This version of the form is not currently in use and is provided for reference only. Download this version of

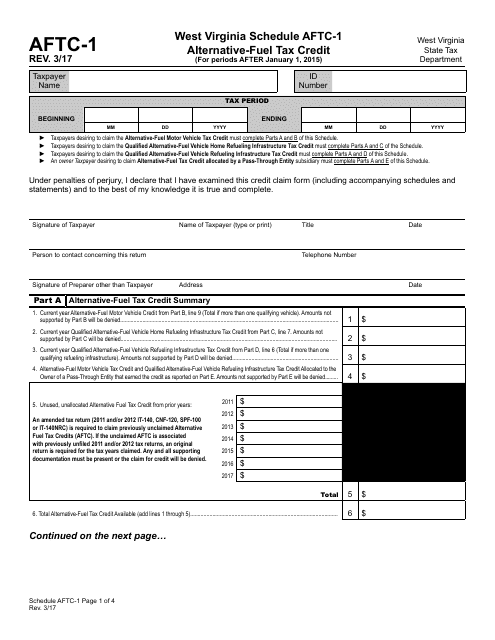

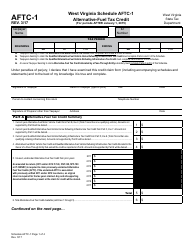

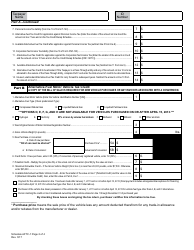

