This version of the form is not currently in use and is provided for reference only. Download this version of

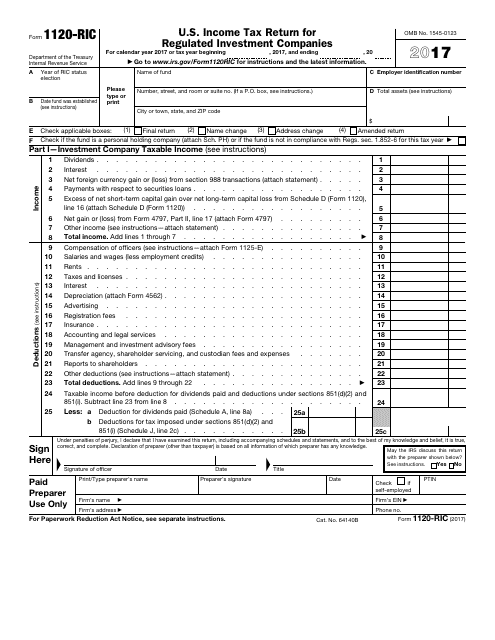

IRS Form 1120-RIC

for the current year.

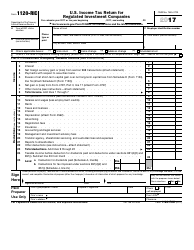

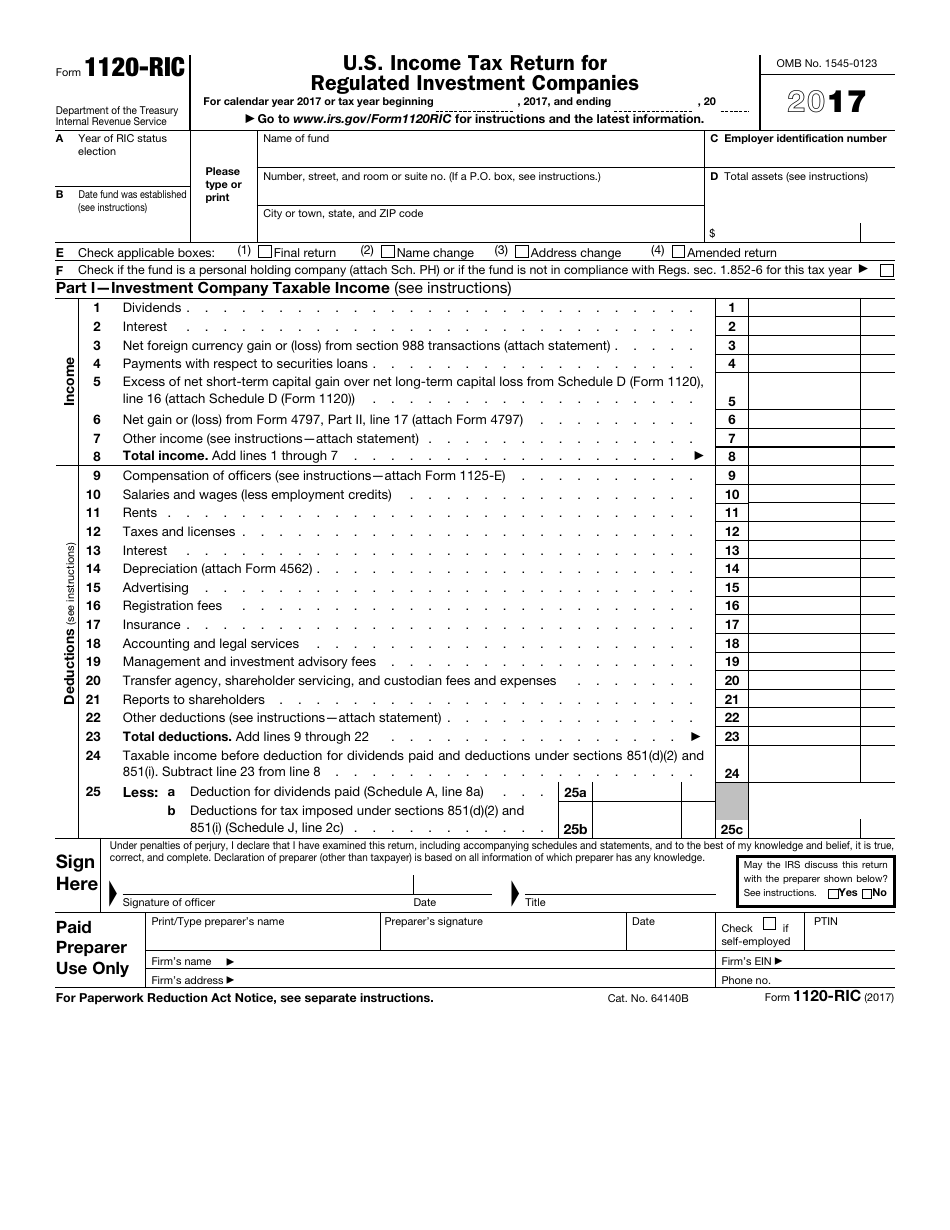

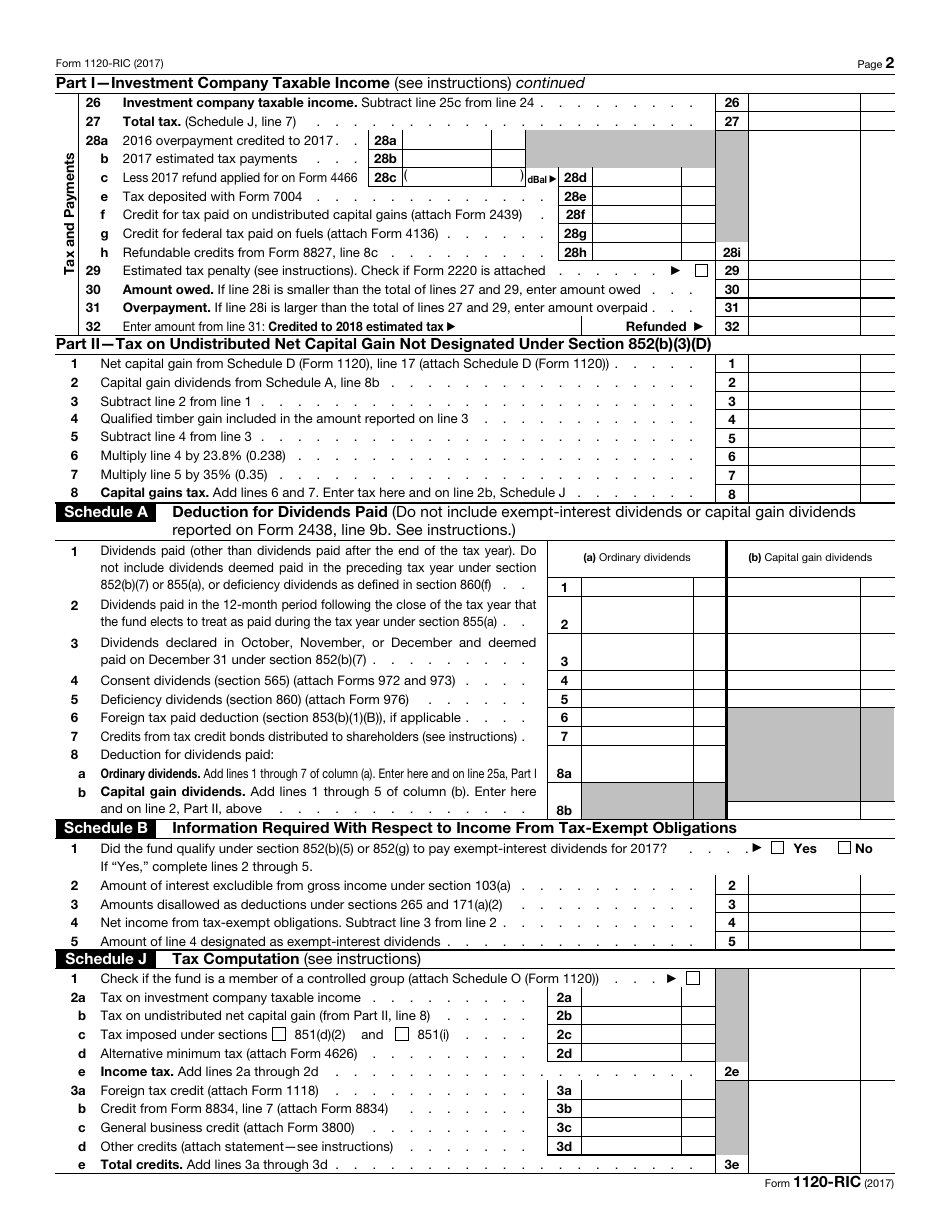

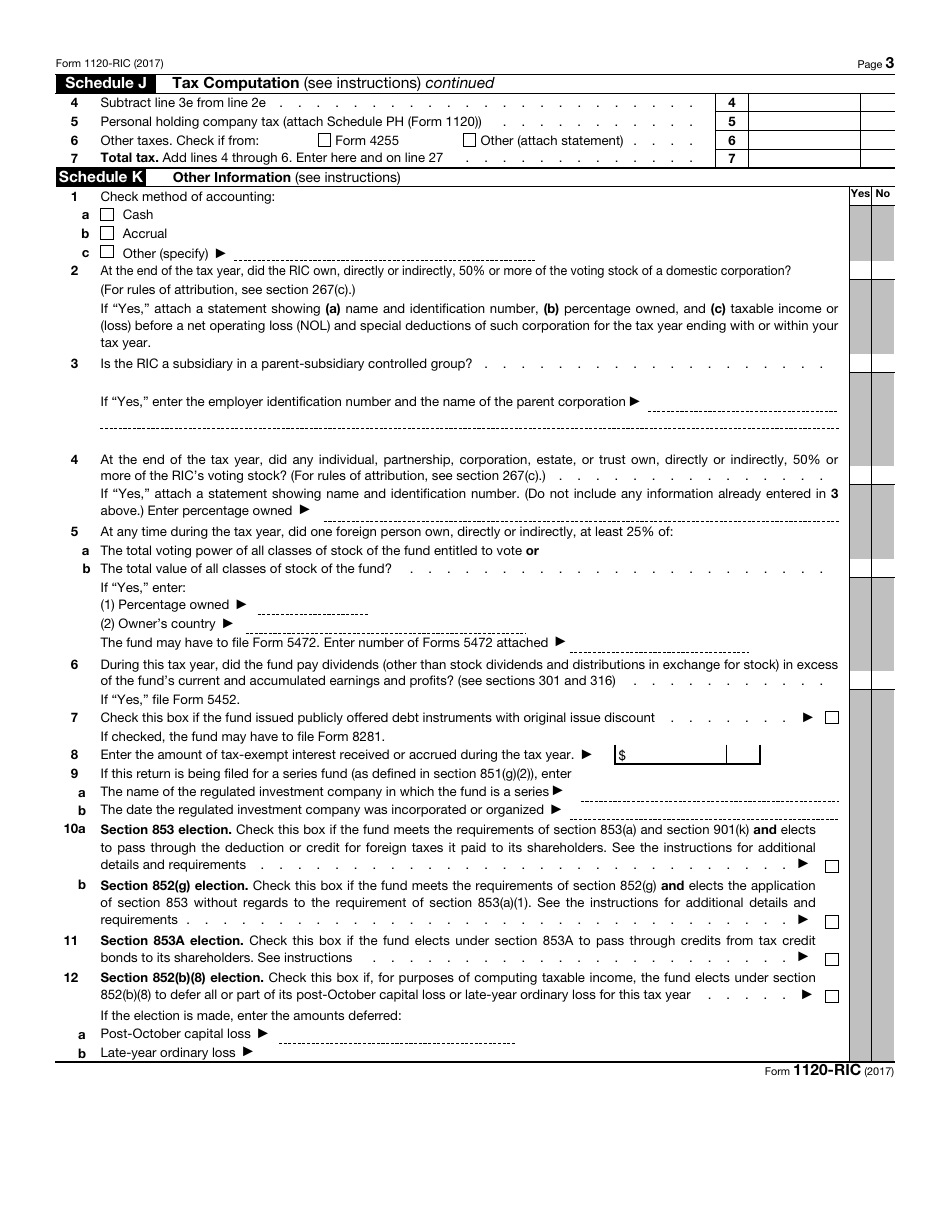

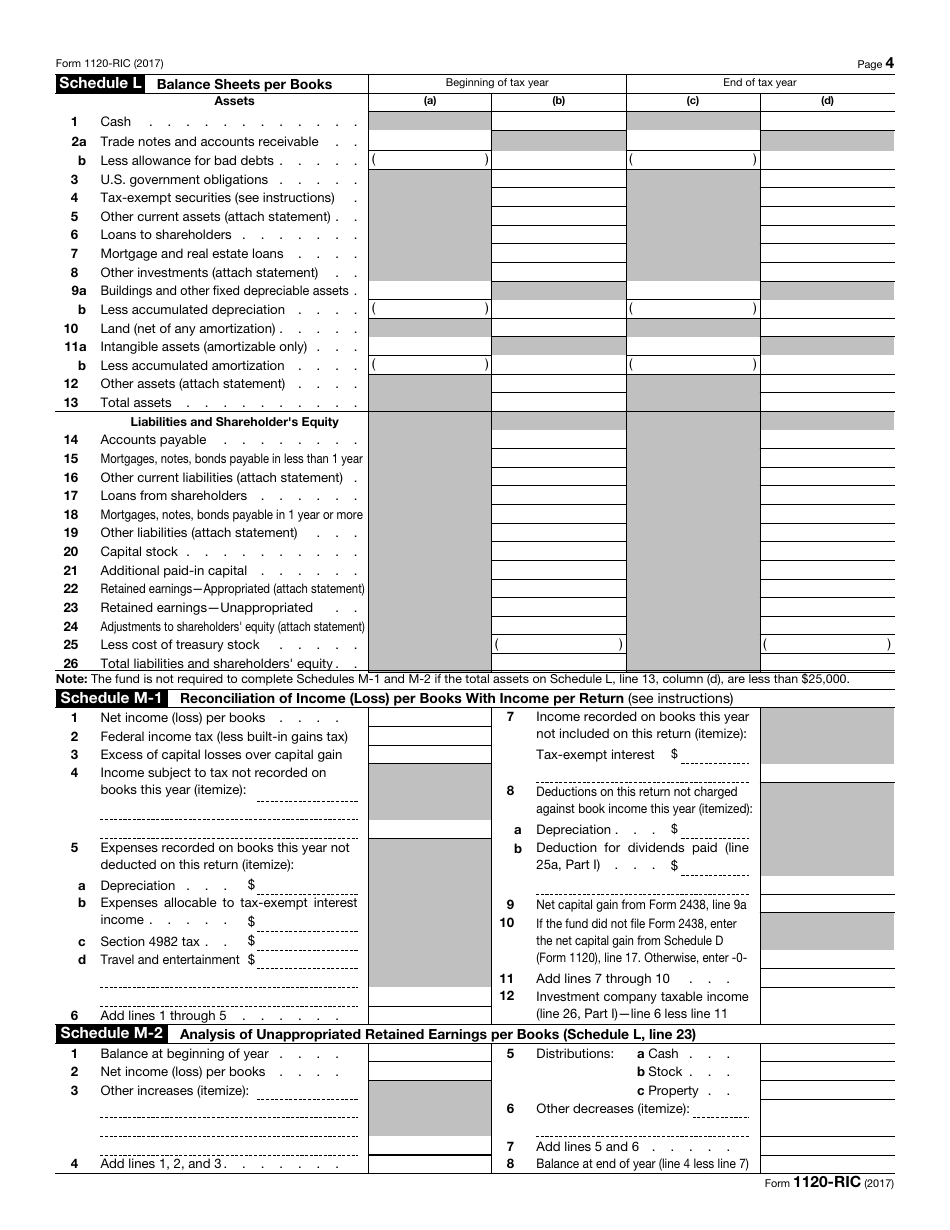

IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

What Is IRS Form 1120-RIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-RIC?

