This version of the form is not currently in use and is provided for reference only. Download this version of

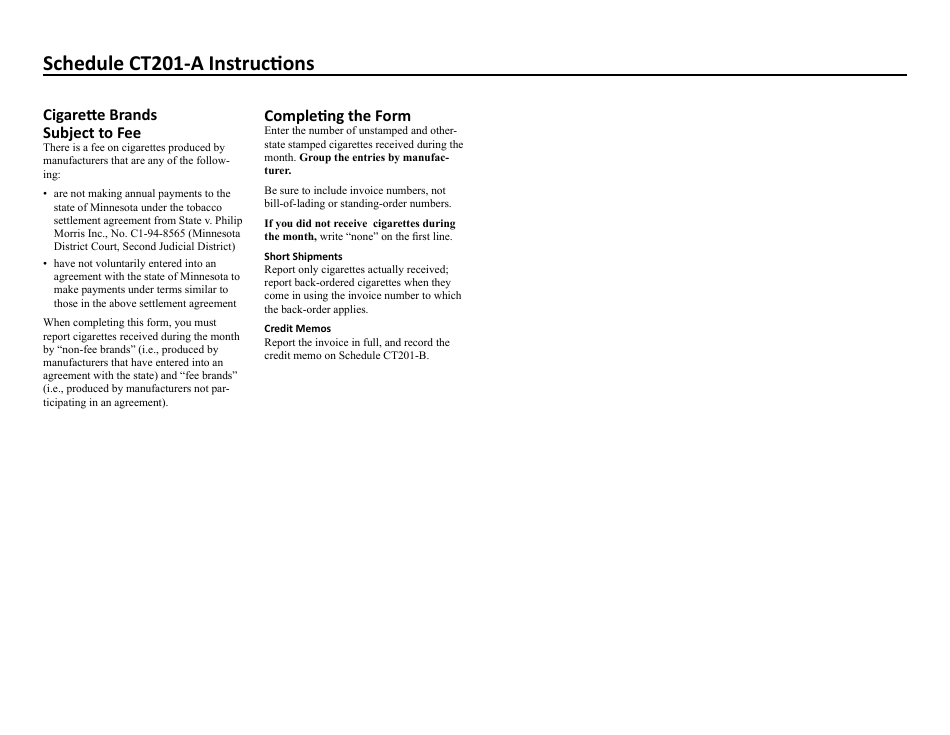

Form CT201-A

for the current year.

