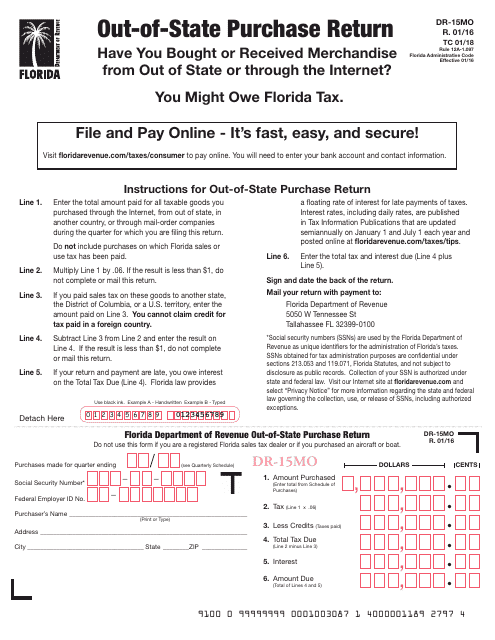

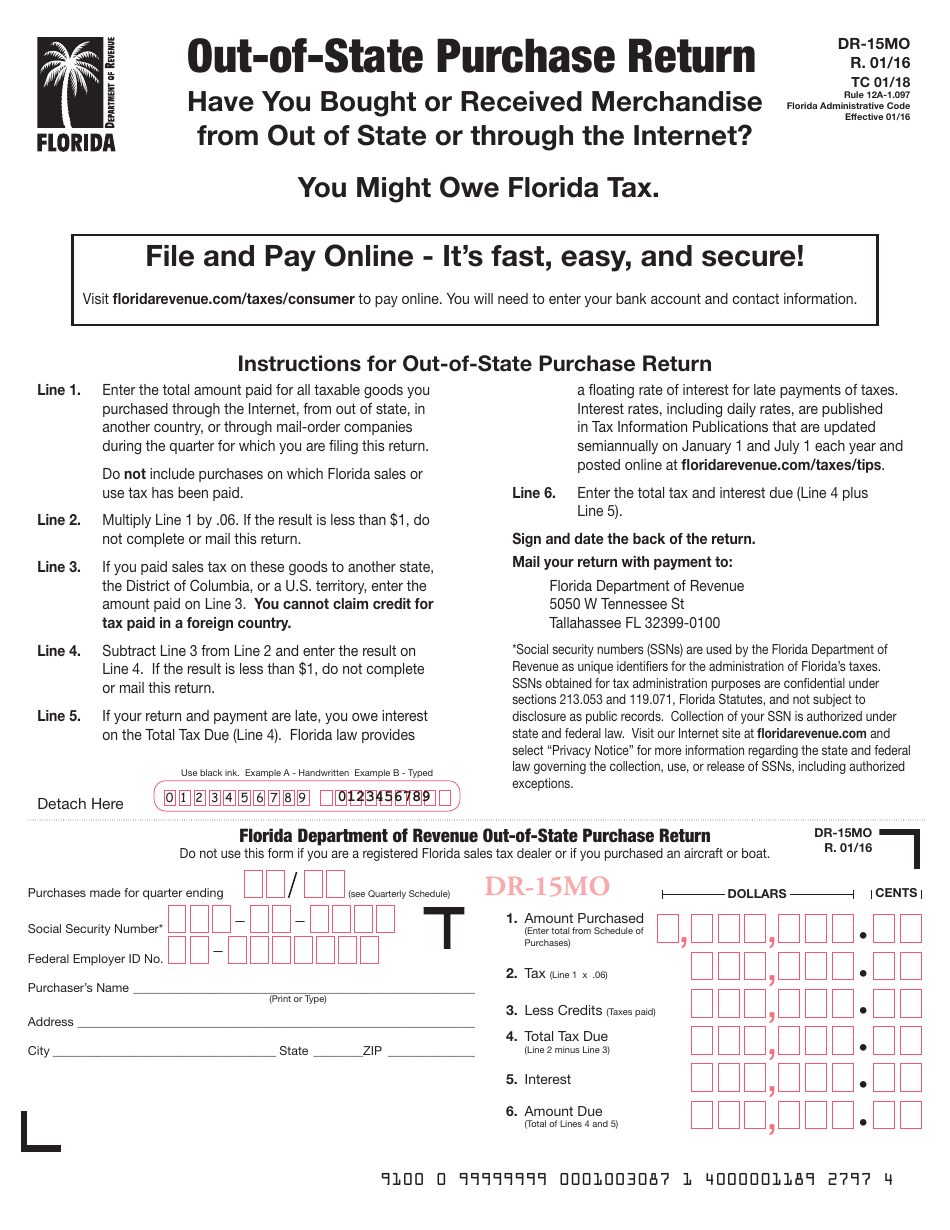

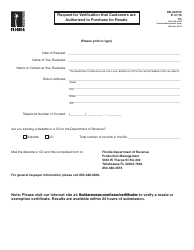

Form DR-15MO Out-of-State Purchase Return - Florida

What Is Form DR-15MO?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-15MO?

