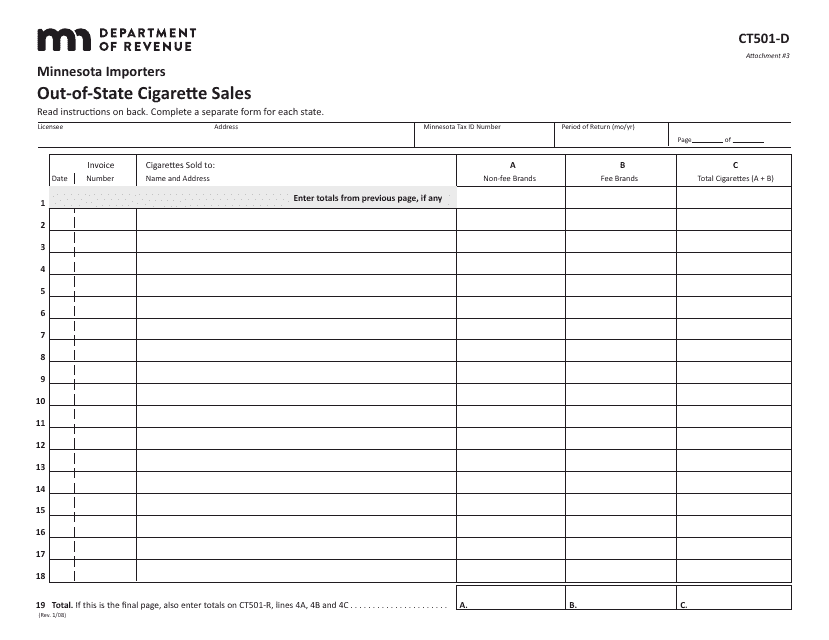

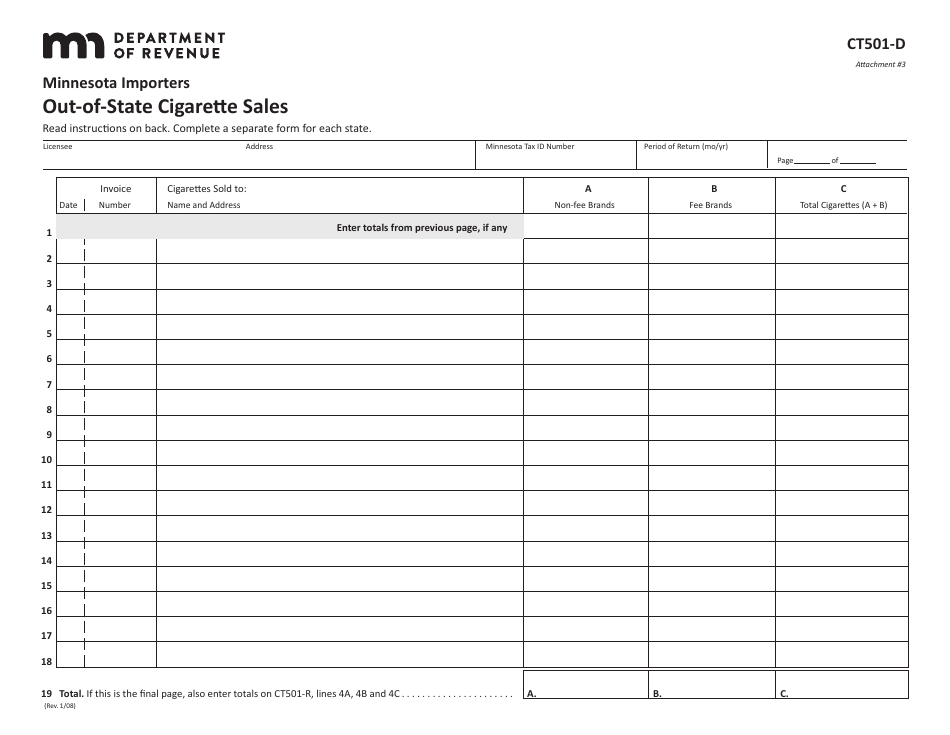

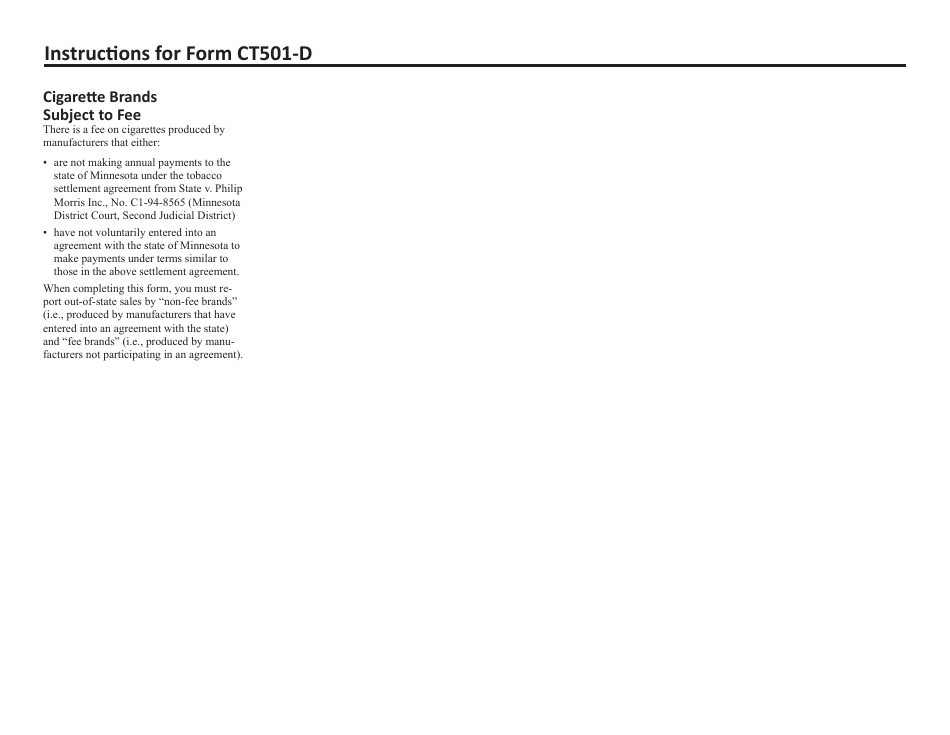

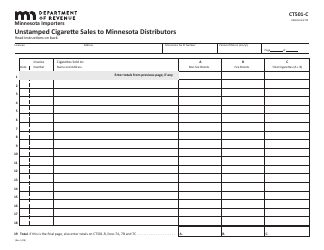

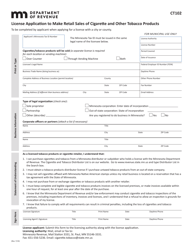

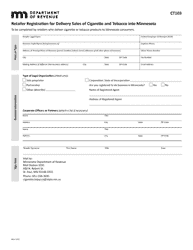

Form CT501-D Out-of-State Cigarette Sales - Minnesota

What Is Form CT501-D?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT501-D?

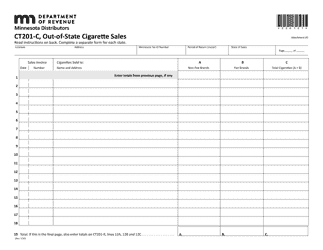

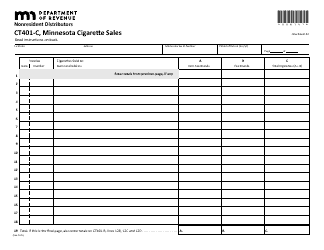

A: Form CT501-D is a form used for reporting out-of-state cigarette sales in Minnesota.

Q: Who should use Form CT501-D?

A: Form CT501-D should be used by cigarette wholesalers located outside of Minnesota who sell cigarettes for resale within the state.

Q: What information is required on Form CT501-D?

A: Form CT501-D requires information such as the name and address of the wholesaler, the quantity of cigarettes sold, and the total sales price.

Q: How often should Form CT501-D be filed?

A: Form CT501-D must be filed on a monthly basis.

Q: Are there any penalties for not filing Form CT501-D?

A: Yes, failure to file Form CT501-D or understating the amount of cigarettes sold may result in penalties.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT501-D by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.