This version of the form is not currently in use and is provided for reference only. Download this version of

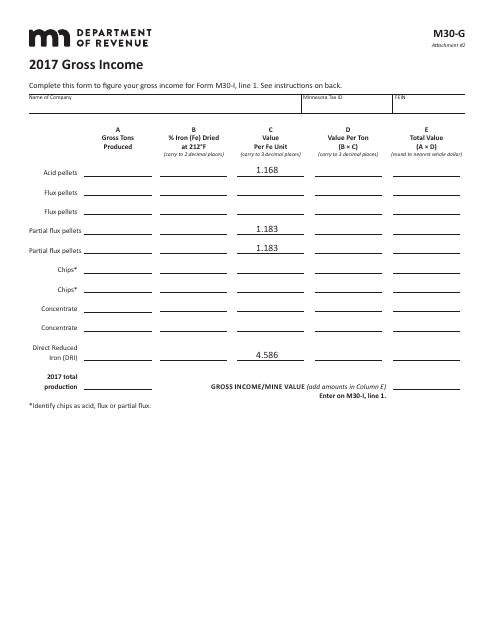

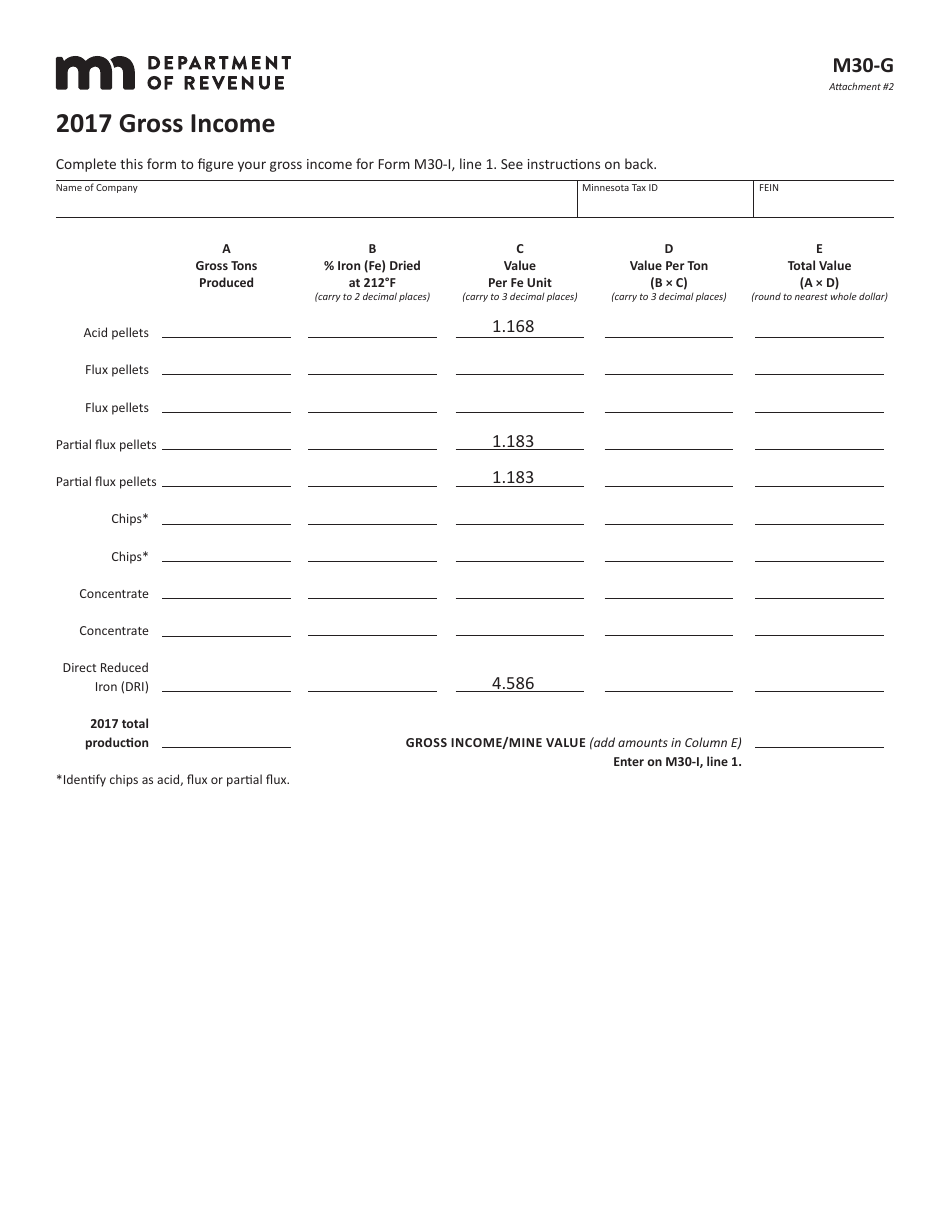

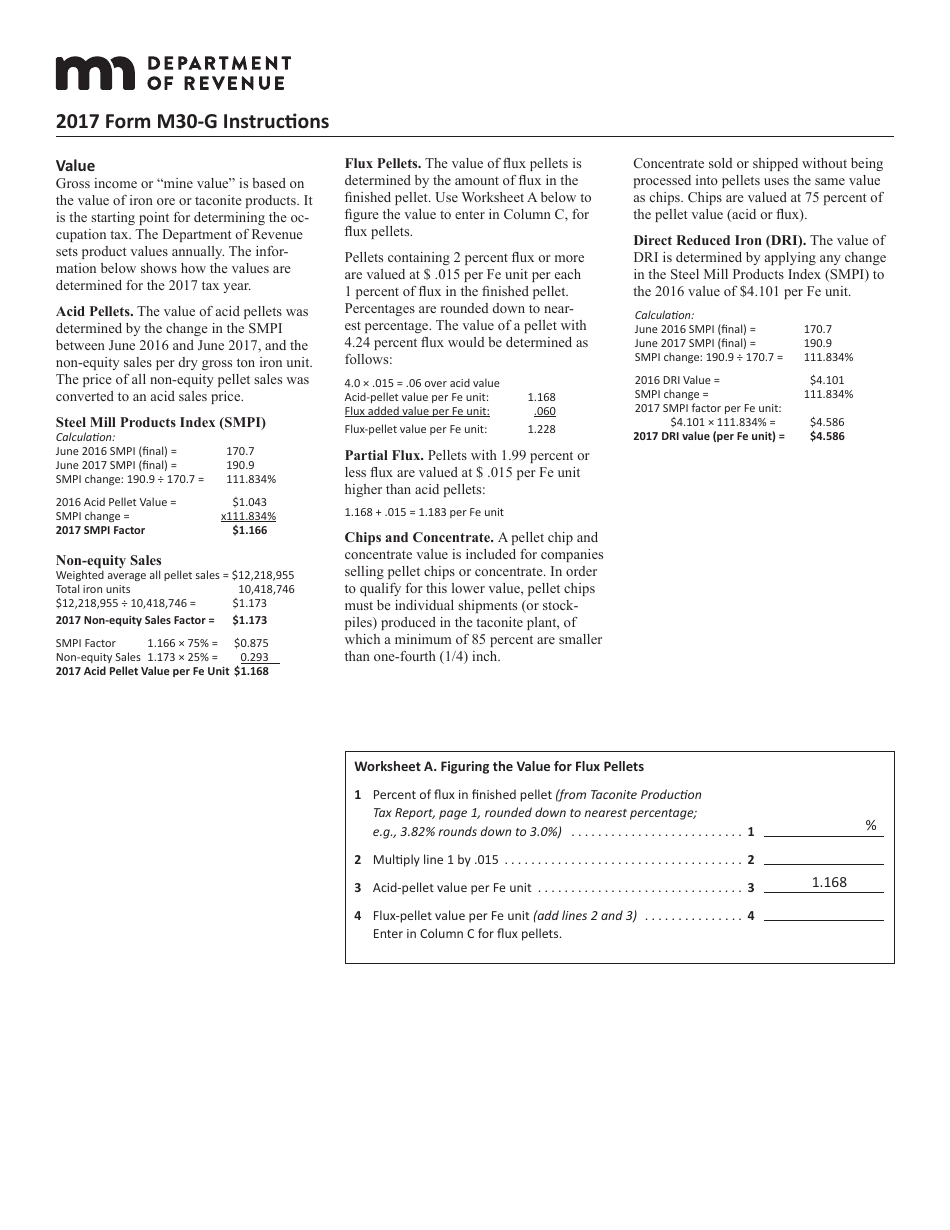

Form M30-G

for the current year.

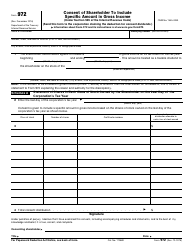

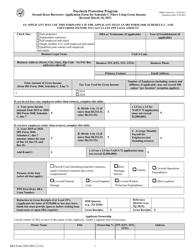

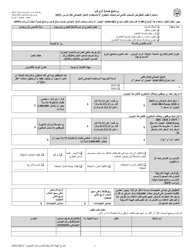

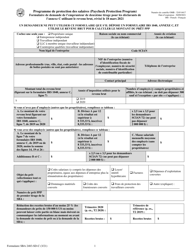

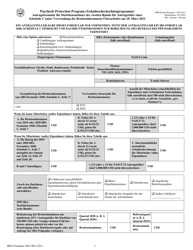

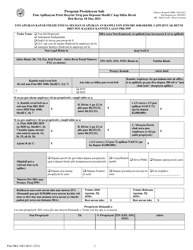

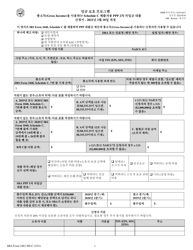

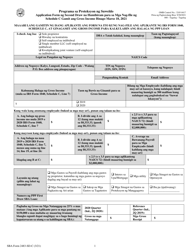

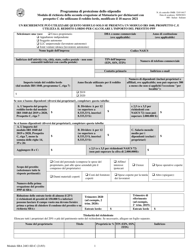

Form M30-G Gross Income - Minnesota

What Is Form M30-G?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M30-G?

A: Form M30-G is a tax form used to report gross income for Minnesota residents.

Q: Who needs to file Form M30-G?

A: Minnesota residents who have gross income need to file Form M30-G.

Q: What is considered gross income for Form M30-G?

A: Gross income for Form M30-G includes income from all sources, such as wages, self-employment income, rental income, and investment income.

Q: Is Form M30-G only for residents of Minnesota?

A: Yes, Form M30-G is specifically for Minnesota residents.

Q: When is the deadline to file Form M30-G?

A: The deadline to file Form M30-G is typically April 15th, the same as the federal tax deadline.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M30-G by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.