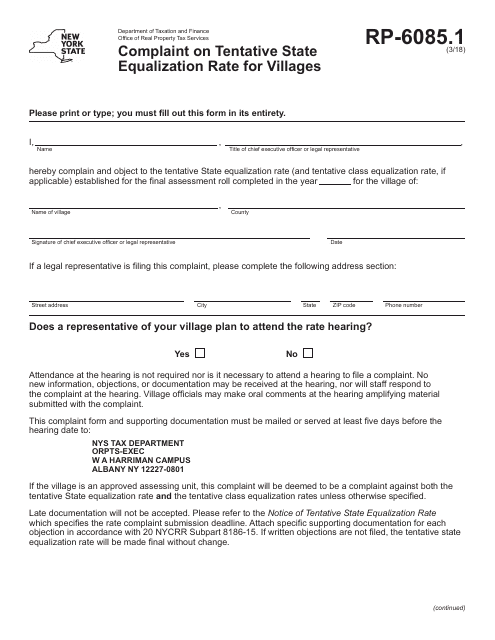

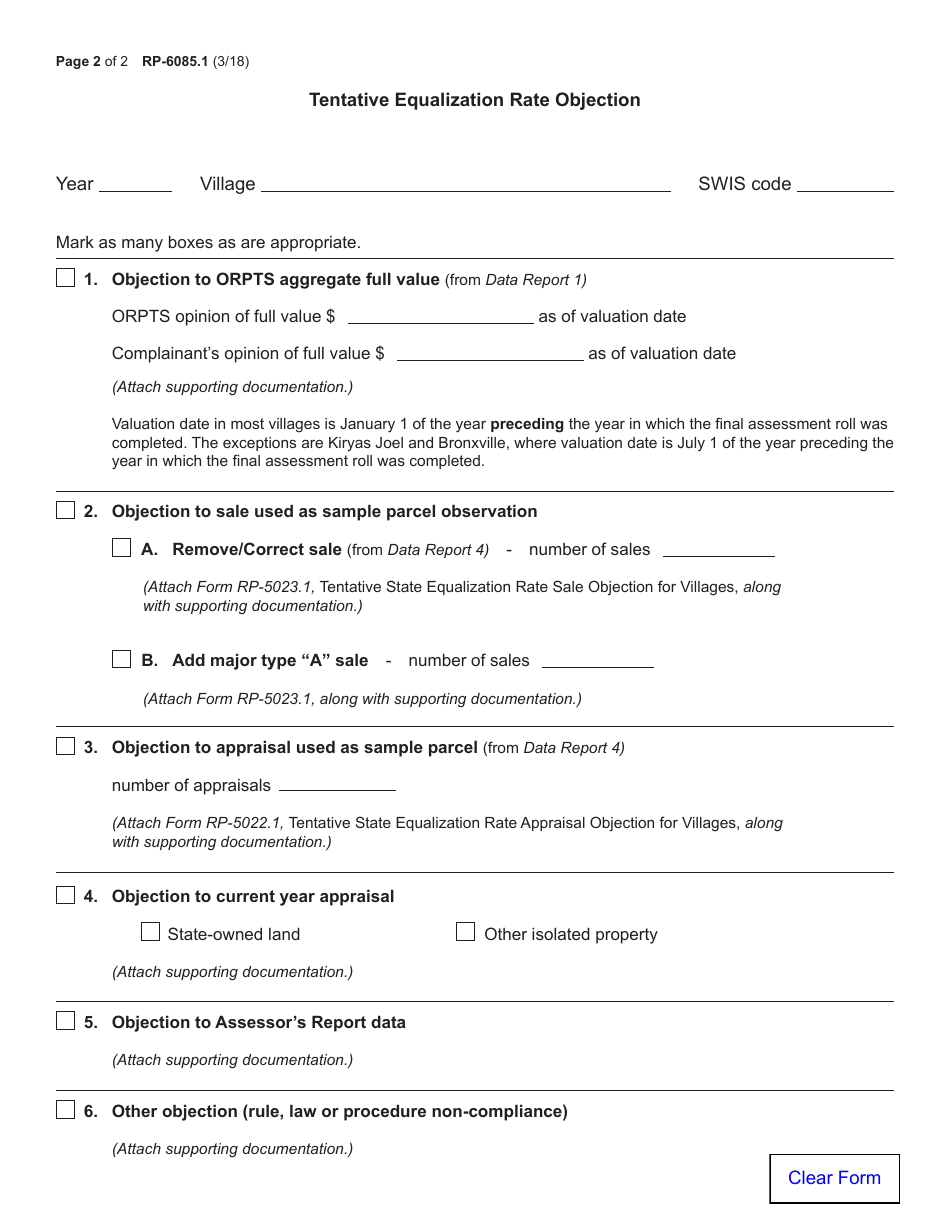

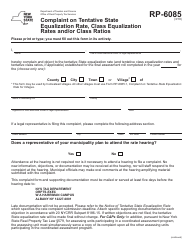

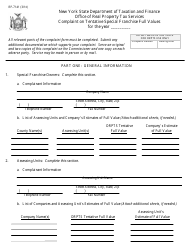

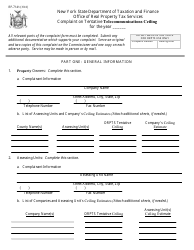

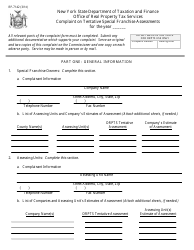

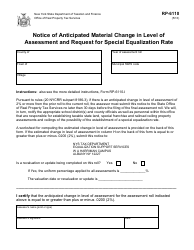

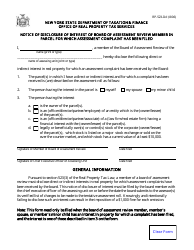

Form RP-6085.1 Complaint on Tentative State Equalization Rate for Villages - New York

What Is Form RP-6085.1?

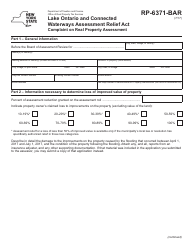

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

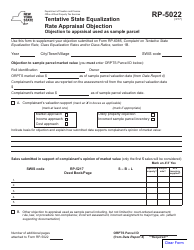

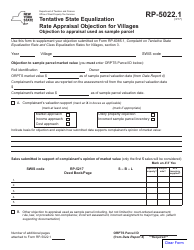

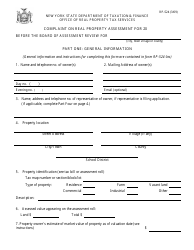

Q: What is Form RP-6085.1?

A: Form RP-6085.1 is a complaint form for challenging the tentative state equalization rate for villages in New York.

Q: What is the purpose of Form RP-6085.1?

A: The purpose of Form RP-6085.1 is to allow village residents in New York to challenge the tentative state equalization rate.

Q: Who can use Form RP-6085.1?

A: Village residents in New York who want to challenge the tentative state equalization rate can use Form RP-6085.1.

Q: Is there a deadline for submitting Form RP-6085.1?

A: Yes, there is a deadline for submitting Form RP-6085.1. The deadline is usually specified on the form or in the accompanying instructions.

