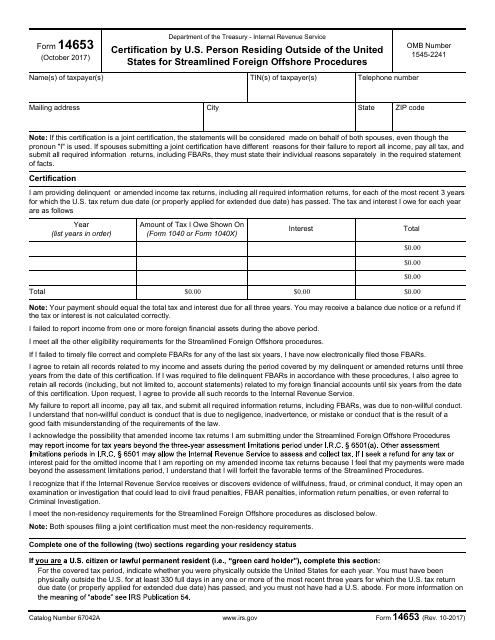

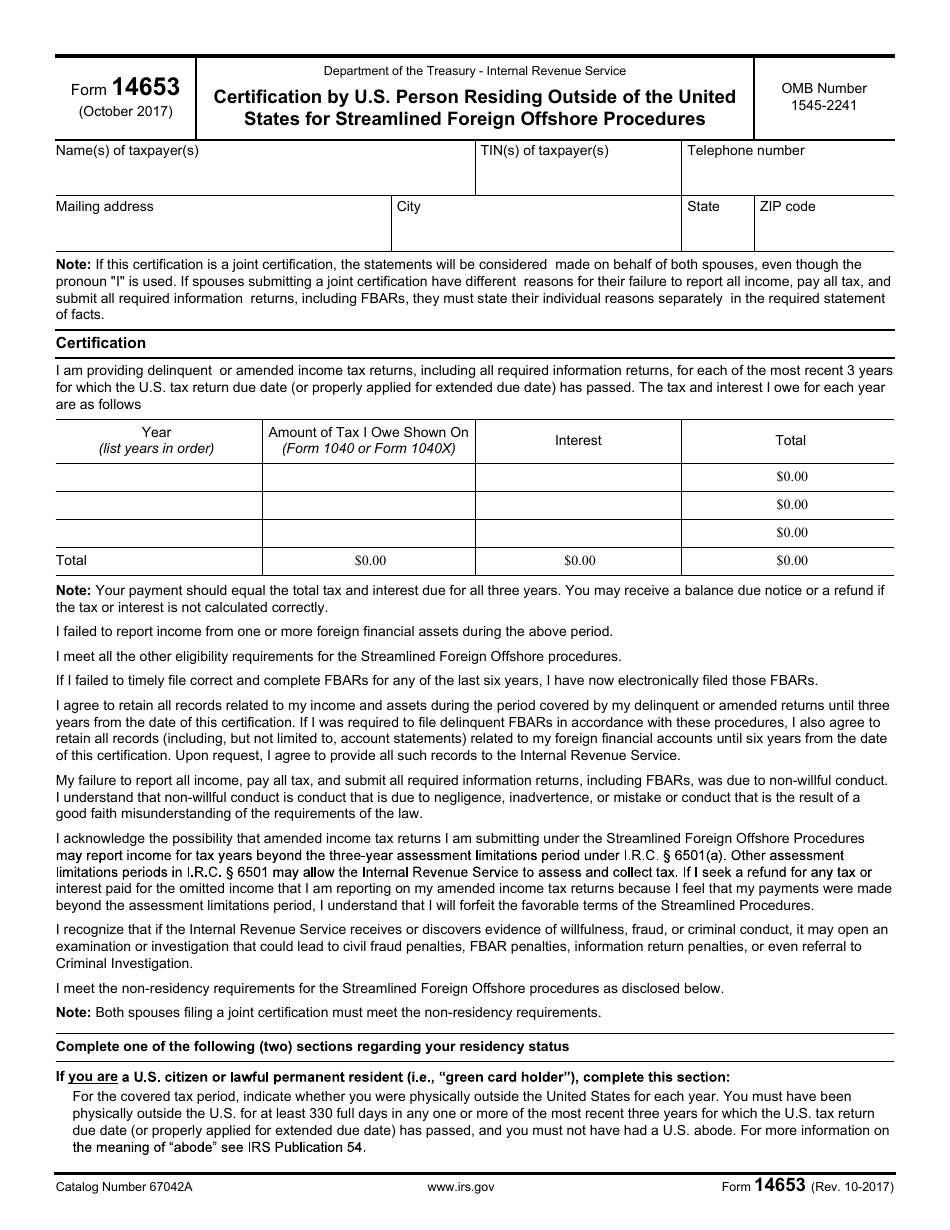

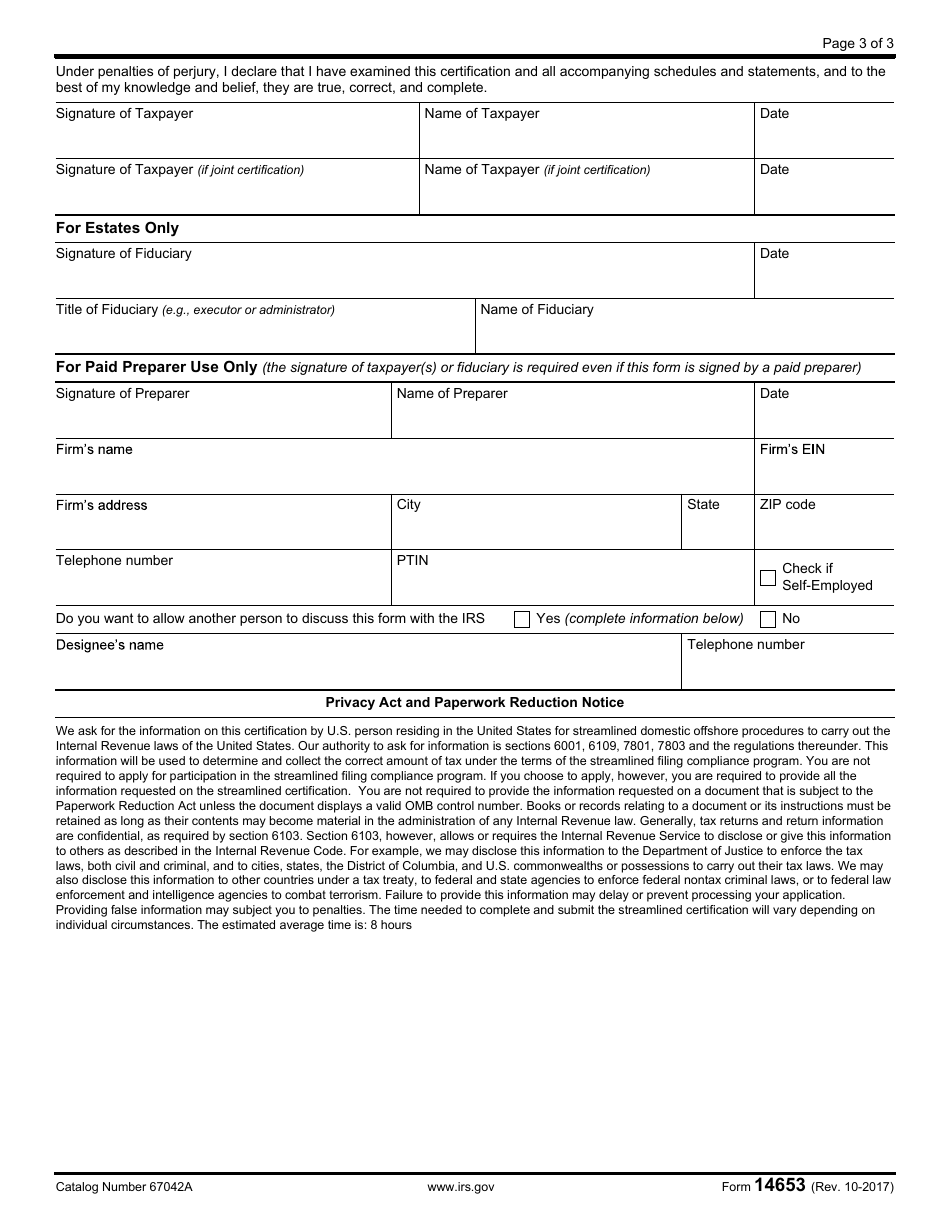

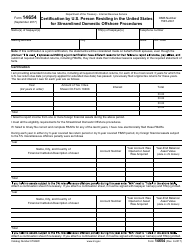

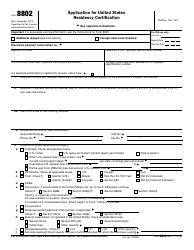

IRS Form 14653 Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures

What Is IRS Form 14653?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14653?

A: IRS Form 14653 is a certification form used by U.S. persons residing outside of the United States for the Streamlined Foreign Offshore Procedures.

Q: Who should use IRS Form 14653?

A: U.S. persons residing outside of the United States who want to use the Streamlined Foreign Offshore Procedures should use IRS Form 14653.

Q: What are the Streamlined Foreign Offshore Procedures?

A: The Streamlined Foreign Offshore Procedures are a way for eligible U.S. taxpayers residing outside of the United States to become compliant with their tax obligations.

Q: What is the purpose of IRS Form 14653?

A: The purpose of IRS Form 14653 is to certify that the taxpayer meets the eligibility criteria for the Streamlined Foreign Offshore Procedures.

Q: Are there any penalties or charges associated with IRS Form 14653?

A: The Streamlined Foreign Offshore Procedures may require the payment of any outstanding taxes, interest, and penalties. However, penalties for non-willful conduct may be reduced or waived under these procedures.

Q: Can IRS Form 14653 be filed electronically?

A: No, IRS Form 14653 cannot be filed electronically. It must be printed, signed, and mailed to the appropriate IRS address.

Q: What supporting documents should be included with IRS Form 14653?

A: The taxpayer should include any required attachments or supporting documents that are specified in the instructions for IRS Form 14653.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14653 through the link below or browse more documents in our library of IRS Forms.