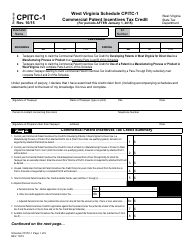

This version of the form is not currently in use and is provided for reference only. Download this version of

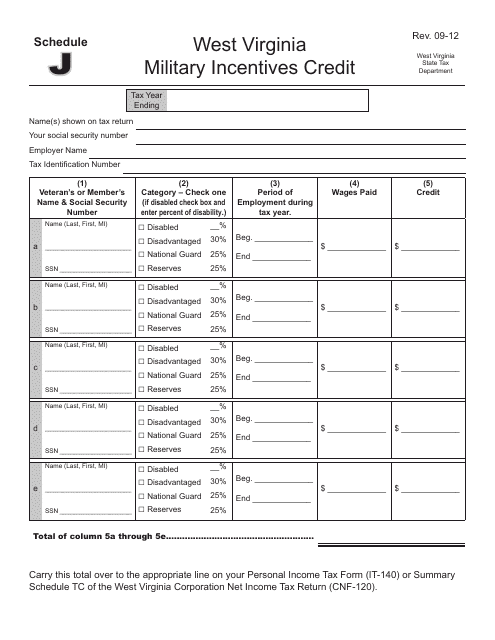

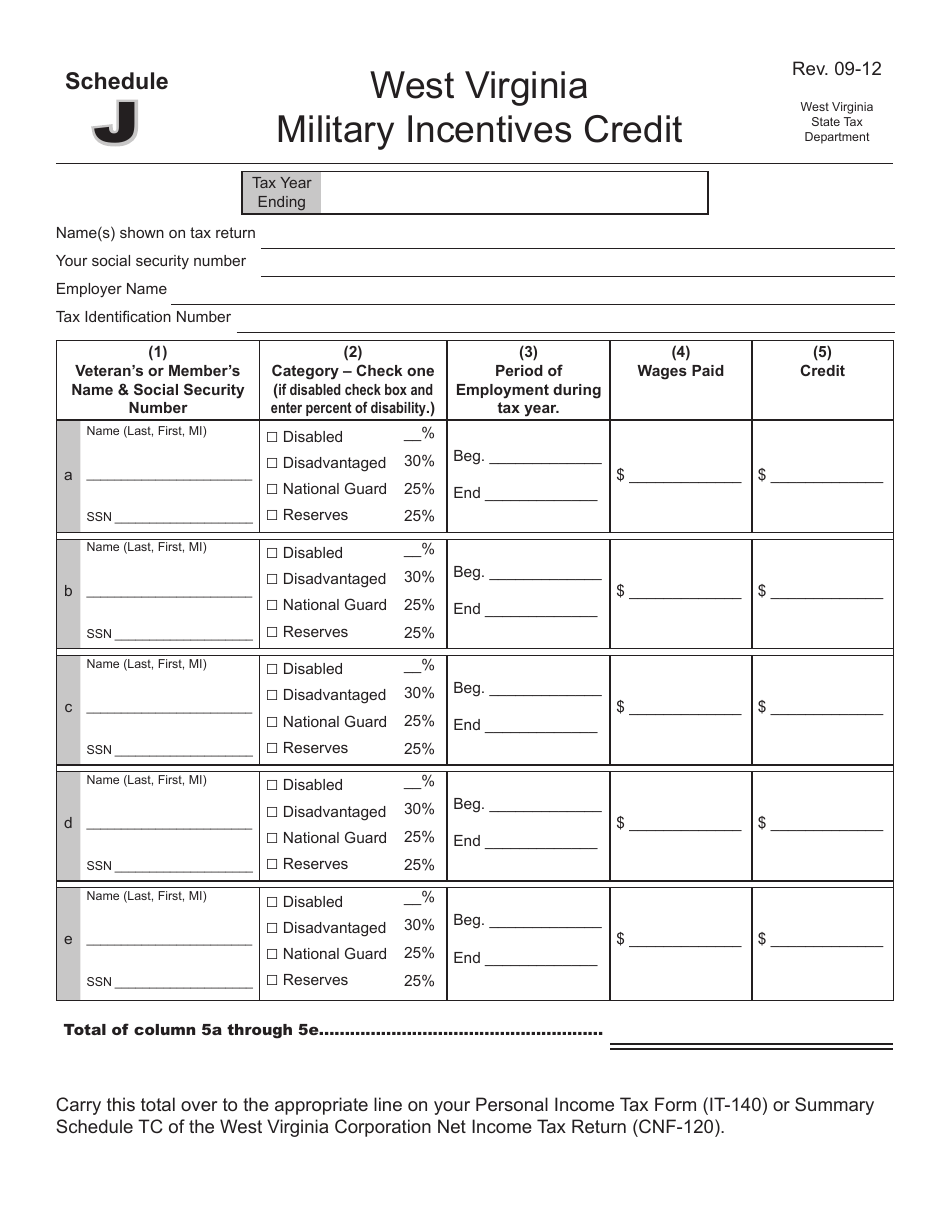

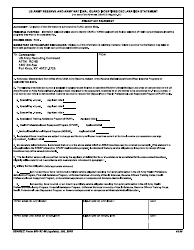

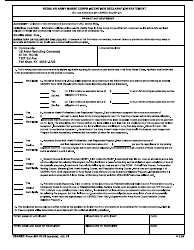

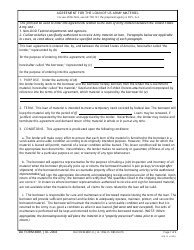

