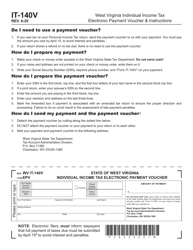

This version of the form is not currently in use and is provided for reference only. Download this version of

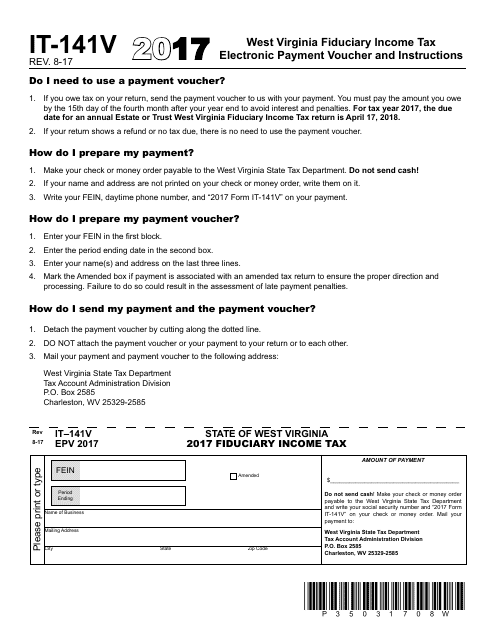

Form IT-141v

for the current year.

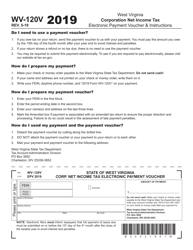

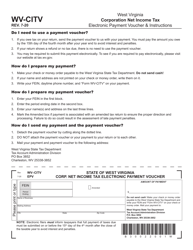

Form IT-141v West Virginia Fiduciary Income Tax Electronic Payment Voucher - West Virginia

What Is Form IT-141v?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-141v?

A: Form IT-141v is the West Virginia Fiduciary Income Tax Electronic Payment Voucher.

Q: Who needs to file Form IT-141v?

A: Form IT-141v is used by individuals and entities who need to make electronic payments for their West Virginia fiduciary income tax.

Q: What is the purpose of Form IT-141v?

A: Form IT-141v is used to submit electronic payments for West Virginia fiduciary income tax.

Q: Are there any filing deadlines for Form IT-141v?

A: Yes, the filing deadlines for Form IT-141v coincide with the regular income tax filing deadlines.

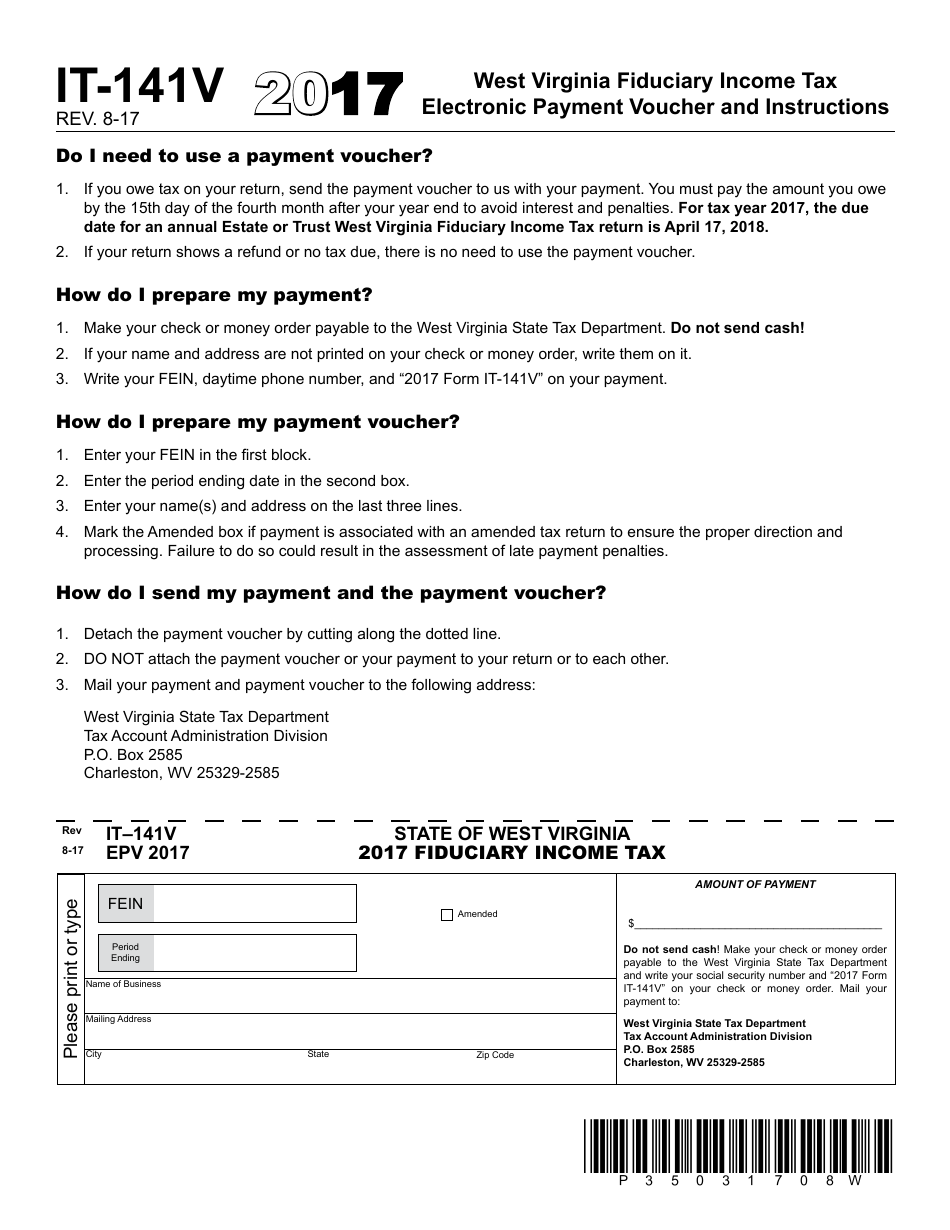

Q: What information is required on Form IT-141v?

A: You will need to provide information such as your name, address, Social Security number or taxpayer identification number, and the amount of your payment.

Q: Can I make a payment using Form IT-141v without filing a tax return?

A: No, Form IT-141v is only used for making electronic payments and should be accompanied by the appropriate tax return.

Q: Is there a penalty for late payment?

A: Yes, there may be penalties for late payment, so it is important to submit your payment by the due date.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-141v by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.