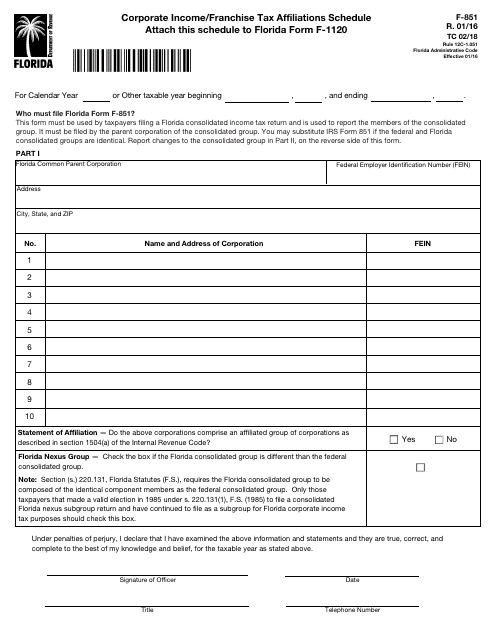

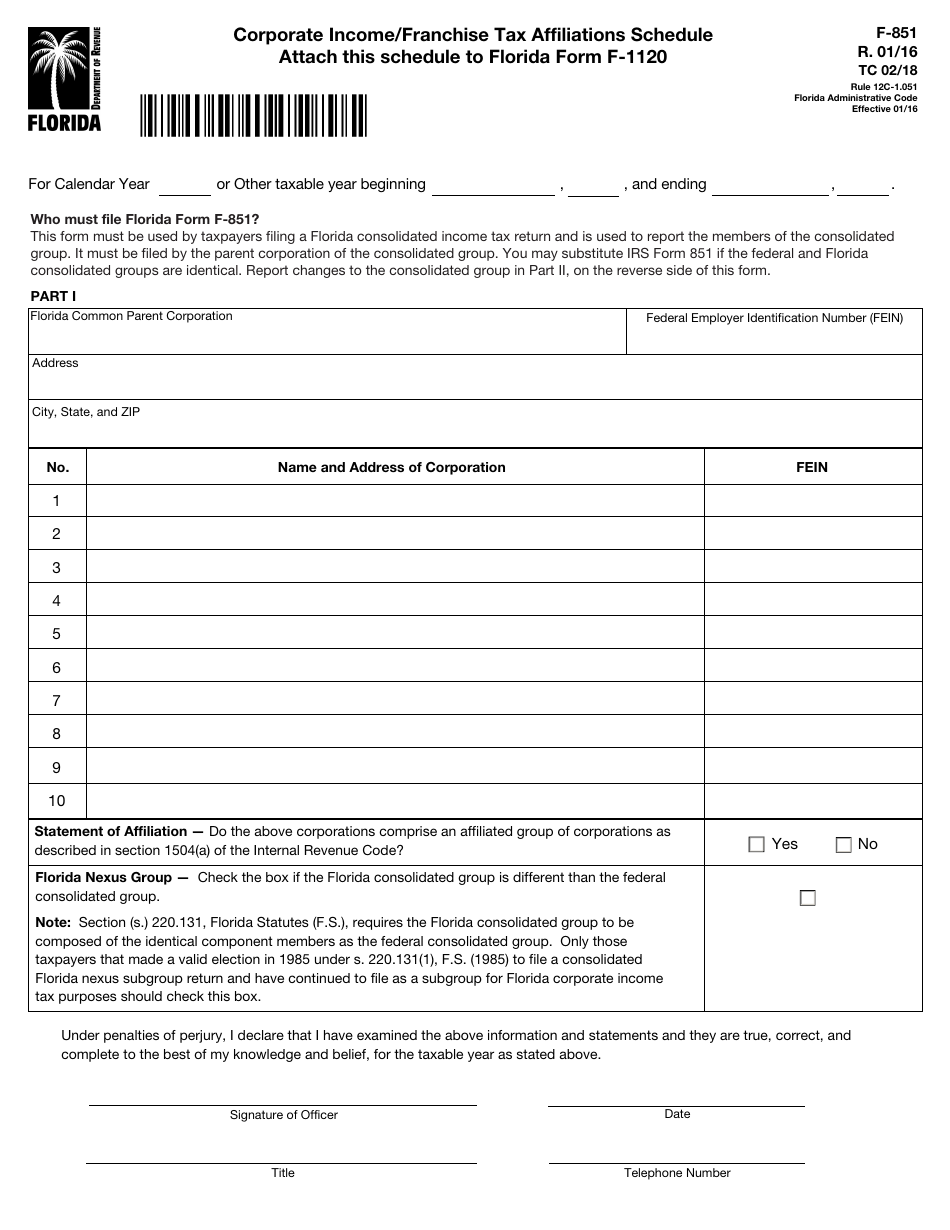

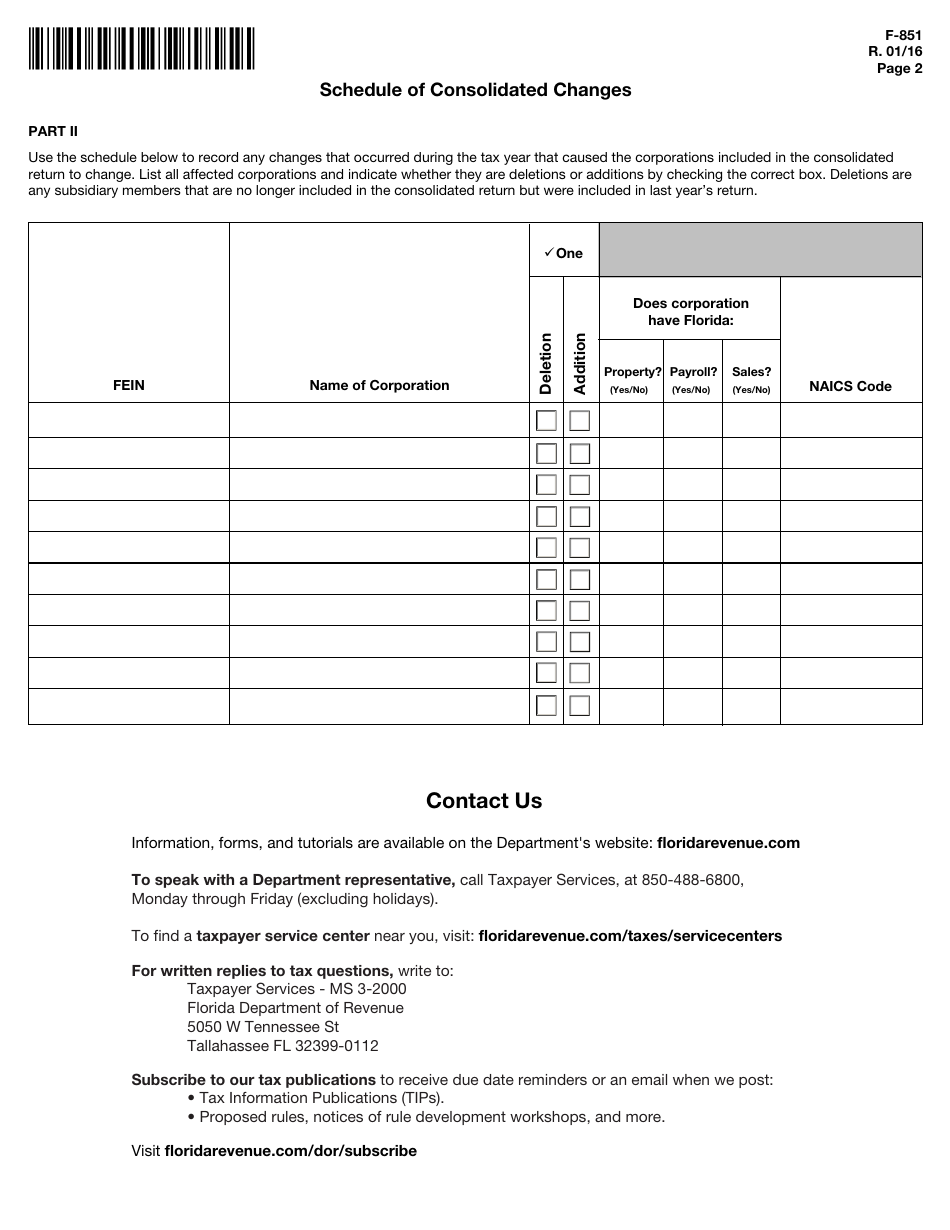

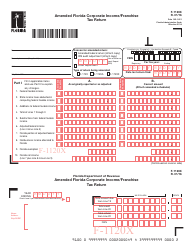

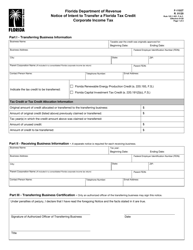

Form F-1120 Schedule F-851 Corporate Income / Franchise Tax Affiliations Schedule - Florida

What Is Form F-1120 Schedule F-851?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida.The document is a supplement to Form F-1120, Florida Corporate Income/Franchise Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1120 Schedule F-851?

A: Form F-1120 Schedule F-851 is a Corporate Income/Franchise Tax Affiliations Schedule used in Florida.

Q: What is the purpose of this form?

A: The purpose of Form F-1120 Schedule F-851 is to report the affiliations of a corporation for tax purposes.

Q: Who needs to file this form?

A: Corporations in Florida who have affiliations with other entities for tax purposes need to file Form F-1120 Schedule F-851.

Q: What information is required on this form?

A: This form requires information about the affiliated corporations, including their names, addresses, and federal employer identification numbers.

Q: When is the deadline to file this form?

A: The deadline to file Form F-1120 Schedule F-851 is the same as the deadline for filing the Florida corporate income/franchise tax return, which is usually on or before May 1st.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

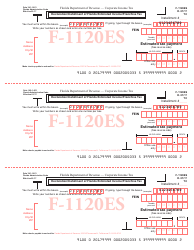

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-1120 Schedule F-851 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.