This version of the form is not currently in use and is provided for reference only. Download this version of

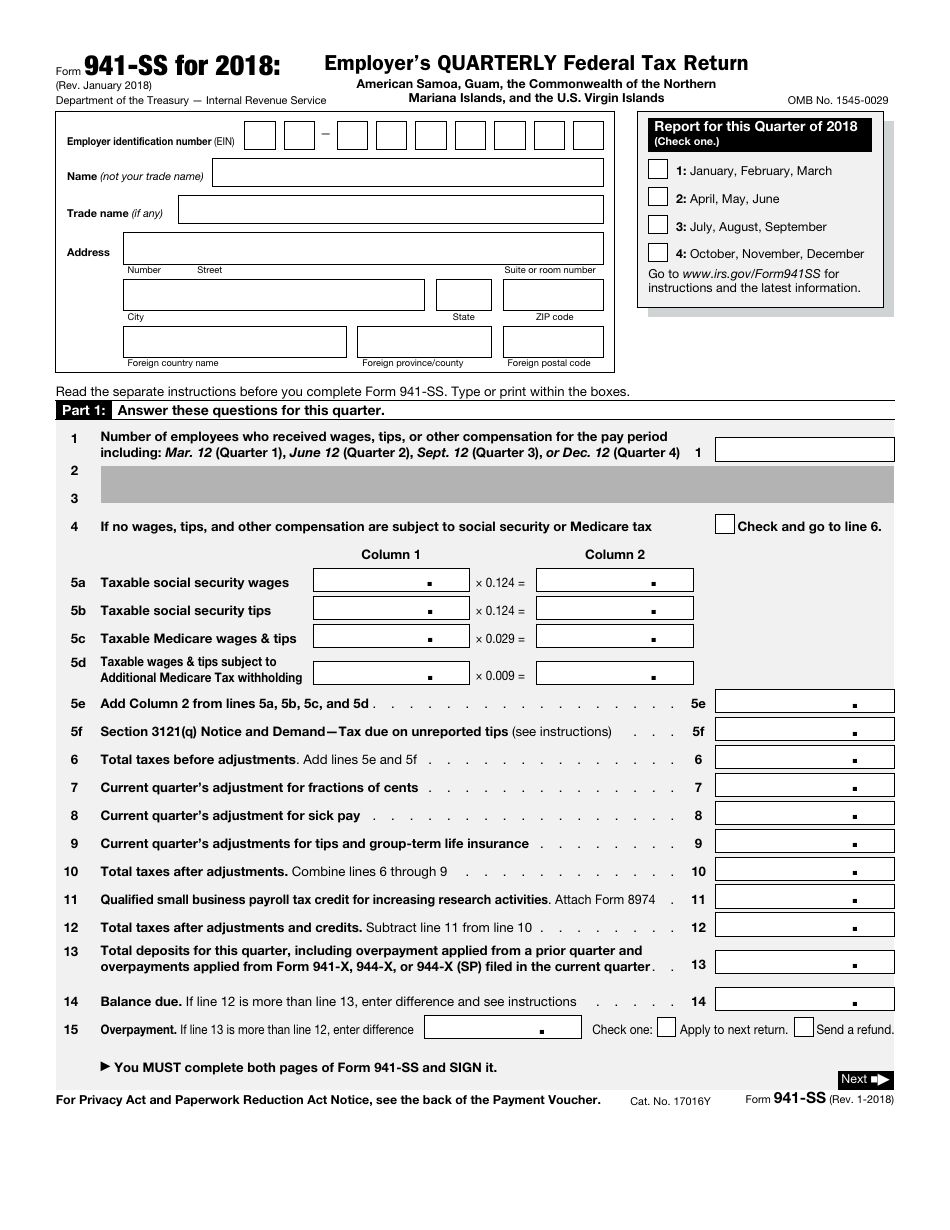

IRS Form 941-SS

for the current year.

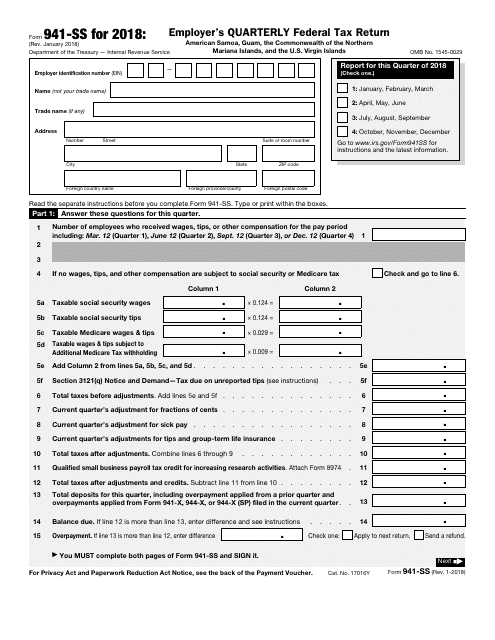

IRS Form 941-SS Employer's Quarterly Federal Tax Return

What Is IRS Form 941-SS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is a tax return specifically designed for employers in U.S. territories, including Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands.

