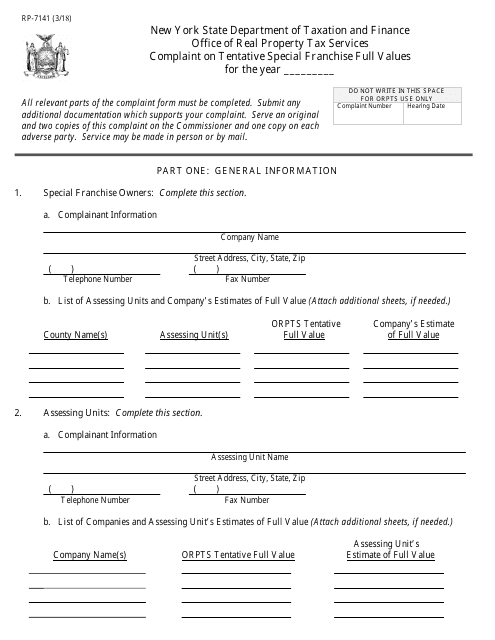

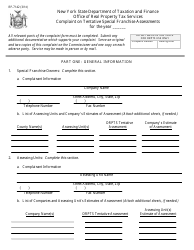

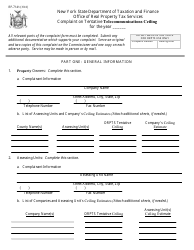

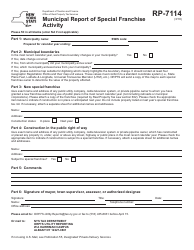

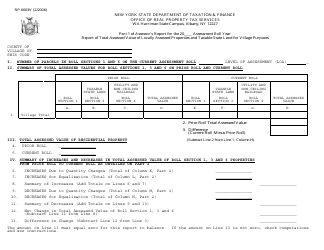

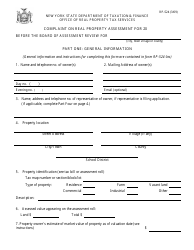

Form RP-7141 Complaint on Tentative Special Franchise Full Values - New York

What Is Form RP-7141?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-7141?

A: Form RP-7141 is a complaint form used to contest the tentative special franchise full values in New York.

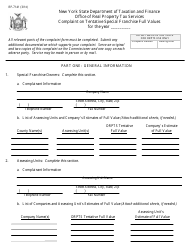

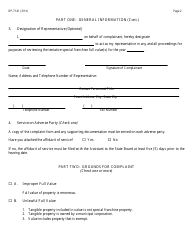

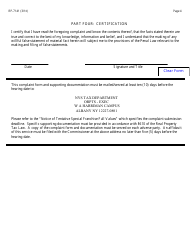

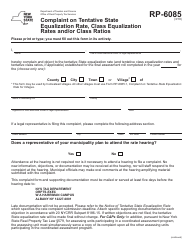

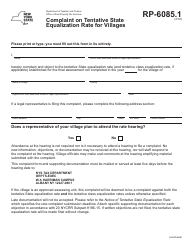

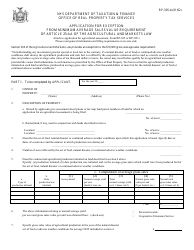

Q: How do I file a complaint using Form RP-7141?

A: To file a complaint using Form RP-7141, you need to complete the form with the required information and submit it to the appropriate authorities.

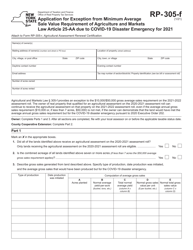

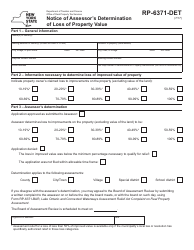

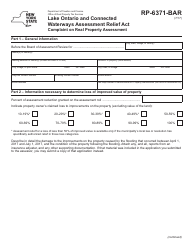

Q: What are tentative special franchise full values?

A: Tentative special franchise full values are the estimated values assigned to special franchises by the tax assessors.

Q: Who should use Form RP-7141?

A: Anyone who wants to contest the tentative special franchise full values in New York can use Form RP-7141.

Q: Is there a deadline for filing a complaint using Form RP-7141?

A: Yes, there is a deadline for filing a complaint using Form RP-7141. The deadline is usually specified on the form or provided by the tax authorities.

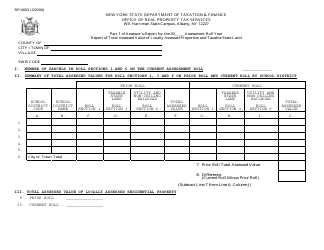

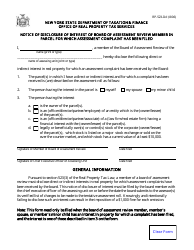

Q: What happens after I submit Form RP-7141?

A: After you submit Form RP-7141, the tax authorities will review your complaint and make a determination based on the information provided.

Q: Can I appeal the decision made on my complaint?

A: Yes, you have the right to appeal the decision made on your complaint if you disagree with the outcome.

Q: Are there any fees associated with filing a complaint using Form RP-7141?

A: There may be filing fees associated with submitting Form RP-7141. The amount and payment instructions are usually outlined on the form or provided by the tax authorities.

Q: Can I get assistance in completing Form RP-7141?

A: Yes, you can seek assistance from the New York State Department of Taxation and Finance or consult with a tax professional for help in completing Form RP-7141.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-7141 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.