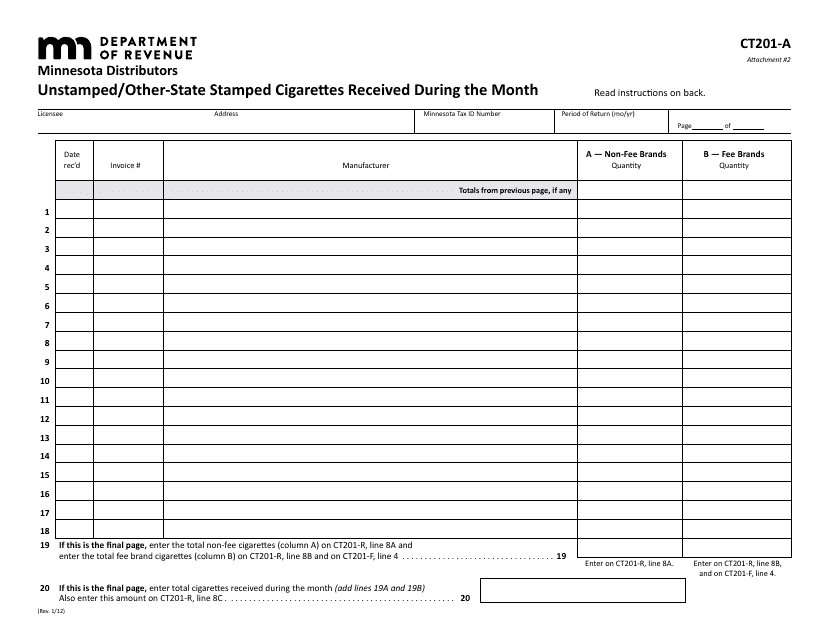

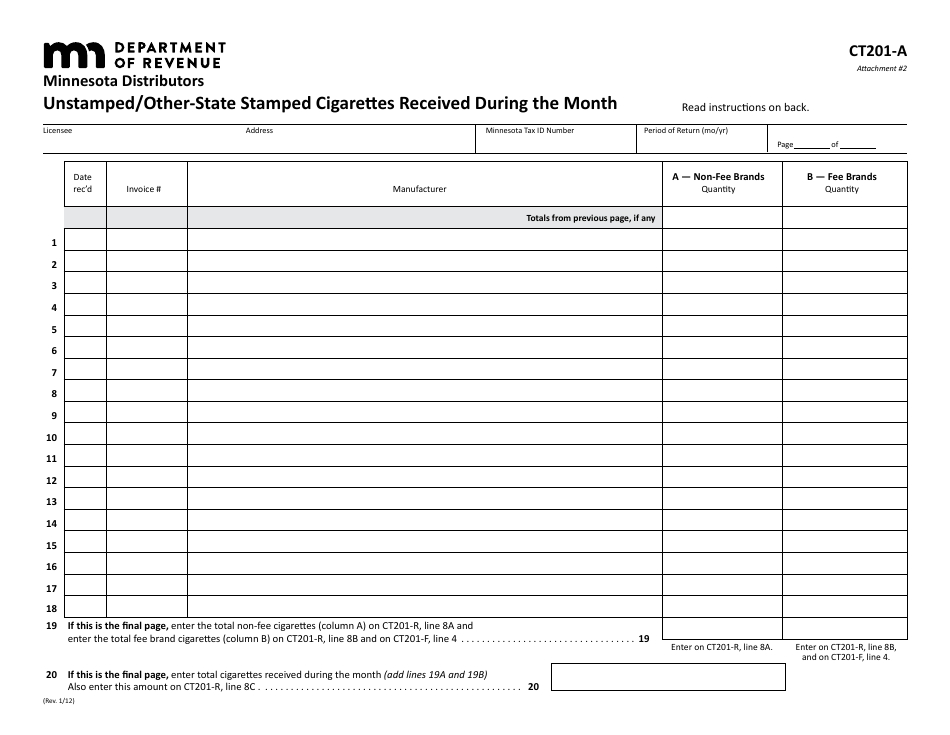

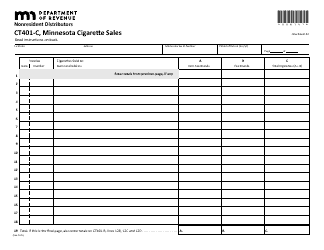

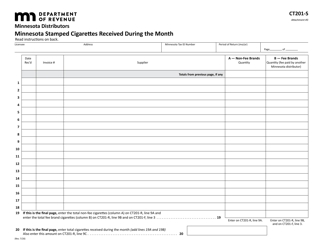

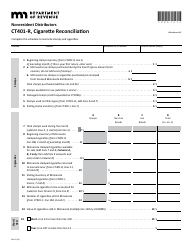

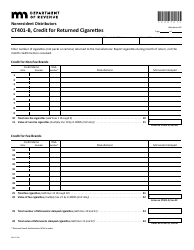

Form CT201-A Unstamped / Other-State Stamped Cigarettes Received During the Month or Minnesota Distributors - Minnesota

What Is Form CT201-A?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT201-A?

A: Form CT201-A is a form used for reporting the receipt of unstamped or other-state stamped cigarettes during the month by Minnesota distributors.

Q: Who uses Form CT201-A?

A: Minnesota distributors use Form CT201-A to report the receipt of unstamped or other-state stamped cigarettes.

Q: What does Form CT201-A report?

A: Form CT201-A reports the receipt of unstamped or other-state stamped cigarettes by Minnesota distributors during the month.

Q: What are unstamped cigarettes?

A: Unstamped cigarettes are cigarettes that do not have the required state tax stamps affixed to the packaging.

Q: What are other-state stamped cigarettes?

A: Other-state stamped cigarettes are cigarettes that have tax stamps affixed by a state other than Minnesota.

Q: Why do distributors need to report the receipt of unstamped or other-state stamped cigarettes?

A: Distributors need to report the receipt of unstamped or other-state stamped cigarettes to comply with state tax laws and regulations.

Q: Does Form CT201-A require any specific information?

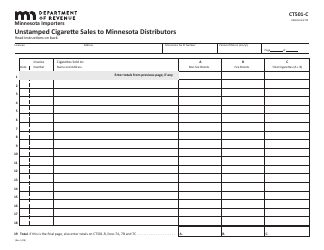

A: Yes, Form CT201-A requires specific information such as the number of cigarettes received, the source of the cigarettes, and the invoiced price.

Q: Are there any penalties for not reporting the receipt of unstamped or other-state stamped cigarettes?

A: Yes, failure to report the receipt of unstamped or other-state stamped cigarettes can result in penalties and fines.

Q: Is Form CT201-A only applicable to Minnesota distributors?

A: Yes, Form CT201-A is specifically for Minnesota distributors who receive unstamped or other-state stamped cigarettes.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT201-A by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.