Q: Who needs to file IRS Form 941-SS?

A: Employers in U.S. territories who have employees need to file IRS Form 941-SS.

Q: When is IRS Form 941-SS due?

A: IRS Form 941-SS is due quarterly, on the last day of the month following the end of the quarter. For example, the form for the first quarter of the year is due by April 30th.

Q: What information is required on IRS Form 941-SS?

A: IRS Form 941-SS requires information about the number of employees, wages paid, and taxes withheld.

Q: Is there a penalty for late or incorrect filing of IRS Form 941-SS?

A: Yes, there may be penalties for late or incorrect filing of IRS Form 941-SS. It's important to file the form on time and accurately to avoid penalties.

Form Details:

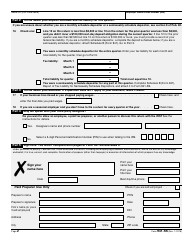

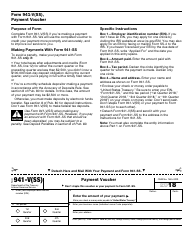

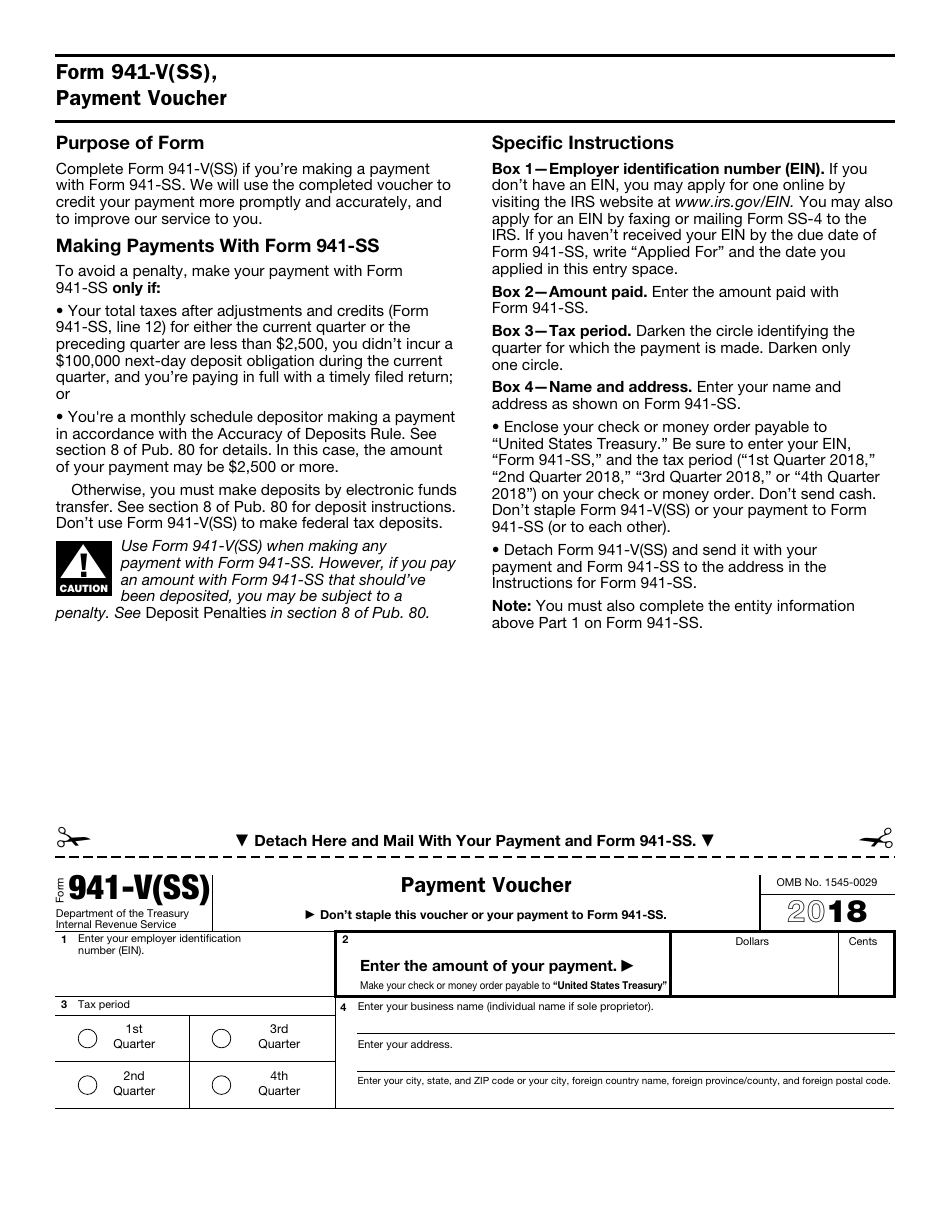

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 941-SS through the link below or browse more documents in our library of IRS Forms.