This version of the form is not currently in use and is provided for reference only. Download this version of

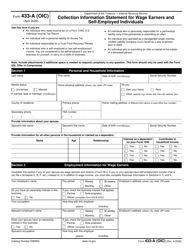

IRS Form 433-A (OIC)

for the current year.

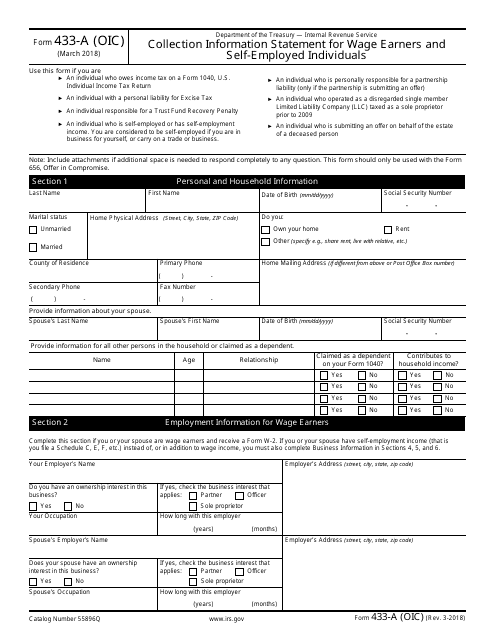

