This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 944-x

for the current year.

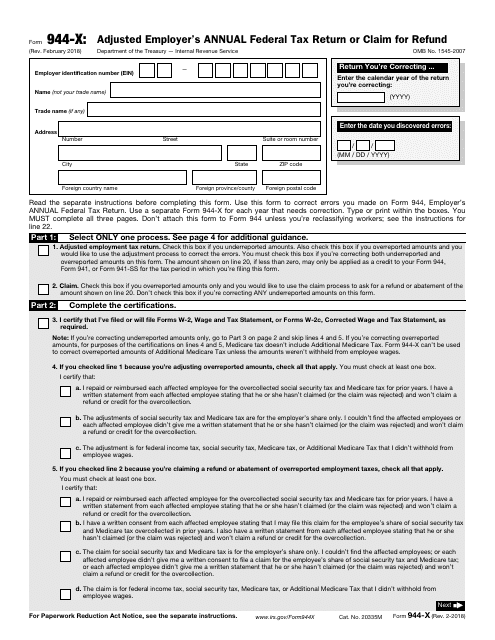

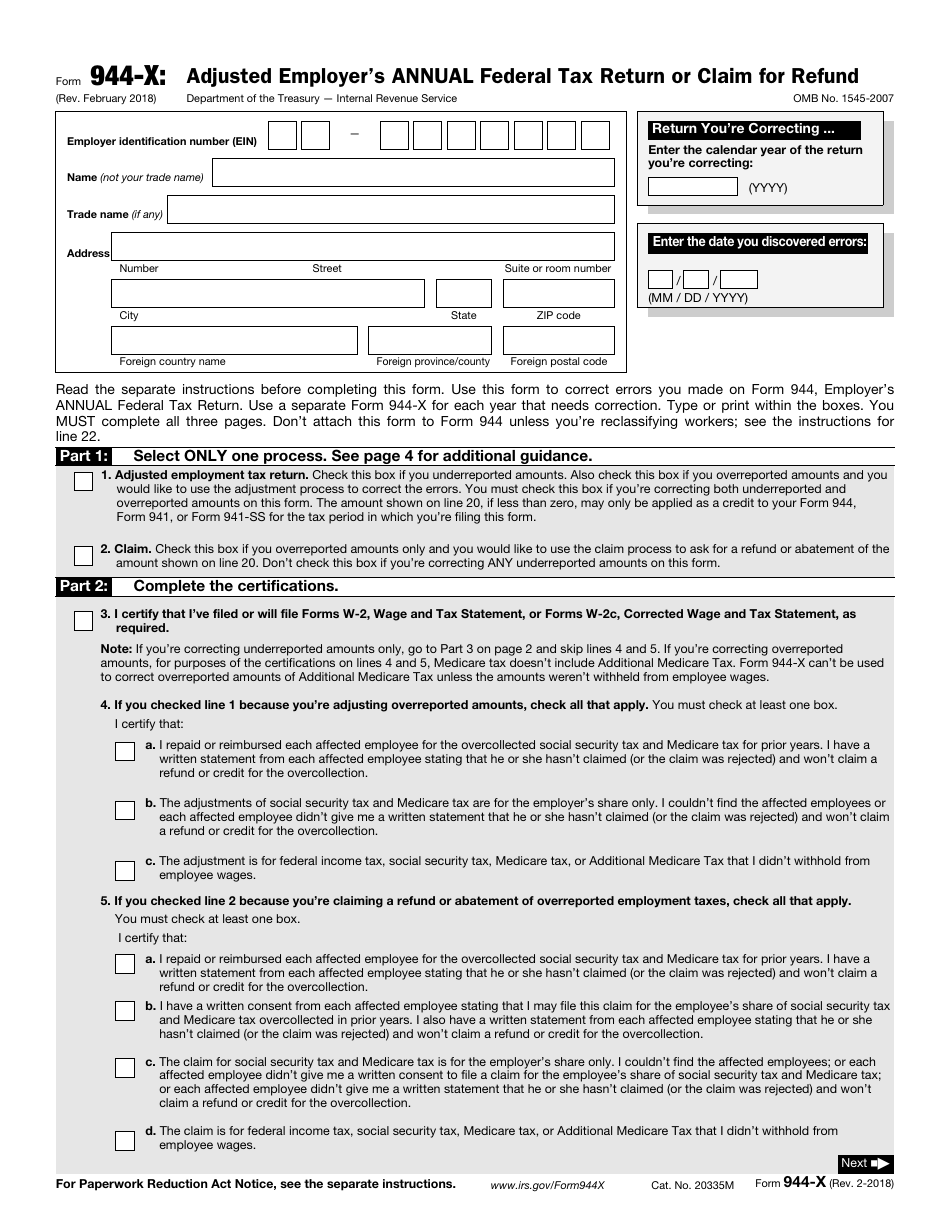

IRS Form 944-x Adjusted Employer's Annual Federal Tax Return or Claim for Refund

What Is Form 944-X?

IRS Form 944-X, Adjusted Employer's Annual Federal Tax Return or Claim for Refund is a form used to correct mistakes on the IRS Form 944, Employer's Annual Federal Tax Return. The most recent version of the form was issued by the Internal Revenue Service (IRS) on February 1, 2018 . A fillable IRS Form 944-X is available for download below.

The form - often referred to as the Adjusted Employer's Quarterly Federal Tax Return - should be filed as soon, as possible after the mistake was discovered. Overreported taxes on a prior IRS Form 944 can be corrected within 3 years after filing the form or 2 years from the date the reported taxes were paid, whichever took place later. Underreported taxes should be corrected within 3 years from the date IRS Form 944 was filed. A separate form should be used for each return that needs corrections.

The mailing address for Form 944-X depends on the location of the business filing the form and the organization type. The complete list of mailing addresses can be found in the IRS-issued instructions for the adjusted return.

