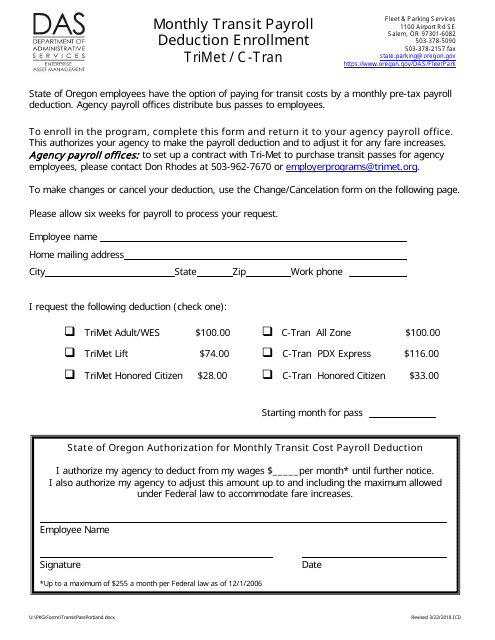

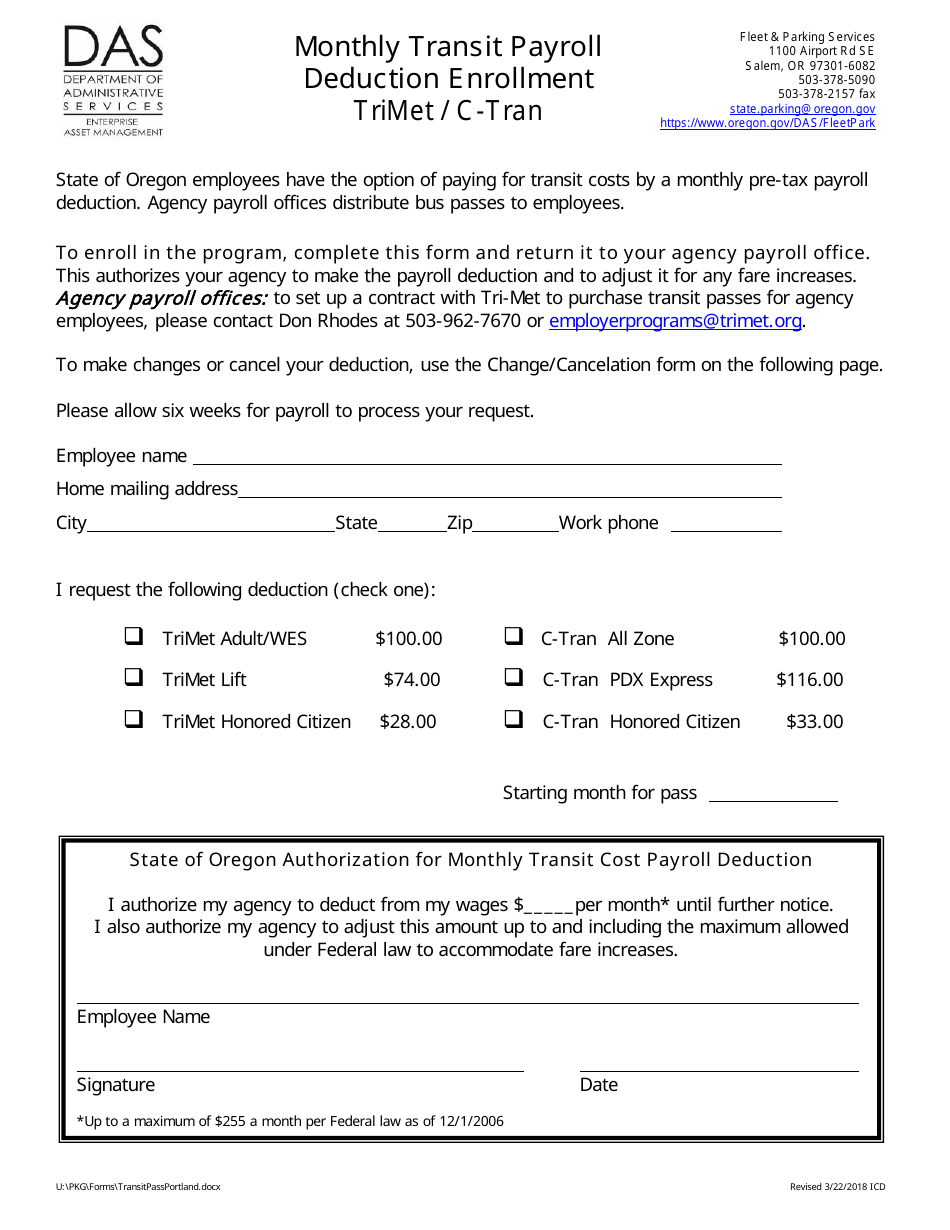

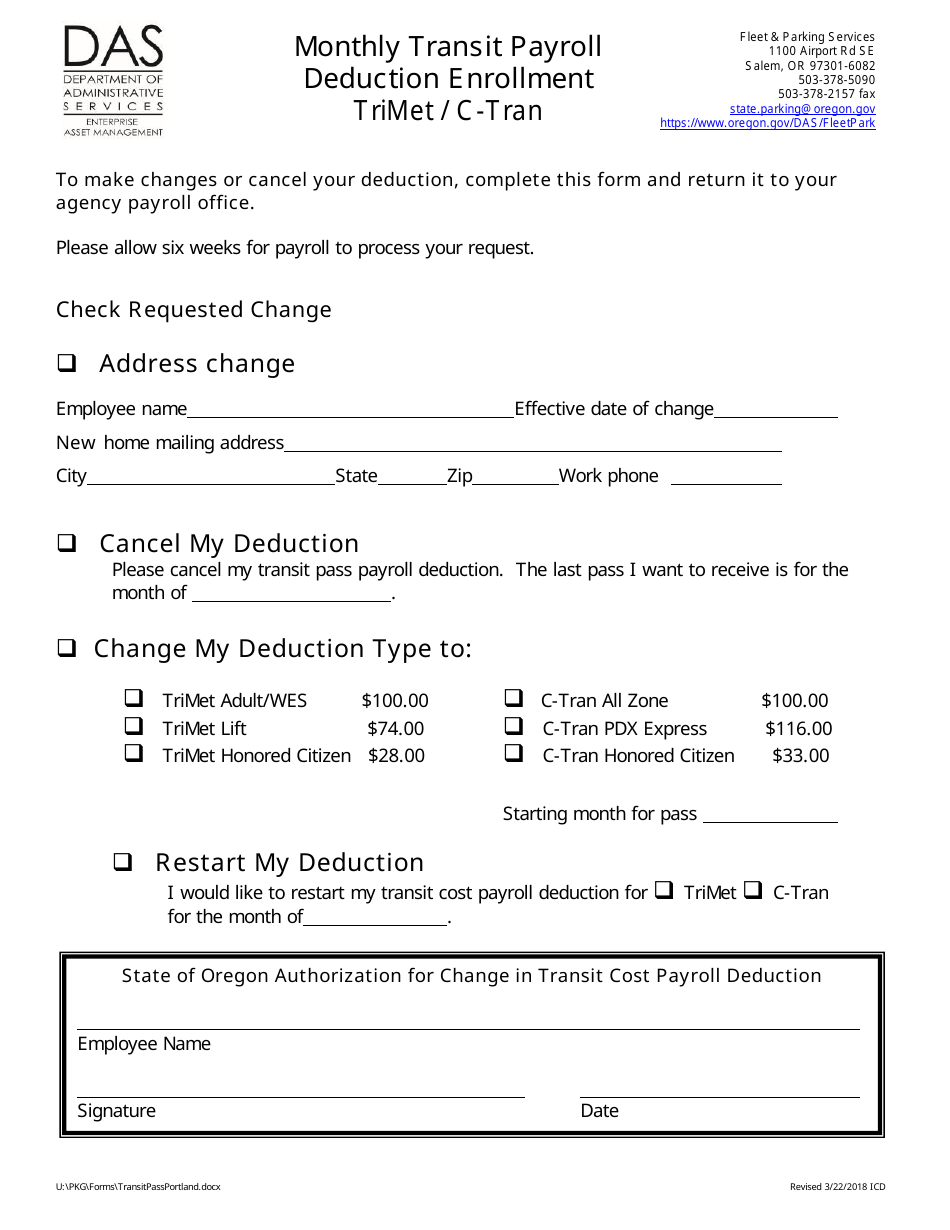

Monthly Transit Payroll Deduction Enrollment (Trimet / C-Tran) - Oregon

Monthly Transit Payroll Deduction Enrollment (Trimet / C-Tran) is a legal document that was released by the Oregon Department of Administrative Services - a government authority operating within Oregon.

FAQ

Q: What is monthly transit payroll deduction enrollment?

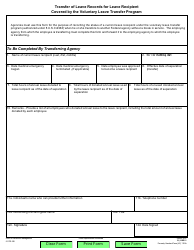

A: Monthly transit payroll deduction enrollment allows employees to have a portion of their salary automatically deducted to cover their transit expenses.

Q: Who is eligible for monthly transit payroll deduction enrollment?

A: Employees who work for organizations that offer this program, such as Trimet or C-Tran in Oregon, are eligible for monthly transit payroll deduction enrollment.

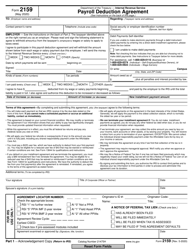

Q: How does monthly transit payroll deduction enrollment work?

A: Employees who sign up for monthly transit payroll deduction enrollment authorize their employer to deduct a predetermined amount from their salary each month to cover their transit expenses.

Q: Can I use monthly transit payroll deduction for any transit system in Oregon?

A: Monthly transit payroll deduction enrollment is specific to the transit systems with which your employer has an arrangement, such as Trimet or C-Tran in Oregon.