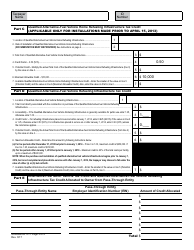

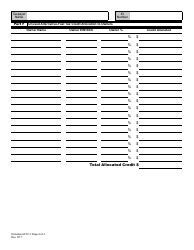

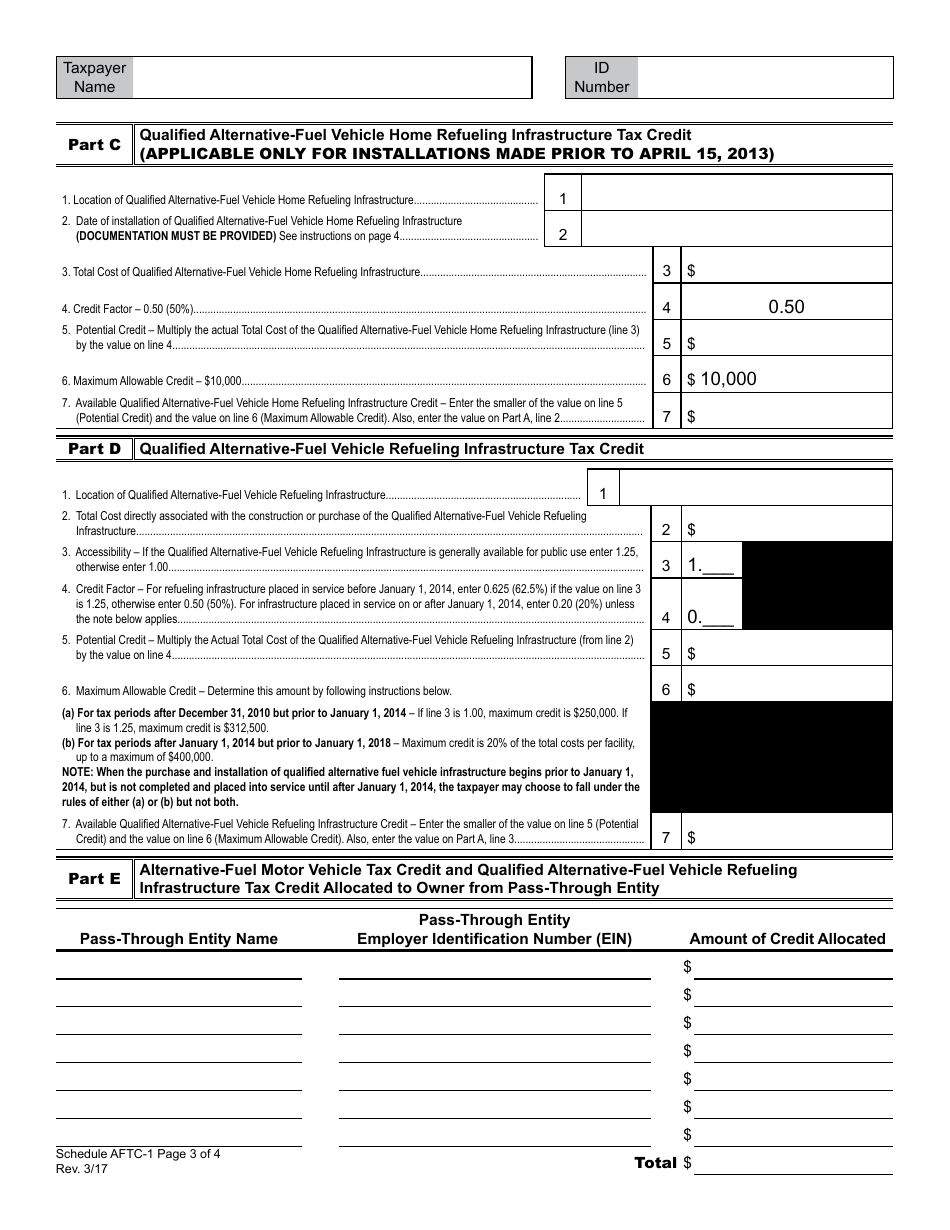

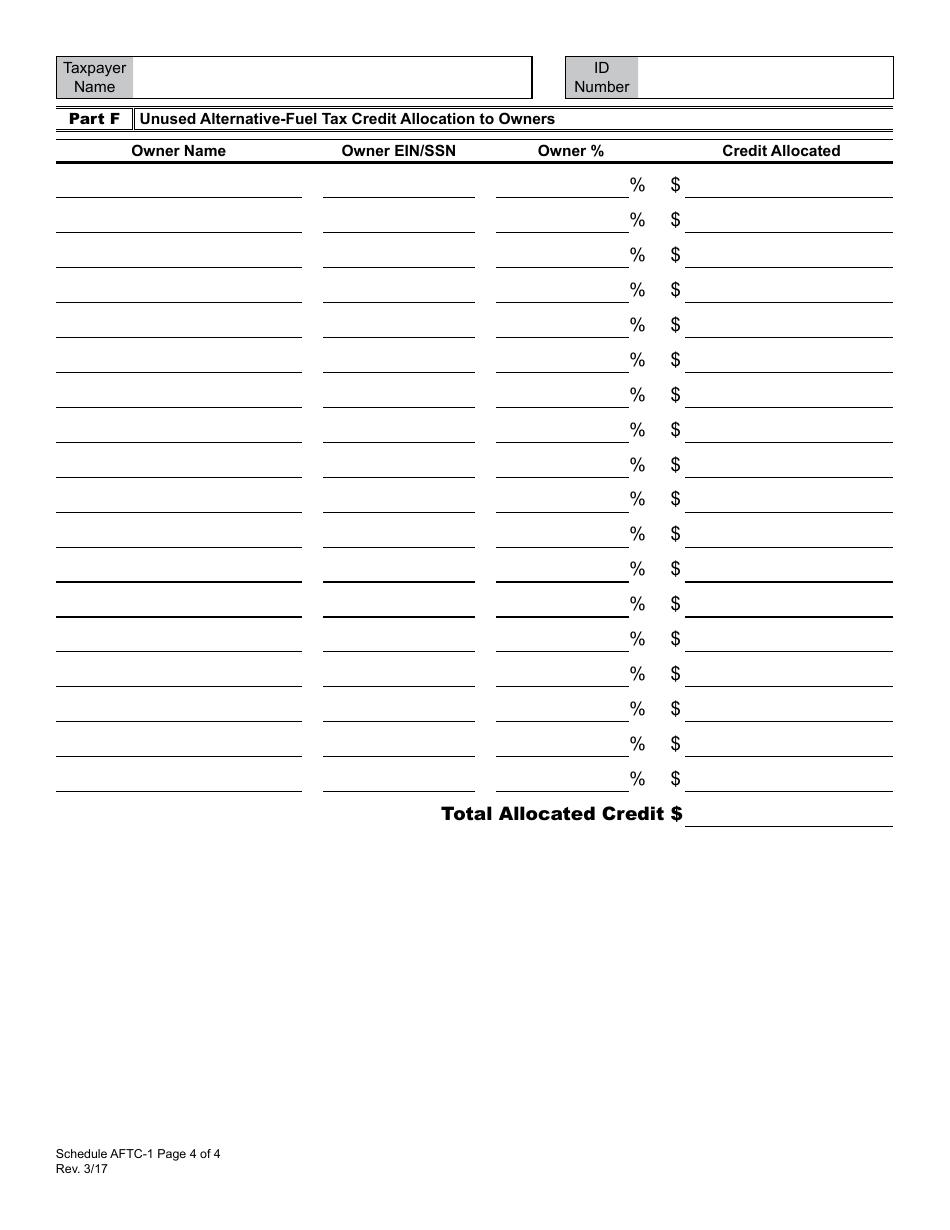

Schedule AFTC-1

for the current year.

