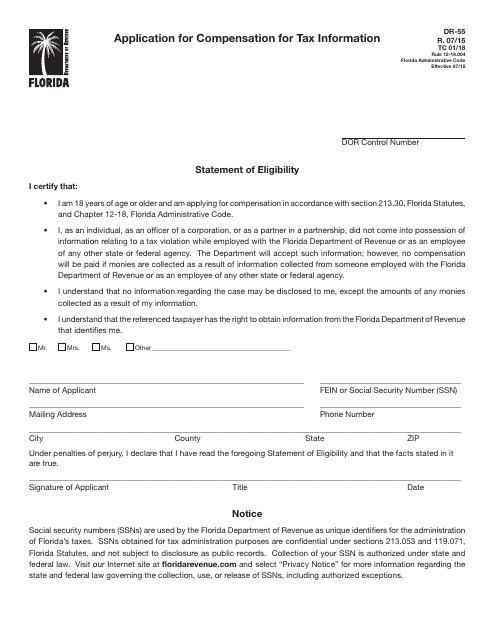

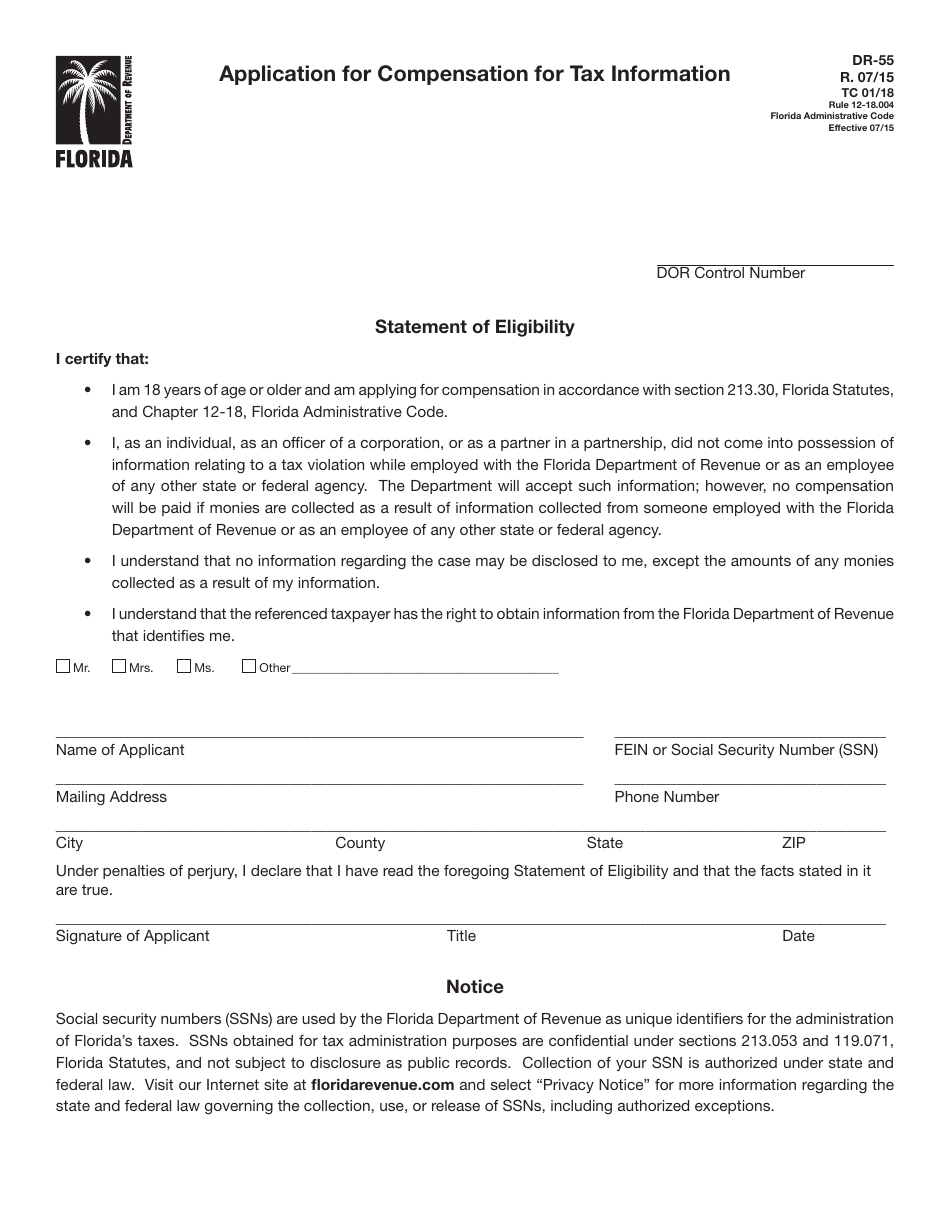

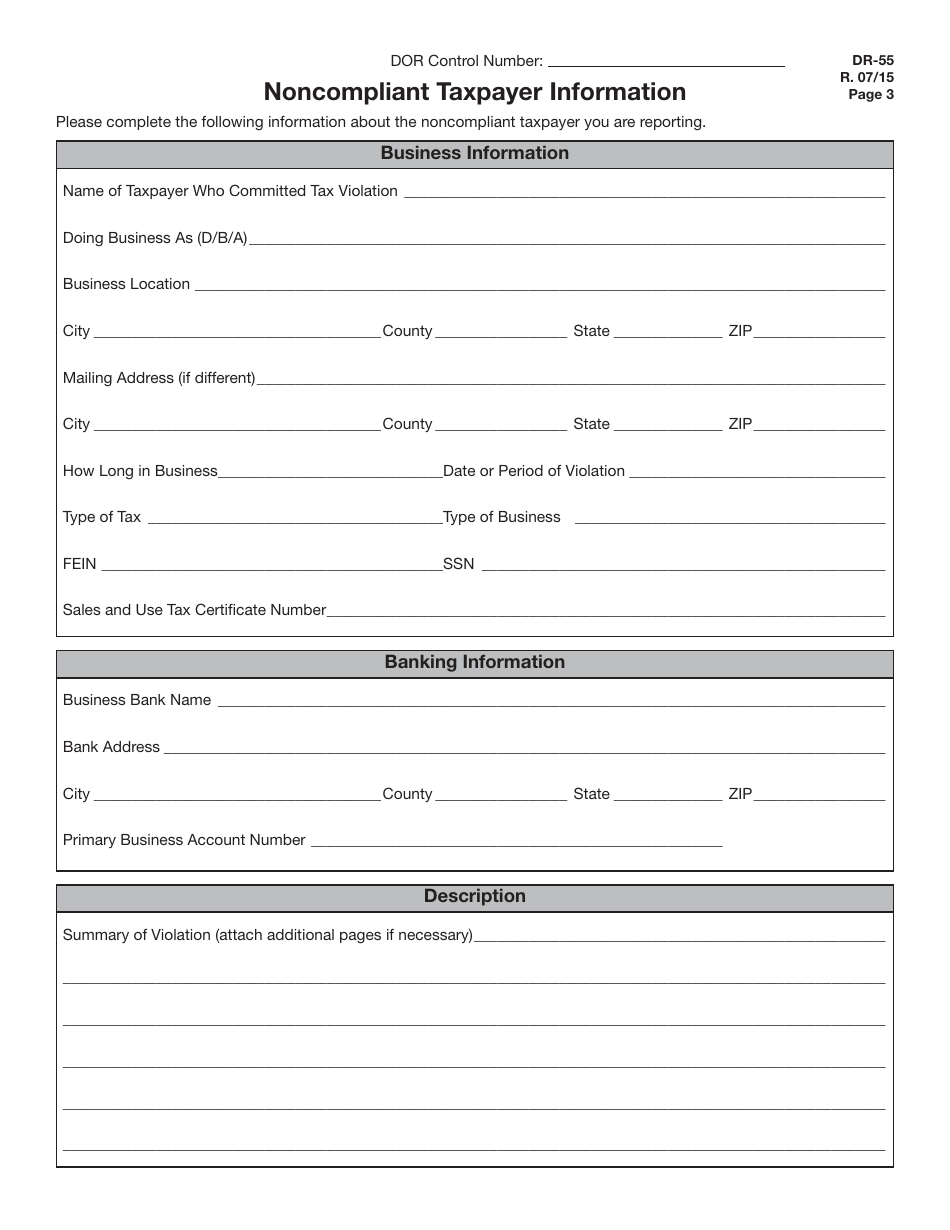

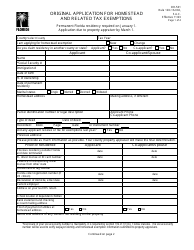

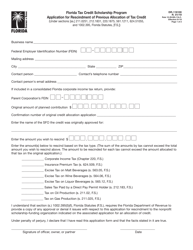

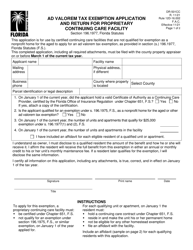

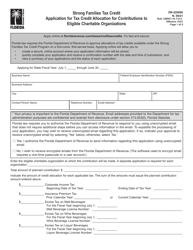

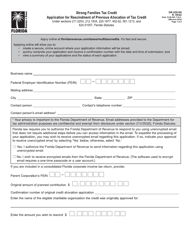

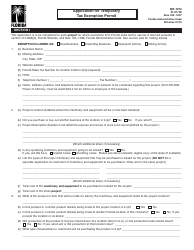

Form DR-55 Application for Compensation for Tax Information - Florida

What Is Form DR-55?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-55?

