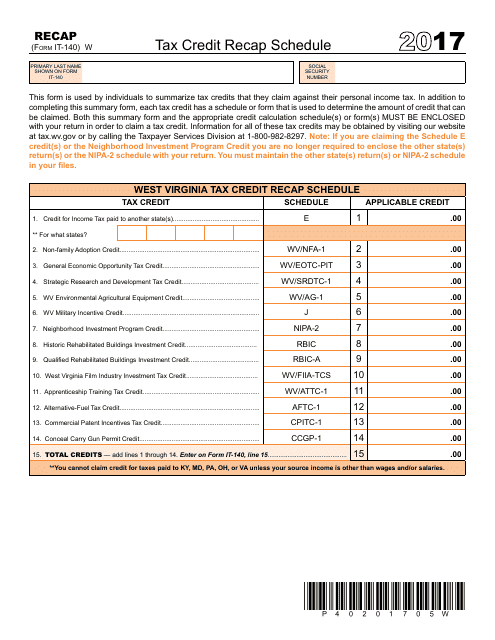

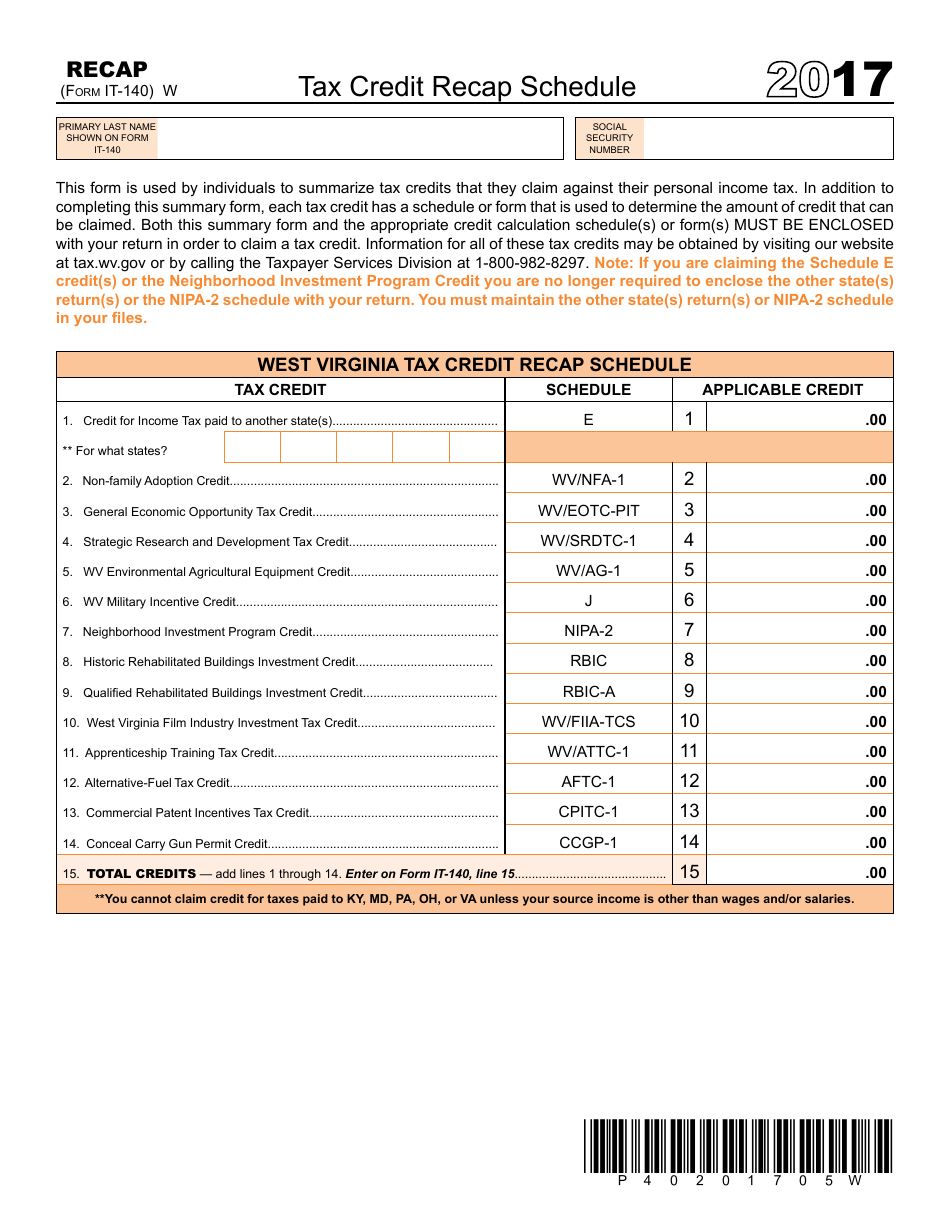

Form IT-140 Tax Credit Recap Schedule - West Virginia

What Is Form IT-140?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140?

A: Form IT-140 is the tax return form used by residents of West Virginia to report their income and claim any applicable tax credits.

Q: What is the Tax Credit Recap Schedule?

A: The Tax Credit Recap Schedule is an additional schedule that is filed along with Form IT-140. It is used to report and calculate any tax credits that you may be eligible for.

Q: Why do I need to file the Tax Credit Recap Schedule?

A: You need to file the Tax Credit Recap Schedule if you want to claim any tax credits that you may be eligible for. It is important to accurately report and calculate your tax credits to ensure that you receive the maximum benefits.

Q: How do I complete the Tax Credit Recap Schedule?

A: To complete the Tax Credit Recap Schedule, you will need to gather information about the tax credits you are eligible for and the amounts you may claim. Follow the instructions provided on the form and enter the necessary information accurately.

Q: When is the deadline to file Form IT-140 and the Tax Credit Recap Schedule?

A: The deadline to file Form IT-140 and the Tax Credit Recap Schedule is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: What happens if I don't file the Tax Credit Recap Schedule?

A: If you fail to file the Tax Credit Recap Schedule, you may miss out on valuable tax credits that you are eligible for. It is important to complete and submit the schedule along with your tax return to ensure that you receive all the benefits you deserve.

Q: What are some common tax credits that I may be eligible for in West Virginia?

A: Some common tax credits in West Virginia include the Earned Income Credit, the West Virginia Home Modification for the Elderly and Disabled Credit, and the West Virginia Child and Dependent Care Credit. However, eligibility for tax credits can vary depending on your individual circumstances, so it is important to review the instructions and consult with a tax professional if needed.

Q: Can I get assistance in completing the Tax Credit Recap Schedule?

A: Yes, if you need assistance in completing the Tax Credit Recap Schedule or have questions about tax credits, you can reach out to the West Virginia Department of Revenue or consult with a tax professional. They can provide guidance and ensure that you correctly report and claim your tax credits.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-140 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.