IRS Form 944-X Instructions

-

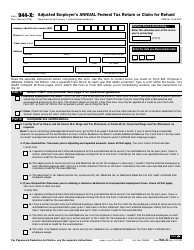

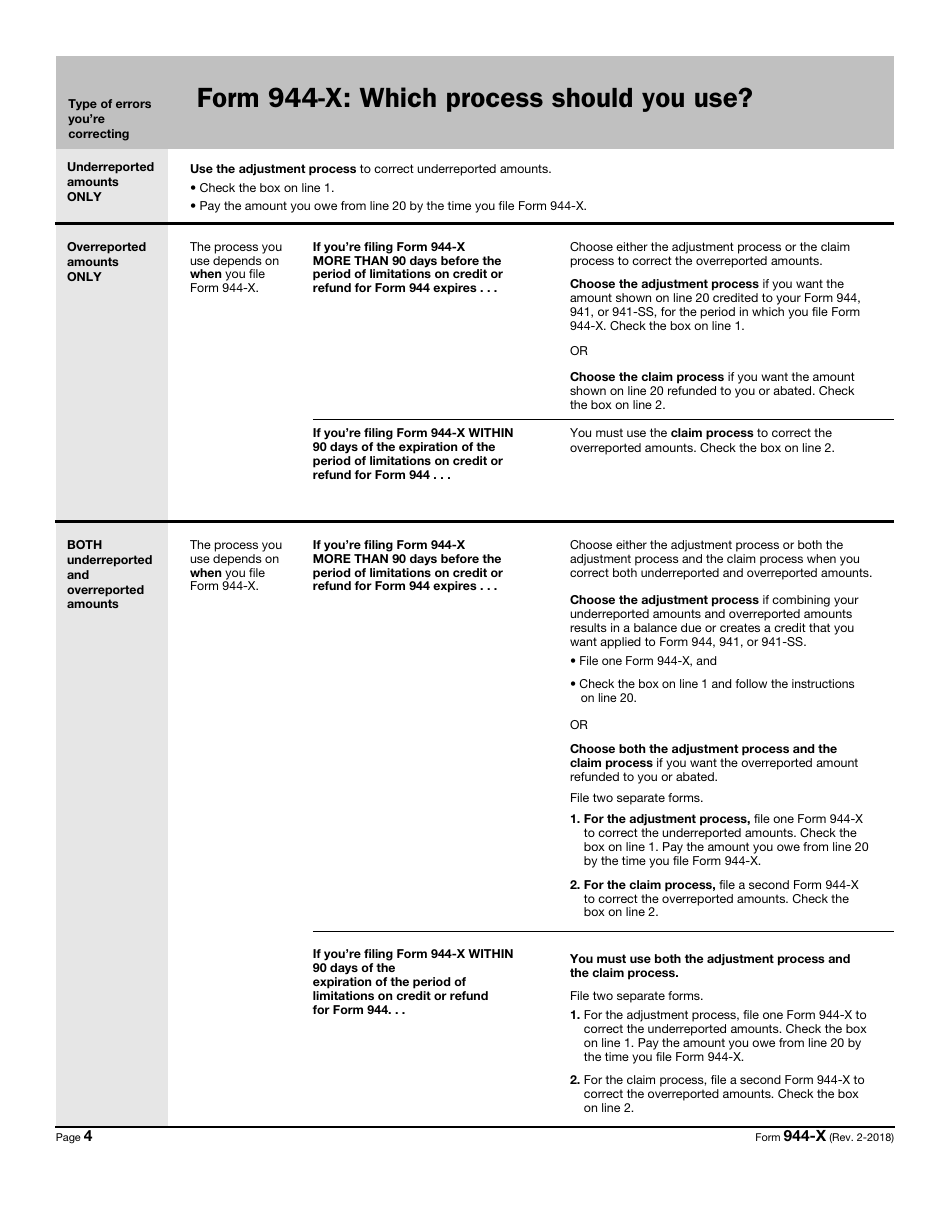

Part 1, Desired Process, and Part 2, Certifications Field, are self-explanatory.

