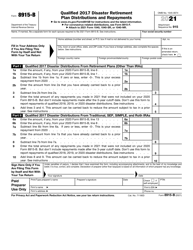

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915B

for the current year.

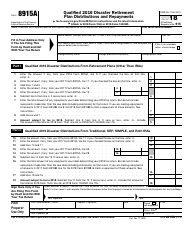

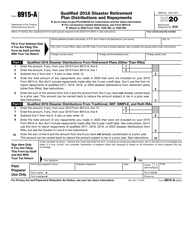

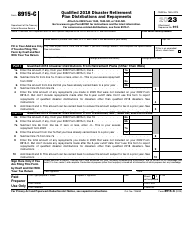

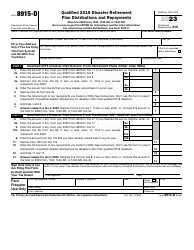

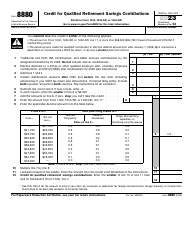

Instructions for IRS Form 8915B Qualified 2017 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915B , Qualified 2017 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915B is available for download through this link.

FAQ

Q: What is IRS Form 8915B?

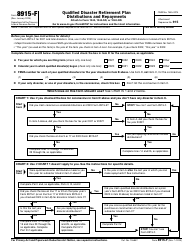

A: IRS Form 8915B is a form used for reporting qualified disaster retirement plan distributions and repayments.

Q: What are qualified disaster retirement plan distributions?

A: Qualified disaster retirement plan distributions are distributions made from a retirement plan that were made on account of a major disaster.

Q: What is the purpose of Form 8915B?

A: The purpose of Form 8915B is to calculate the taxable amount and any additional tax owed or credit due for qualifying retirement plan distributions and repayments.

Q: What is a major disaster?

A: A major disaster is an event declared by the President of the United States to warrant assistance from the federal government.

Q: Who is eligible to file Form 8915B?

A: Individuals who received qualified disaster retirement plan distributions or made repayments related to those distributions in the tax year 2017 are eligible to file Form 8915B.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.