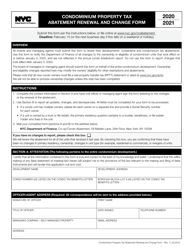

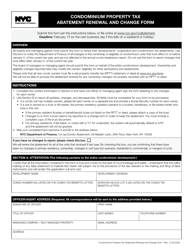

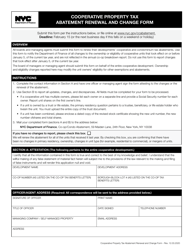

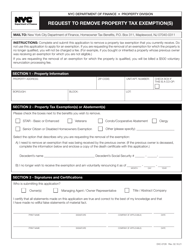

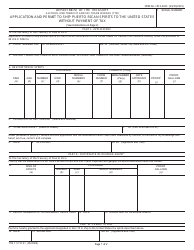

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

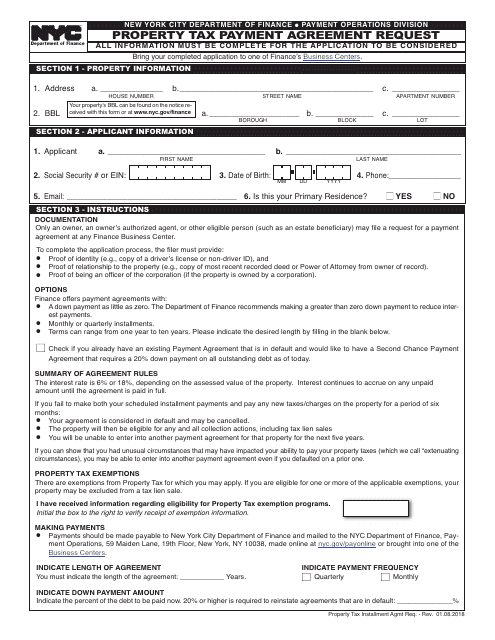

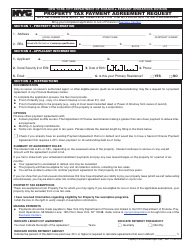

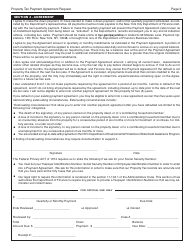

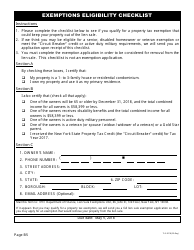

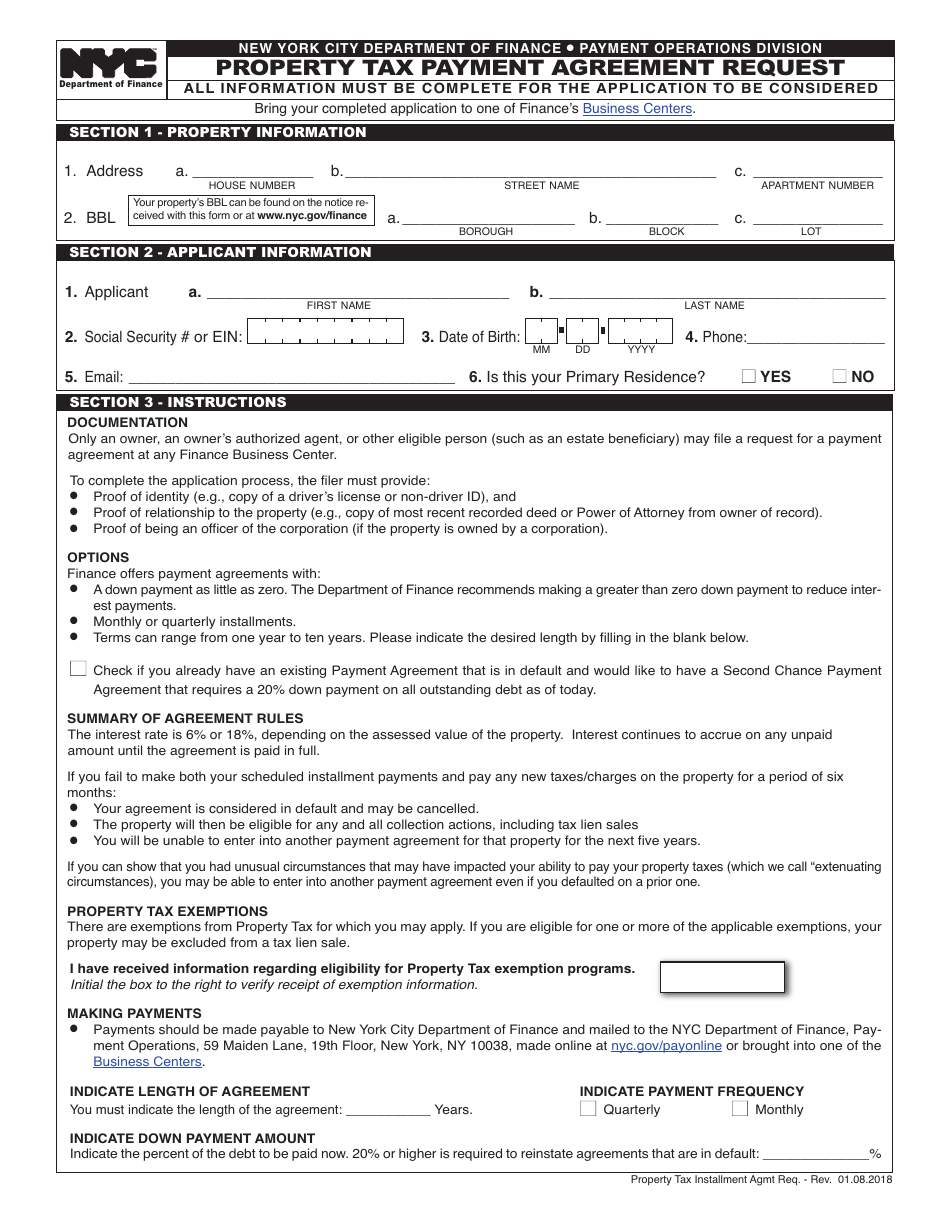

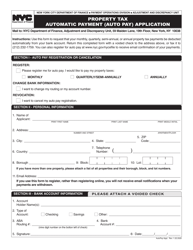

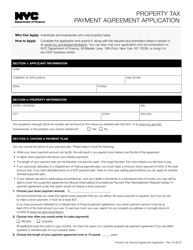

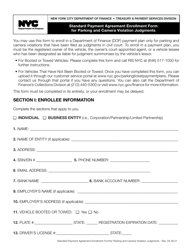

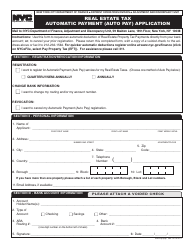

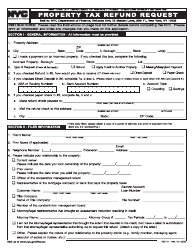

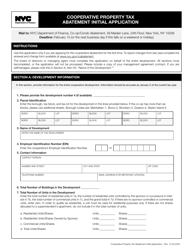

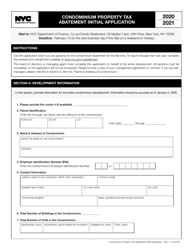

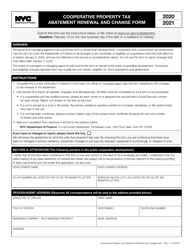

Property Tax Payment Agreement Request - New York City

Property Tax Payment Agreement Request is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is a Property Tax Payment Agreement?

A: A Property Tax Payment Agreement is an arrangement made between a taxpayer and the local government to pay property taxes in installments.

Q: Who is eligible for a Property Tax Payment Agreement in New York City?

