This version of the form is not currently in use and is provided for reference only. Download this version of

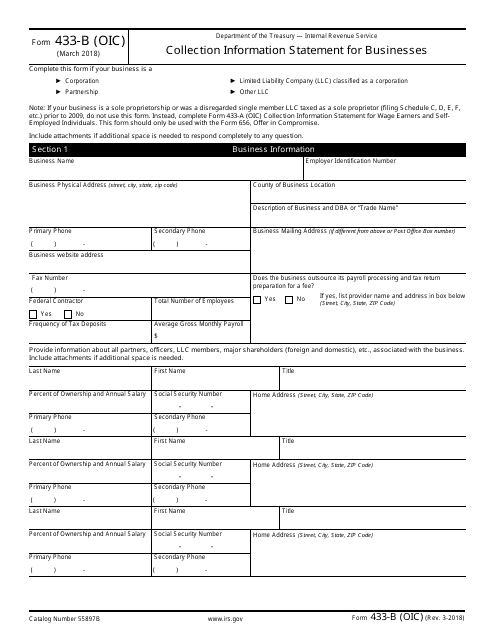

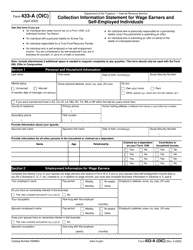

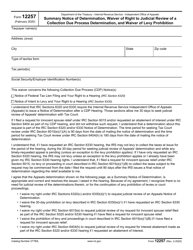

IRS Form 433-B (OIC)

for the current year.

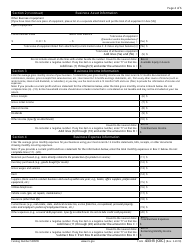

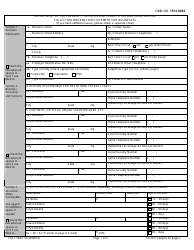

IRS Form 433-B (OIC) Collection Information Statement for Businesses

What Is IRS Form 433-B (OIC)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 433-B (OIC)?

A: IRS Form 433-B (OIC) is a Collection Information Statement for Businesses.

Q: What is the purpose of IRS Form 433-B (OIC)?

