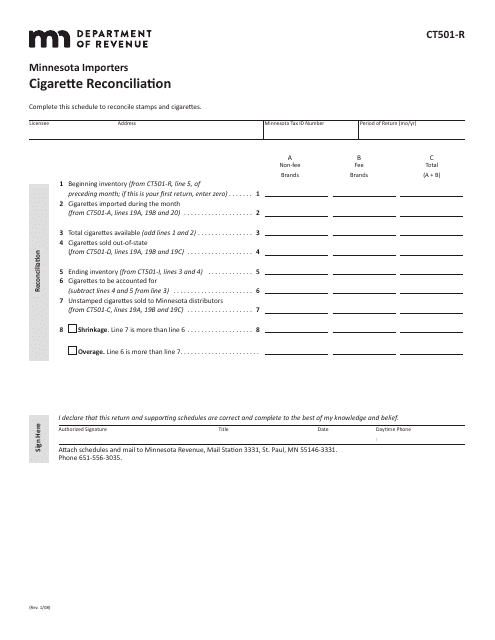

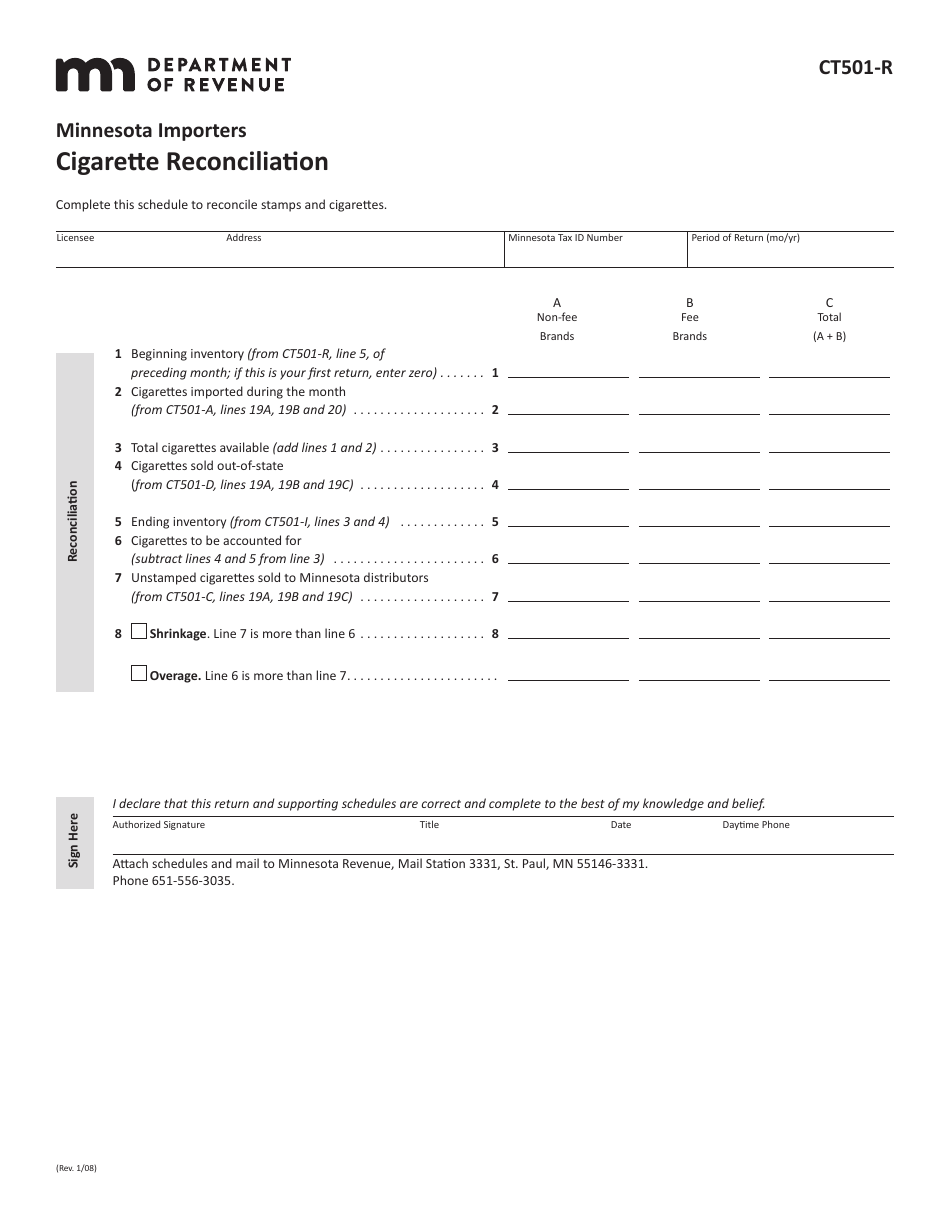

Form CT501-R Cigarette Reconciliation for Minnesota Importers - Minnesota

What Is Form CT501-R?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT501-R?

A: Form CT501-R is the Cigarette Reconciliation form for Minnesota Importers.

Q: Who needs to file Form CT501-R?

A: Minnesota Importers of cigarettes need to file Form CT501-R.

Q: What is the purpose of Form CT501-R?

A: The purpose of Form CT501-R is to reconcile the number of cigarettes imported into Minnesota with the number of cigarettes reported on the State's cigarette tax return.

Q: How often should Form CT501-R be filed?

A: Form CT501-R should be filed on a monthly basis.

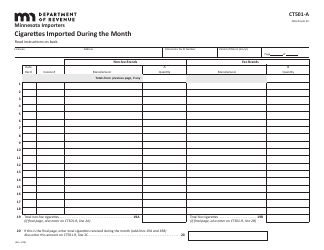

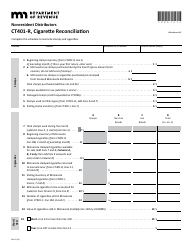

Q: What information is required on Form CT501-R?

A: Form CT501-R requires information such as the importer's name, address, and federal employer identification number, as well as the number of cigarettes imported and the amount of state tax paid.

Q: Are there any penalties for not filing Form CT501-R?

A: Yes, failure to file Form CT501-R or filing false information may result in penalties and interest.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT501-R by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.