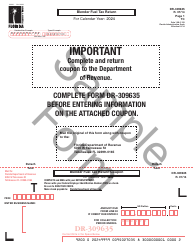

This version of the form is not currently in use and is provided for reference only. Download this version of

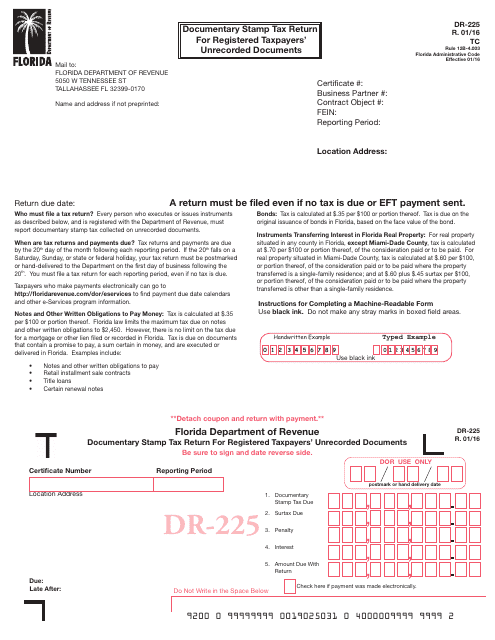

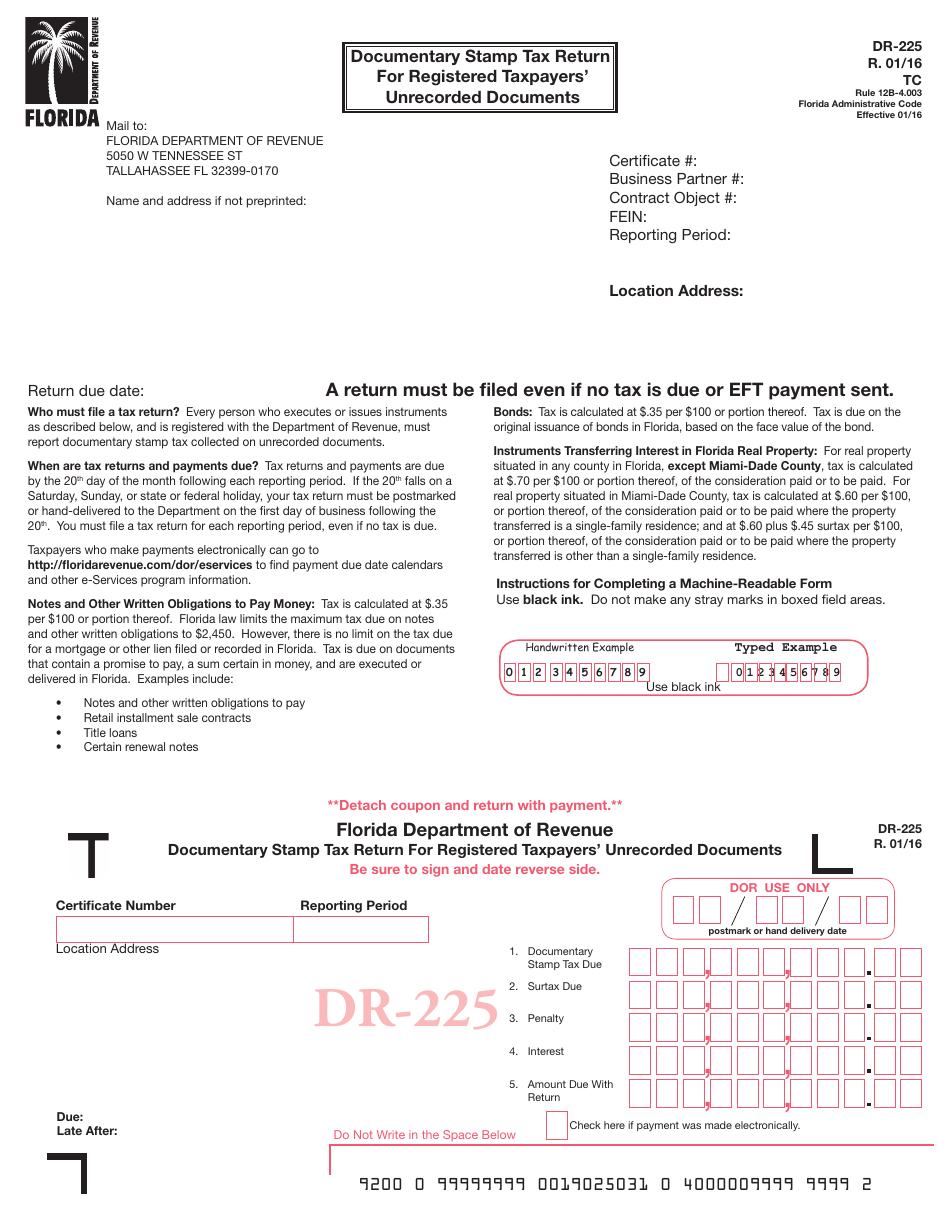

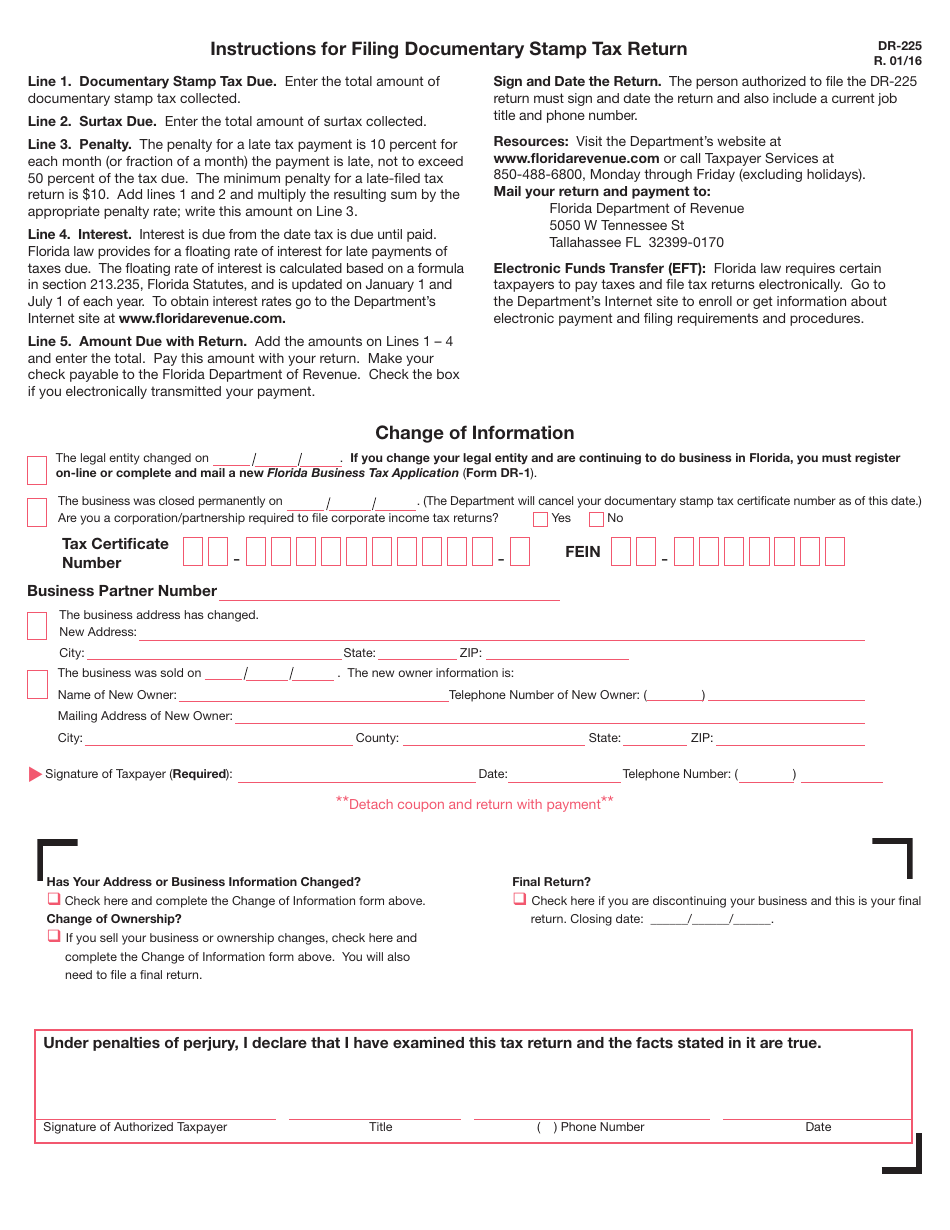

Form DR-225

for the current year.

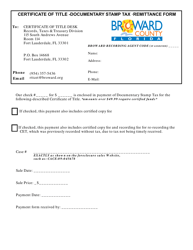

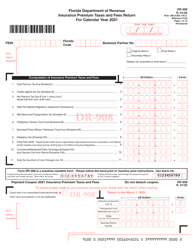

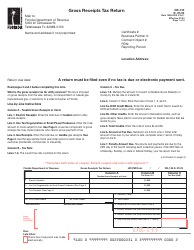

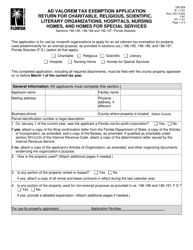

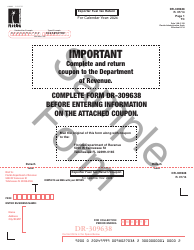

Form DR-225 Documentary Stamp Tax Return for Registered Taxpayers' Unrecorded Documents - Florida

What Is Form DR-225?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-225?

A: Form DR-225 is the Documentary Stamp Tax Return for Registered Taxpayers' Unrecorded Documents in Florida.

Q: Who needs to file Form DR-225?

A: Registered taxpayers who have unrecorded documents subject to documentary stamp tax in Florida need to file Form DR-225.

Q: What is the purpose of Form DR-225?

A: The purpose of Form DR-225 is to report and pay documentary stamp tax on unrecorded documents in Florida.

Q: How often do I need to file Form DR-225?

A: Form DR-225 should be filed on a monthly basis, by the 20th day of the following month.

Q: Is there a penalty for not filing Form DR-225?

A: Yes, there may be penalties for not filing Form DR-225 or for late filing.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-225 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.