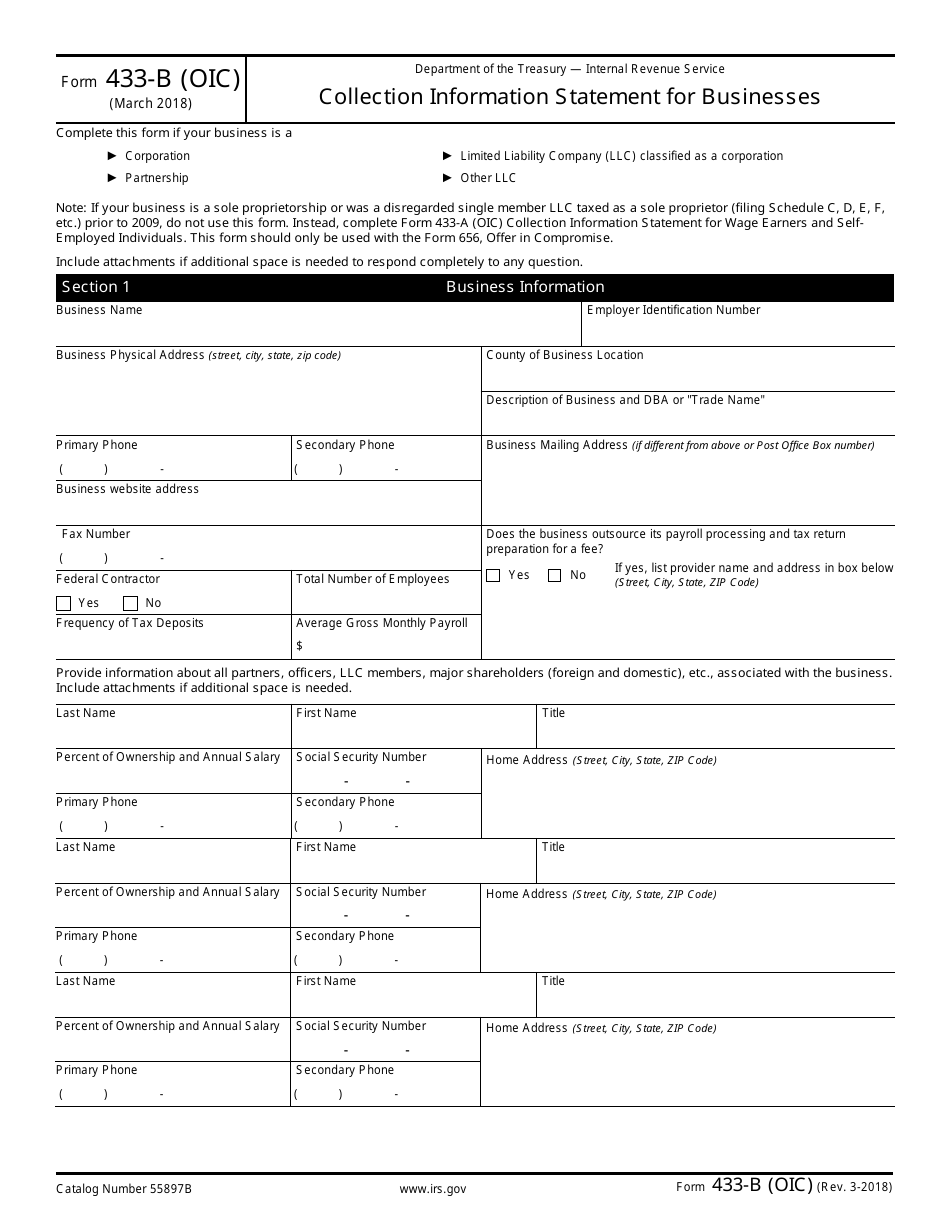

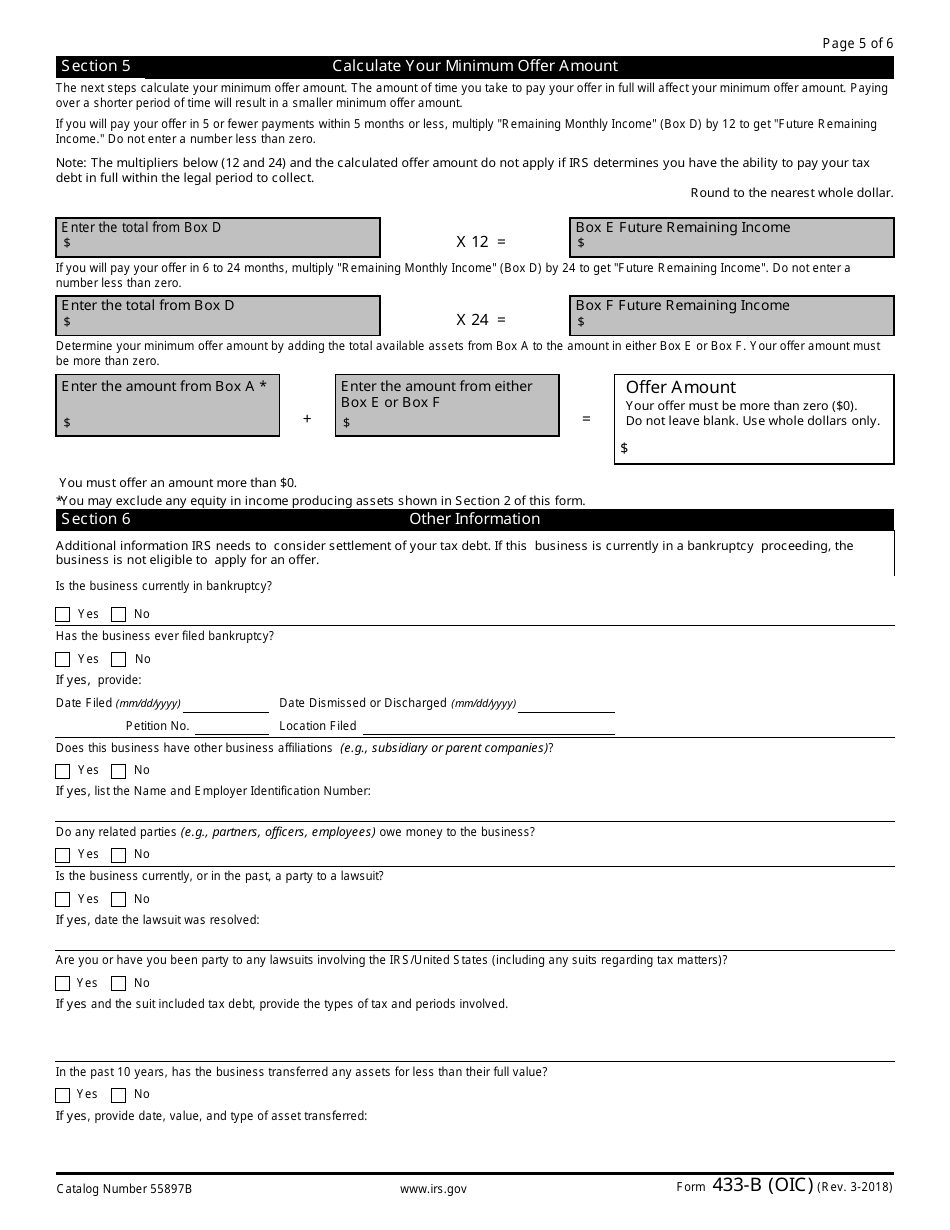

A: The purpose of IRS Form 433-B (OIC) is to provide financial information about a business to the IRS in order to determine eligibility for an Offer in Compromise.

Q: Who needs to fill out IRS Form 433-B (OIC)?

A: Businesses that are seeking to apply for an Offer in Compromise with the IRS need to fill out IRS Form 433-B (OIC).

