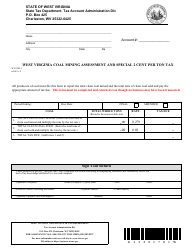

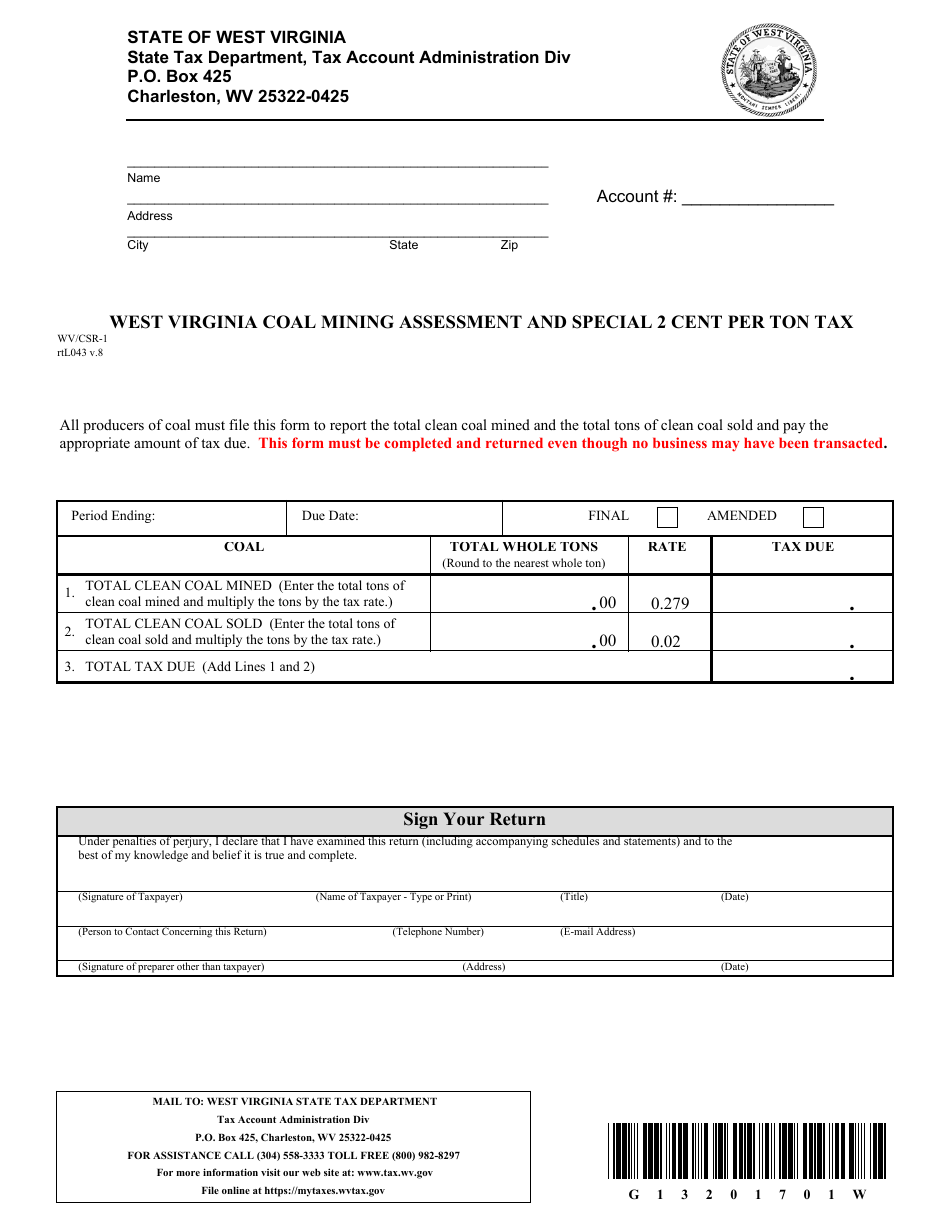

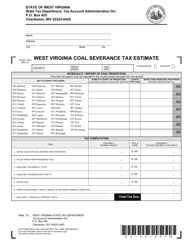

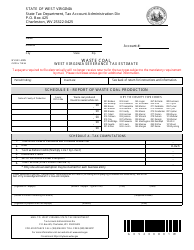

Form WV / CSR-1 West Virginia Coal Mining Assessment and Special 2 Cent Per Ton Tax - West Virginia

What Is Form WV/CSR-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/CSR-1?

A: WV/CSR-1 is a form used for the West Virginia Coal Mining Assessment and Special 2 Cent Per Ton Tax.

