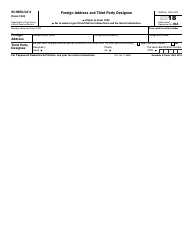

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8822-b

for the current year.

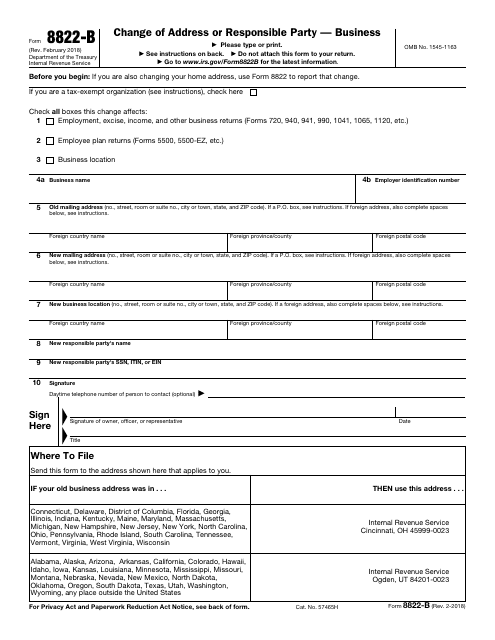

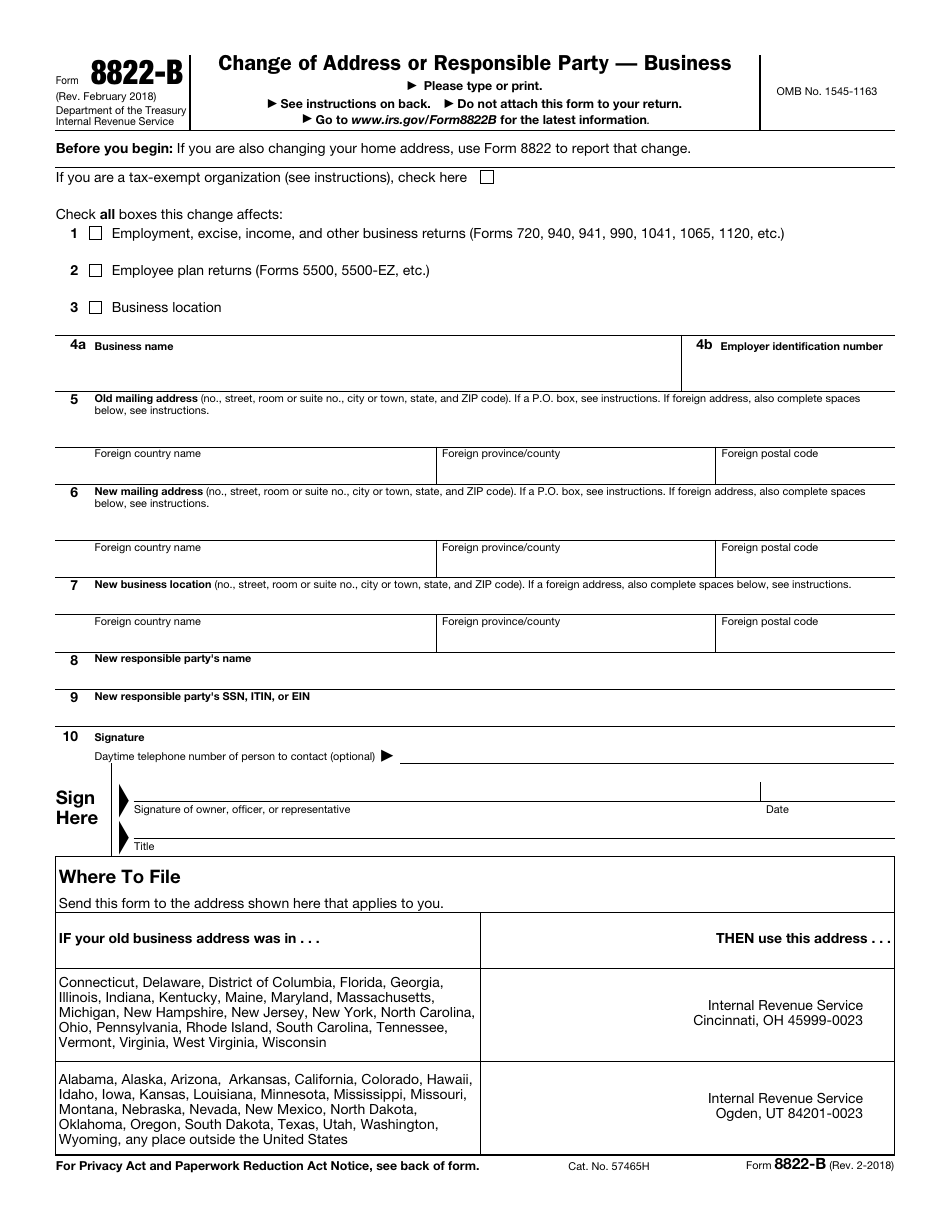

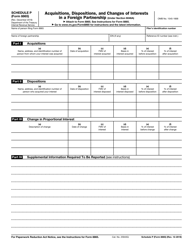

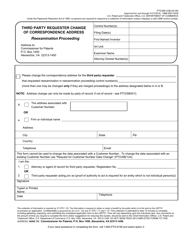

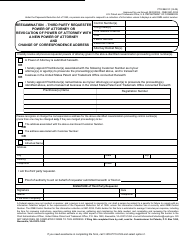

IRS Form 8822-b Change of Address or Responsible Party " Business

What Is IRS Form 8822-b?

