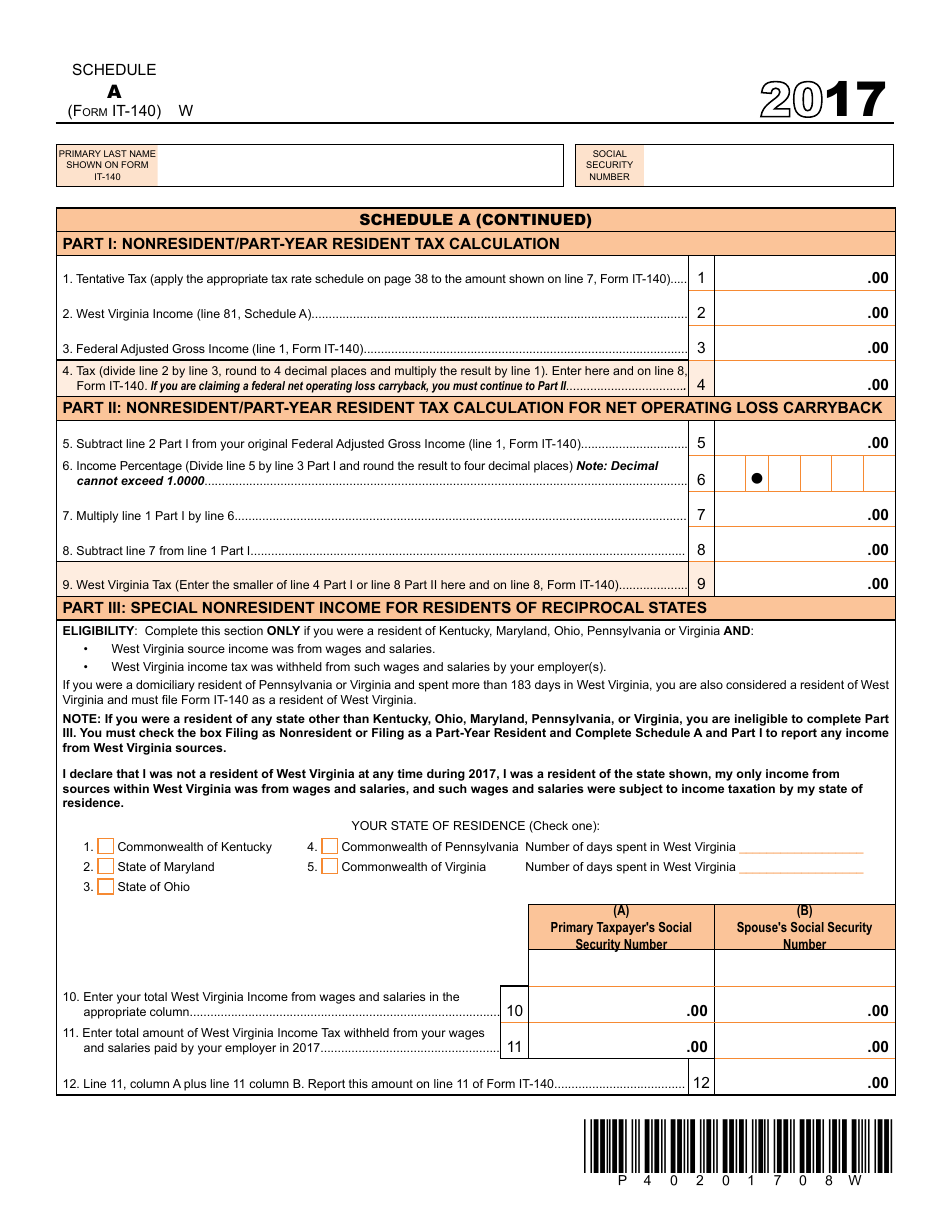

This version of the form is not currently in use and is provided for reference only. Download this version of