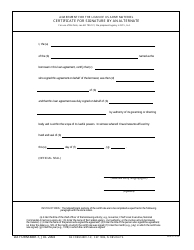

Schedule J

for the current year.

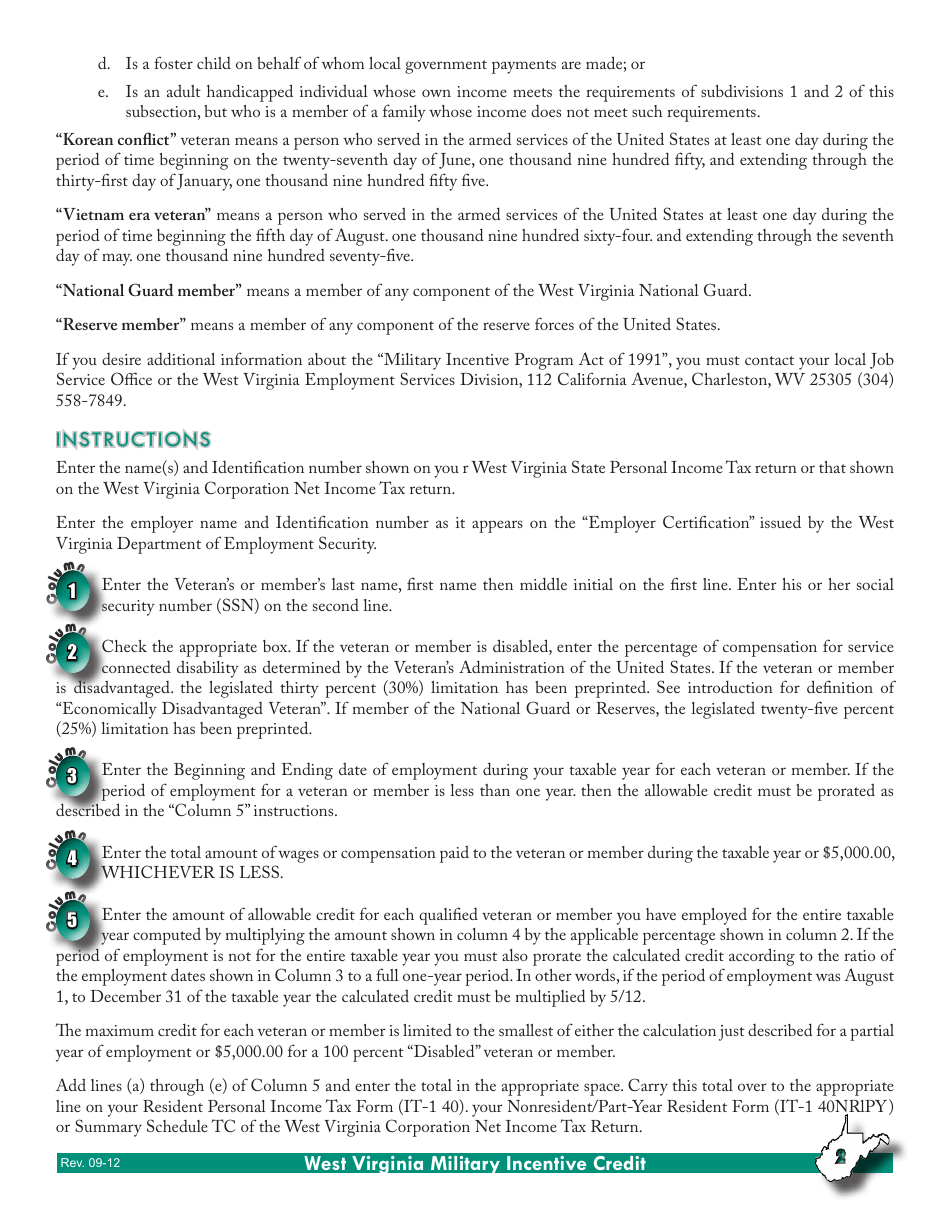

Schedule J West Virginia Military Incentives Credit - West Virginia

What Is Schedule J?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule J?

A: Schedule J is a form used to claim the West Virginia Military Incentives Credit.

