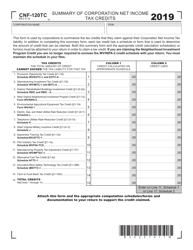

This version of the form is not currently in use and is provided for reference only. Download this version of

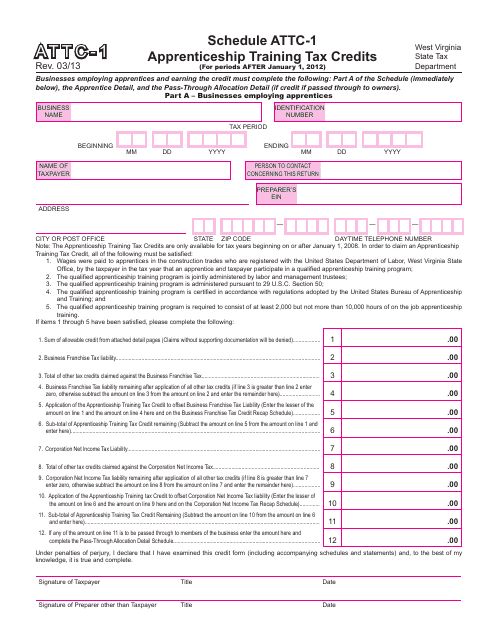

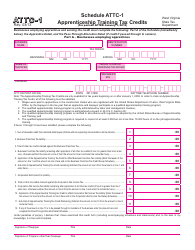

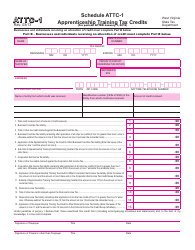

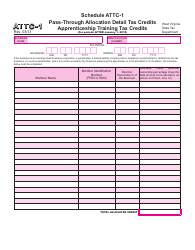

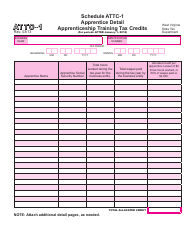

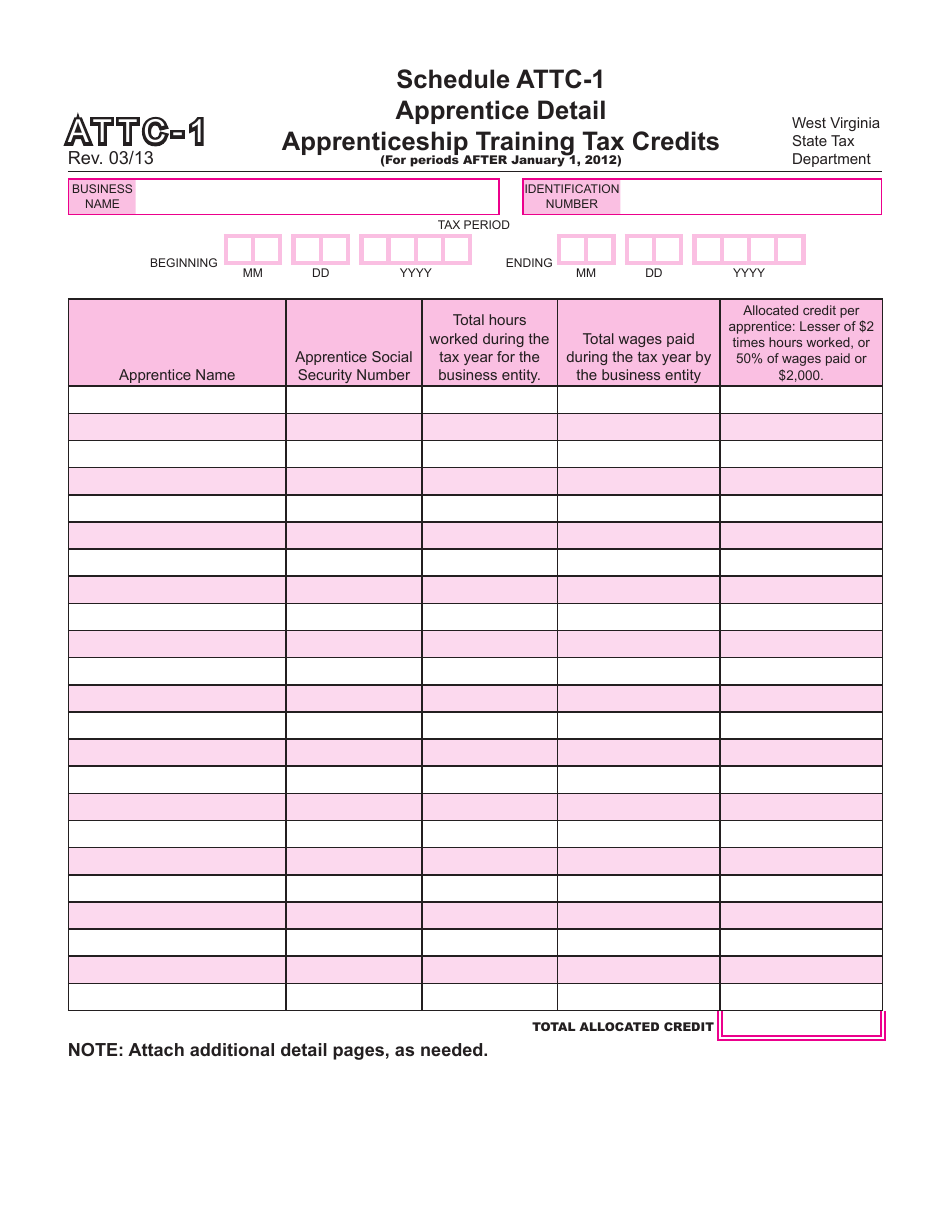

Schedule ATTC-1

for the current year.

Schedule ATTC-1 Apprenticeship Training Tax Credits for Periods After January 1, 2012 - West Virginia