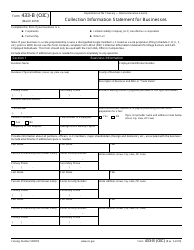

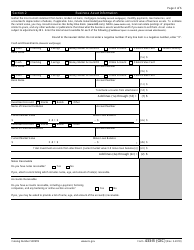

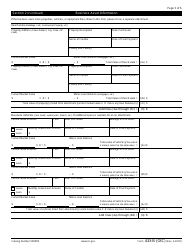

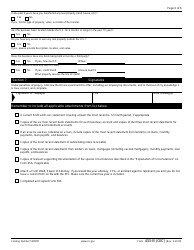

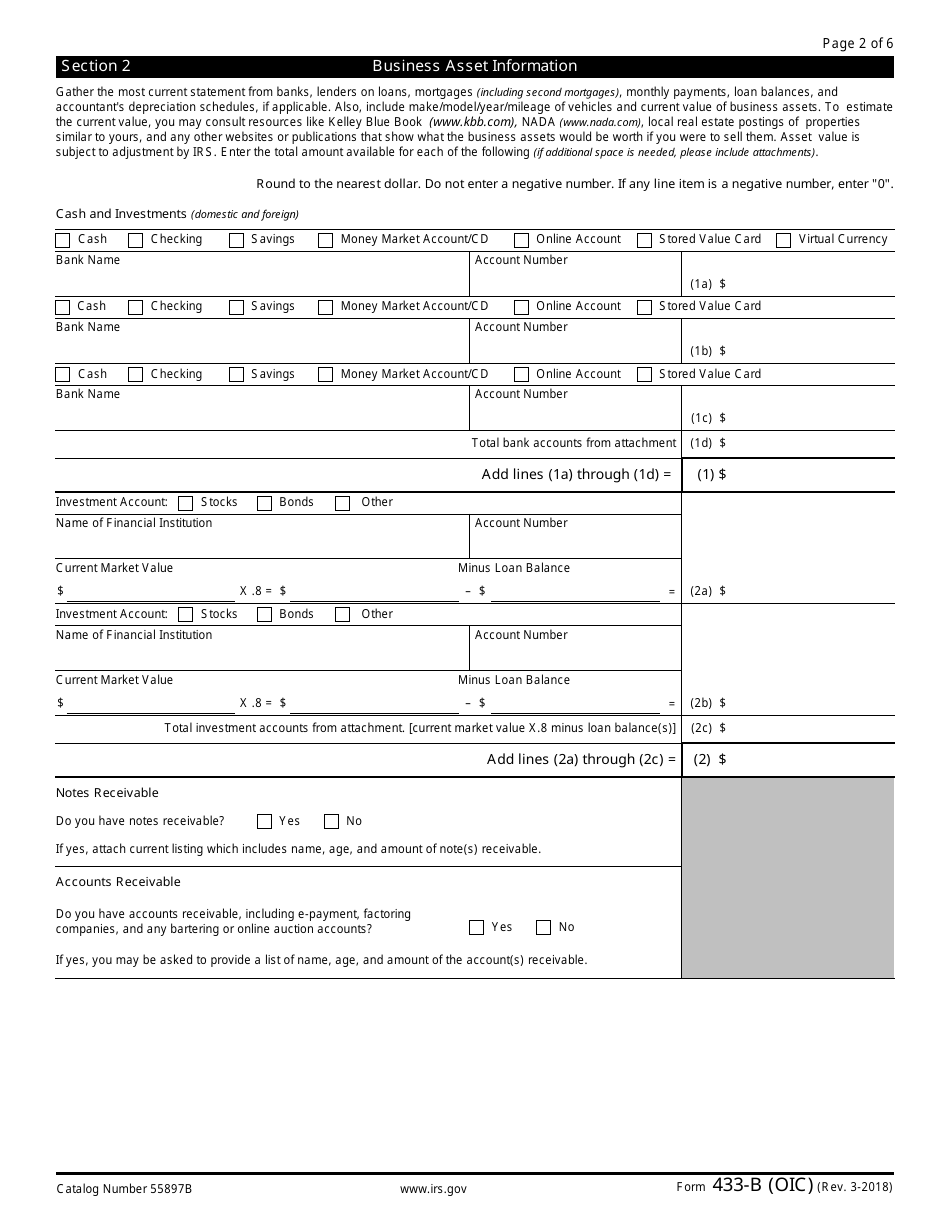

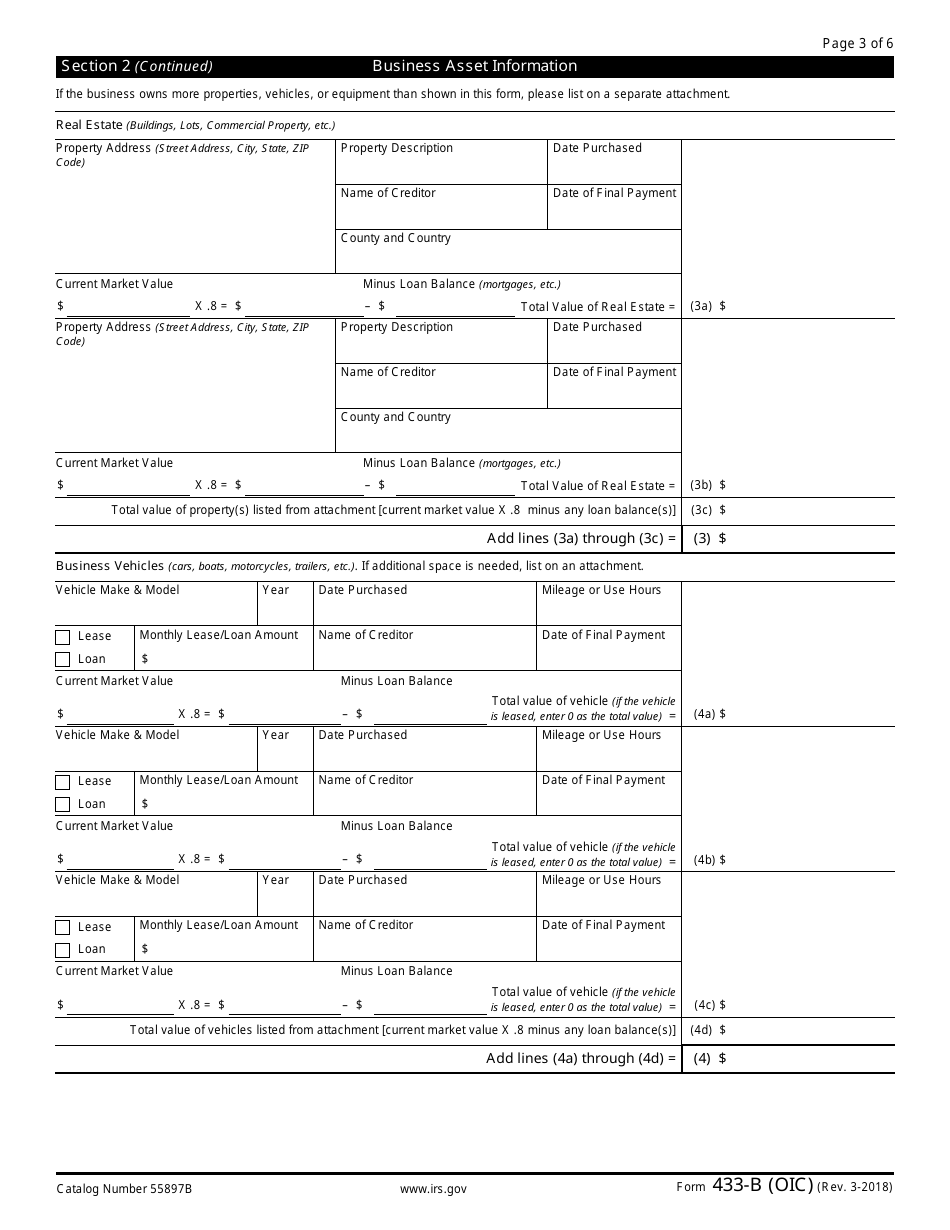

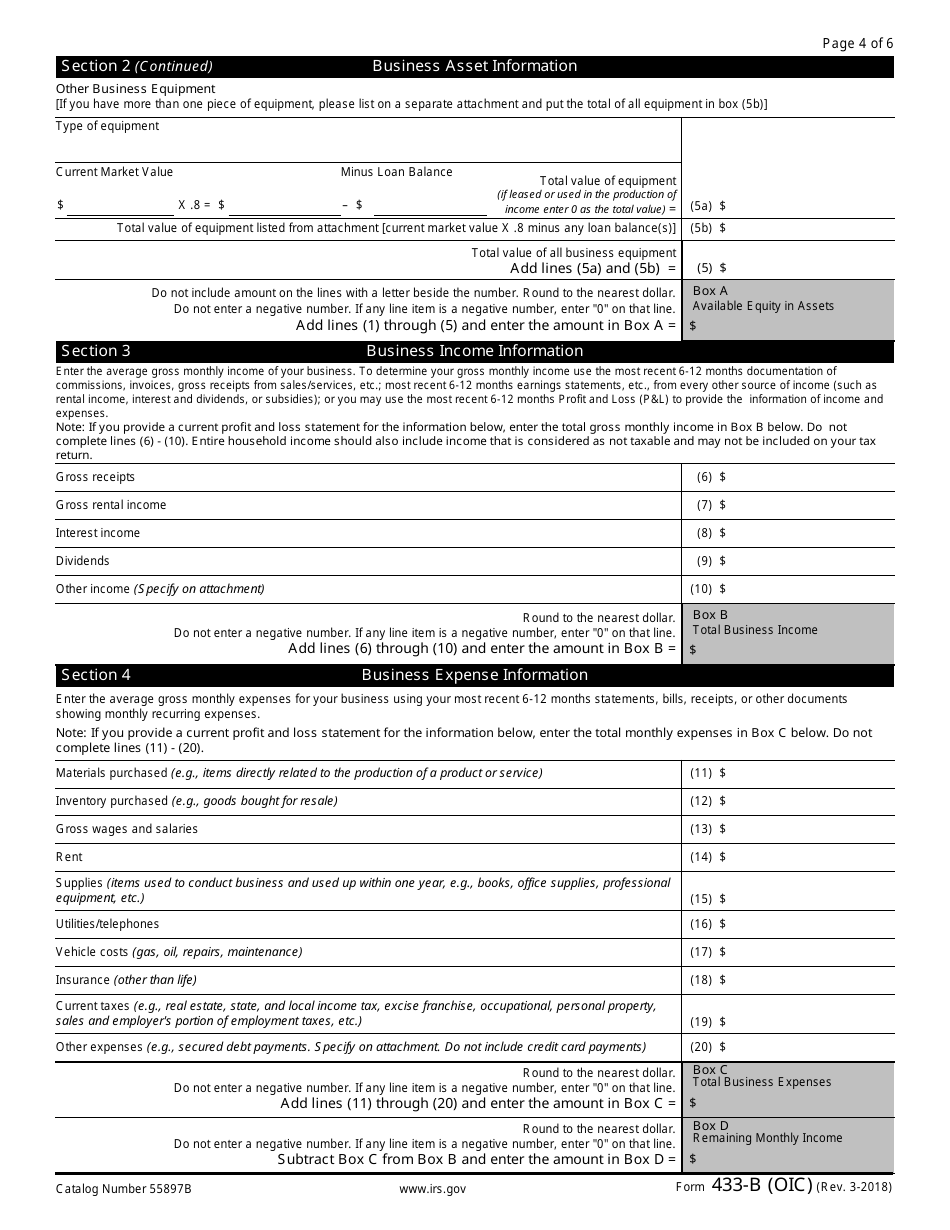

Q: What information does IRS Form 433-B (OIC) require?

A: IRS Form 433-B (OIC) requires information about the business's assets, liabilities, income, expenses, and other financial details.

Q: What happens after I submit IRS Form 433-B (OIC)?

A: After submitting IRS Form 433-B (OIC), the IRS will review the financial information provided and determine whether to accept or reject the Offer in Compromise.

Q: Can I negotiate with the IRS using IRS Form 433-B (OIC)?

A: Yes, IRS Form 433-B (OIC) is the form used to negotiate an Offer in Compromise with the IRS.