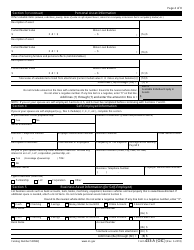

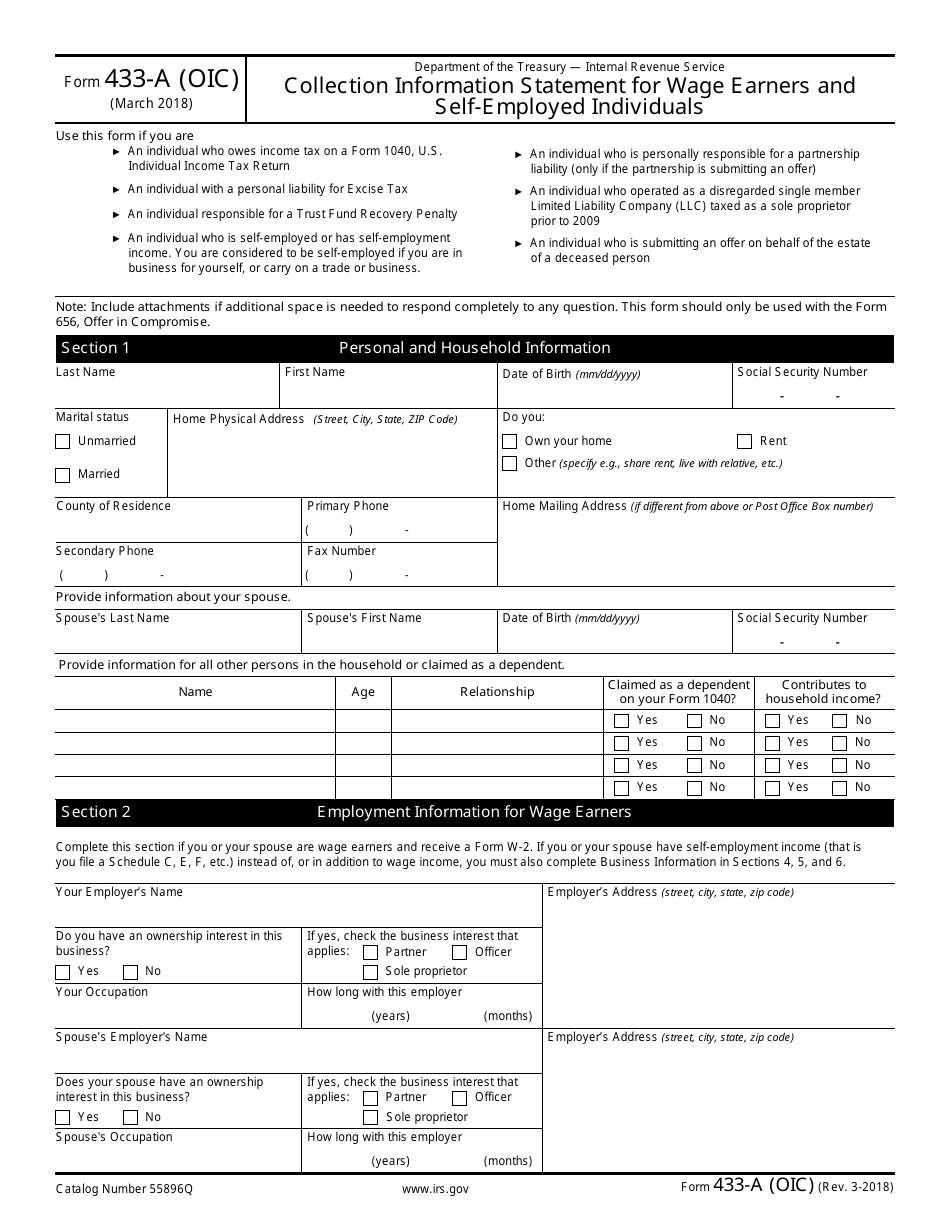

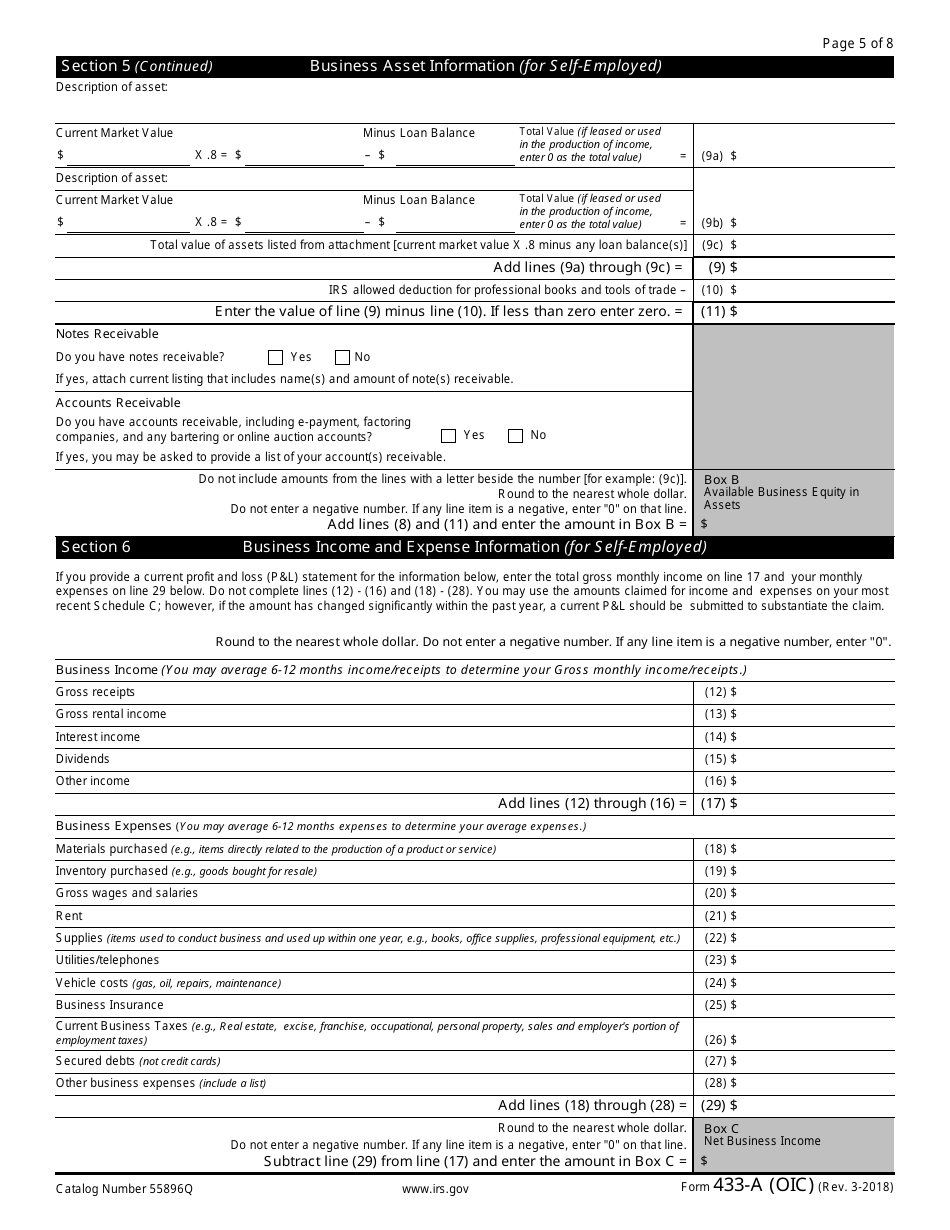

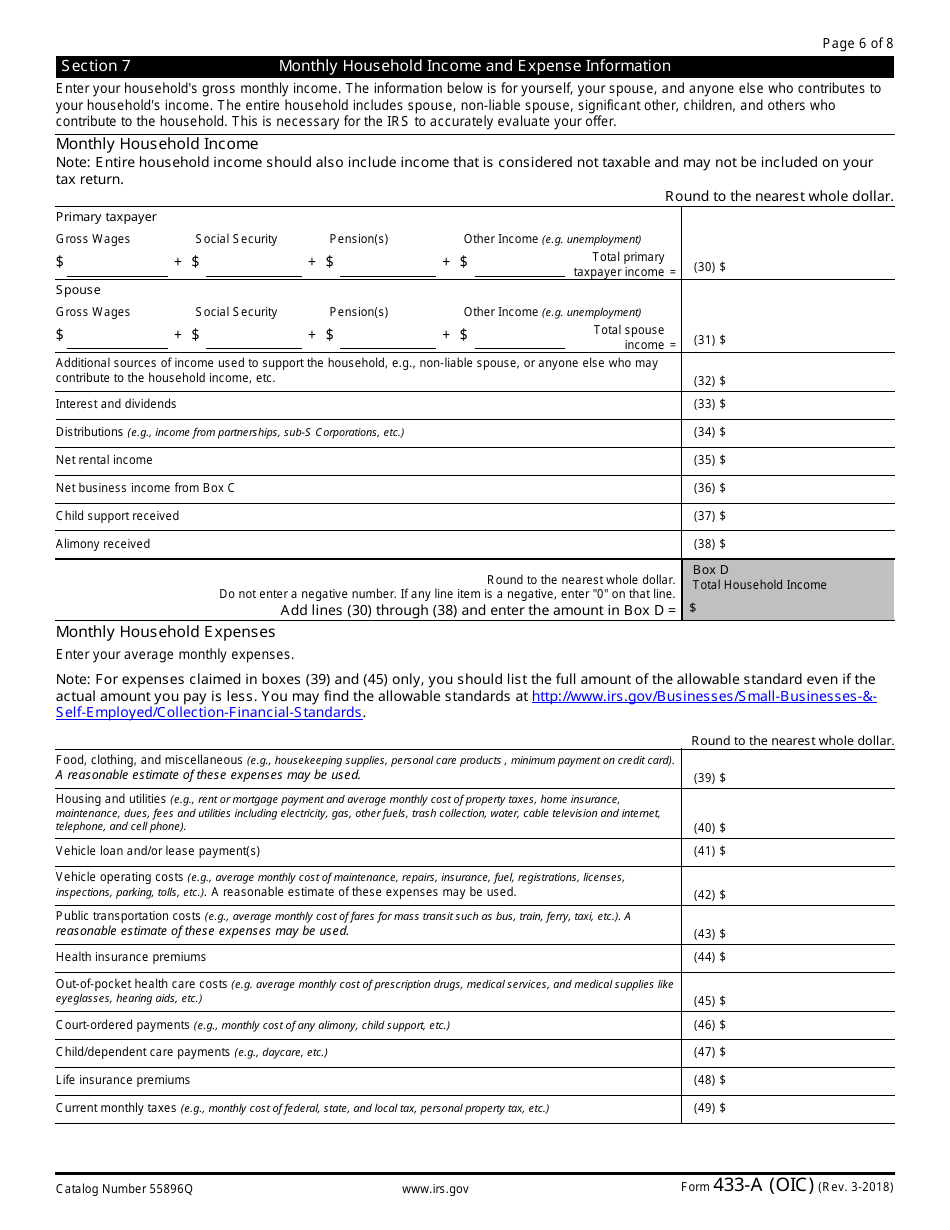

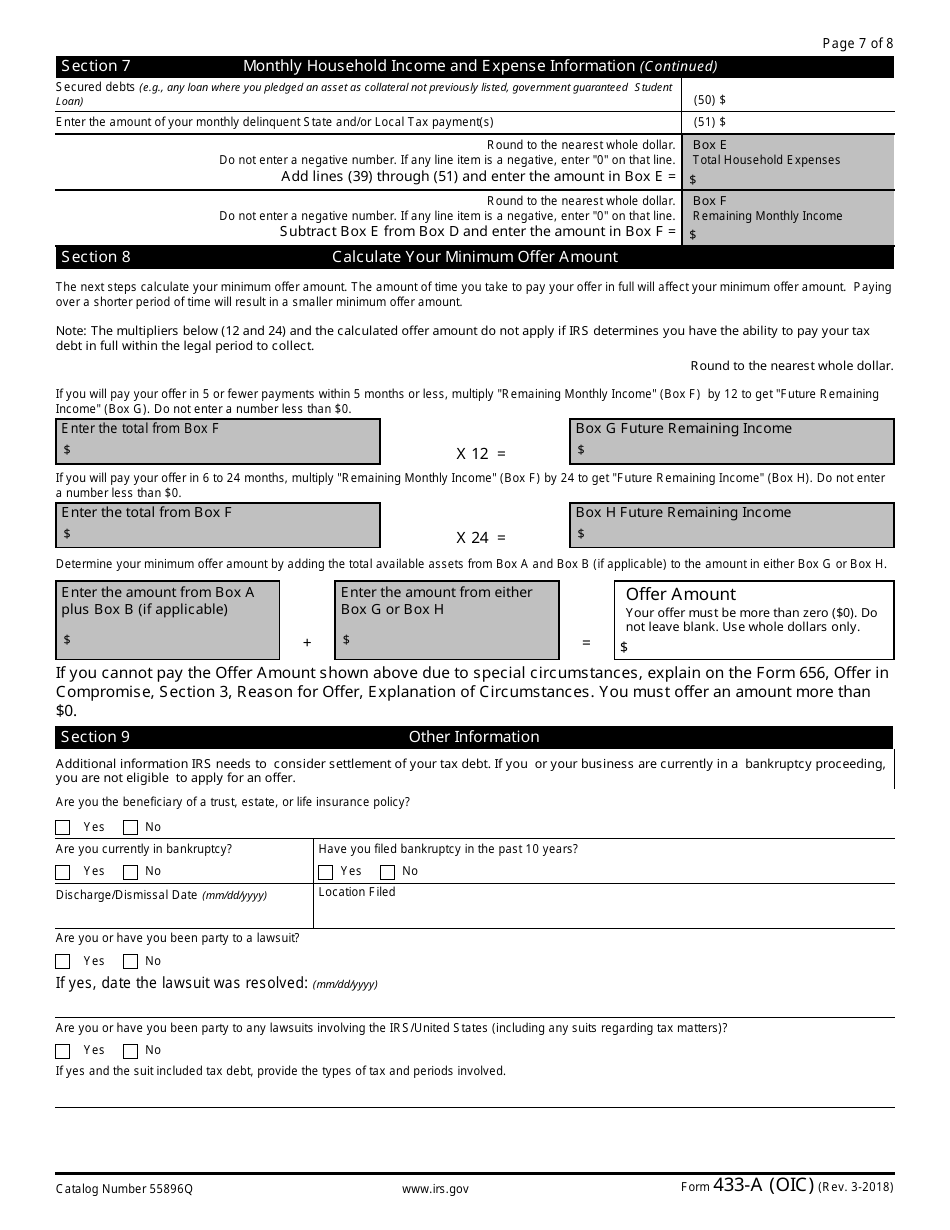

