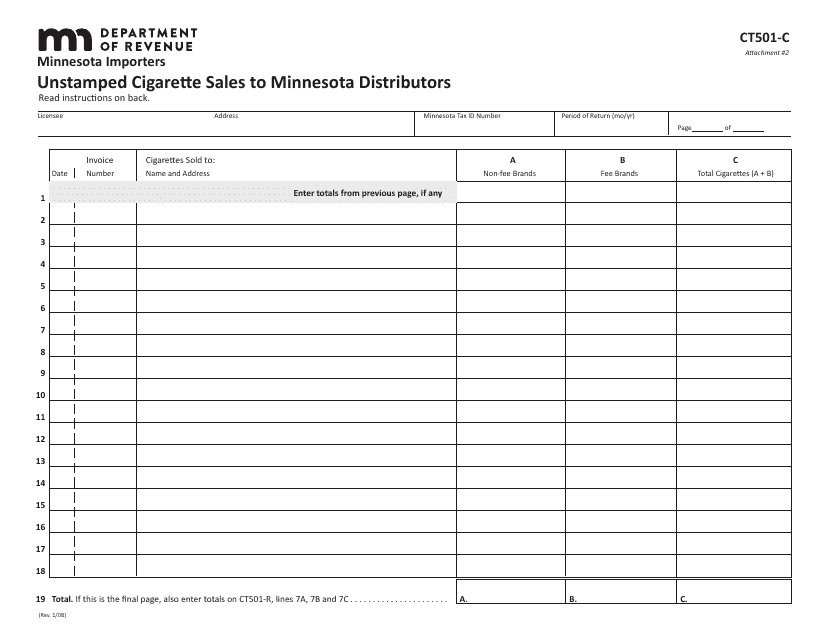

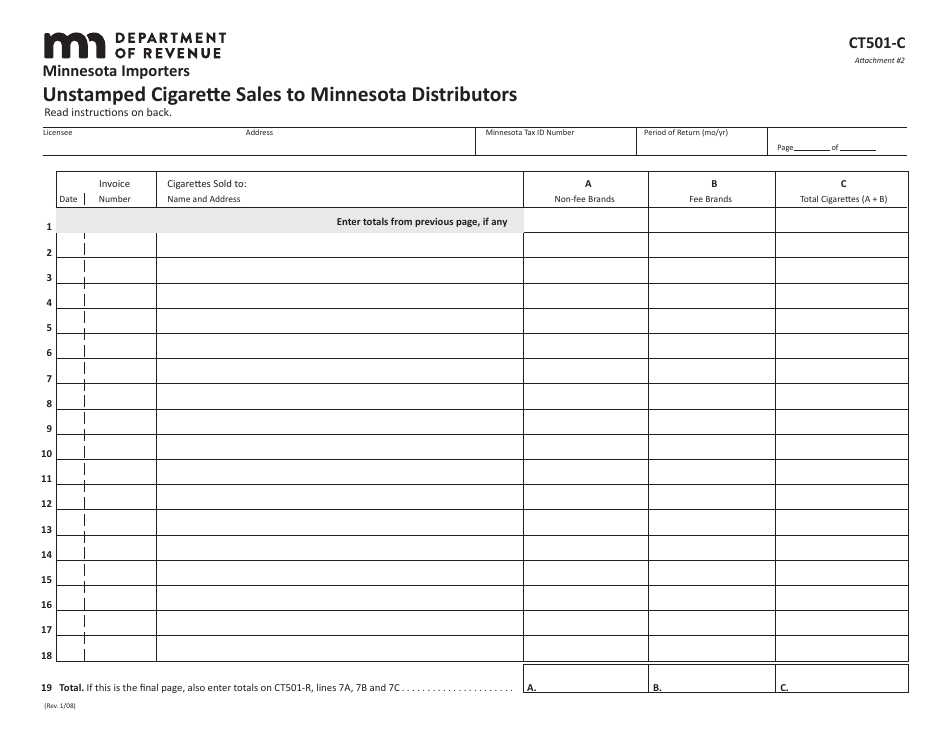

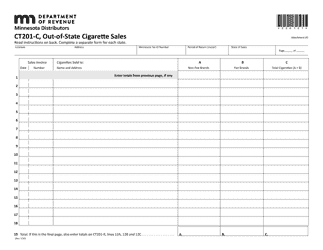

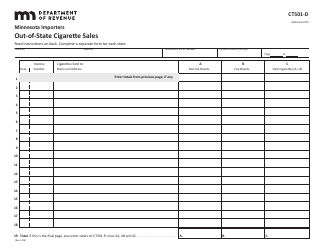

Form CT501-C Unstamped Cigarette Sales to Minnesota Distributors - Minnesota

What Is Form CT501-C?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT501-C?

A: Form CT501-C is a form used for reporting unstamped cigarette sales to Minnesota distributors.

Q: Who is required to complete Form CT501-C?

A: Any person or entity that sells unstamped cigarettes to Minnesota distributors is required to complete Form CT501-C.

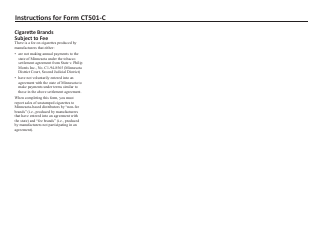

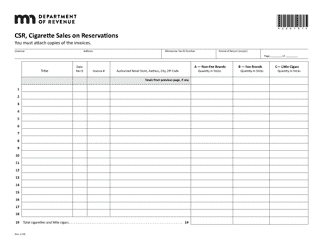

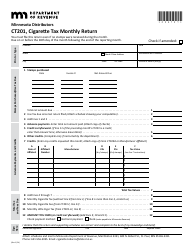

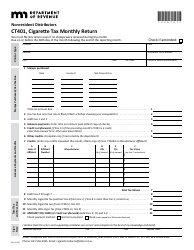

Q: What information needs to be reported on Form CT501-C?

A: Form CT501-C requires information such as the name of the distributor, the date of sale, the quantity of unstamped cigarettes sold, and the total price of the sale.

Q: What is the purpose of reporting unstamped cigarette sales?

A: Reporting unstamped cigarette sales helps ensure compliance with Minnesota's tobacco tax laws and helps the department in collecting the appropriate taxes.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT501-C by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.