Q: Are there other forms related to IRS Form 433-B (OIC)?

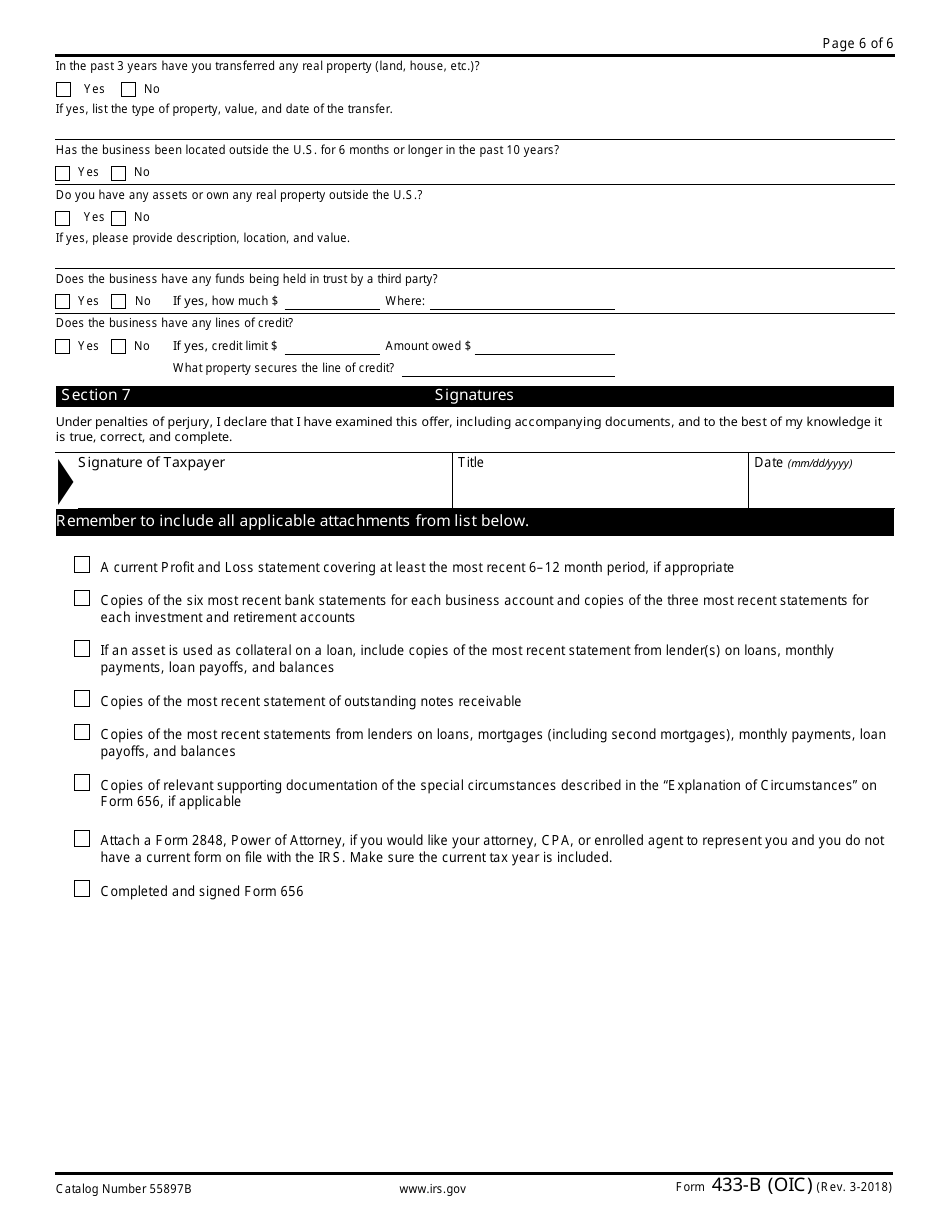

A: Yes, there are other forms related to IRS Form 433-B (OIC) such as Form 656, Offer in Compromise.

Q: Can I obtain assistance in filling out IRS Form 433-B (OIC)?

A: Yes, you can obtain assistance in filling out IRS Form 433-B (OIC) from tax professionals or by contacting the IRS directly.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

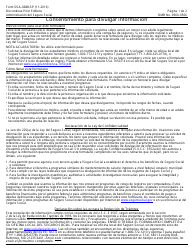

- A Spanish version of IRS Form 433-B (OIC) is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 433-B (OIC) through the link below or browse more documents in our library of IRS Forms.