-

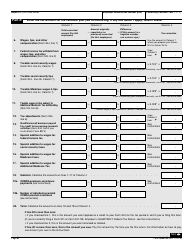

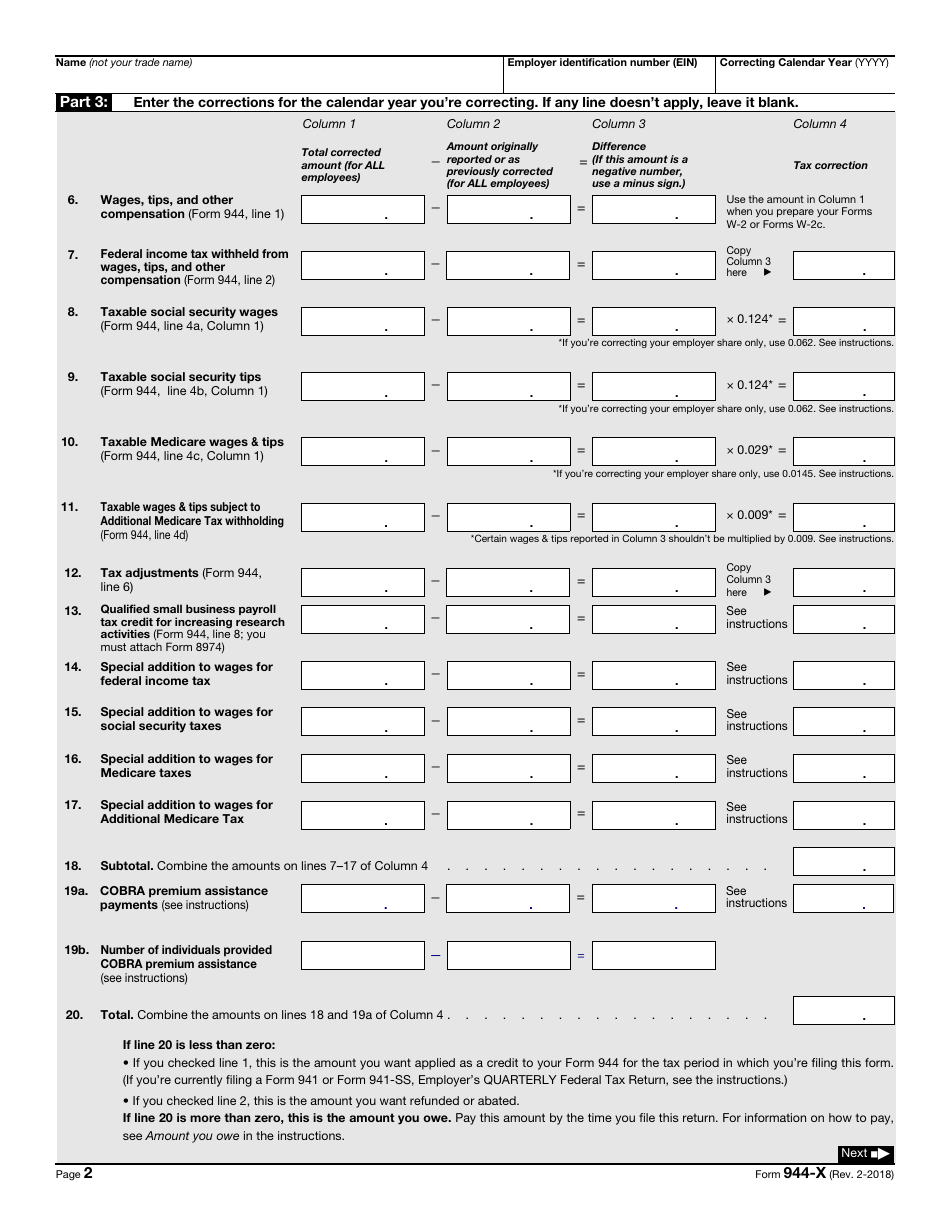

Part 3, Corrections:

- Line 6, Wages, tips, and other compensation. Enter the correct amount in Column 1 and the originally reported amount in Column 2. Enter the difference between these amounts in Column 3, using a minus sign for negative numbers;

- Lines 7-13 are self-explanatory;

- Lines 14-17 are applicable if corrections are made for wages resulting from reclassifying employees. The only amount paid to reclassified employees must be recorded. Enter the total correct amount in Column 1, the originally reported amount in Column 2, the difference between these amounts in Column 3 and Column 4;

- Line 18, Subtotal. Add the amounts entered in Column 4 for lines 7-14;

- Line 19a, COBRA premium assistance payments. Enter 65% of the total COBRA payments for eligible individuals in Column 1. For tax periods ending after December 31, 2013, enter 0 in Column 2, for tax periods ending before January 1, 2014, enter any payments reported on Form 944. Enter the difference between amounts in Columns 1 and 2 in Columns 3 and 4;

- Line 19b, Number of Individuals Provided COBRA Premium Assistance. Enter the total number of individuals receiving COBRA assistance in Column 1. For tax periods beginning after December 31, 2013, enter 0 in Column 2, for tax periods ending after January 1, 2014, enter the number of eligible individuals reported on previously filed IRS Form 944. Enter the difference between the two columns in Columns 3 and 4;

- Line 20, Total. Add amounts entered in Lines 18 and 19a of Column 4.

