This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8900

for the current year.

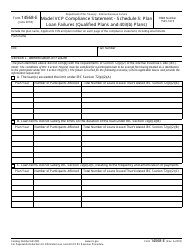

Instructions for IRS Form 8900 Qualified Railroad Track Maintenance Credit

This document contains official instructions for IRS Form 8900 , Qualified Railroad Track Maintenance Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8900 is available for download through this link.

FAQ

Q: What is IRS Form 8900?

A: IRS Form 8900 is a tax form used to claim the Qualified Railroad Track Maintenance Credit.

Q: What is the Qualified Railroad Track Maintenance Credit?

A: The Qualified Railroad Track Maintenance Credit is a tax credit available to eligible taxpayers who perform qualified railroad track maintenance.

Q: Who is eligible to claim the Qualified Railroad Track Maintenance Credit?

A: Eligible taxpayers include Class II and Class III railroad track owners and operators who maintain and rehabilitate their railroad tracks.

Q: What expenses can be claimed for the credit?

A: Eligible expenses include the costs of maintaining, rehabilitating, or replacing railroad tracks.

Q: How is the credit amount calculated?

A: The credit amount is based on a percentage of the eligible expenses incurred during the tax year.

Q: How does one claim the credit?

A: To claim the credit, taxpayers must complete and attach Form 8900 to their annual tax return.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations and restrictions on the credit, such as the credit not being available for expenses reimbursed by the federal government.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.