This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8864

for the current year.

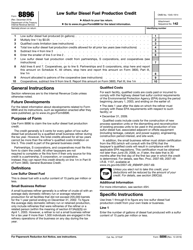

Instructions for IRS Form 8864 Biodiesel and Renewable Diesel Fuels Credit

This document contains official instructions for IRS Form 8864 , Biodiesel and Renewable Diesel Fuels Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8864 is available for download through this link.

FAQ

Q: What is IRS Form 8864?

A: IRS Form 8864 is a form used to claim the Biodiesel and Renewable Diesel Fuels Credit.

Q: What is the Biodiesel and Renewable Diesel Fuels Credit?

A: The Biodiesel and Renewable Diesel Fuels Credit is a federal tax credit for using biodiesel or renewable diesel fuels in qualified vehicles or equipment.

Q: Who can claim the Biodiesel and Renewable Diesel Fuels Credit?

A: Taxpayers who are eligible biodiesel or renewable diesel fuel producers, blenders, distributors, or ultimate vendors can claim this credit.

Q: What information is required to fill out IRS Form 8864?

A: You will need to provide information on the quantity of biodiesel or renewable diesel fuels produced, sold, or used during the tax year.

Q: Are there any deadlines for filing IRS Form 8864?

A: Yes, generally the form must be filed by the due date of your federal income tax return, including extensions.

Q: What documents should I keep to support my claim for the Biodiesel and Renewable Diesel Fuels Credit?

A: You should keep records of the biodiesel or renewable diesel fuels produced, sold, or used, as well as any documentation to support your claim.

Q: Can I e-file IRS Form 8864?

A: No, currently IRS Form 8864 cannot be e-filed and must be filed in paper format.

Q: Are there any limitations or restrictions on the Biodiesel and Renewable Diesel Fuels Credit?

A: Yes, there are certain limitations and restrictions on the credit, such as a per-gallon credit limit and additional requirements for claiming the credit.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.