This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915A

for the current year.

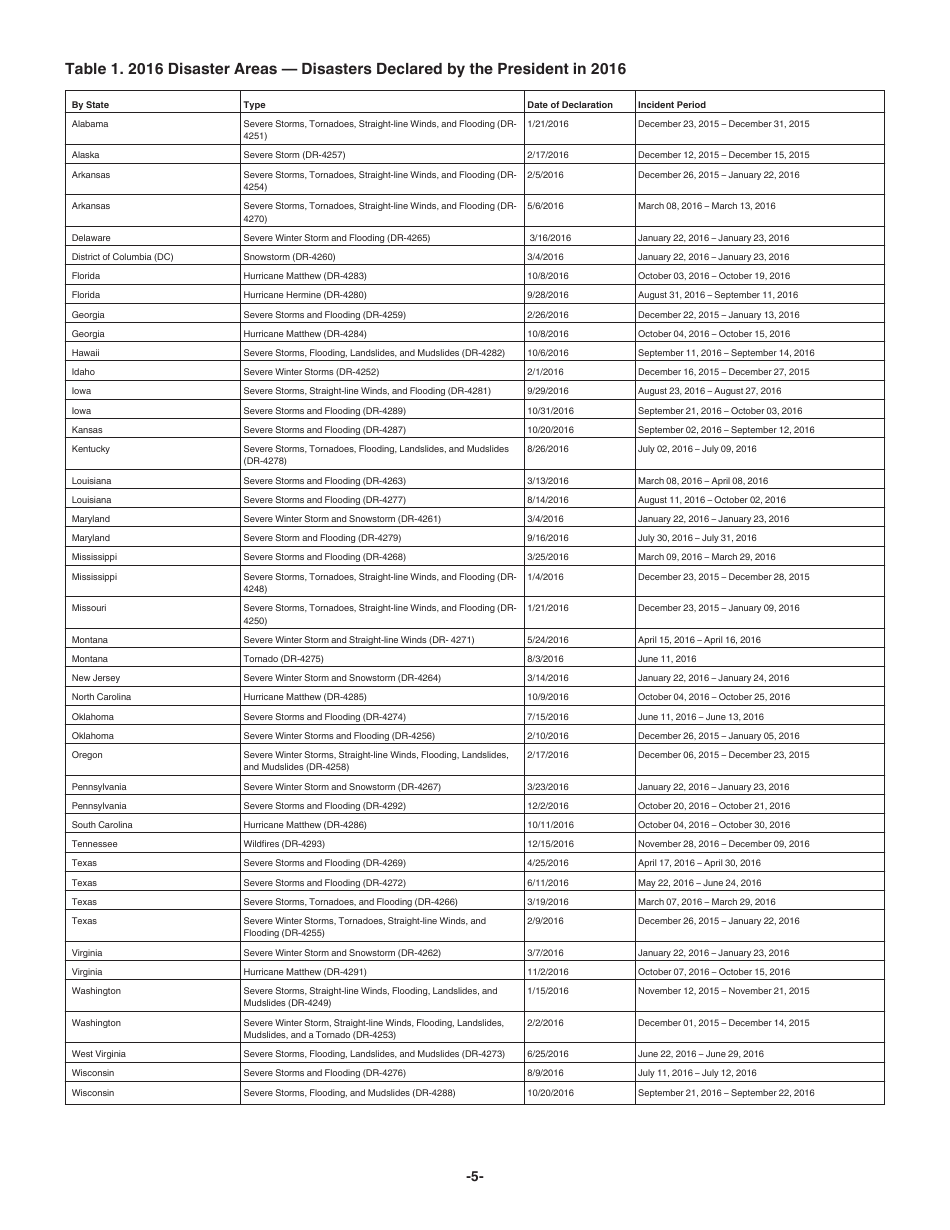

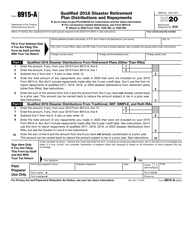

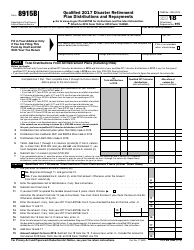

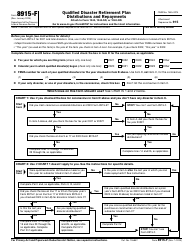

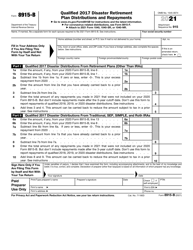

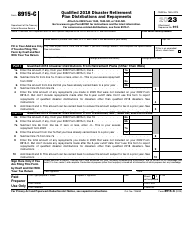

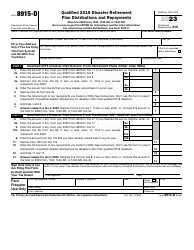

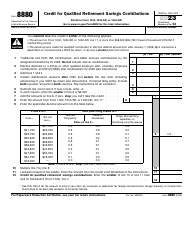

Instructions for IRS Form 8915A Qualified 2016 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915A , Qualified 2016 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915A is available for download through this link.

FAQ

Q: What is IRS Form 8915A?

A: IRS Form 8915A is a form used to report qualified disaster retirement plan distributions and repayments in the year 2016.

Q: Who should use IRS Form 8915A?

A: Individuals who received qualified disaster retirement plan distributions in 2016 and wish to repay them within the specified time frame should use IRS Form 8915A.

Q: What are qualified disaster retirement plan distributions?

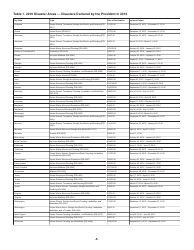

A: Qualified disaster retirement plan distributions are distributions received from a retirement plan that were directly related to a qualified disaster in 2016.

Q: What is the purpose of IRS Form 8915A?

A: The purpose of IRS Form 8915A is to report qualified disaster retirement plan distributions and repayments.

Q: What information is required on IRS Form 8915A?

A: IRS Form 8915A requires information such as the taxpayer's name, address, Social Security number, details of the qualified disaster, and the amount of distributions and repayments.

Q: When is the deadline to submit IRS Form 8915A?

A: The deadline to submit IRS Form 8915A is usually the same as the annual tax filing deadline, which is April 15th.

Q: Can IRS Form 8915A be filed electronically?

A: Yes, IRS Form 8915A can be filed electronically if the taxpayer is using tax software that supports this form.

Q: Is there a penalty for not filing IRS Form 8915A?

A: Yes, there may be a penalty for not filing IRS Form 8915A or for filing it late, depending on the circumstances.

Q: Is professional assistance required to complete IRS Form 8915A?

A: While professional assistance is not required, it may be beneficial for individuals who are unsure about how to properly complete IRS Form 8915A.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.