This version of the form is not currently in use and is provided for reference only. Download this version of

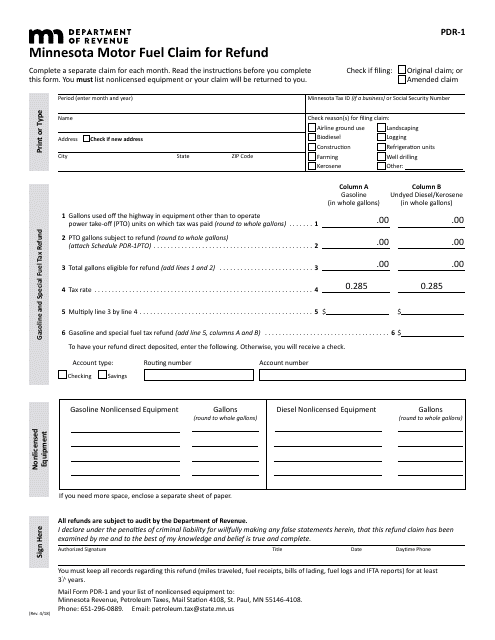

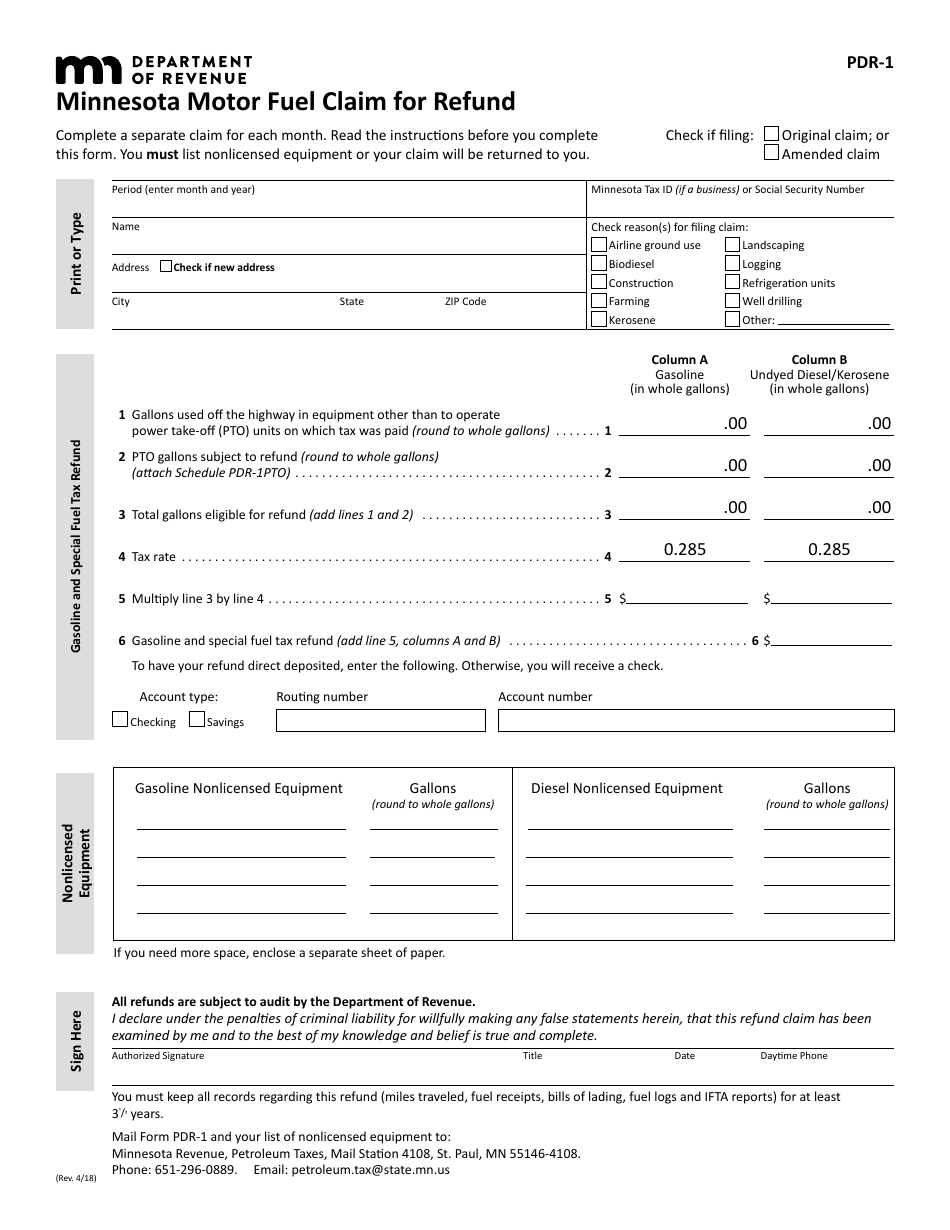

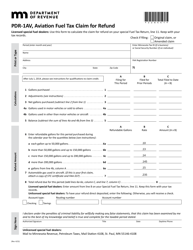

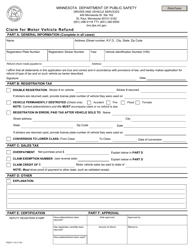

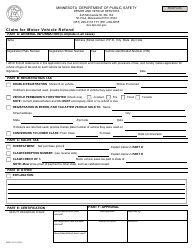

Form PDR-1

for the current year.