A: IRS Form 1120-RIC is the U.S. Income Tax Return specifically designed for Regulated Investment Companies (RICs).

Q: Who needs to file IRS Form 1120-RIC?

A: RICs, which are investment companies registered with the Securities and Exchange Commission (SEC), need to file IRS Form 1120-RIC.

Q: What is the purpose of filing IRS Form 1120-RIC?

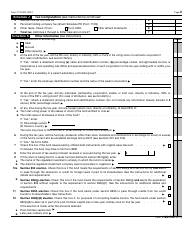

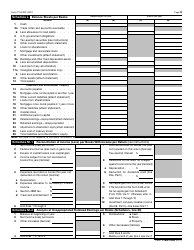

A: The purpose of filing IRS Form 1120-RIC is to report the income, deductions, gains, losses, and other related information of a Regulated Investment Company.

Q: When is the due date for filing IRS Form 1120-RIC?

A: The due date for filing IRS Form 1120-RIC is usually the 15th day of the 3rd month following the end of the RIC's tax year.

Q: What are the penalties for not filing IRS Form 1120-RIC on time?

A: Penalties for not filing IRS Form 1120-RIC on time can include monetary fines and interest charges on any unpaid taxes.

Q: Can I electronically file IRS Form 1120-RIC?

A: Yes, you can electronically file IRS Form 1120-RIC using the IRS e-file system or authorized e-file providers.

Q: Are there any special requirements for RICs when filing IRS Form 1120-RIC?

A: RICs are subject to certain specific tax rules and requirements outlined in the Internal Revenue Code and IRS regulations. It is recommended to consult a tax professional for guidance.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-RIC through the link below or browse more documents in our library of IRS Forms.