Q: Is monthly transit payroll deduction enrollment mandatory?

A: No, monthly transit payroll deduction enrollment is optional for employees who choose to take advantage of this program.

Q: How do I enroll in monthly transit payroll deduction?

A: To enroll in monthly transit payroll deduction, you need to check with your employer to see if they offer this program. If they do, they will provide you with the necessary forms and instructions to enroll.

Q: What are the benefits of monthly transit payroll deduction enrollment?

A: Monthly transit payroll deduction enrollment allows employees to conveniently use pre-tax dollars to pay for their transit expenses, potentially saving them money on taxes.

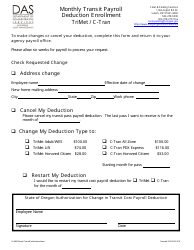

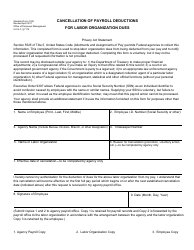

Q: Can I change or cancel my monthly transit payroll deduction?

A: Yes, you can typically change or cancel your monthly transit payroll deduction enrollment by contacting your employer's HR department or payroll administrator.

Q: Are there any limitations to monthly transit payroll deduction enrollment?

A: The specific limitations and terms of monthly transit payroll deduction enrollment may vary depending on your employer's program and the transit system you use. It's best to consult with your employer for more information.

Form Details:

- Released on March 22, 2018;

- The latest edition currently provided by the Oregon Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Administrative Services.