the severance of natural resources is calculated based on the value and quantity of the resources extracted.

Q: Are there any exemptions or deductions available for the additional tax?

A: There may be exemptions or deductions available for the additional tax on the severance of natural resources in certain cases. It is recommended to consult with a tax professional for specific information.

Q: When is the deadline for filing the WV/SEV-400v form?

A: The deadline for filing the WV/SEV-400v form may vary. It is important to check with the West Virginia Department of Revenue or consult with a tax professional to determine the specific deadline.

Q: What happens if I don't file the WV/SEV-400v form?

A: Failure to file the WV/SEV-400v form or pay the additional tax on the severance of natural resources may result in penalties and interest charges.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/SEV-400v by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.