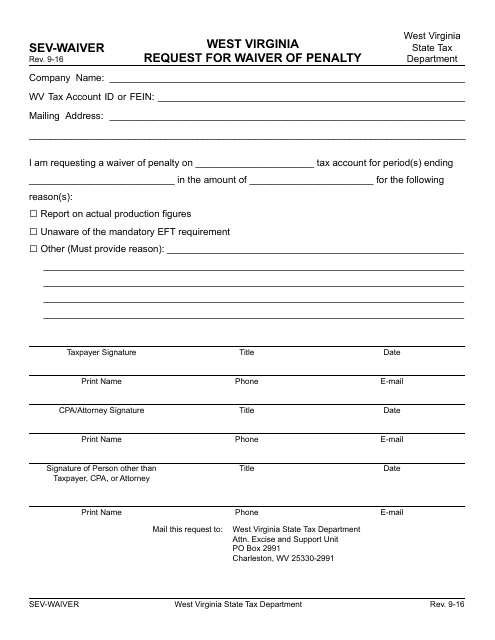

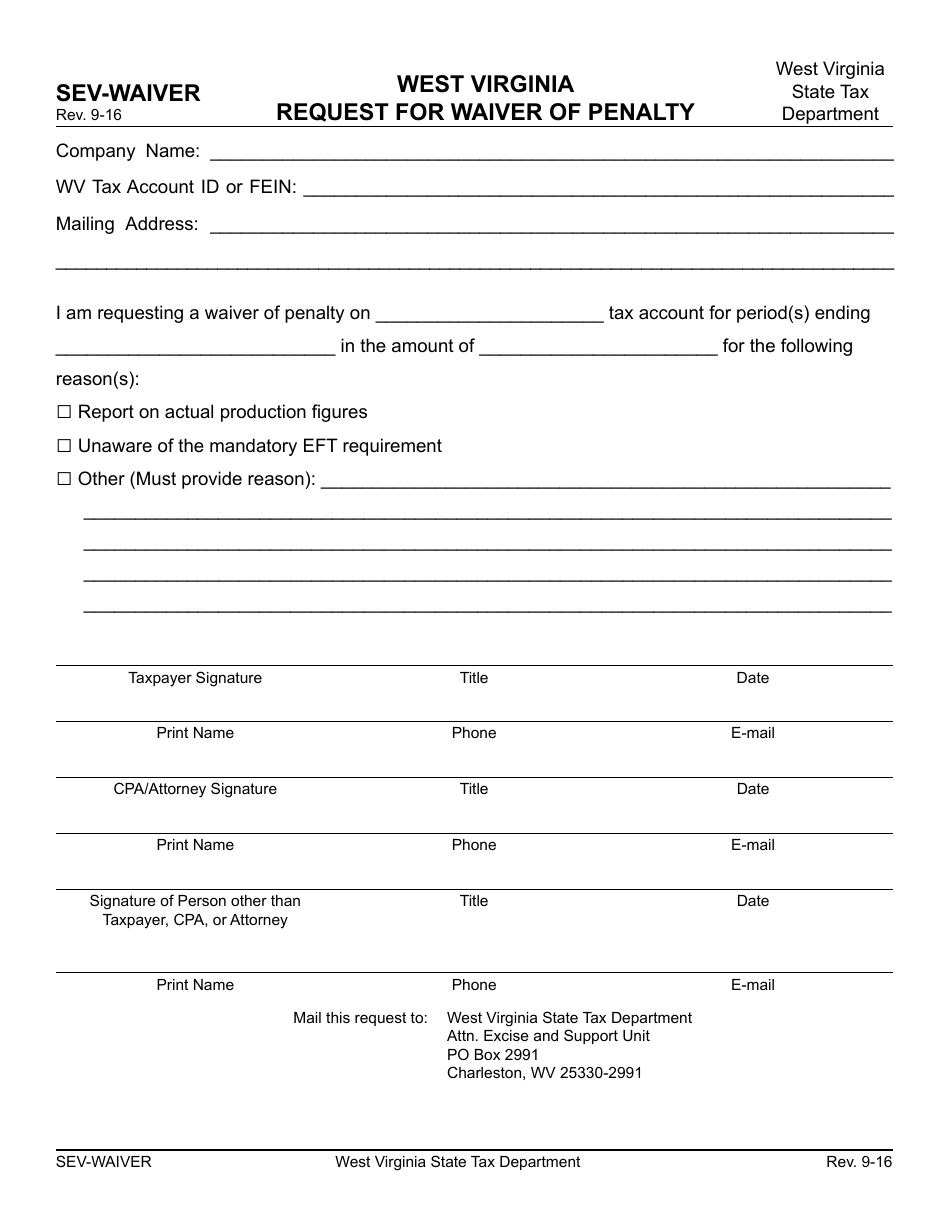

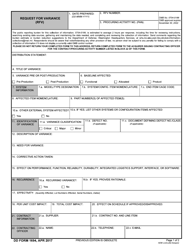

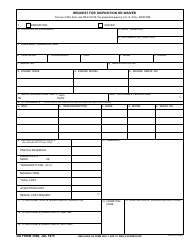

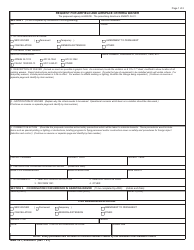

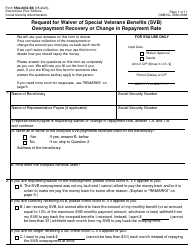

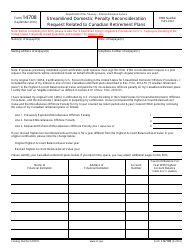

Form SEV-WAIVER Request for Waiver of Penalty - West Virginia

What Is Form SEV-WAIVER?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEV-WAIVER?

A: SEV-WAIVER is a request form for a waiver of penalty in West Virginia.

Q: What is the purpose of the SEV-WAIVER form?

A: The purpose of the SEV-WAIVER form is to request a waiver of penalty in West Virginia.

Q: What penalties does the SEV-WAIVER form apply to?

A: The SEV-WAIVER form applies to penalties in West Virginia.

Q: How do I fill out the SEV-WAIVER form?

A: To fill out the SEV-WAIVER form, you need to provide the required information and follow the instructions on the form.

Q: What happens after I submit the SEV-WAIVER form?

A: After you submit the SEV-WAIVER form, your request for a waiver of penalty will be reviewed by the relevant authorities in West Virginia.

Q: Is there a deadline to submit the SEV-WAIVER form?

A: Yes, there may be a deadline to submit the SEV-WAIVER form. Please check the instructions or consult with the relevant authorities in West Virginia.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV-WAIVER by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.