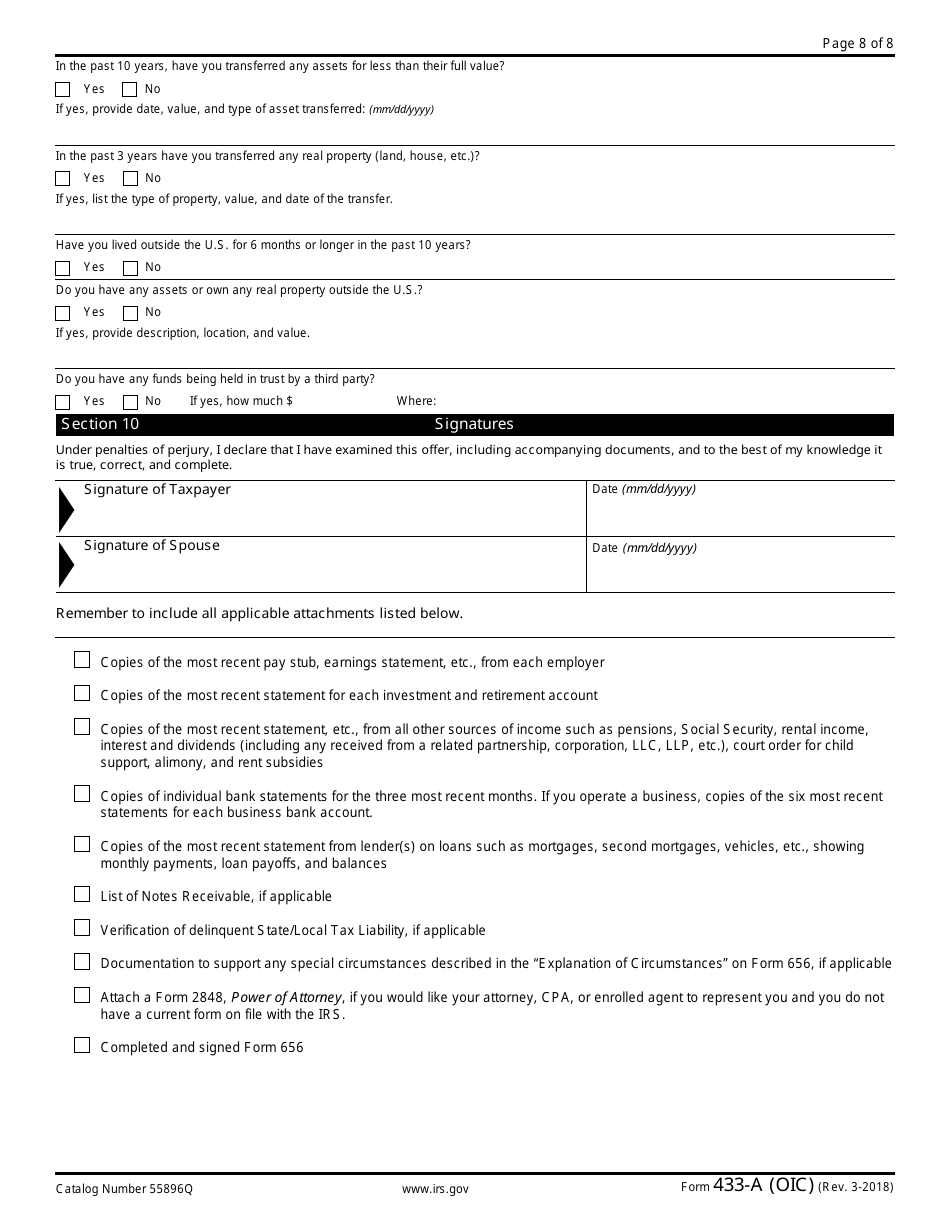

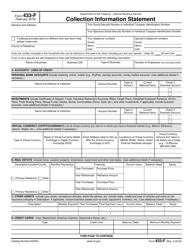

IRS Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-employed Individuals

What Is IRS Form 433-A (OIC)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-A?

A: IRS Form 433-A is a Collection Information Statement used by wage earners and self-employed individuals.

Q: Who needs to fill out IRS Form 433-A?

A: Wage earners and self-employed individuals who are seeking to negotiate an Offer in Compromise (OIC) with the IRS need to fill out IRS Form 433-A.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program offered by the IRS that allows taxpayers to settle their tax debt for less than the full amount owed.