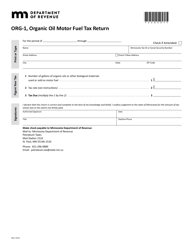

Form PDR-1 Minnesota Motor Fuel Claim for Refund - Minnesota

What Is Form PDR-1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PDR-1?

A: Form PDR-1 is a Minnesota motor fuelclaim for refund form.

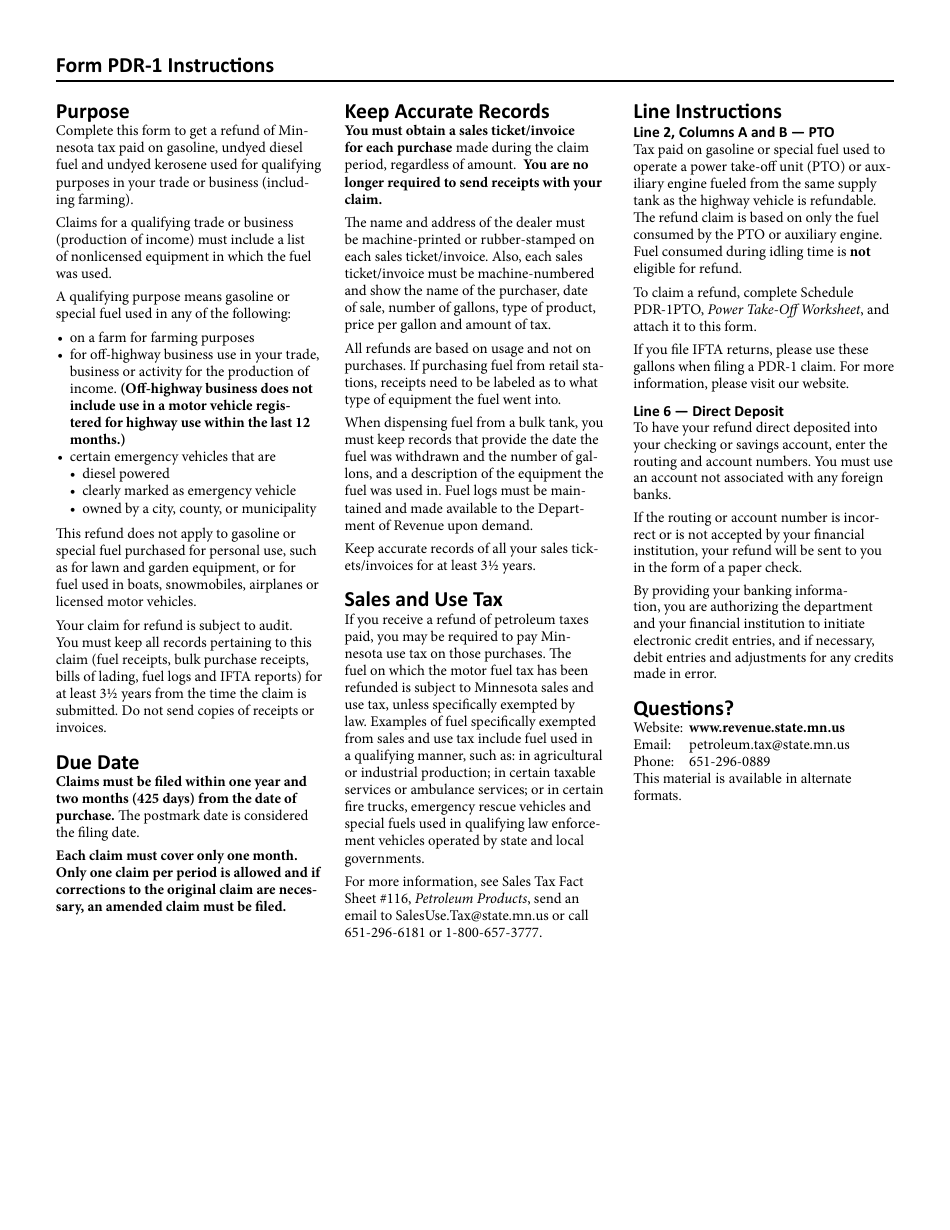

Q: What is the purpose of Form PDR-1?

A: The purpose of Form PDR-1 is to claim a refund for motor fuel tax paid in Minnesota.

Q: Who needs to file Form PDR-1?

A: Anyone who has paid motor fuel tax in Minnesota and wants to claim a refund needs to file Form PDR-1.

Q: What information is required on Form PDR-1?

A: Form PDR-1 requires information such as the name and address of the claimant, the amount of fuel purchased, and the amount of tax paid.

Q: When should Form PDR-1 be filed?

A: Form PDR-1 should be filed within two years from the date the tax was paid or the fuel was purchased, whichever is later.

Q: What supporting documents should be included with Form PDR-1?

A: Supporting documents such as fuel purchase receipts and copies of tax returns should be included with Form PDR-1.

Q: How long does it take to process a Form PDR-1 refund?

A: The processing time for a Form PDR-1 refund varies, but it can take several weeks to several months.

Q: Can I check the status of my Form PDR-1 refund?

A: Yes, you can check the status of your Form PDR-1 refund by contacting the Minnesota Department of Revenue.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDR-1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.