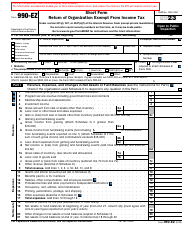

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-W

for the current year.

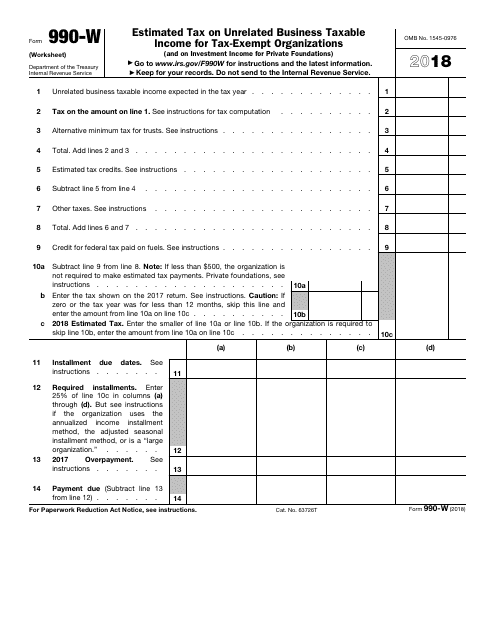

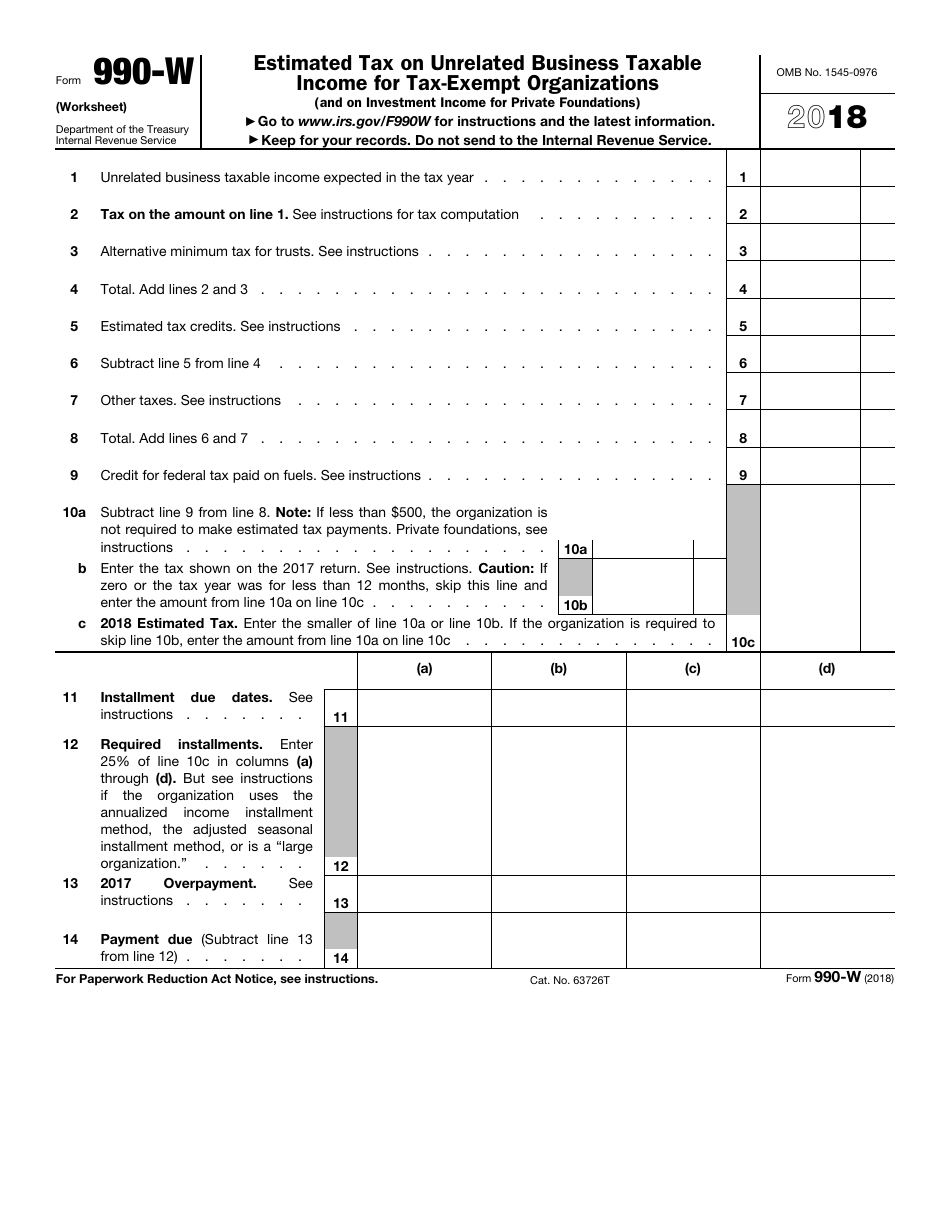

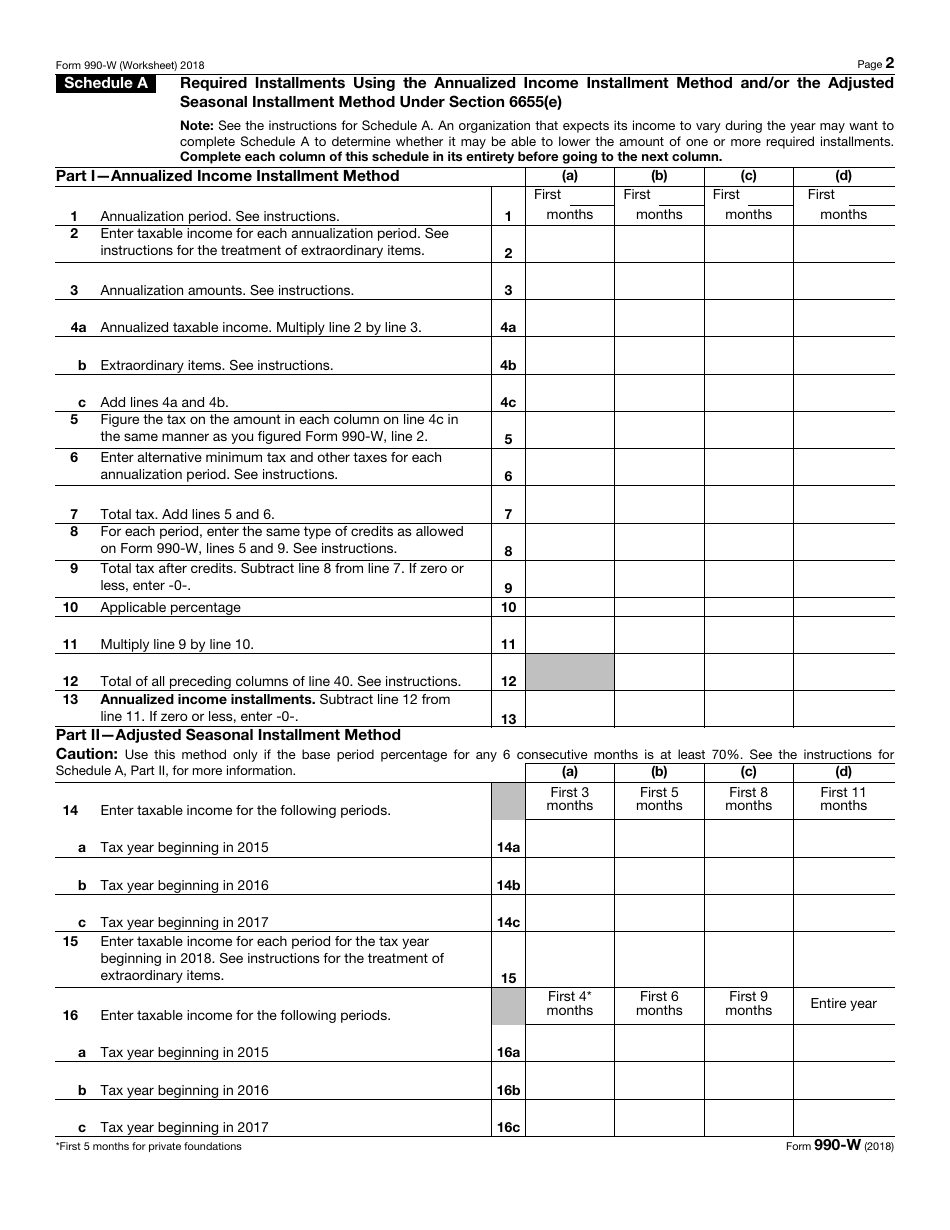

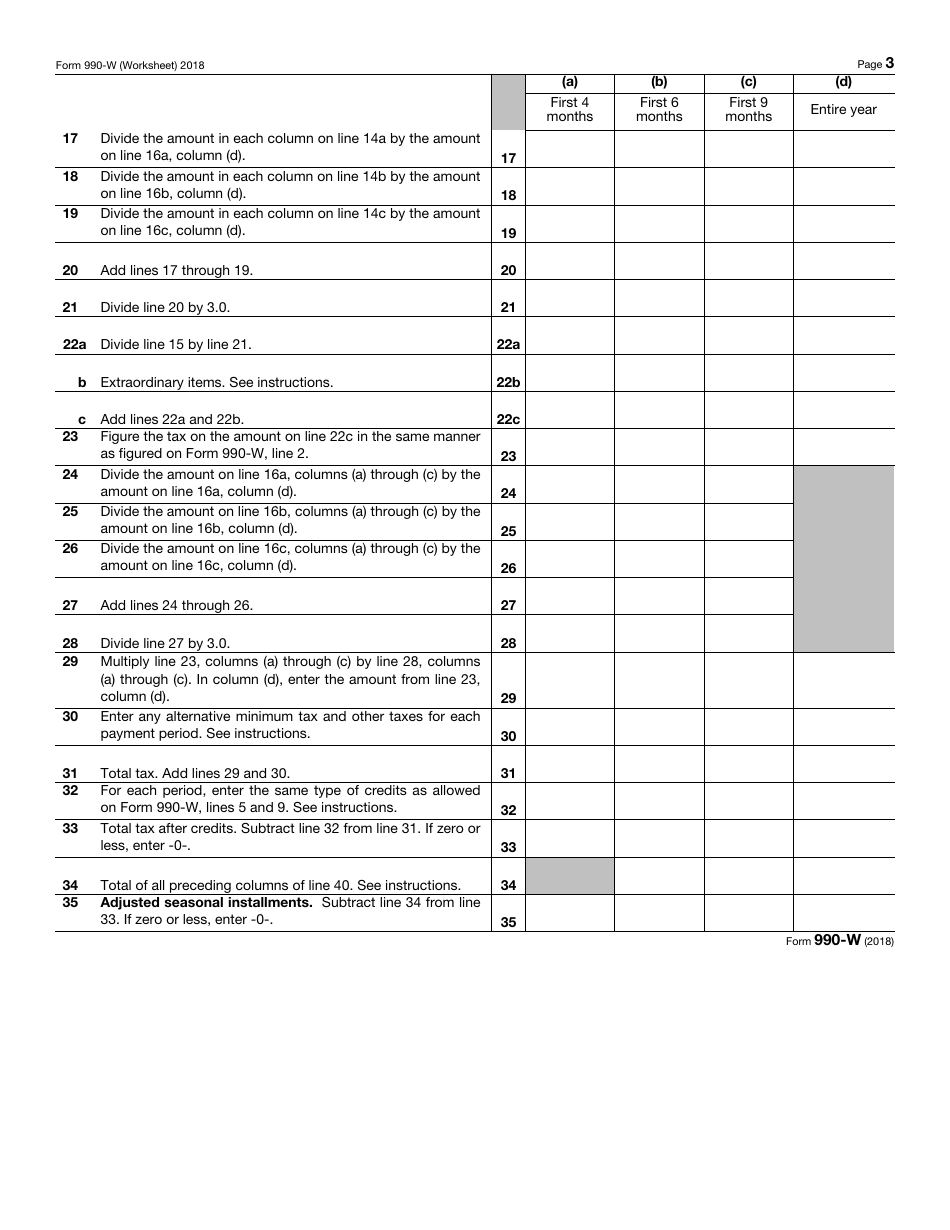