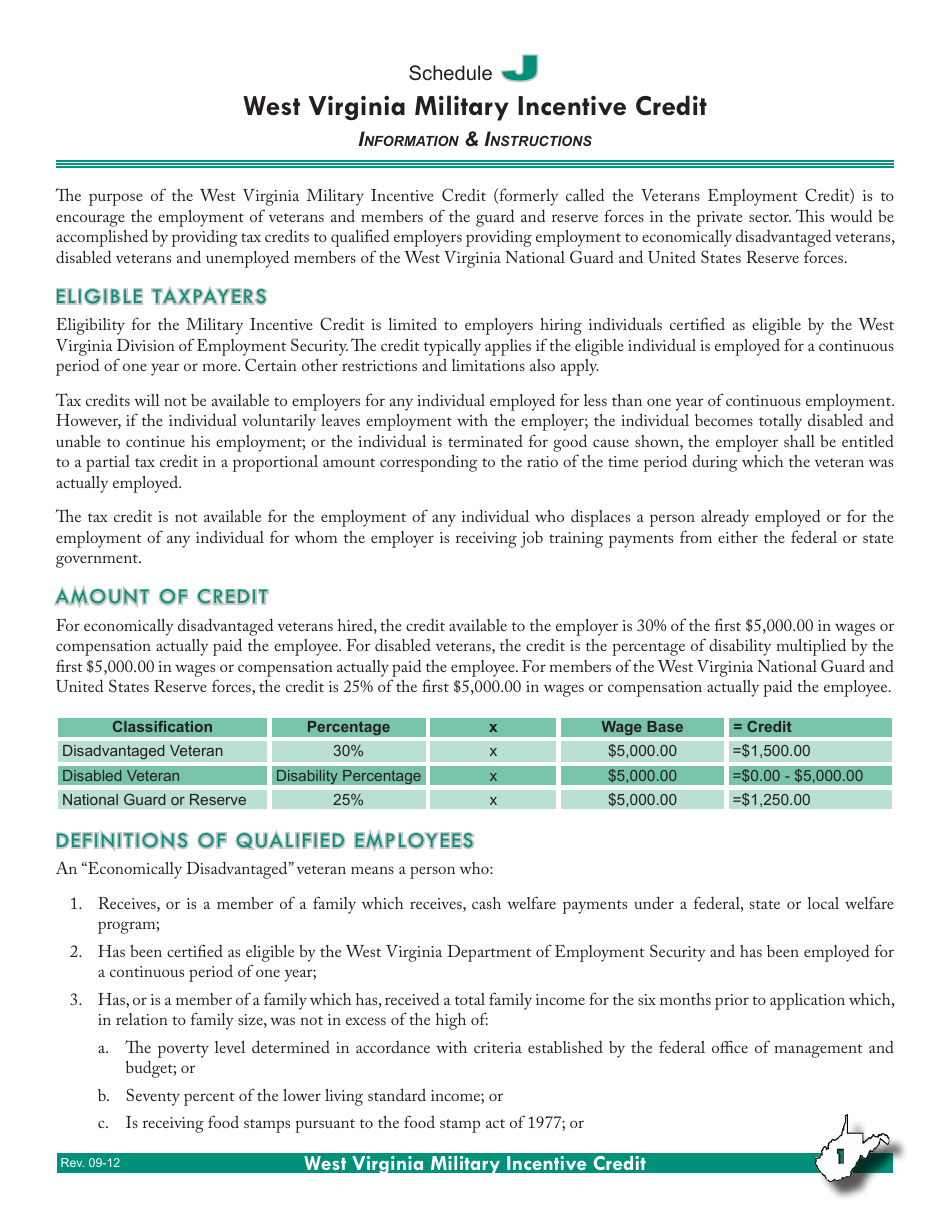

Q: What is the West Virginia Military Incentives Credit?

A: The West Virginia Military Incentives Credit is a tax credit available to qualified active duty military personnel.

Q: Who is eligible for the West Virginia Military Incentives Credit?

A: Qualified active duty military personnel are eligible for the West Virginia Military Incentives Credit.

Q: How much is the West Virginia Military Incentives Credit?

A: The amount of the credit varies and is based on certain factors, such as the length of active duty service.

Q: How do I claim the West Virginia Military Incentives Credit?

A: You can claim the credit by completing Schedule J and including it with your West Virginia state tax return.

Q: Are there any deadlines for claiming the West Virginia Military Incentives Credit?

A: Yes, the credit must be claimed on your annual West Virginia state tax return by the designated deadline.

Q: Can I claim the West Virginia Military Incentives Credit if I am a veteran?

A: No, the credit is only available to qualified active duty military personnel.

Q: Is the West Virginia Military Incentives Credit refundable?

A: No, the credit is non-refundable, but any unused credits can be carried forward to future tax years.

Q: Are there any income limitations for claiming the West Virginia Military Incentives Credit?

A: No, there are no income limitations for claiming the credit.

Form Details:

- Released on September 1, 2012;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule J by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.