What Is Schedule ATTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

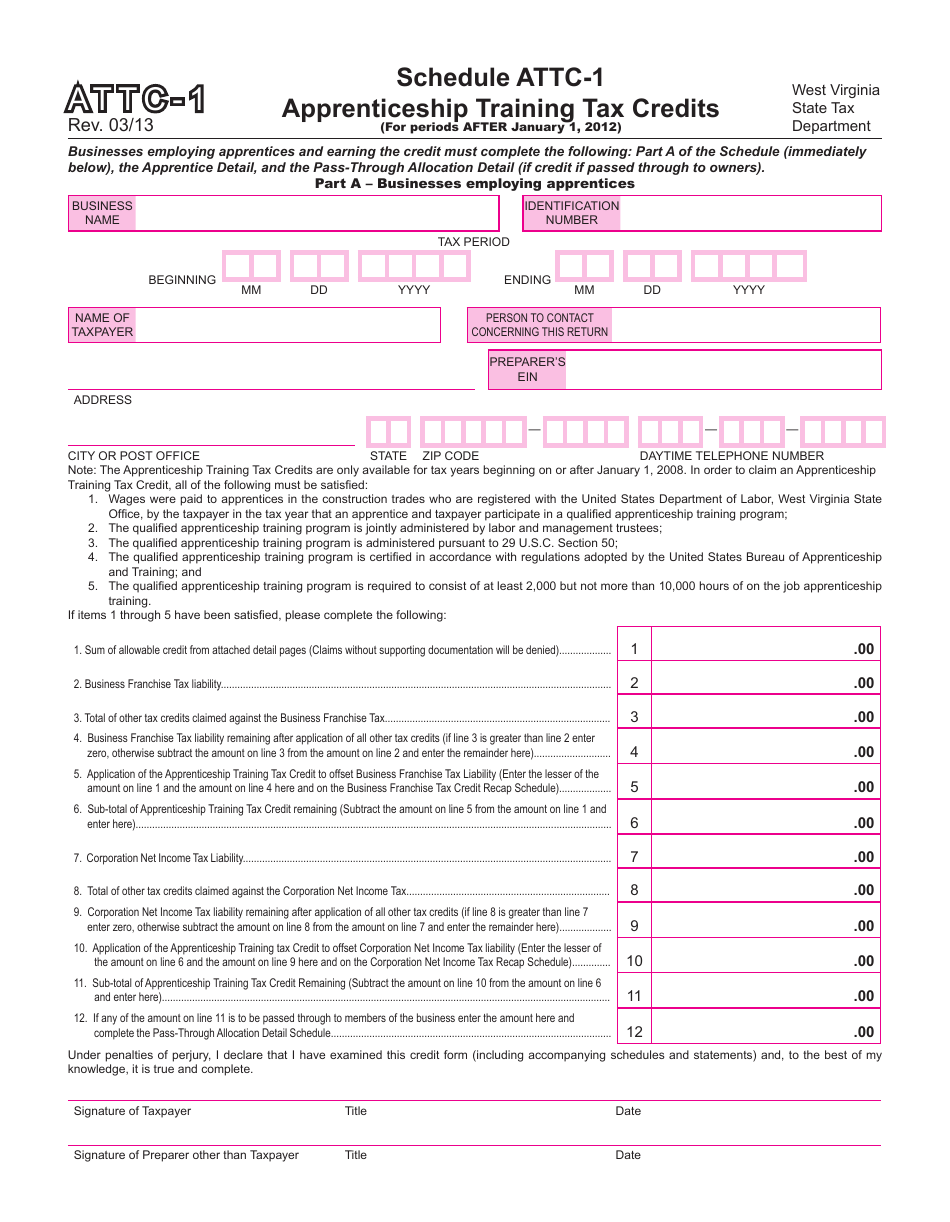

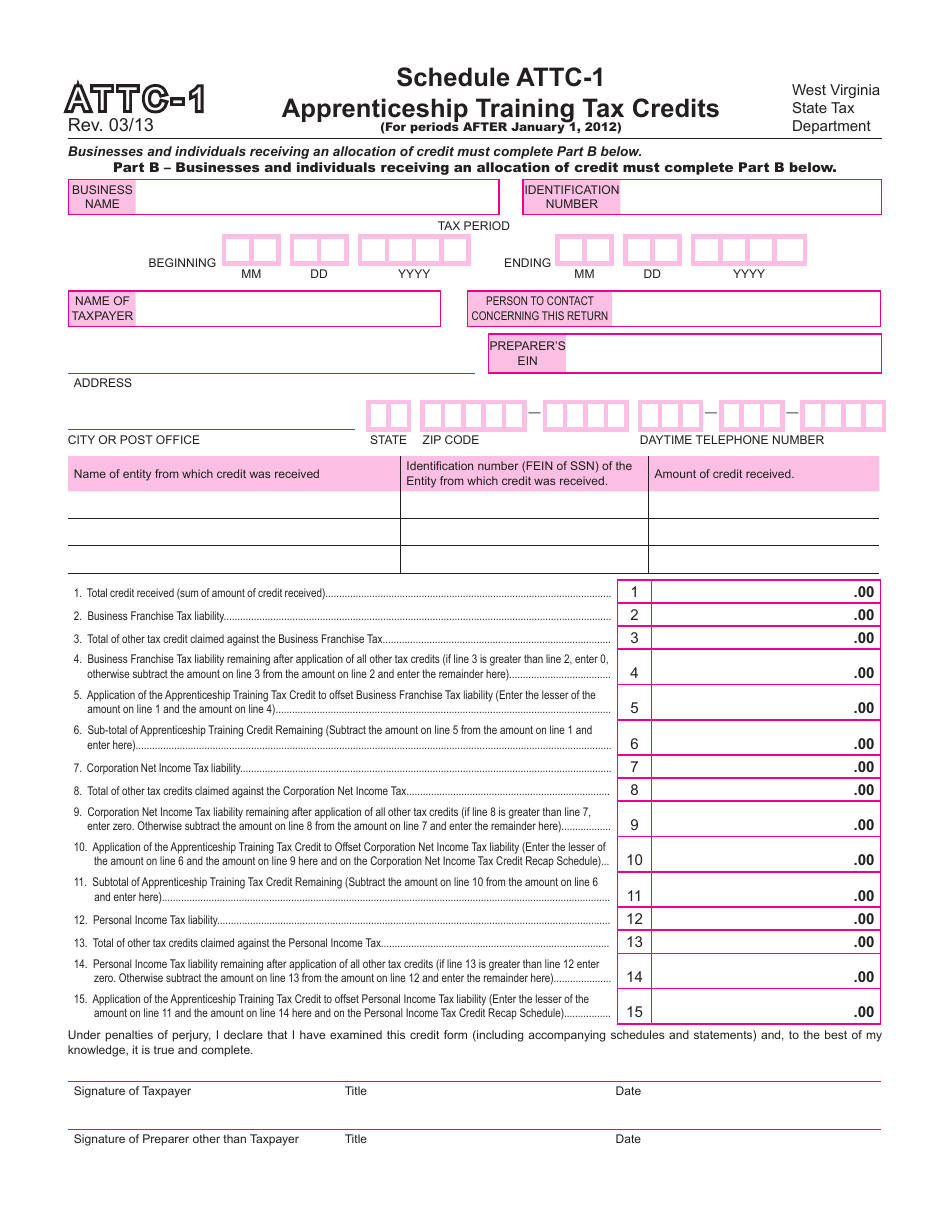

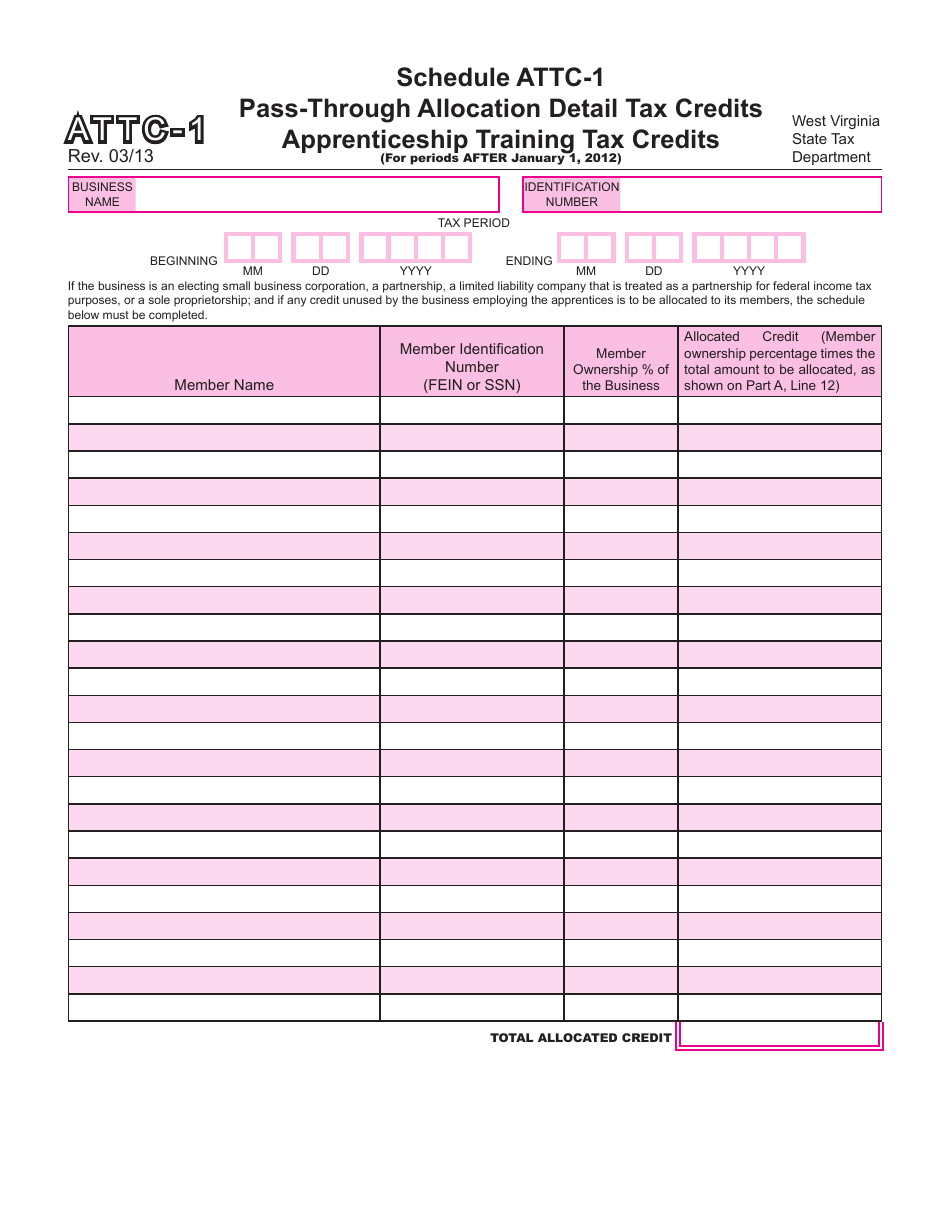

Q: What is Schedule ATTC-1?

A: Schedule ATTC-1 is a form used for reporting apprenticeship training tax credits in West Virginia.

Q: What is the purpose of Schedule ATTC-1?

A: The purpose of Schedule ATTC-1 is to claim tax credits for the costs associated with apprenticeship training programs.

Q: What periods does Schedule ATTC-1 cover?

A: Schedule ATTC-1 covers periods after January 1, 2012.

Q: Who is eligible for apprenticeship training tax credits?

A: Businesses or organizations that incur costs for qualified apprenticeship training programs in West Virgina are eligible for tax credits.

Q: How much tax credit can be claimed?

A: The amount of tax credit that can be claimed depends on the number of qualified apprentices and the total cost incurred for their training.

Q: Are there any deadlines for filing Schedule ATTC-1?

A: Yes, Schedule ATTC-1 must be filed by the due date of the associated tax return.

Q: Is there any additional documentation required?

A: Yes, businesses or organizations must attach supporting documentation, such as proof of apprenticeship training expenses, with Schedule ATTC-1.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule ATTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.