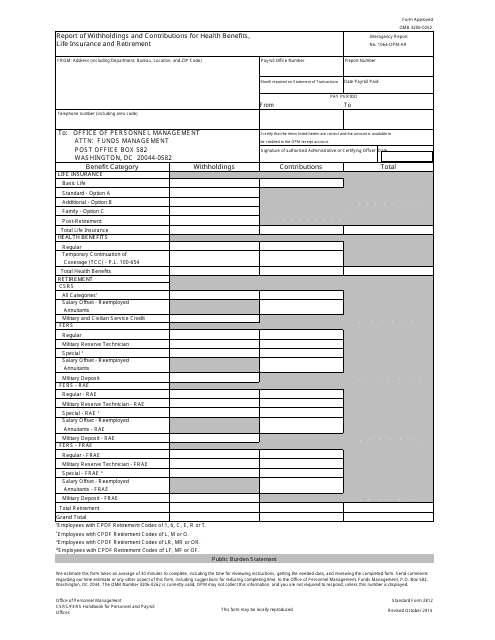

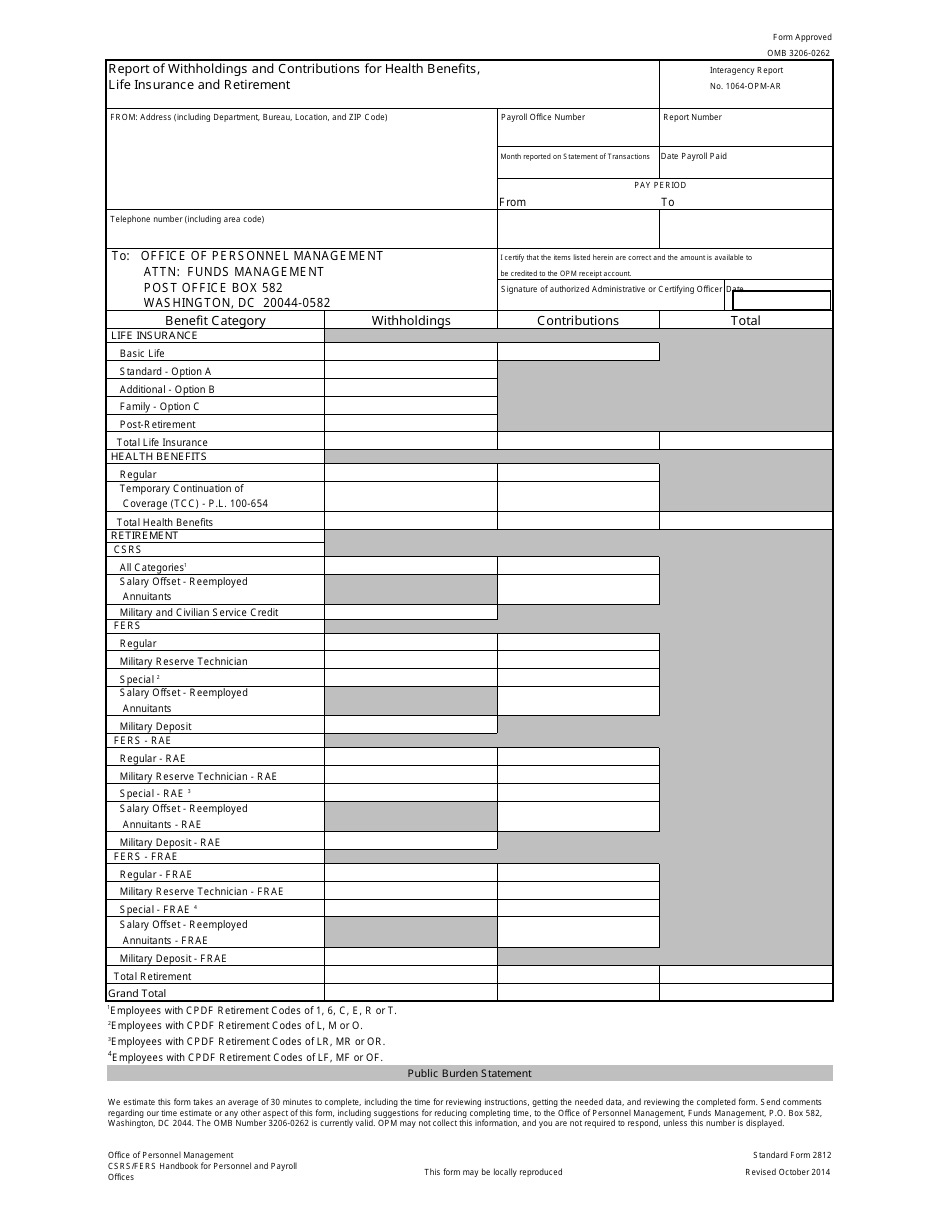

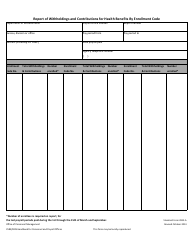

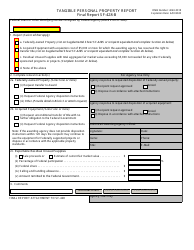

Form SF-2812 Report of Withholdings and Contributions for Health Benefits, Life Insurance and Retirement

What Is Form SF-2812?

This is a legal form that was released by the U.S. Office of Personnel Management on October 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SF-2812?

A: SF-2812 is a form used to report withholdings and contributions for health benefits, life insurance, and retirement.

Q: What information is required on SF-2812?

A: SF-2812 requires information about the employee's withholdings and contributions for health benefits, life insurance, and retirement.

Q: Who needs to fill out SF-2812?

A: Employees who have withholdings and contributions for health benefits, life insurance, and retirement need to fill out SF-2812.

Q: How often do I need to fill out SF-2812?

A: The frequency of filling out SF-2812 depends on the specific requirements of your employer and the benefit programs you participate in. It is best to consult with your employer or HR department for guidance on how often to fill out SF-2812.

Q: What should I do with the completed SF-2812 form?

A: After completing SF-2812, you should submit it to your employer or the appropriate HR department as instructed.

Q: Can I make changes to SF-2812 after submitting it?

A: In most cases, you can make changes to SF-2812 by submitting a revised form to your employer or HR department. However, it is important to check with them for their specific policies.

Q: Can I get a copy of SF-2812 if I lose the original?

A: If you lose the original SF-2812, you can request a copy from your employer or HR department. They should be able to provide you with a duplicate form.

Form Details:

- Released on October 1, 2014;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-2812 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.