-

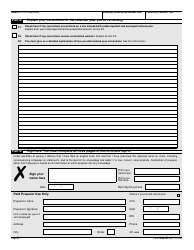

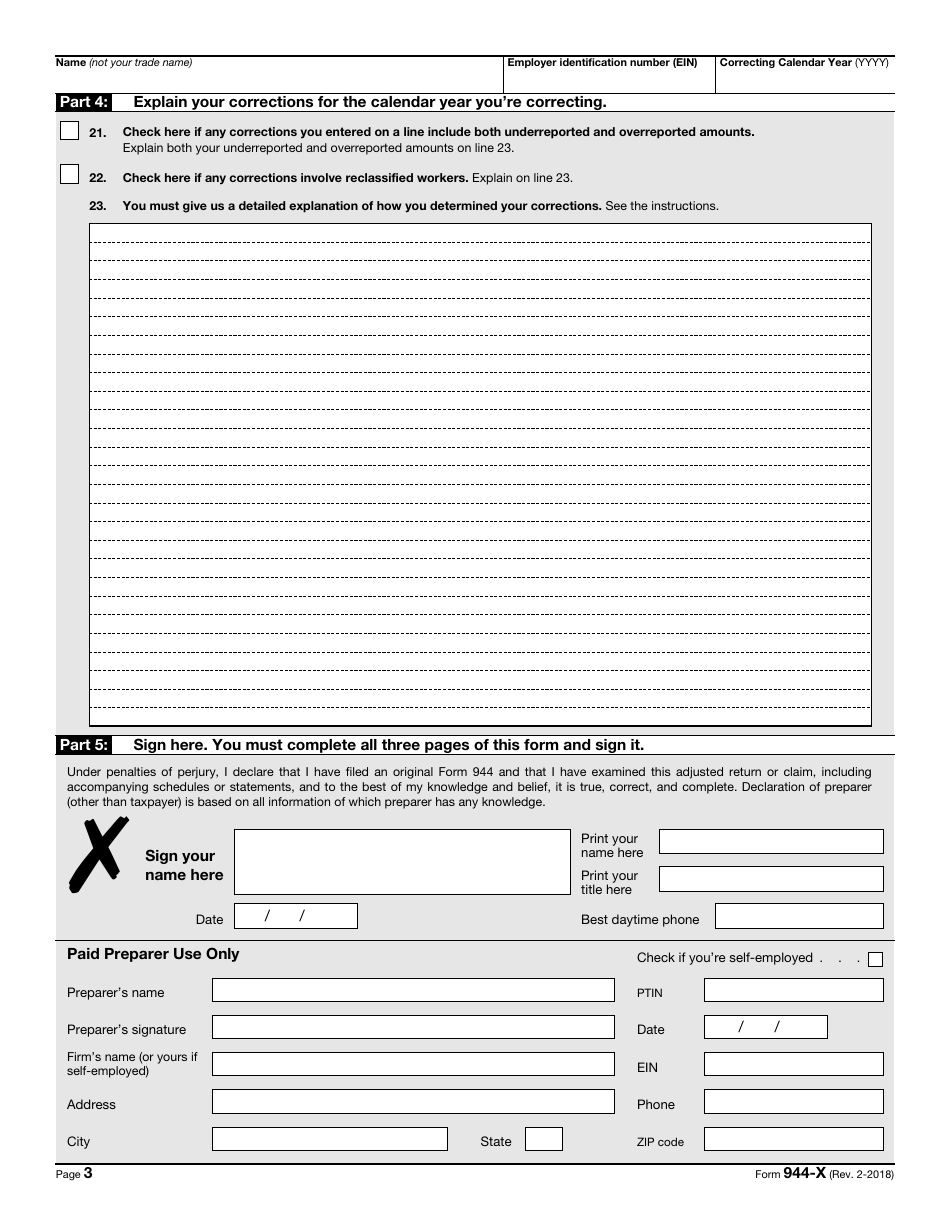

Part 4. Explanations for Corrections:

- Lines 21-22. Check the boxes, if they apply to you;

- Line 23. Provide a detailed explanation of how your corrections were determined.

-

Part 5. Signature Field. Type or print your name and title, enter your daytime phone number, sign and date the form. If you are a paid preparer, complete the Paid Preparer Use Only part. Check the box, if you are self-employed. Enter your name, your firm's name, EIN, Preparer Tax Identification Number (PTIN), phone number, and address, sign the form.