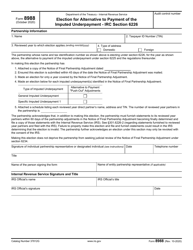

This version of the form is not currently in use and is provided for reference only. Download this version of

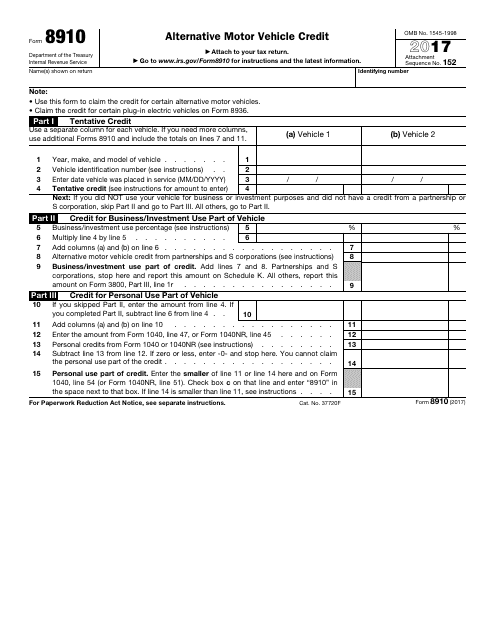

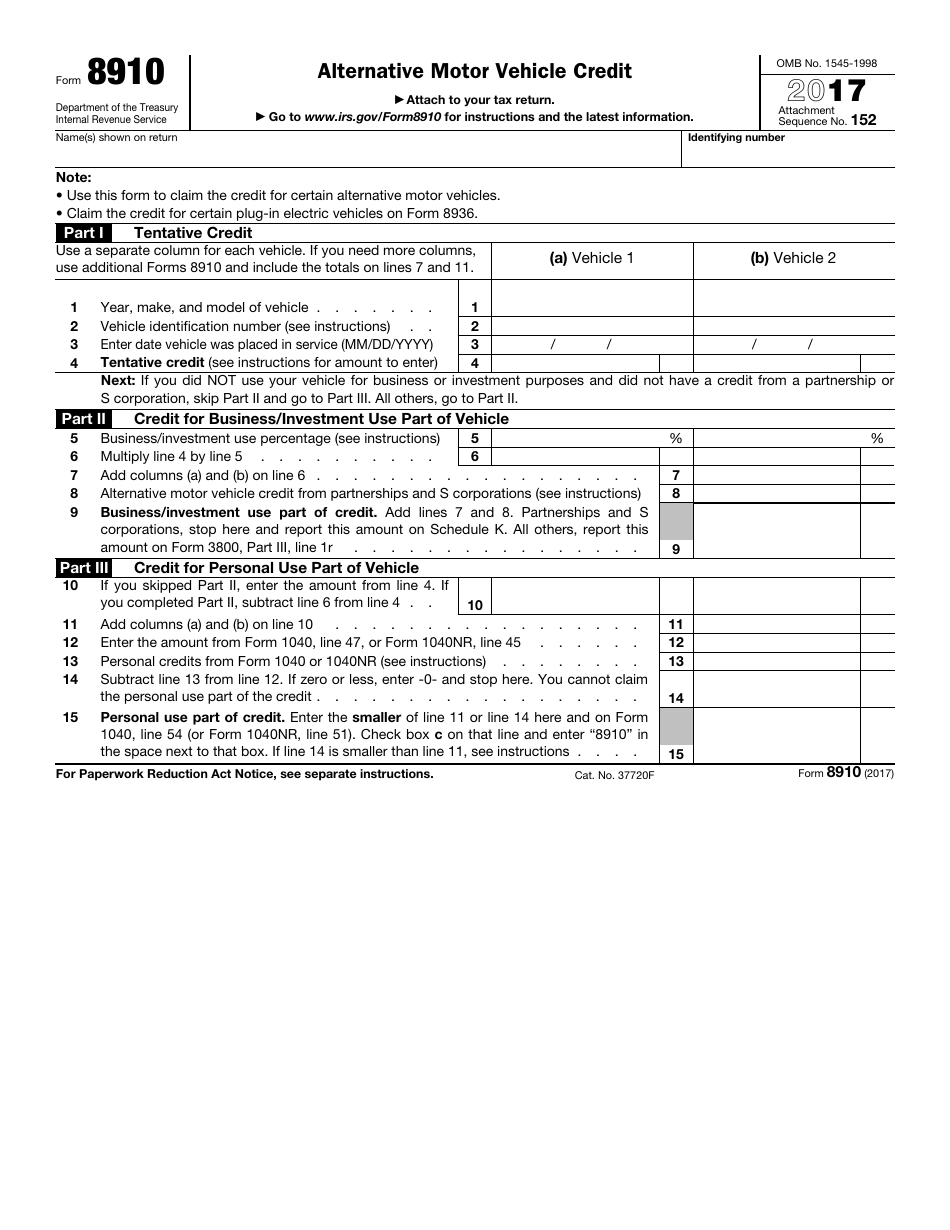

IRS Form 8910

for the current year.

IRS Form 8910 Alternative Motor Vehicle Credit

What Is IRS Form 8910?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8910?

A: IRS Form 8910 is a tax form used to claim the Alternative Motor Vehicle Credit.

Q: What is the Alternative Motor Vehicle Credit?

A: The Alternative Motor Vehicle Credit is a tax credit provided to individuals who purchase qualified hybrid, electric, or alternative fuel vehicles.

Q: Who is eligible to claim the Alternative Motor Vehicle Credit?

A: Individuals who have purchased a qualified hybrid, electric, or alternative fuel vehicle may be eligible to claim the credit.

Q: What vehicles qualify for the Alternative Motor Vehicle Credit?

A: Vehicles that meet specific criteria, such as being powered by electricity, hybrid power, or alternative fuels, may qualify for the credit.

Q: How much is the Alternative Motor Vehicle Credit?

A: The amount of the credit varies depending on the type of vehicle and its energy efficiency. It can range from several hundred dollars to several thousand dollars.

Q: How do I claim the Alternative Motor Vehicle Credit?

A: To claim the credit, you need to fill out IRS Form 8910 and include it with your tax return.

Q: Is there a deadline to claim the Alternative Motor Vehicle Credit?

A: Yes, you must claim the credit within the tax year in which you purchased the qualifying vehicle.

Q: Are there any income limitations to claim the Alternative Motor Vehicle Credit?

A: No, there are no income limitations to claim the Alternative Motor Vehicle Credit.

Q: Can I claim the Alternative Motor Vehicle Credit if I purchased a used vehicle?

A: No, the Alternative Motor Vehicle Credit is only available for the purchase of new qualified vehicles.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8910 through the link below or browse more documents in our library of IRS Forms.