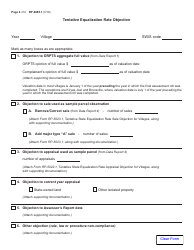

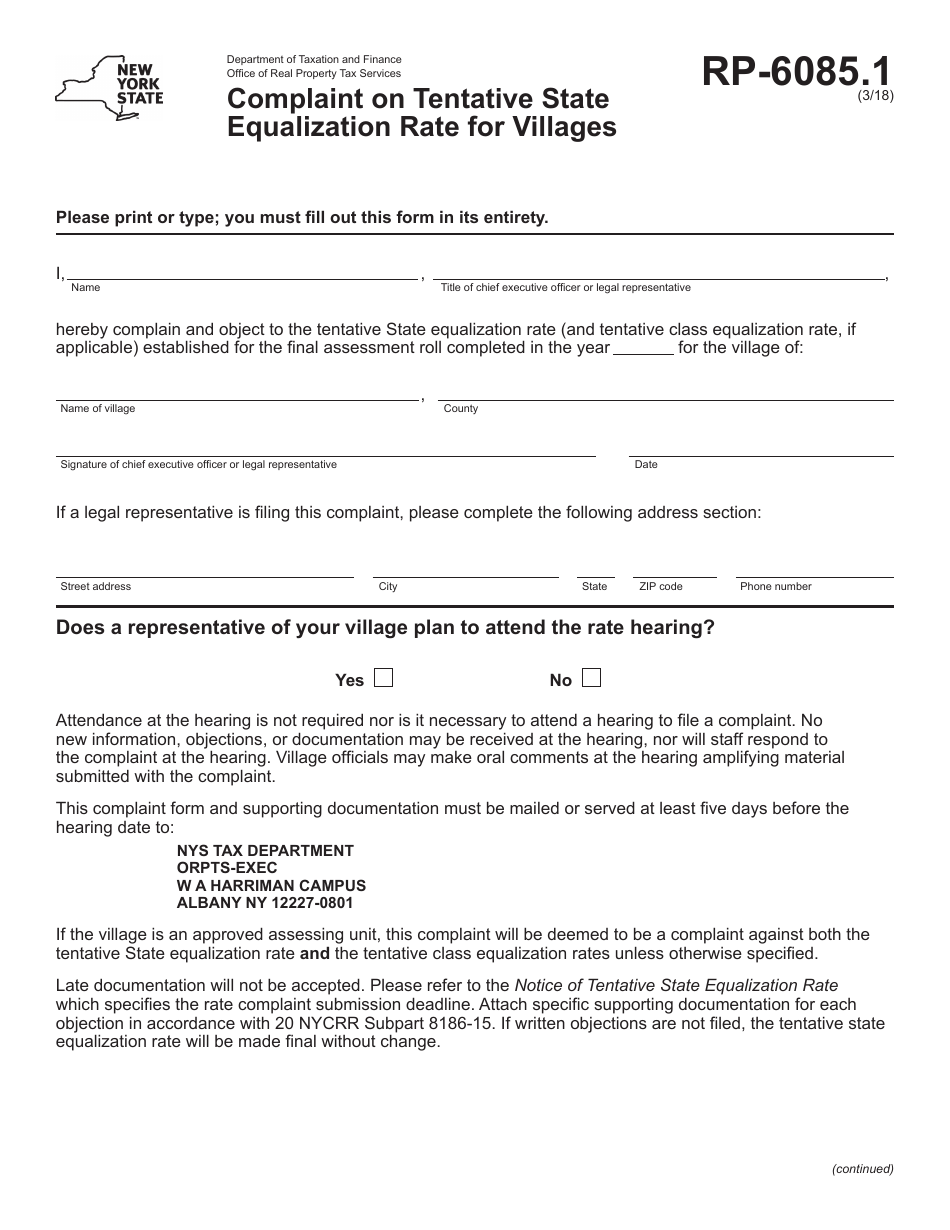

Q: What should I include when submitting Form RP-6085.1?

A: When submitting Form RP-6085.1, you should include relevant supporting documentation and any other required information as specified on the form or in the instructions.

Q: What happens after I submit Form RP-6085.1?

A: After you submit Form RP-6085.1, the New York State Department of Taxation and Finance will review your complaint and may make adjustments to the tentative state equalization rate if warranted.

Q: Can I appeal the decision made on my Form RP-6085.1 complaint?

A: Yes, if you are not satisfied with the decision made on your Form RP-6085.1 complaint, you can appeal to the New York State Board of Real PropertyTax Services.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6085.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.