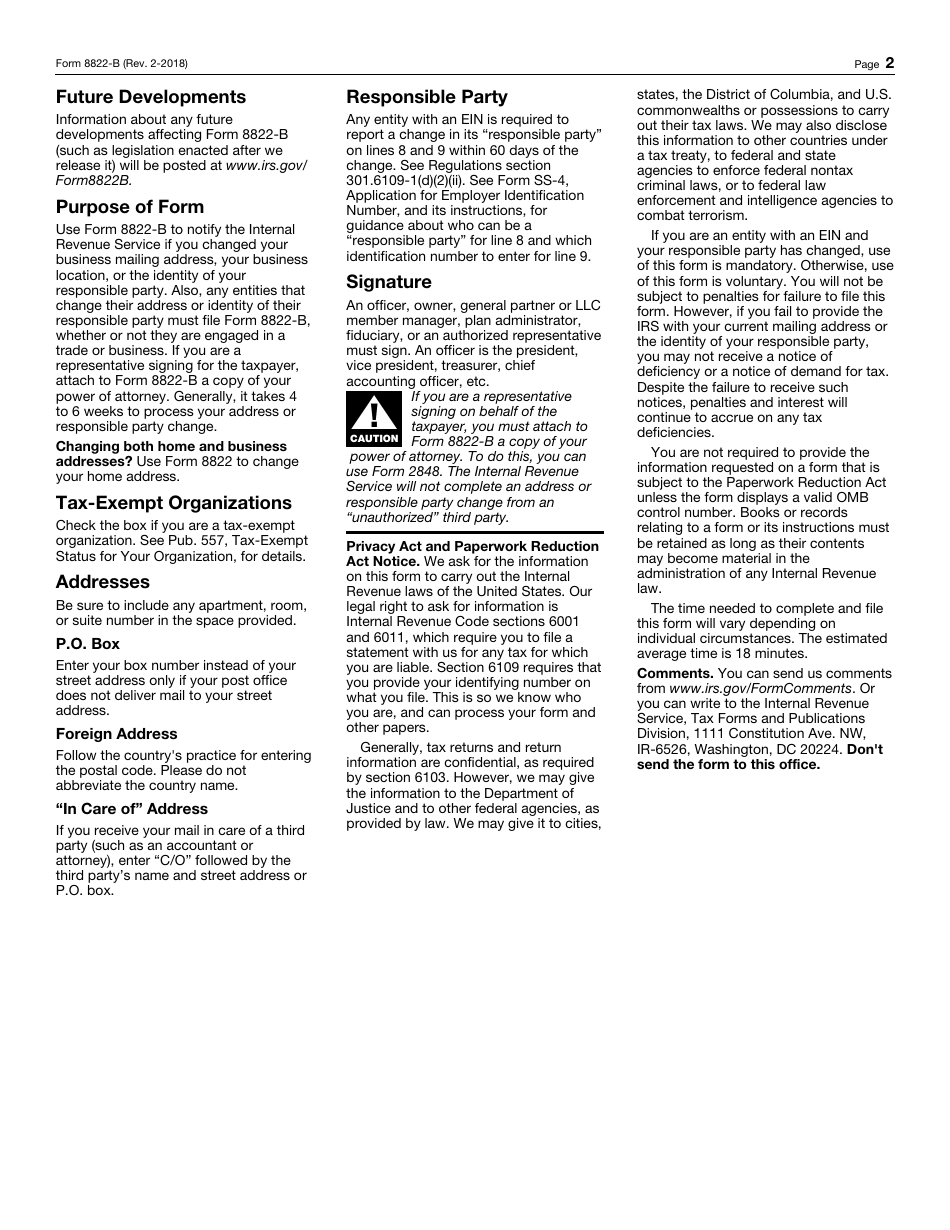

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8822-b?

A: IRS Form 8822-b is used to notify the IRS of a change in business address or responsible party.

Q: Who needs to file IRS Form 8822-b?

A: Businesses need to file IRS Form 8822-b if there is a change in their address or responsible party.

Q: What information do I need to provide on IRS Form 8822-b?

A: You need to provide your business name, old address, new address, and information about the responsible party.

Q: When should I file IRS Form 8822-b?

A: You should file IRS Form 8822-b as soon as possible after the change in address or responsible party.

Q: Is there a fee to file IRS Form 8822-b?

A: No, there is no fee to file IRS Form 8822-b.

Q: What happens if I don't file IRS Form 8822-b?

A: If you don't file IRS Form 8822-b, the IRS may continue to send correspondence to your old address or the previous responsible party.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8822-b through the link below or browse more documents in our library of IRS Forms.