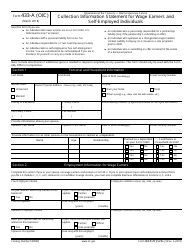

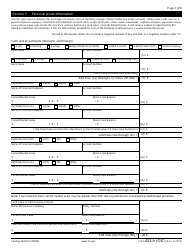

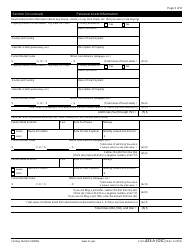

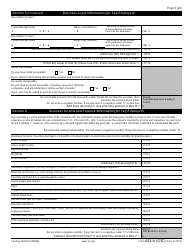

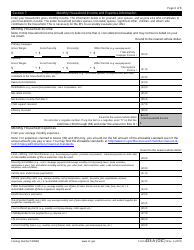

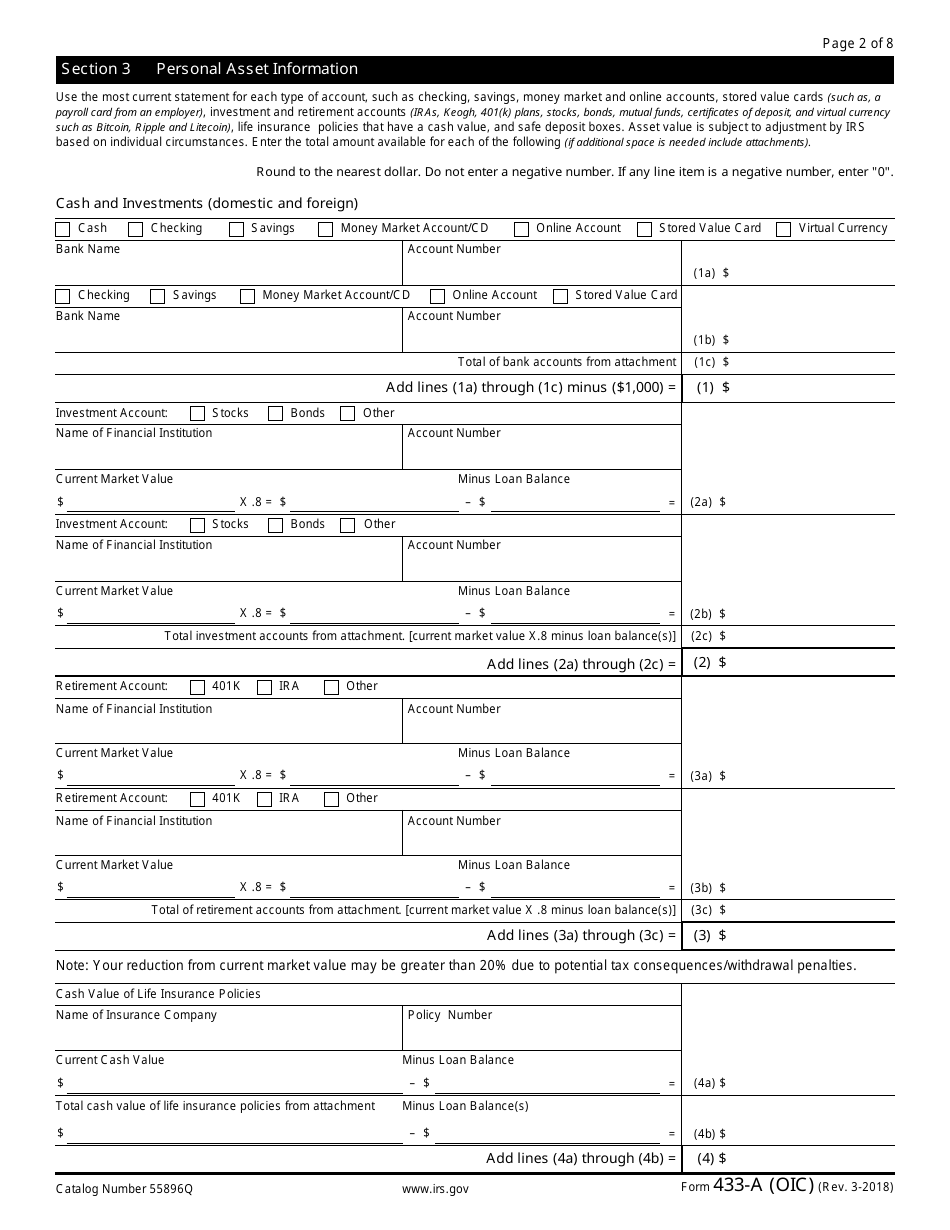

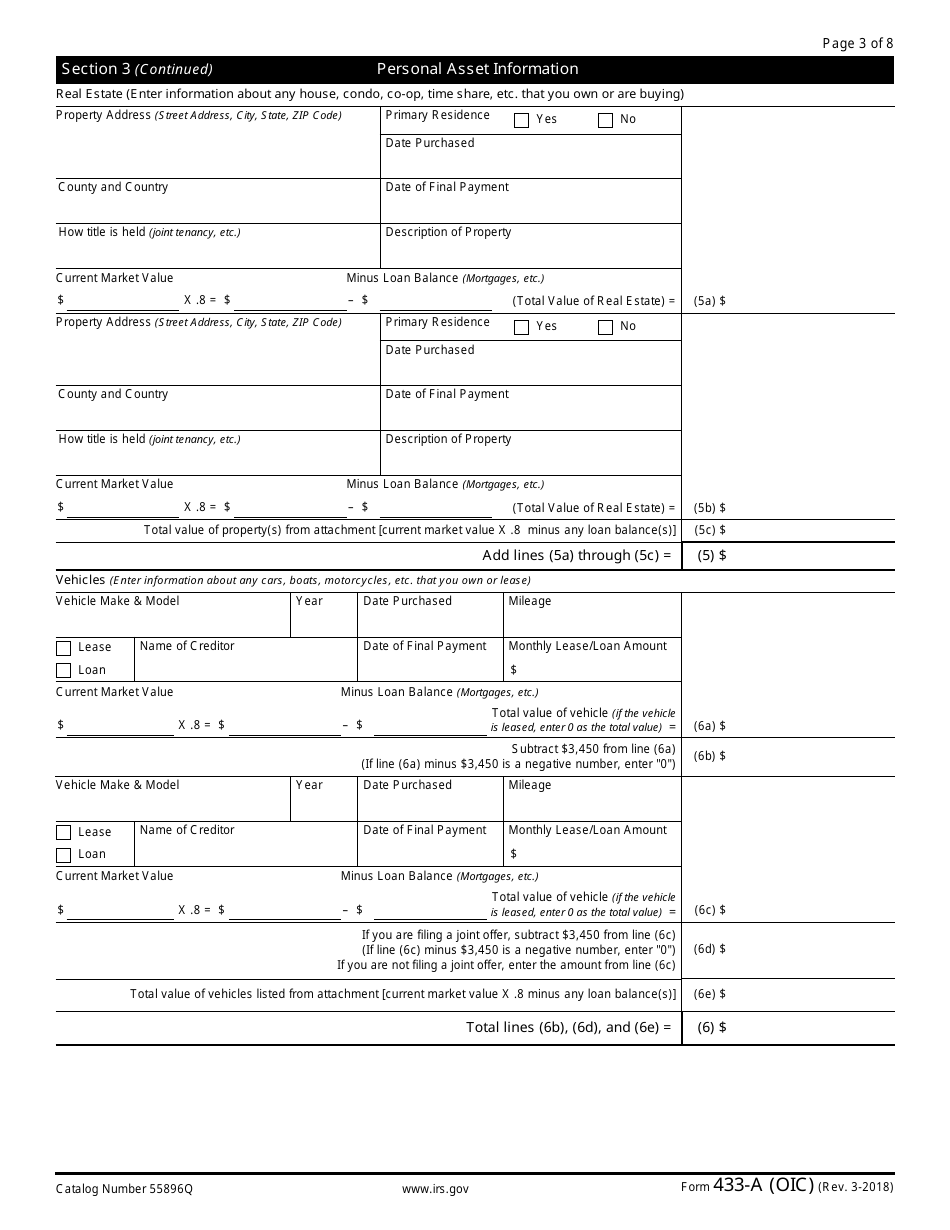

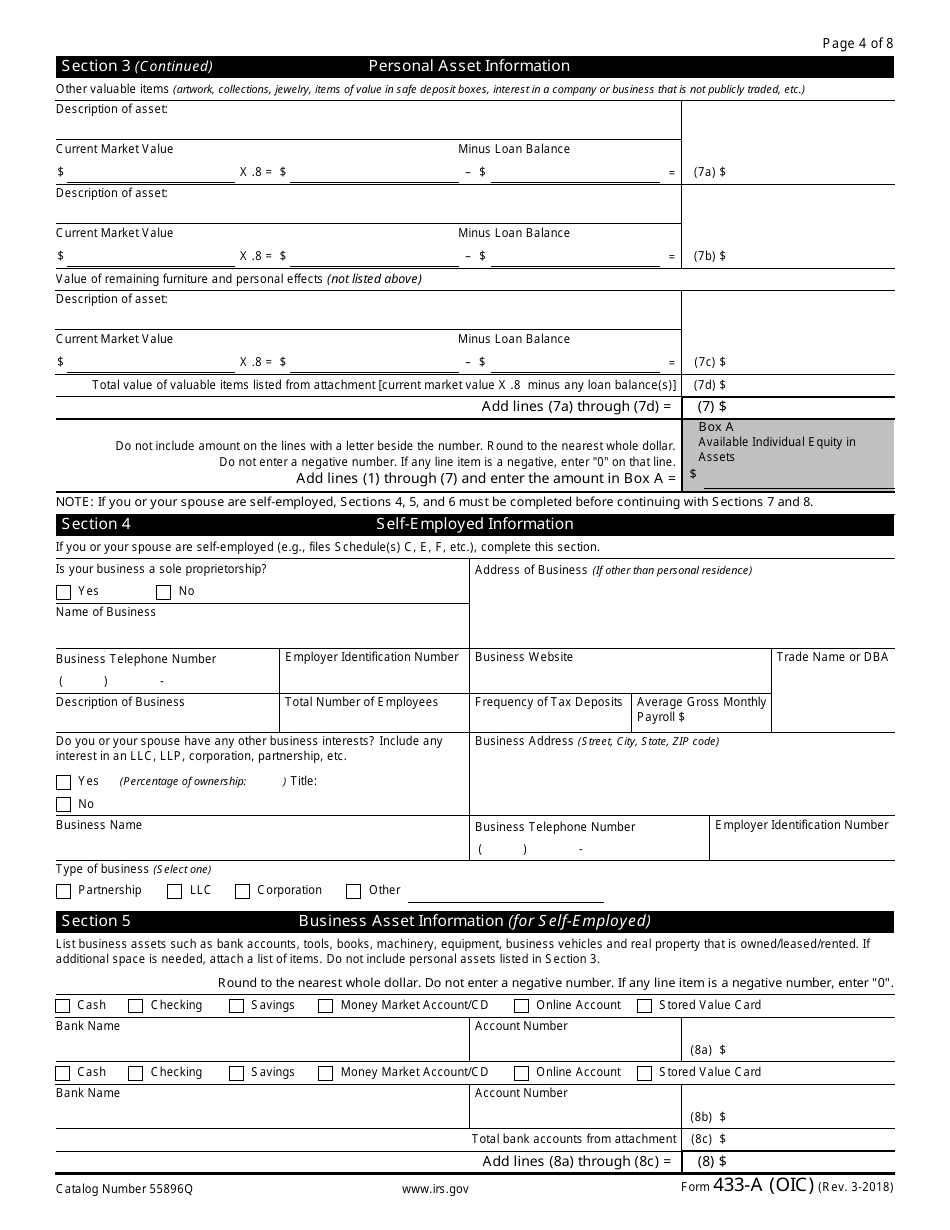

Q: What information is required on IRS Form 433-A?

A: IRS Form 433-A requires information about your income, expenses, assets, liabilities, and other financial details.

Q: Why is IRS Form 433-A important?

A: IRS Form 433-A is important because it provides the IRS with a detailed picture of your financial situation, which helps determine your eligibility for an Offer in Compromise.

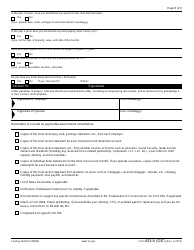

Q: Do I need to include supporting documents with IRS Form 433-A?

A: Yes, you may need to include supporting documents such as bank statements, pay stubs, and tax returns with IRS Form 433-A to verify the information provided.

Q: What should I do if I need help filling out IRS Form 433-A?

A: If you need assistance with filling out IRS Form 433-A, you can consult a tax professional or seek help from a Low Income Taxpayer Clinic (LITC) for free or low-cost assistance.

Q: What is the deadline for submitting IRS Form 433-A?

A: There is no specific deadline for submitting IRS Form 433-A, but it is generally recommended to submit it as soon as possible when seeking an Offer in Compromise.

Form Details:

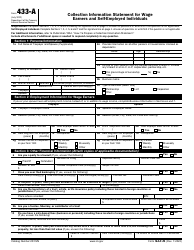

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 433-A (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-A (OIC) through the link below or browse more documents in our library of IRS Forms.