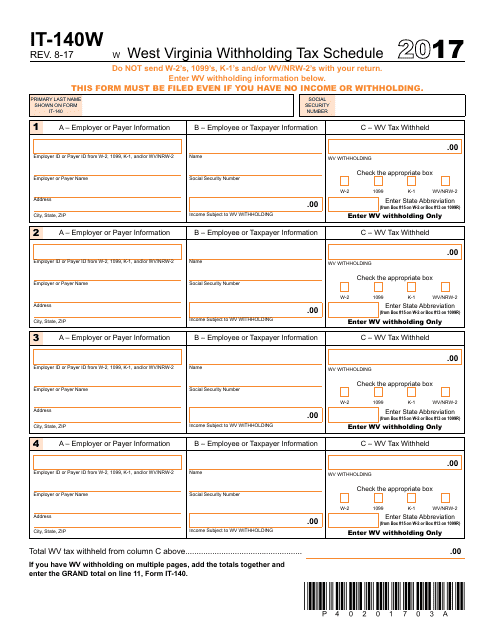

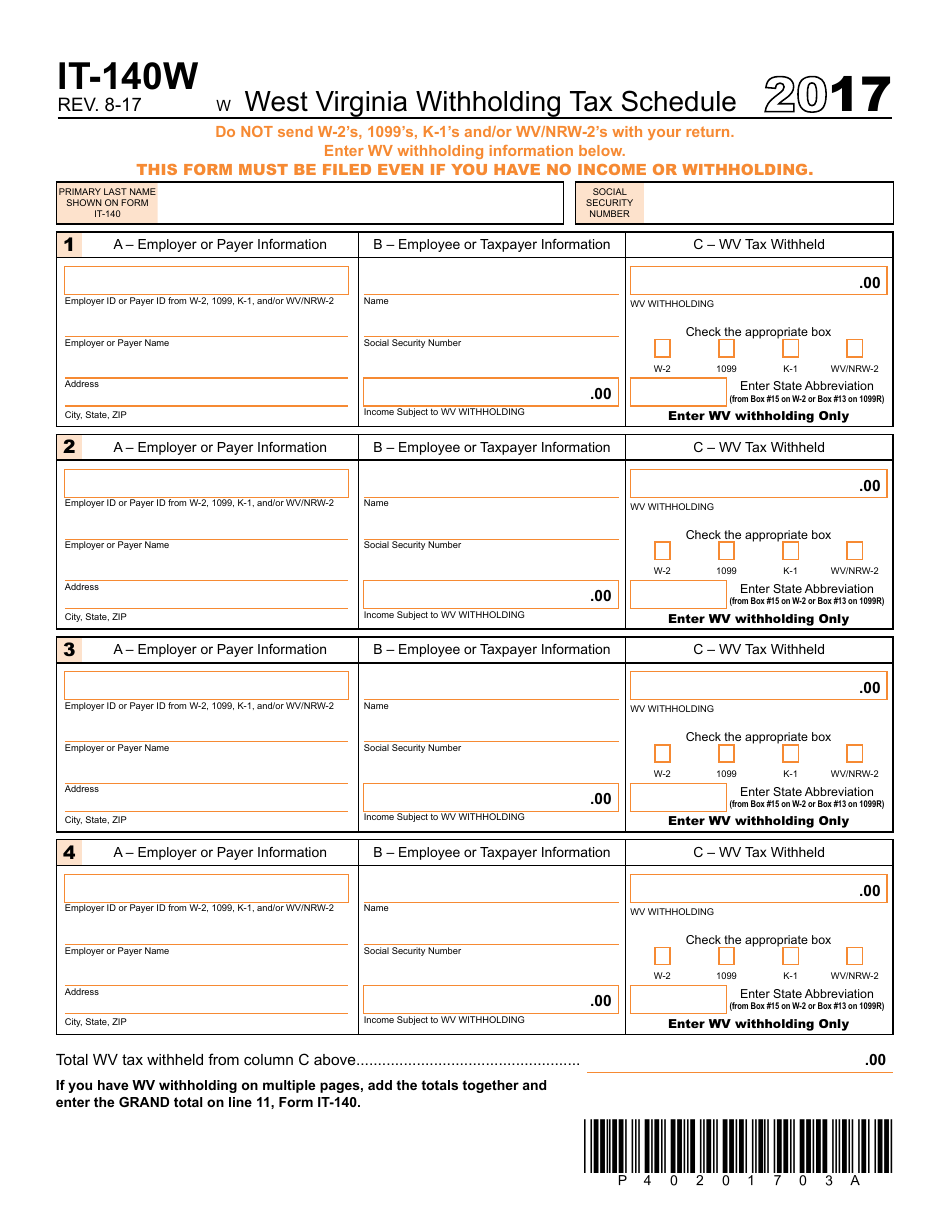

Form IT-140W West Virginia Withholding Tax Schedule - West Virginia

What Is Form IT-140W?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140W?

A: Form IT-140W is the West Virginia Withholding Tax Schedule.

Q: What is the purpose of Form IT-140W?

A: The purpose of Form IT-140W is to calculate and report the West Virginia withholding tax.

Q: Who needs to file Form IT-140W?

A: Anyone who has West Virginia withholding tax to report must file Form IT-140W.

Q: What information is required on Form IT-140W?

A: Form IT-140W requires information about your employer, the amount of wages subject to West Virginia withholding, and the amount of withholding tax already paid.

Q: When is the due date for filing Form IT-140W?

A: The due date for filing Form IT-140W is generally the same as the due date for filing your West Virginia income tax return, which is April 15th.

Q: Are there any penalties for late filing of Form IT-140W?

A: Yes, there may be penalties for late filing of Form IT-140W. It is important to file by the due date to avoid any penalties.

Q: Can I file Form IT-140W electronically?

A: Yes, you can file Form IT-140W electronically if you are filing your West Virginia income tax return electronically.

Q: Is Form IT-140W the only form I need to file for West Virginia withholding tax?

A: No, there may be other forms you need to file depending on your specific situation. Consult the West Virginia State Tax Department or a tax professional for guidance.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-140W by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.