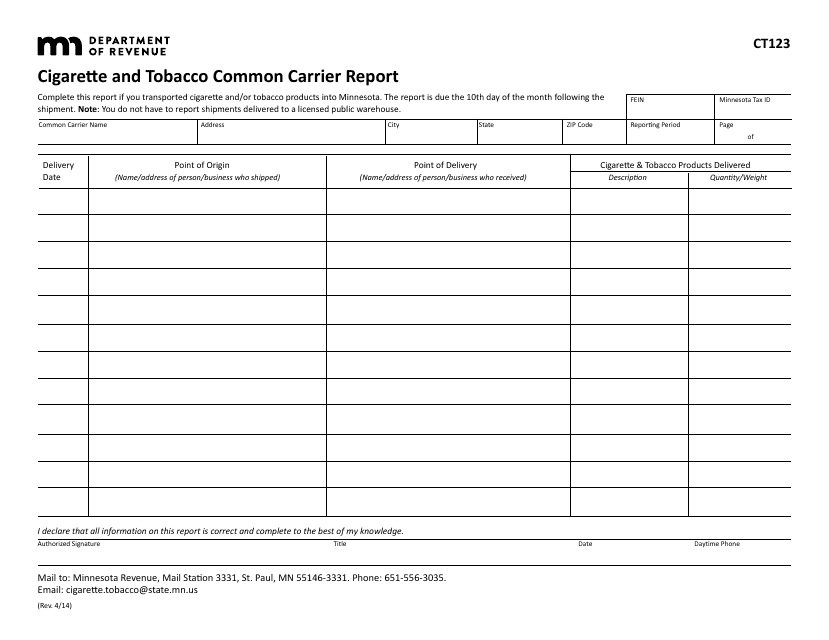

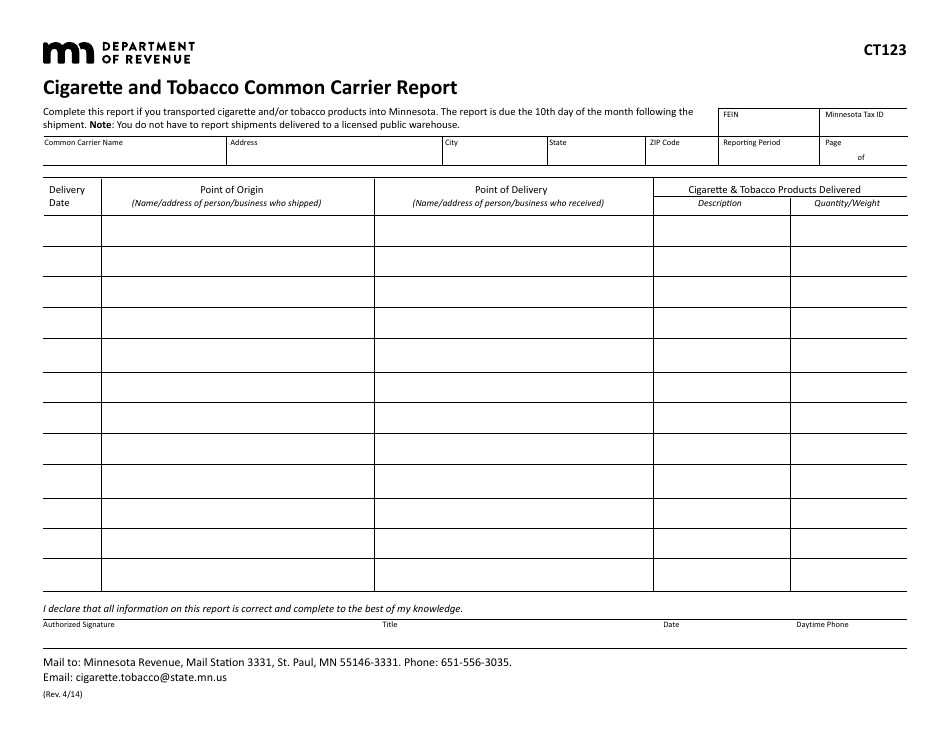

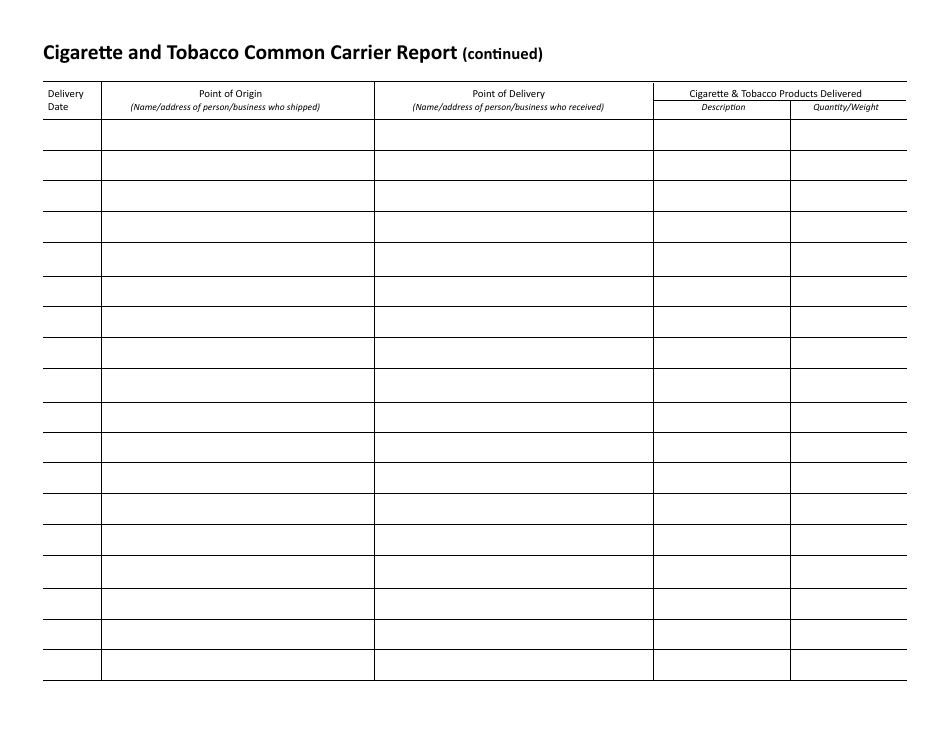

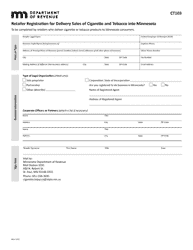

Form CT123 Cigarette and Tobacco Common Carrier Report - Minnesota

What Is Form CT123?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT123?

A: Form CT123 is the Cigarette and Tobacco Common Carrier Report.

Q: What is the purpose of Form CT123?

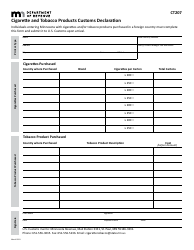

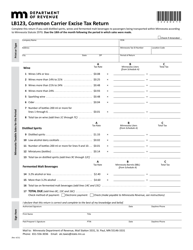

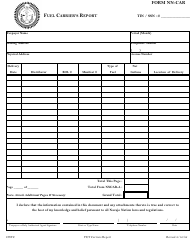

A: The purpose of Form CT123 is to report information about the transportation and delivery of cigarettes and tobacco products in Minnesota.

Q: Who is required to file Form CT123?

A: Common carriers transporting cigarettes and tobacco products in Minnesota are required to file Form CT123.

Q: What information is reported on Form CT123?

A: Form CT123 requires details such as the name of the common carrier, the origin and destination of the shipment, the quantity of cigarettes or tobacco products, and other relevant information.

Q: When is Form CT123 due?

A: Form CT123 is due on a quarterly basis. It must be filed by the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for late or non-filing of Form CT123?

A: Yes, there are penalties for late or non-filing of Form CT123. It is important to file the form by the due date to avoid these penalties.

Q: Is there any fee associated with filing Form CT123?

A: No, there is no fee associated with filing Form CT123.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT123 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.