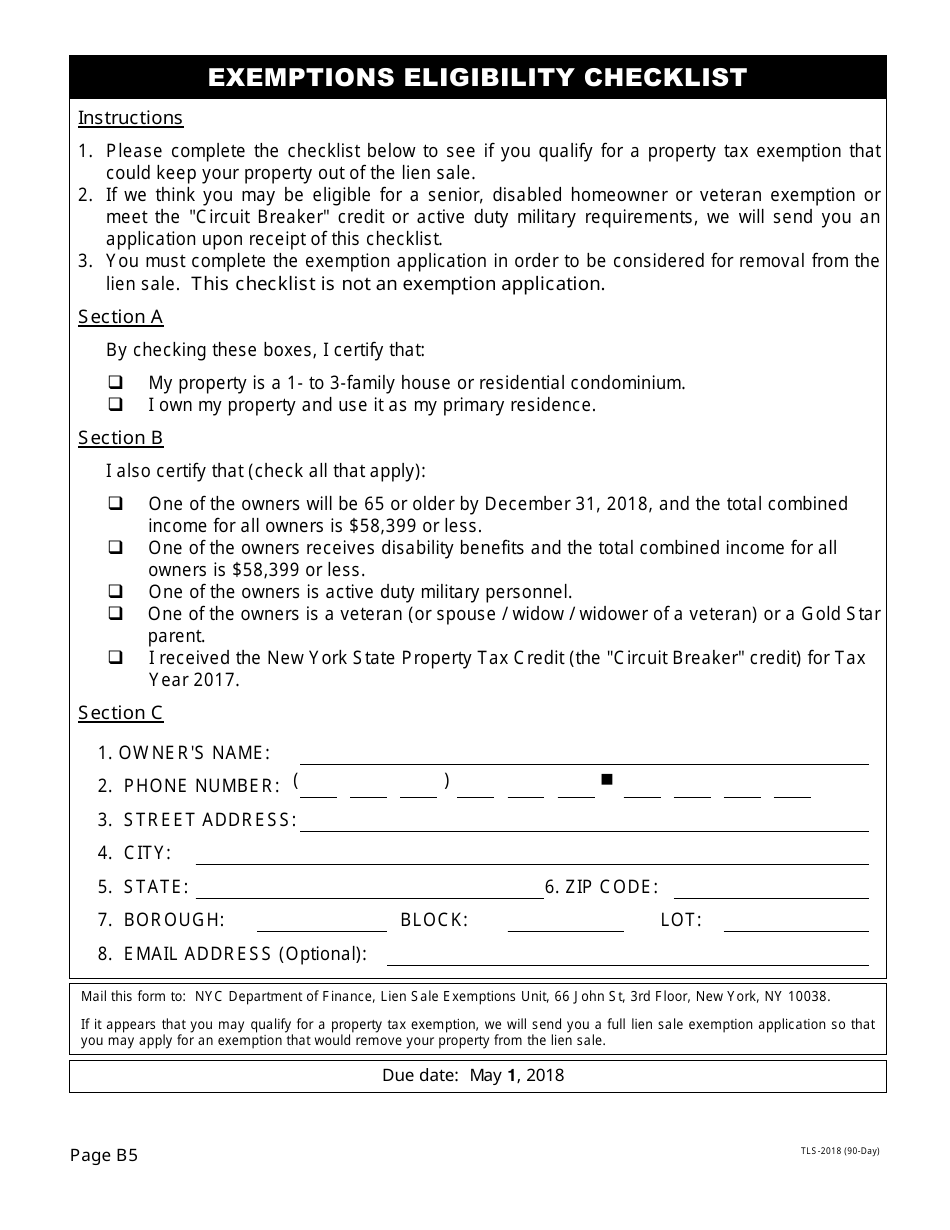

A: Property owners in New York City who are facing financial hardship and struggling to pay their property taxes may be eligible for a payment agreement.

Q: What are the benefits of a Property Tax Payment Agreement?

A: A Property Tax Payment Agreement allows property owners to avoid significant penalties and interest charges on overdue taxes, and it provides them with a manageable way to pay their property tax debt.

Q: Can I negotiate the terms of a Property Tax Payment Agreement?

A: The terms of a Property Tax Payment Agreement are generally determined by the local government, but it may be possible to negotiate certain aspects of the agreement in some cases.