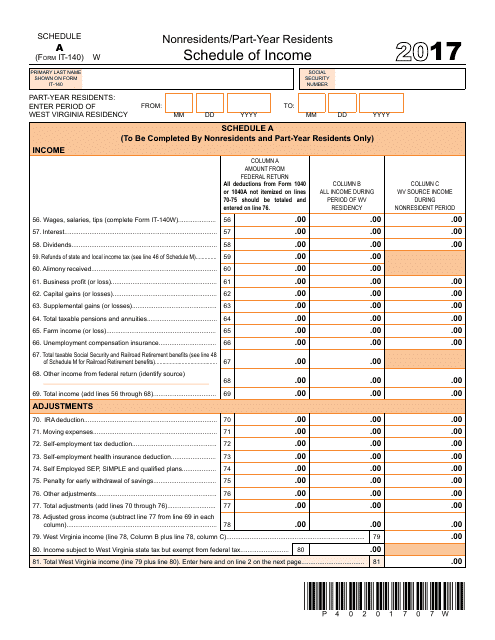

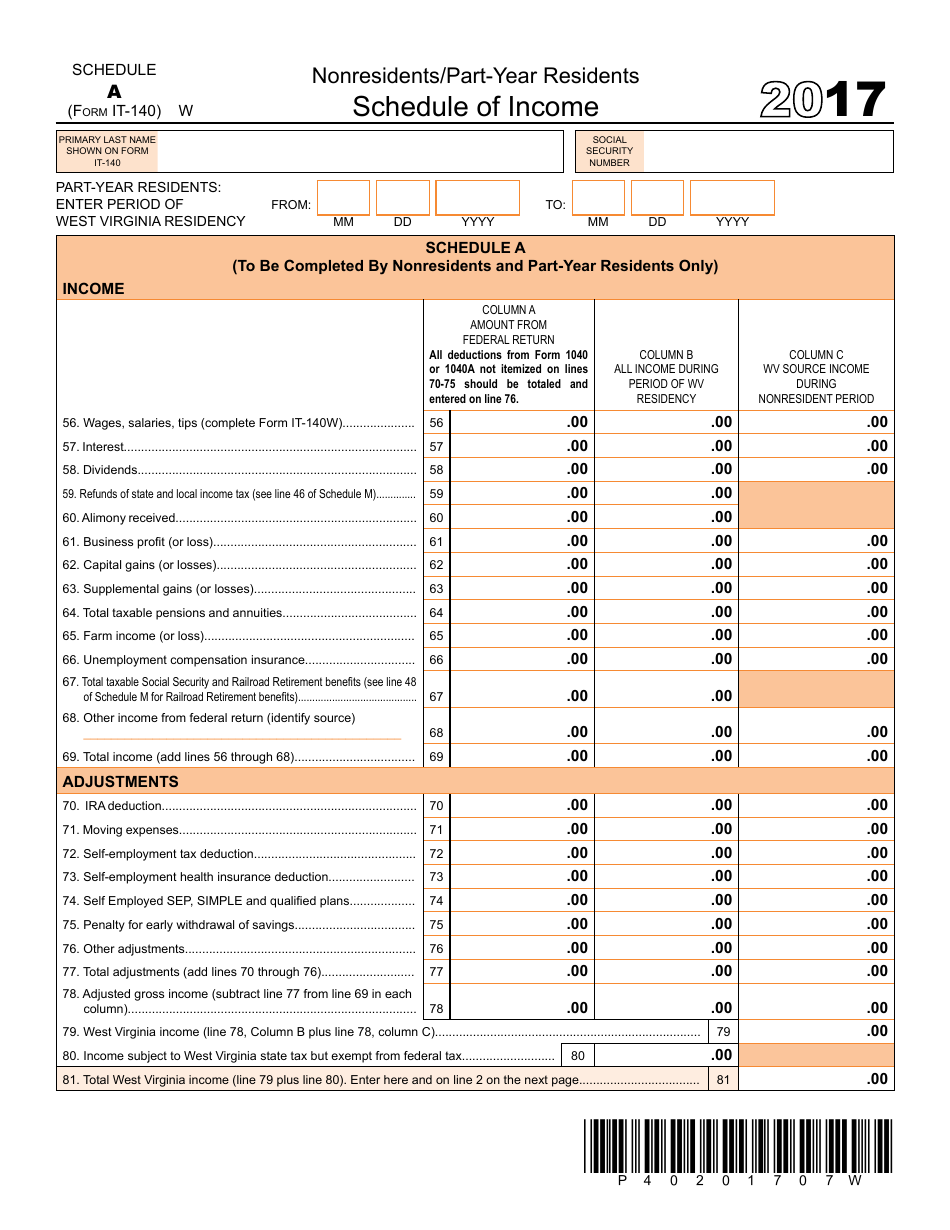

Form IT-140 Schedule A

for the current year.

Form IT-140 Schedule A Nonresidents / Part-Year Residents Schedule of Income - West Virginia

What Is Form IT-140 Schedule A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form IT-140, Tax Credit Recap Schedule. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140 Schedule A?

A: Form IT-140 Schedule A is a schedule of income for nonresidents and part-year residents of West Virginia.

Q: Who needs to file Form IT-140 Schedule A?

A: Nonresidents and part-year residents of West Virginia who have income from West Virginia sources need to file Form IT-140 Schedule A.

Q: What is the purpose of Form IT-140 Schedule A?

A: The purpose of Form IT-140 Schedule A is to report income earned in West Virginia by nonresidents and part-year residents.

Q: What information is required on Form IT-140 Schedule A?

A: Form IT-140 Schedule A requires information about the taxpayer's income from West Virginia sources, such as wages, self-employment income, and rental income.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 Schedule A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.