Schedule AFTC-1 Alternative-Fuel Tax Credit for Periods After January 1, 2015 - West Virginia

What Is Schedule AFTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AFTC-1?

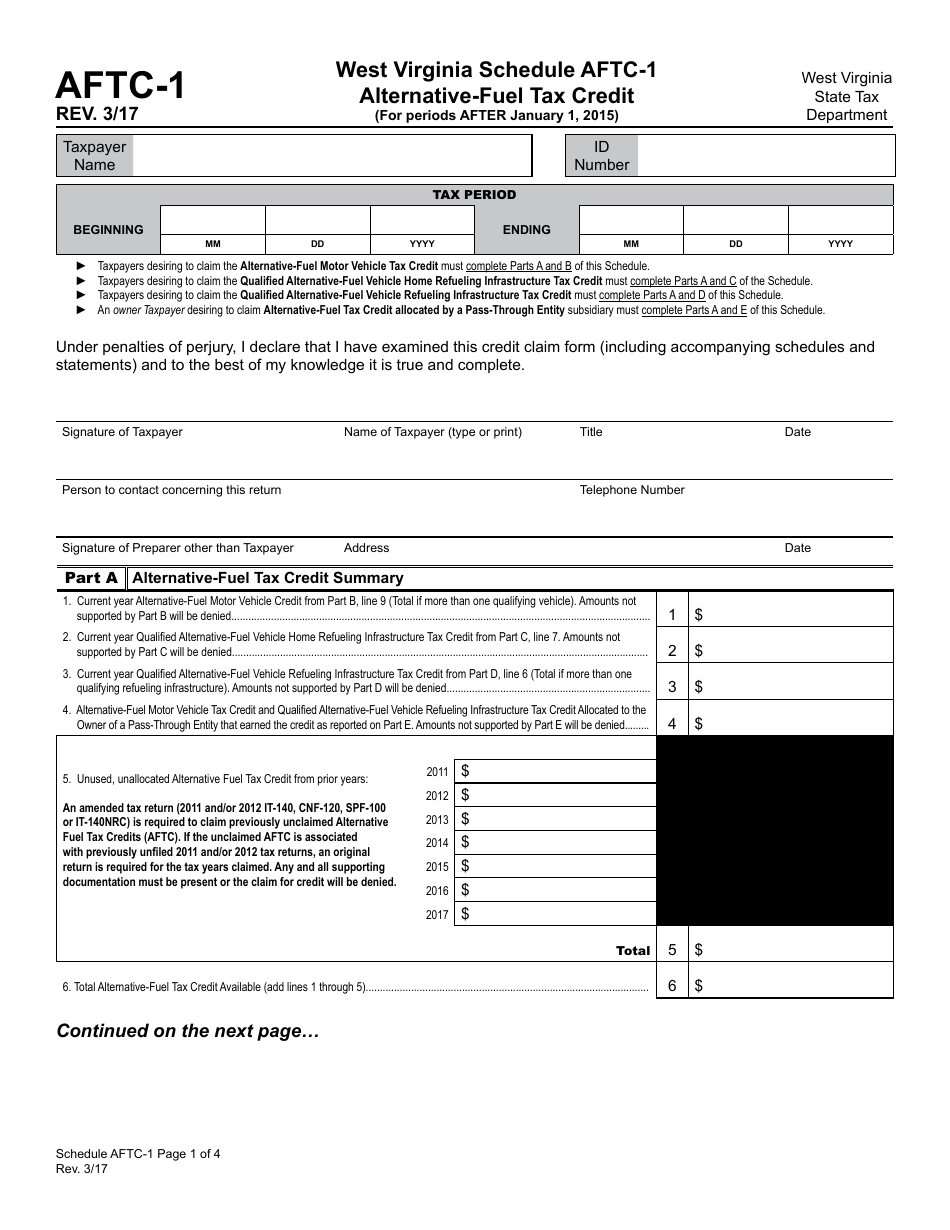

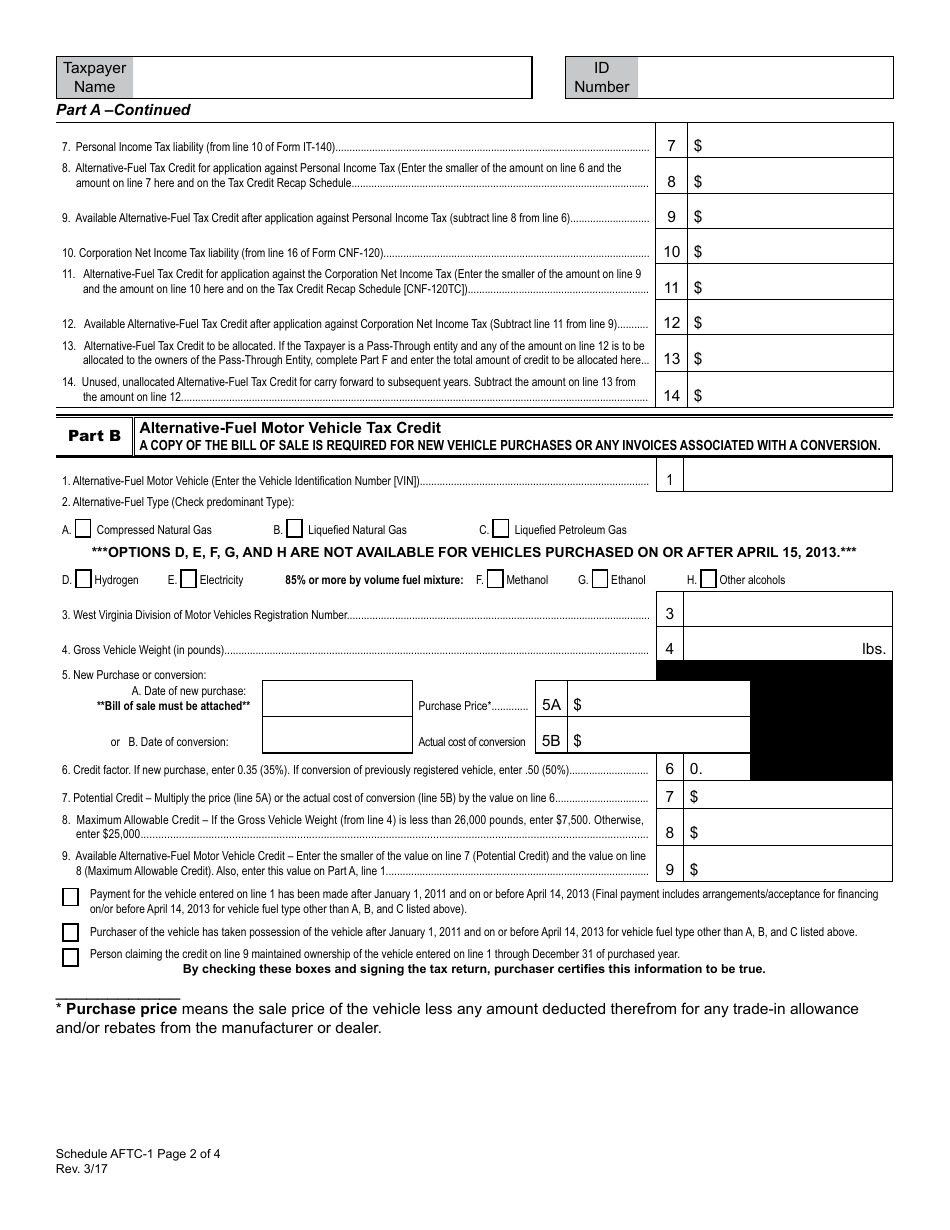

A: AFTC-1 is the Alternative-Fuel Tax Credit for periods after January 1, 2015 in West Virginia.

Q: Who is eligible for AFTC-1?

A: Taxpayers who use alternative fuels as a motor fuel for their vehicles are eligible for AFTC-1.

Q: What is the purpose of AFTC-1?

A: The purpose of AFTC-1 is to provide a tax credit to encourage the use of alternative fuels and reduce dependency on conventional fuels.

Q: When does AFTC-1 take effect?

A: AFTC-1 takes effect for periods after January 1, 2015.

Q: How can I claim the AFTC-1 tax credit?

A: To claim the AFTC-1 tax credit, you must complete Schedule AFTC-1 and attach it to your state tax return.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule AFTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.