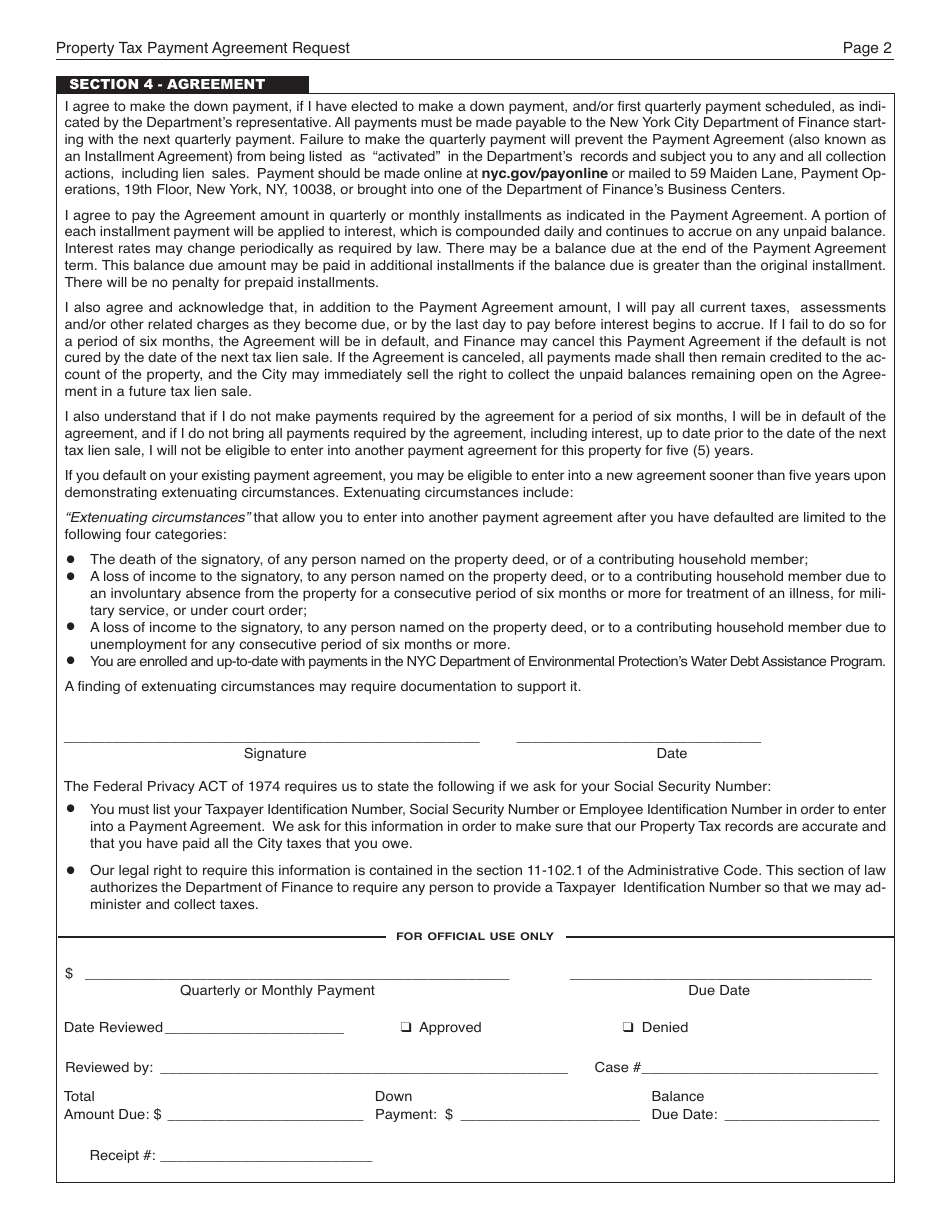

Q: What happens if I default on a Property Tax Payment Agreement?

A: If you default on a Property Tax Payment Agreement, the local government may take legal action to recover the unpaid taxes, and you could face additional penalties and interest charges.

Q: Is there a fee to request a Property Tax Payment Agreement?

A: There may be a fee associated with requesting a Property Tax Payment Agreement. Contact the NYC Department of Finance for more information on any applicable fees.

Q: Can I apply for a Property Tax Payment Agreement if I have outstanding property tax debt?

A: Yes, you can still apply for a Property Tax Payment Agreement even if you have outstanding property tax debt. However, it's important to address any existing debt as part of your application.

Q: What documents do I need to provide when applying for a Property Tax Payment Agreement?

A: When applying for a Property Tax Payment Agreement, you may need to provide documents such as proof of income, property ownership, and financial hardship.

Q: Can a Property Tax Payment Agreement be used to pay off other types of debt?

A: No, a Property Tax Payment Agreement is specifically for paying property taxes and cannot be used to pay off other types of debt.

Form Details:

- Released on August 1, 2018;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.