Q: What is the purpose of WV/CSR-1 form?

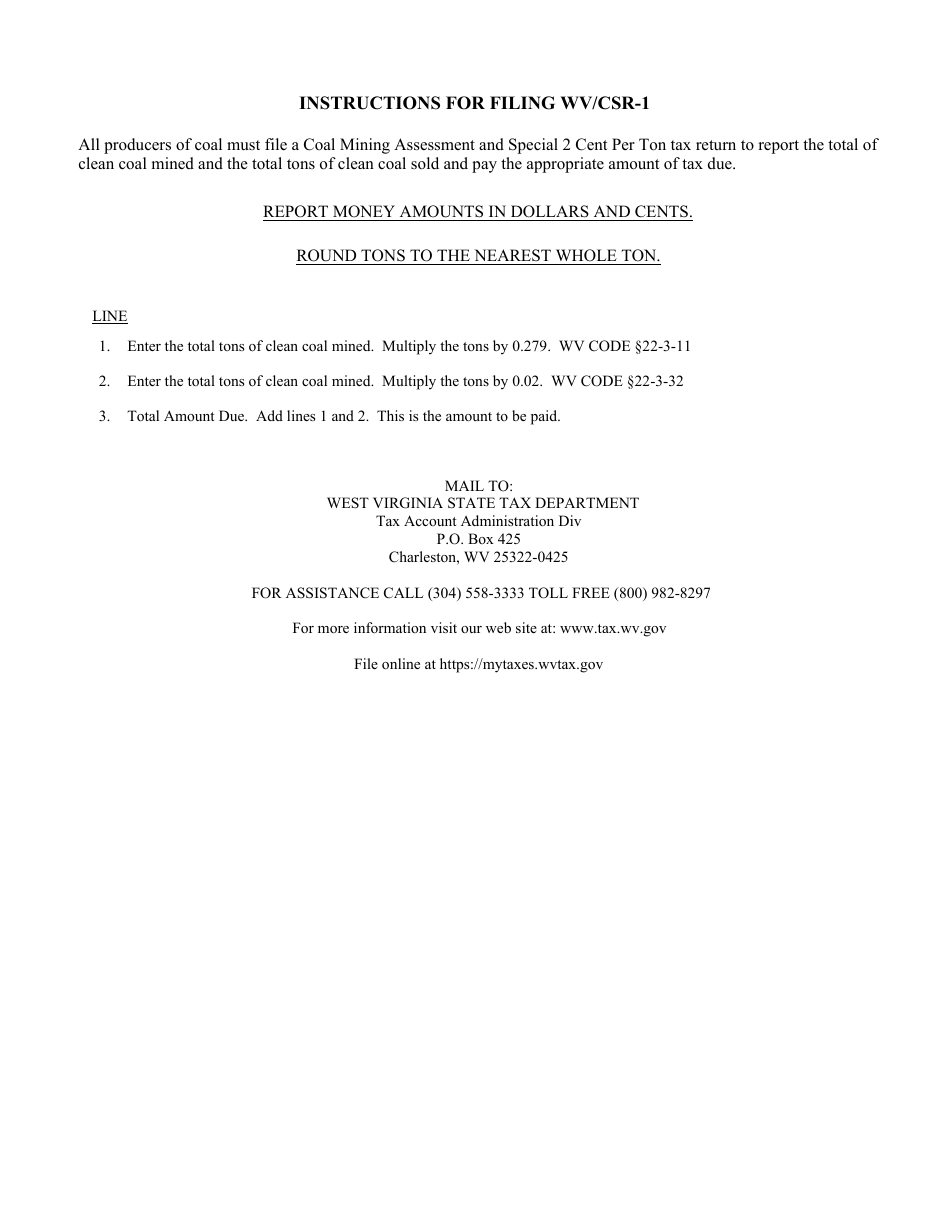

A: The purpose of WV/CSR-1 form is to calculate and report the Coal Mining Assessment and Special 2 Cent Per Ton Tax for coal mining operations in West Virginia.

Q: What is the Coal Mining Assessment?

A: The Coal Mining Assessment is a tax imposed on coal mining operations in West Virginia.

Q: How is the Coal Mining Assessment calculated?

A: The Coal Mining Assessment is calculated based on the tons of coal mined and sold.

Q: What is the Special 2 Cent Per Ton Tax?

A: The Special 2 Cent Per Ton Tax is an additional tax imposed on each ton of coal mined and sold in West Virginia.

Q: Who is required to file the WV/CSR-1 form?

A: Coal mining operators in West Virginia are required to file the WV/CSR-1 form.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CSR-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.