A: Form DR-55 is the Application for Compensation for Tax Information in the state of Florida.

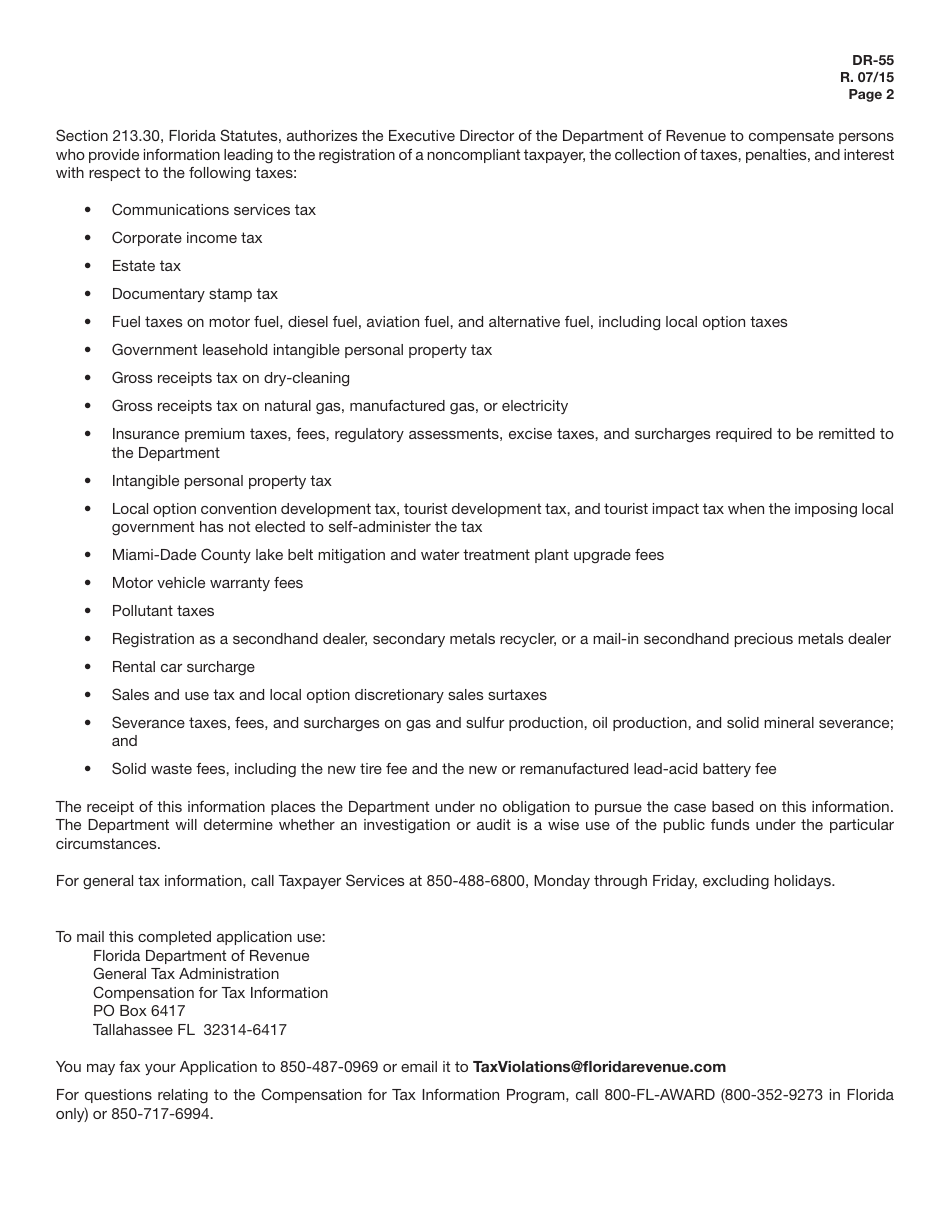

Q: What is the purpose of Form DR-55?

A: The purpose of Form DR-55 is to apply for compensation for providing tax information in Florida.

Q: Who can use Form DR-55?

A: Anyone who has provided tax information in the state of Florida may use Form DR-55 to apply for compensation.

Q: Is there a fee to submit Form DR-55?

A: No, there is no fee to submit Form DR-55.

Q: What documents should be included with Form DR-55?

A: It is recommended to include any supporting documents that verify the tax information provided.

Q: How long does it take to process Form DR-55?

A: The processing time for Form DR-55 can vary, but it typically takes several weeks to be reviewed and processed.

Q: Is there a deadline to submit Form DR-55?

A: There is no specific deadline to submit Form DR-55, but it is recommended to submit it as soon as possible after providing the tax information.

Q: Who can I contact for more information about Form DR-55?

A: For more information about Form DR-55, you can contact the Florida Department of Revenue or refer to the instructions provided with the form.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-55 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.