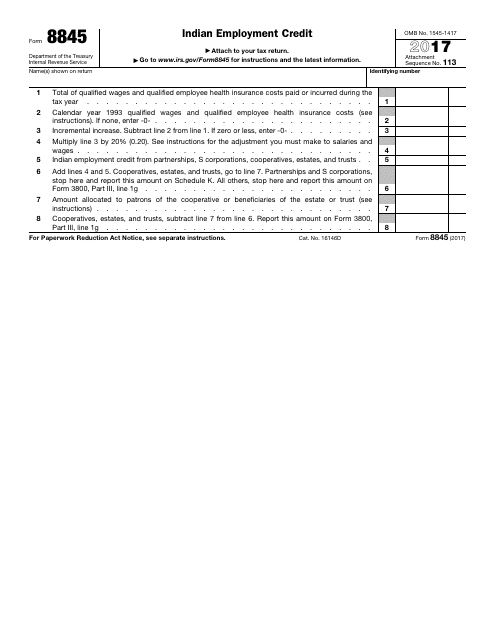

IRS Form 845 Indian Employment Credit

What Is IRS Form 845?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 845?

A: IRS Form 845 is a tax form used to claim the Indian Employment Credit.

Q: What is the Indian Employment Credit?

A: The Indian Employment Credit is a tax credit available to employers who hire qualified Native American individuals.

Q: Who qualifies as a Native American for the Indian Employment Credit?

A: To qualify, an individual must be a member of a federally recognized Indian tribe or be married to a member of a federally recognized Indian tribe.

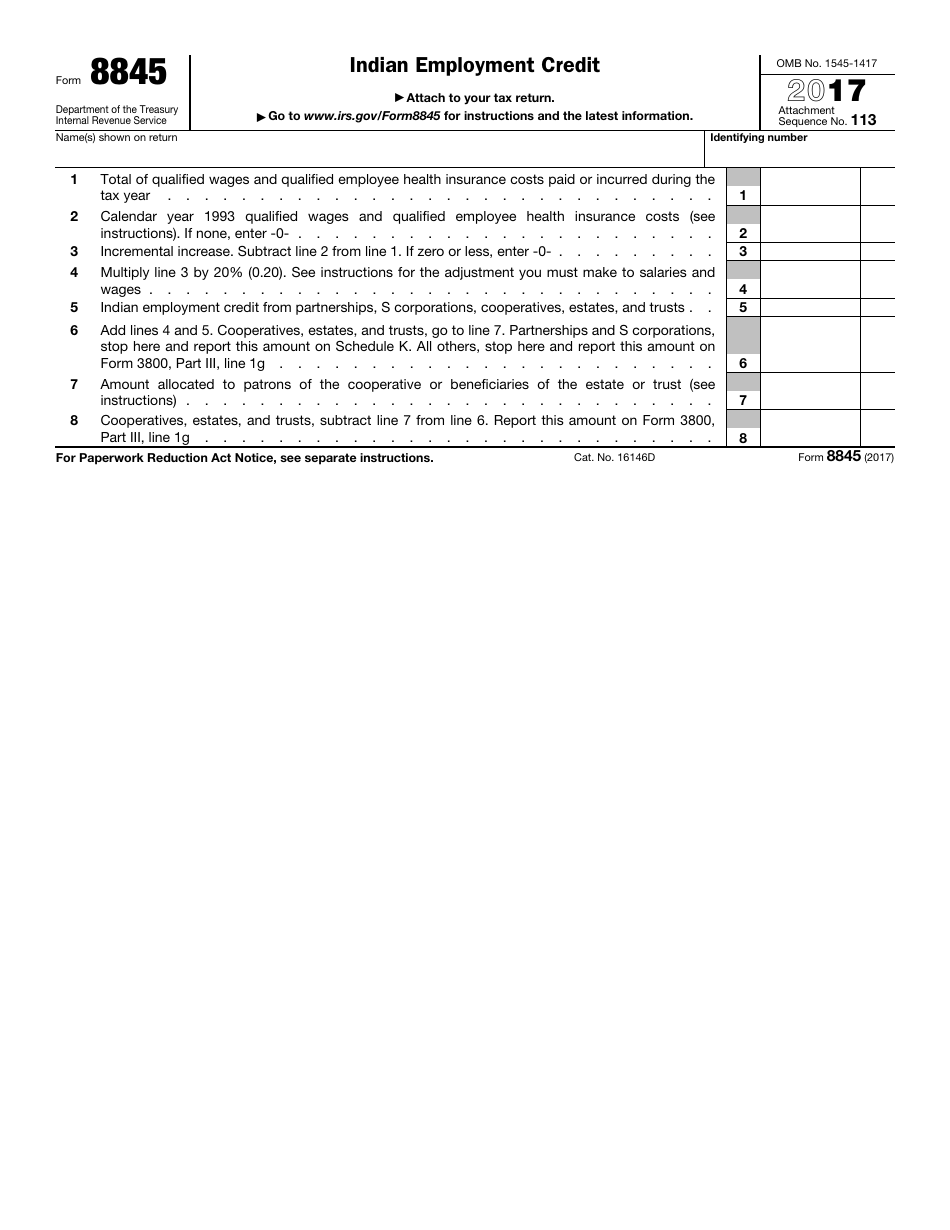

Q: How is the Indian Employment Credit calculated?

A: The credit is based on a percentage of wages paid to qualified Native American individuals.

Q: Are there any limitations or restrictions for claiming the Indian Employment Credit?

A: Yes, there are certain limitations and restrictions. It is best to consult the IRS guidelines or a tax professional for specific details.

Q: When is the deadline to file IRS Form 845?

A: The deadline to file IRS Form 845 is usually the same as the deadline for filing the annual tax return, which is typically April 15th.

Q: Can I claim the Indian Employment Credit if I am self-employed?

A: No, the Indian Employment Credit is only available to employers who have hired qualified Native American individuals.

Q: What other tax credits are available for employers?

A: There are various tax credits available for employers, such as the Work Opportunity Tax Credit and the Empowerment Zone Employment Credit. It is recommended to consult the IRS guidelines or a tax professional for more information.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 845 through the link below or browse more documents in our library of IRS Forms.