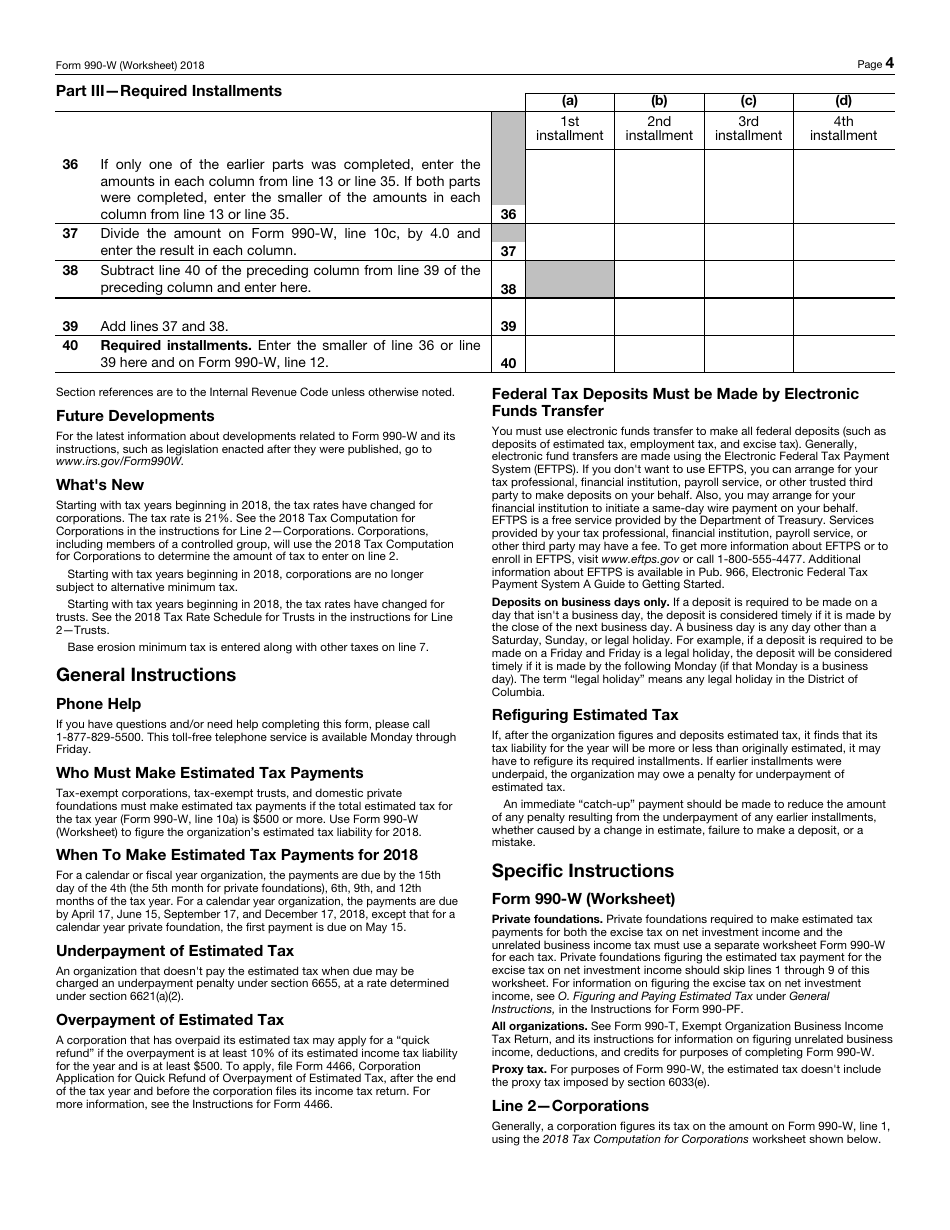

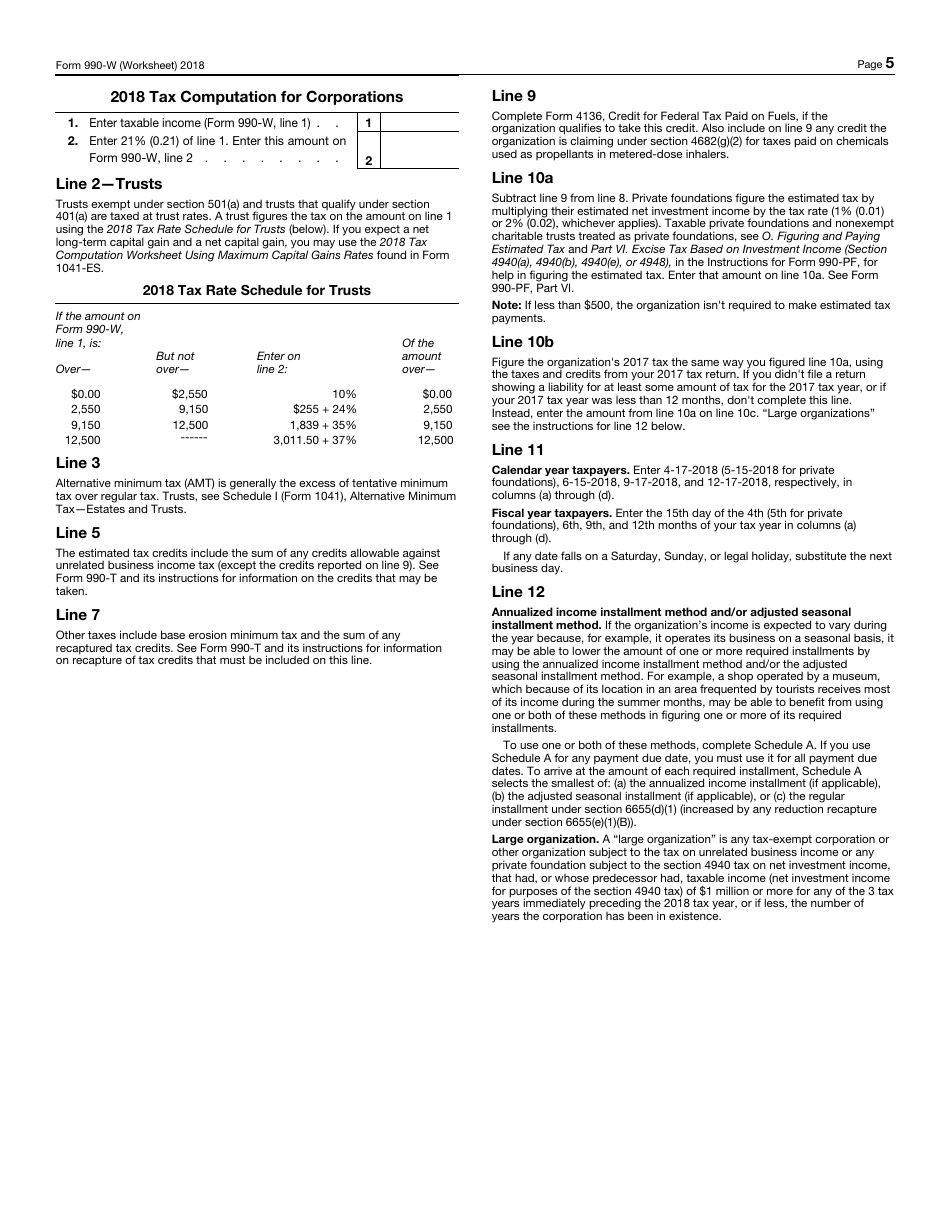

IRS Form 990-W Estimated Tax on Unrelated Business Taxable Income for Tax-Exempt Organizations

What Is IRS Form 990-W?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990-W?

A: IRS Form 990-W is used to calculate the estimated tax on unrelated business taxable income for tax-exempt organizations.

Q: Who needs to file IRS Form 990-W?

A: Tax-exempt organizations that have unrelated business taxable income exceeding $1,000 in a tax year need to file IRS Form 990-W.

Q: What is unrelated business taxable income?

A: Unrelated business taxable income refers to income generated from activities that are not related to the tax-exempt organization's exempt purpose.

Q: How is the estimated tax on unrelated business taxable income calculated?

A: The estimated tax on unrelated business taxable income is calculated using the instructions provided with IRS Form 990-W.

Q: When is IRS Form 990-W due?

A: IRS Form 990-W is typically due on the 15th day of the 5th month after the end of the organization's tax year.

Form Details:

- A 7-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-W through the link below or browse more documents in our library of IRS Forms.