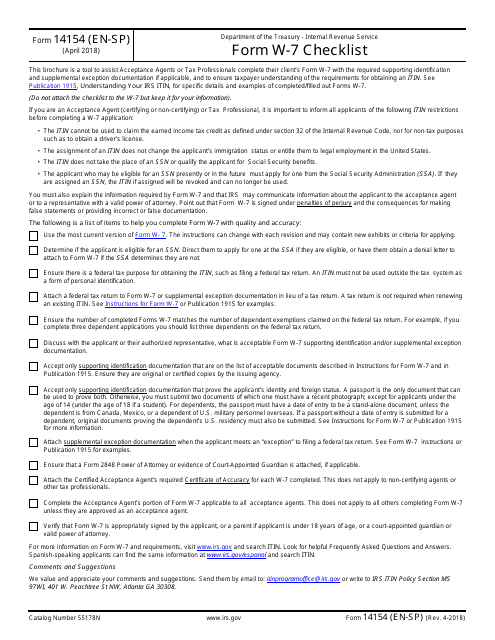

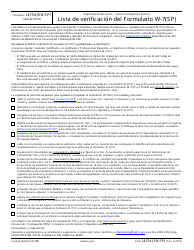

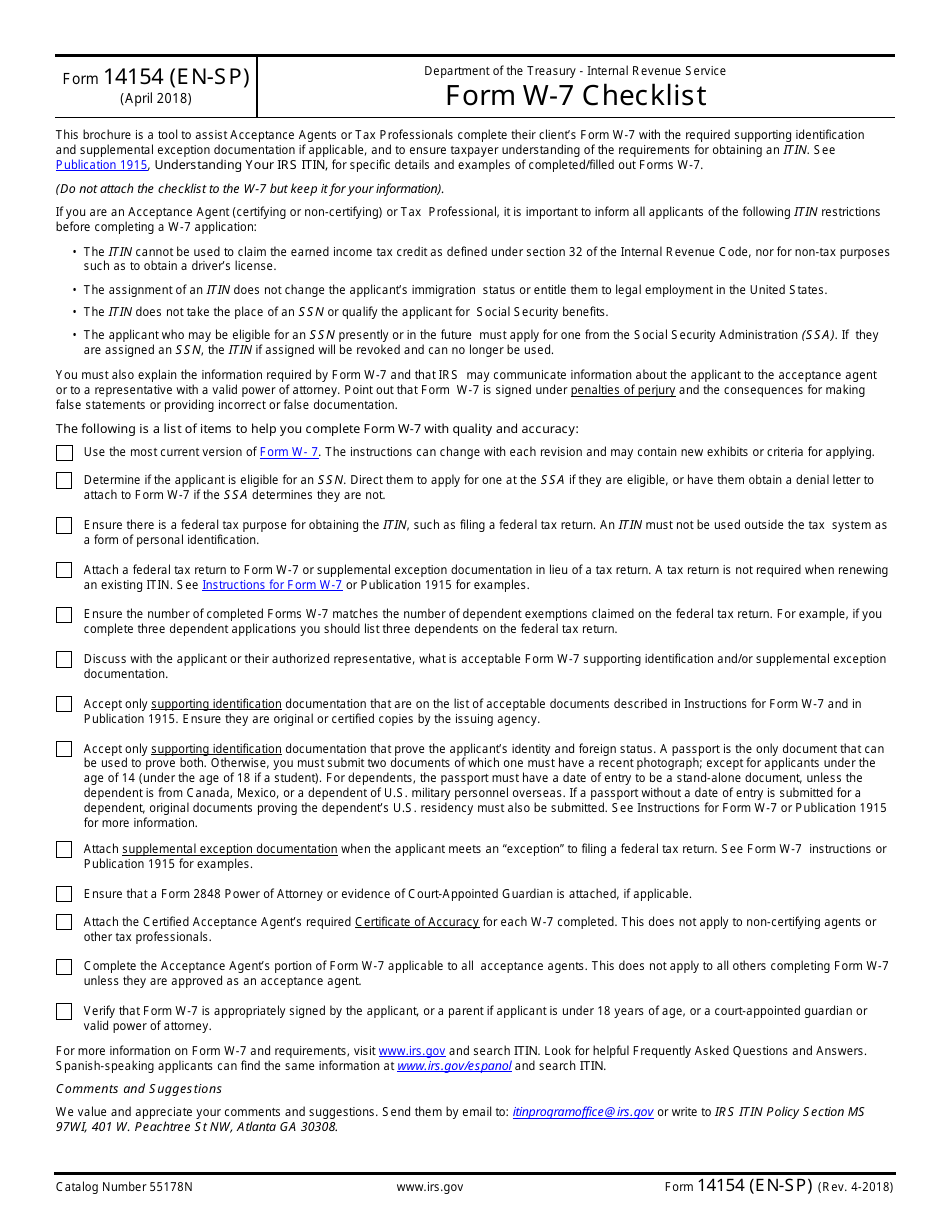

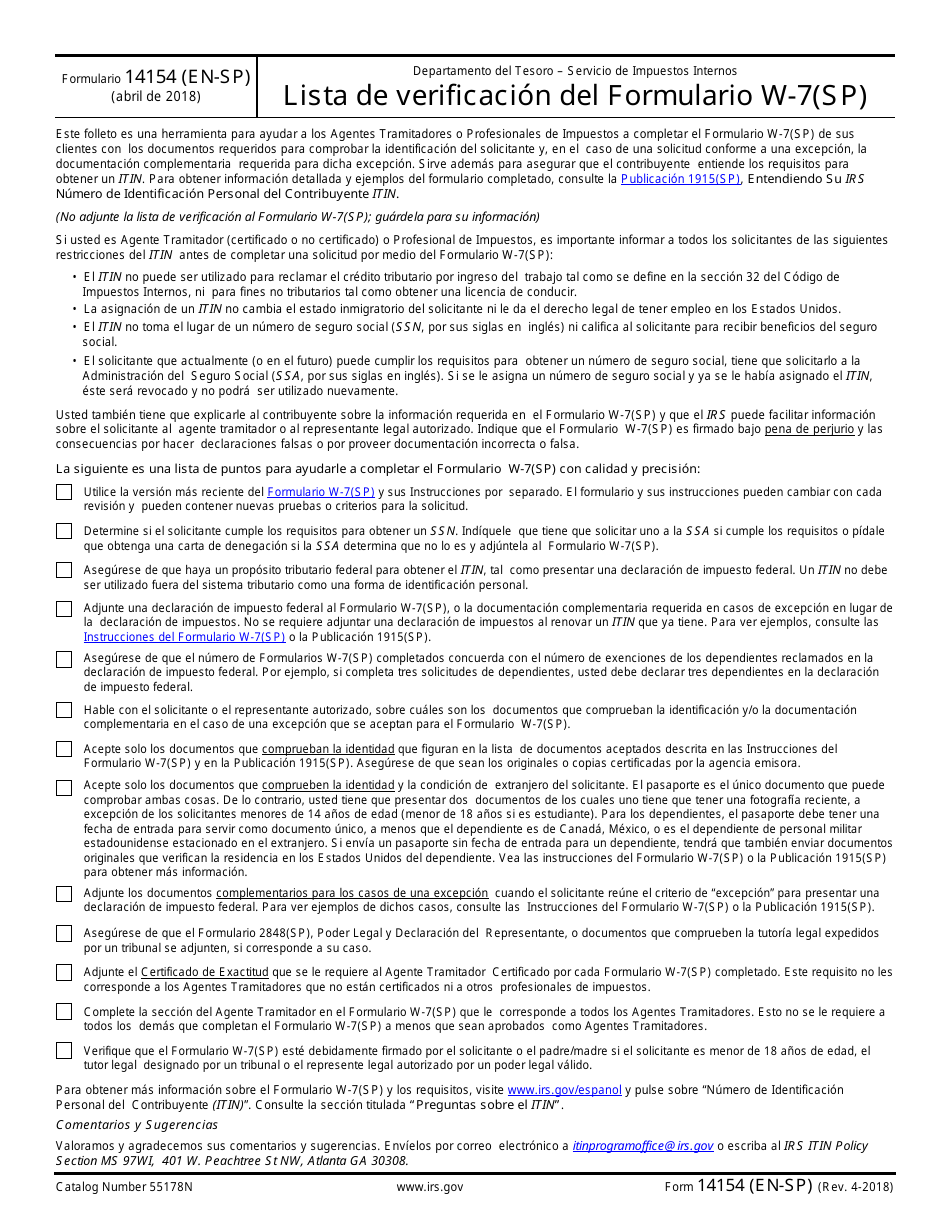

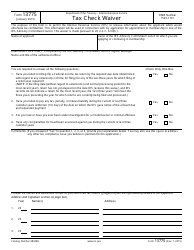

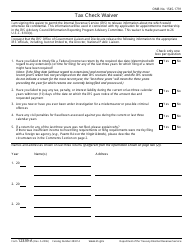

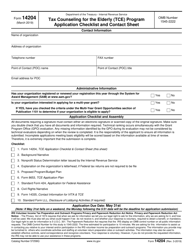

IRS Form 14154 (EN-SP) Form W-7 Checklist (English / Spanish)

What Is IRS Form 14154 (EN-SP)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14154?

A: IRS Form 14154 is the Form W-7 Checklist.

Q: What is the purpose of IRS Form 14154?

A: The purpose of IRS Form 14154 is to provide a checklist for completing Form W-7 in both English and Spanish.

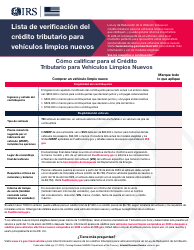

Q: What is Form W-7?

A: Form W-7 is the Application for Individual Taxpayer Identification Number (ITIN).

Q: Why do I need to fill out Form W-7?

A: You need to fill out Form W-7 if you are not eligible for a Social Security Number but need an ITIN to fulfill your tax obligations.

Q: Is Form W-7 available in languages other than English and Spanish?

A: No, Form W-7 is currently available only in English and Spanish.

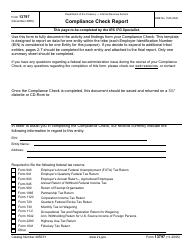

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14154 (EN-SP) through the link below or browse more documents in our library of IRS Forms.