A: Form DR-15MO is a tax return form used in the state of Florida for reporting out-of-state purchases.

Q: Who needs to file Form DR-15MO?

A: Anyone in Florida who has made out-of-state purchases and owes use tax must file Form DR-15MO.

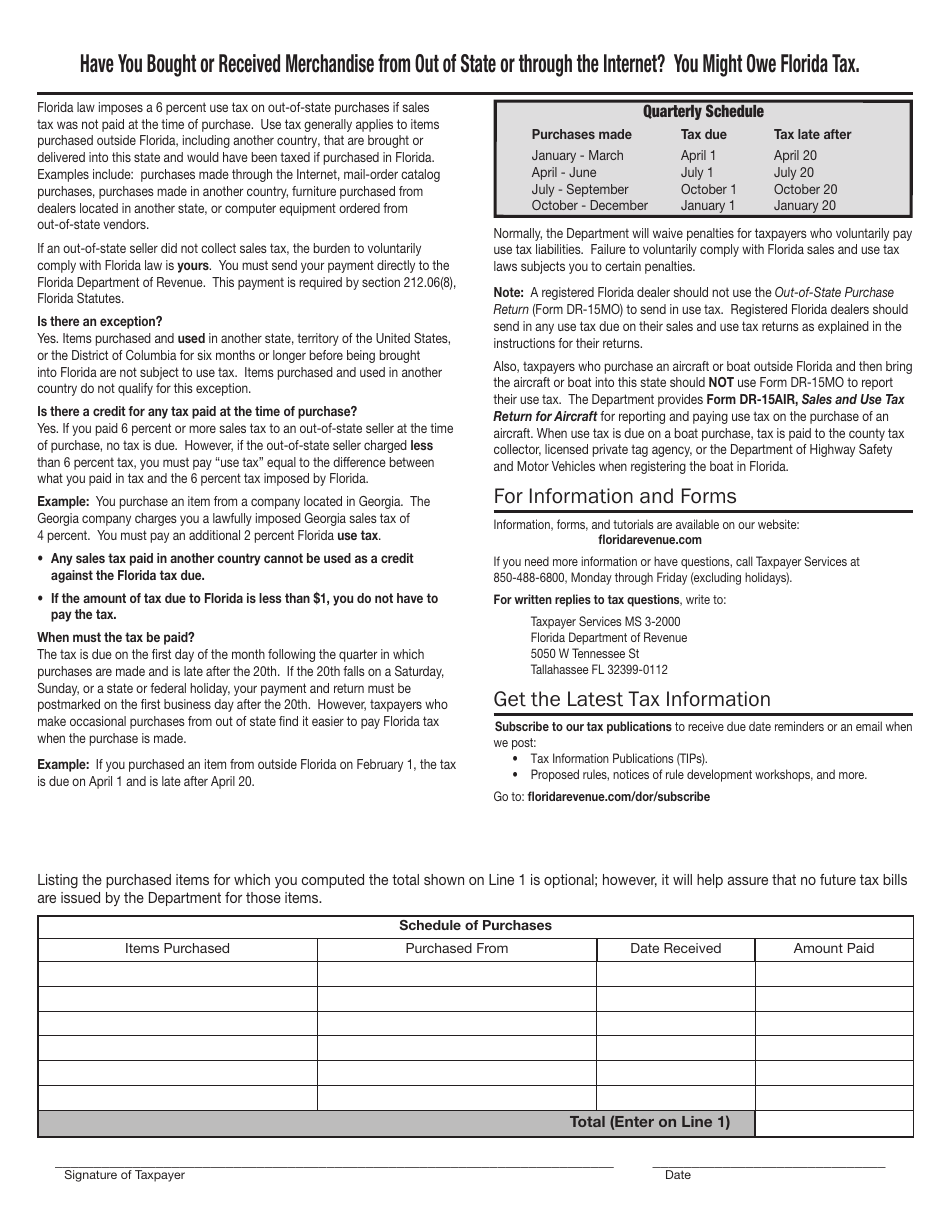

Q: What is use tax?

A: Use tax is a tax on goods purchased for use, storage, or consumption in Florida where sales tax was not paid.

Q: When should Form DR-15MO be filed?

A: Form DR-15MO should be filed annually by April 15th of the following year.

Q: What information is required to complete Form DR-15MO?

A: You will need to provide information about your out-of-state purchases, including the date, description, and cost of each item.

Q: Are there any penalties for not filing Form DR-15MO?

A: Yes, failure to file Form DR-15MO or pay the use tax owed can result in penalties and interest.

Q: Is Form DR-15MO for personal or business use?

A: Form DR-15MO can be used for both personal and business out-of-state purchases.

Q: Can I claim a refund on Form DR-15MO?

A: No, Form DR-15MO is only used for reporting and paying use tax, not for claiming refunds.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-15MO by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.